Printable Transfer-on-Death Deed Document for New York

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows an individual to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The TOD Deed is governed by New York Estates, Powers and Trusts Law (EPTL) § 13-16. |

| Revocability | The deed can be revoked at any time before the death of the grantor, allowing for flexibility in estate planning. |

| Beneficiary Designation | Multiple beneficiaries can be named, and the deed can specify how the property is divided among them. |

| Filing Requirements | The completed TOD Deed must be filed with the county clerk's office where the property is located to be valid. |

Key takeaways

Filling out and utilizing the New York Transfer-on-Death Deed form can be a straightforward process, but it is essential to understand the key aspects to ensure that your wishes are honored. Here are ten important takeaways:

- Eligibility: Only individuals who own real property in New York can use the Transfer-on-Death Deed.

- Purpose: This deed allows property owners to designate beneficiaries who will receive the property upon their death, avoiding probate.

- Form Requirements: The form must be completed with accurate information regarding the property and the designated beneficiaries.

- Signature: The property owner must sign the deed in the presence of a notary public to validate it.

- Recording: After signing, the deed must be recorded with the county clerk in the county where the property is located.

- Revocation: The owner can revoke the deed at any time before death by filing a revocation form or executing a new deed.

- Beneficiary Rights: Beneficiaries do not have any rights to the property until the owner's death.

- Tax Implications: The property may still be subject to estate taxes, and it is advisable to consult a tax professional.

- Legal Assistance: Although the process can be completed without an attorney, seeking legal advice can help clarify any uncertainties.

- Updates: It is important to review and update the deed if there are changes in circumstances, such as a change in beneficiaries.

By understanding these key points, individuals can navigate the Transfer-on-Death Deed process with greater confidence and clarity, ensuring their wishes regarding property transfer are fulfilled.

Dos and Don'ts

When filling out the New York Transfer-on-Death Deed form, it’s important to be thorough and careful. Here are ten things to keep in mind:

- Do: Ensure that you have the correct property description. This should include the address and any identifying details.

- Do: Clearly identify the beneficiaries. Use full names and consider including their relationship to you.

- Do: Sign the deed in the presence of a notary public. This step is crucial for the deed to be valid.

- Do: Review the form for accuracy before submitting. Double-check all names and details.

- Do: File the completed deed with the county clerk’s office where the property is located.

- Don’t: Leave any sections blank. Every part of the form must be completed to avoid complications.

- Don’t: Use outdated forms. Always make sure you have the most current version of the deed.

- Don’t: Forget to keep a copy for your records. This is important for future reference.

- Don’t: Assume that verbal agreements will suffice. Everything should be documented in writing.

- Don’t: Delay in filing the deed. There may be deadlines that could affect your estate planning.

More Transfer-on-Death Deed State Templates

Affidavit for Transfer Without Probate Ohio - Beneficiaries receive the property automatically upon your passing, without needing court intervention.

Virginia Tod Deed - A Transfer-on-Death Deed can help minimize estate taxes and avoid complications when distributing your property.

For those seeking to delegate financial responsibilities effectively, the important Durable Power of Attorney form ensures that your financial decisions are managed by a trusted individual in times of need.

Washington Transfer on Death Deed - The beneficiary's interest in the property is contingent upon the owner's death, preventing premature claims.

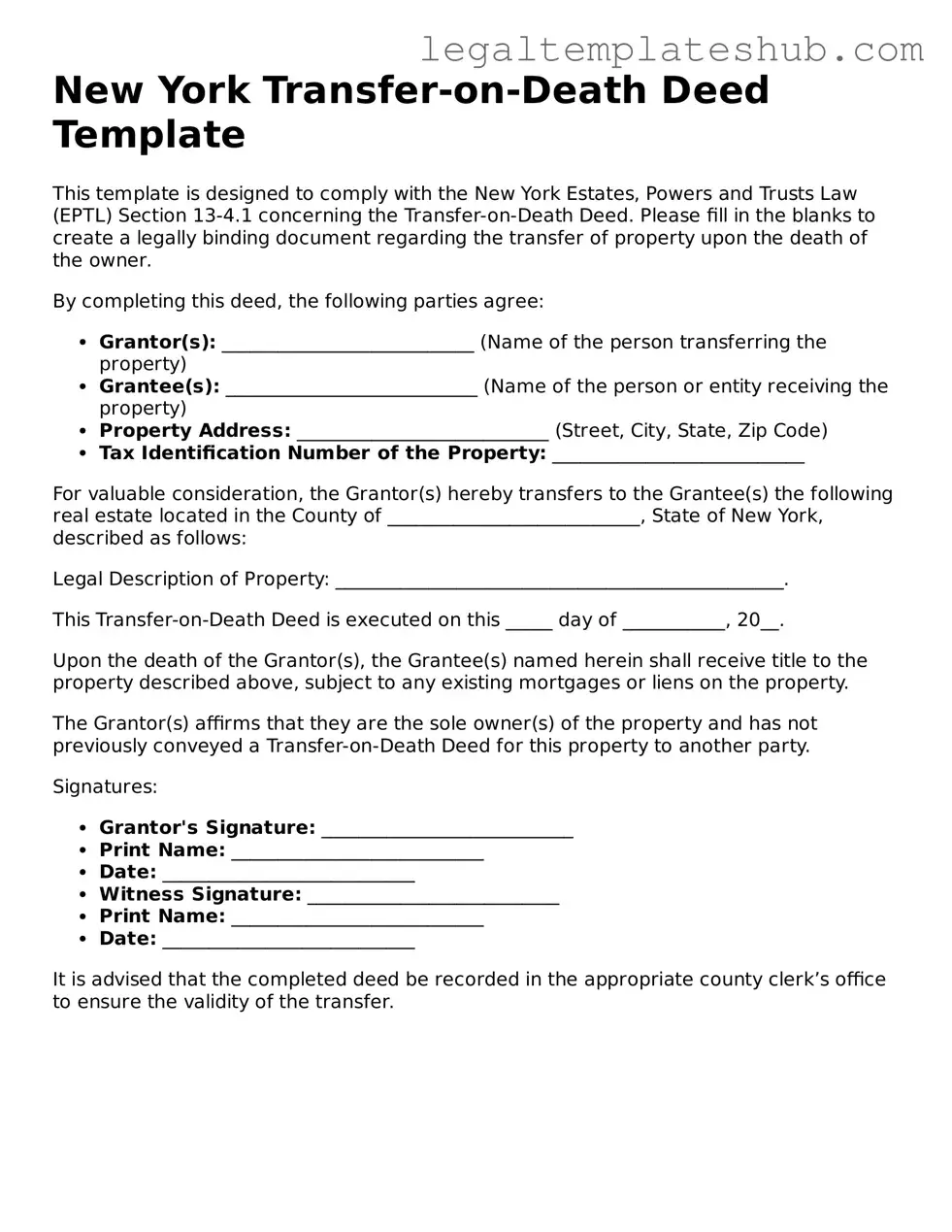

Instructions on Filling in New York Transfer-on-Death Deed

Filling out the New York Transfer-on-Death Deed form is an important step in ensuring that your property is transferred to your chosen beneficiaries upon your passing. The process may seem daunting, but by following these clear steps, you can complete the form accurately and efficiently. After filling out the form, you will need to file it with the appropriate county office to ensure it is legally recognized.

- Begin by downloading the New York Transfer-on-Death Deed form from the New York State government website or obtaining a hard copy from your local county clerk's office.

- Fill in your name and address in the designated fields at the top of the form. This identifies you as the grantor.

- Provide a description of the property you wish to transfer. Include the address and any other identifying information, such as the tax parcel number, if available.

- Next, identify the beneficiary or beneficiaries. Include their full names and addresses. If there are multiple beneficiaries, make sure to clearly indicate how the property will be divided among them.

- Sign and date the form in the presence of a notary public. This step is crucial, as the notary will verify your identity and witness your signature.

- Once the form is signed and notarized, make copies for your records before proceeding to file.

- File the completed form with the county clerk's office in the county where the property is located. There may be a filing fee, so be prepared to pay that at the time of submission.

- Finally, confirm that the deed has been recorded by the county clerk's office. This ensures that the transfer-on-death designation is legally recognized.

Misconceptions

-

Misconception 1: A Transfer-on-Death Deed automatically transfers property upon death.

This is not entirely true. While the deed allows for the transfer of property without going through probate, it only takes effect when the owner passes away. Until then, the property remains under the owner's control.

-

Misconception 2: You cannot change or revoke a Transfer-on-Death Deed once it is filed.

This is incorrect. The owner has the right to revoke or change the deed at any time before their death. Proper procedures must be followed to ensure the changes are legally recognized.

-

Misconception 3: A Transfer-on-Death Deed avoids all taxes and fees.

While this deed can help avoid probate fees, it does not exempt the property from estate taxes or other potential liabilities. Tax implications can still arise, depending on the value of the estate.

-

Misconception 4: The Transfer-on-Death Deed is only for single individuals.

This is false. Couples, including married and domestic partners, can also use this deed to transfer property. It can be a useful tool for estate planning for anyone, regardless of their relationship status.