Printable Promissory Note Document for North Carolina

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a specified time. |

| Governing Law | The North Carolina Promissory Note is governed by Article 3 of the North Carolina Uniform Commercial Code. |

| Parties Involved | The note involves at least two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The note can specify an interest rate, which must comply with North Carolina usury laws. |

| Payment Terms | Payment terms must be clearly stated, including the due date and payment schedule. |

| Default Clause | A default clause outlines the consequences if the borrower fails to make payments as agreed. |

| Signature Requirement | The maker's signature is required for the note to be legally binding. |

| Transferability | Promissory notes are generally transferable, allowing the payee to sell or assign the note to another party. |

| Enforceability | To be enforceable, the note must meet specific legal requirements, including clarity of terms and intent to create a legal obligation. |

| Modification | Any changes to the terms of the promissory note must be made in writing and signed by both parties. |

Key takeaways

When dealing with a North Carolina Promissory Note, it's important to understand the key elements involved in its creation and use. Here are some essential takeaways to keep in mind:

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan under specified terms.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. Accurate identification helps avoid confusion later.

- Specify Loan Details: Include the loan amount, interest rate, repayment schedule, and any late fees. These details ensure both parties are on the same page.

- Consider Security: If applicable, mention any collateral securing the loan. This can provide the lender with a sense of security in case of default.

- Include Signatures: Both parties must sign the document for it to be legally binding. Consider having it notarized for added protection.

- Keep Copies: After completing the promissory note, ensure both parties retain a copy. This helps in tracking payments and resolving any disputes.

By paying attention to these elements, you can create a clear and effective promissory note that protects both the lender and the borrower.

Dos and Don'ts

When filling out the North Carolina Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do read the entire form carefully before filling it out.

- Do provide accurate information regarding the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable.

- Do outline the repayment terms in detail.

- Don't leave any fields blank unless they are marked as optional.

- Don't use abbreviations or unclear language.

- Don't forget to sign and date the document.

- Don't alter the form in any way that could change its meaning.

- Don't submit the form without reviewing it for errors.

Following these guidelines will help ensure that the Promissory Note is filled out correctly and serves its intended purpose.

More Promissory Note State Templates

Promissory Note for Personal Loan - Consider consulting a financial advisor before signing a note.

The Pennsylvania Bill of Sale form serves as a crucial legal document that records the transfer of ownership for various types of personal property. This form provides both the seller and buyer with a written acknowledgment of the transaction, reducing the likelihood of disputes in the future. For those interested in securing their transactions, filling out this form is a recommended step; to find a reliable option, consider exploring these PDF Templates to get started.

Pennsylvania Promissory Note - Used to outline the terms of a loan or financial agreement between two parties.

Utah Promissory Note - A valid promissory note must include essential elements like an unconditional promise to pay and a definite amount.

Create Promissory Note - Keep in mind that some states have specific laws governing promissory notes.

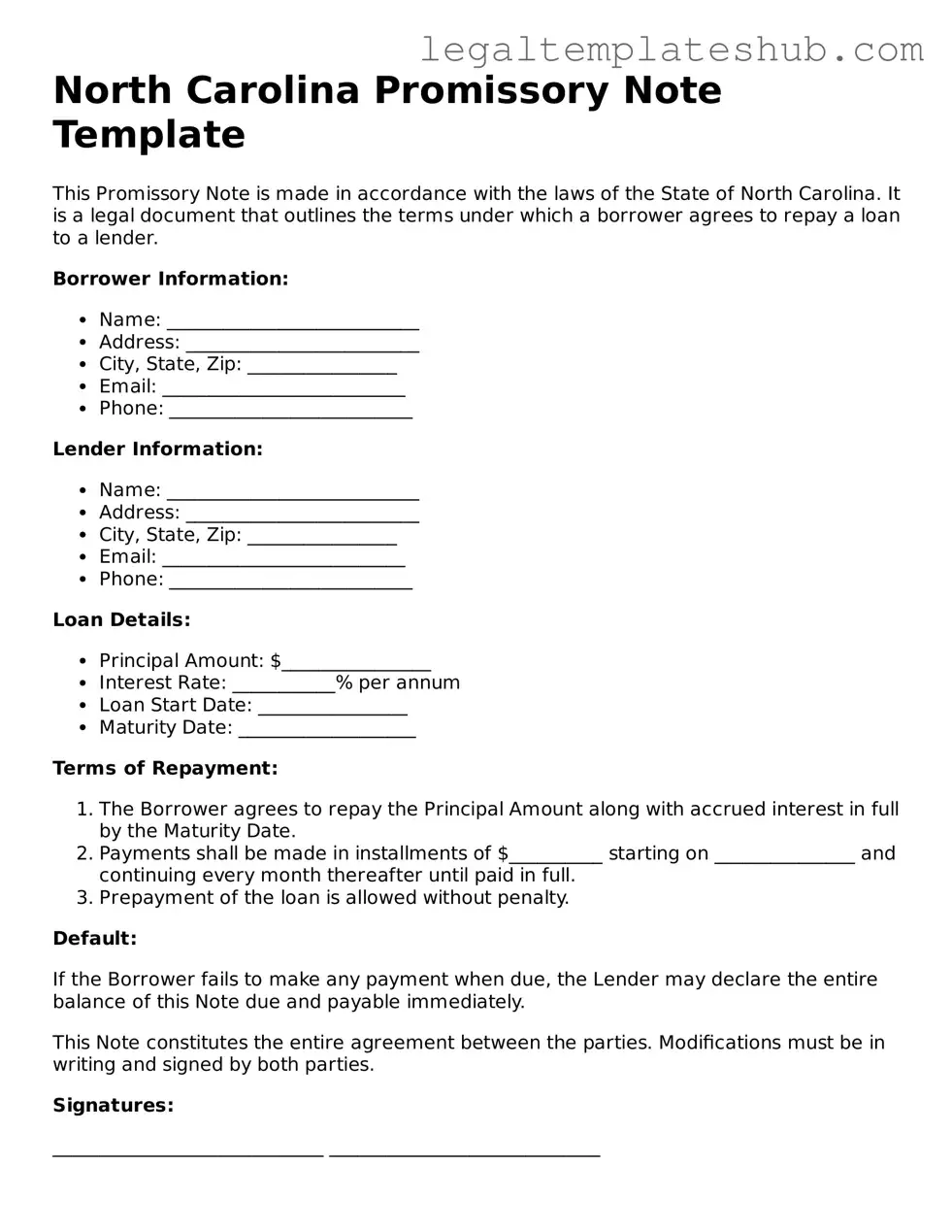

Instructions on Filling in North Carolina Promissory Note

Once you have the North Carolina Promissory Note form ready, it’s time to fill it out carefully. Make sure you have all the necessary information at hand. This form will require details about the borrower, the lender, and the loan terms. Follow these steps to complete the form accurately.

- Title the Document: At the top of the form, write "Promissory Note."

- Fill in the Date: Write the date when the note is being signed.

- Enter Borrower Information: Provide the full name and address of the borrower.

- Enter Lender Information: Write the full name and address of the lender.

- State the Loan Amount: Clearly indicate the total amount of money being borrowed.

- Specify the Interest Rate: Write down the interest rate that will apply to the loan.

- Outline Payment Terms: Describe how and when payments will be made, including the due dates.

- Include Late Fees: If applicable, state any late fees that will be charged for missed payments.

- Signatures: Both the borrower and the lender should sign and date the form at the bottom.

After completing the form, make sure to keep a copy for your records. The signed Promissory Note is a binding agreement, so it’s important that all information is accurate and clearly stated. Once everything is in order, you can proceed with your next steps.

Misconceptions

Understanding the North Carolina Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are six common misconceptions and clarifications for each:

- It is a legally binding contract only if notarized. Notarization is not a requirement for a promissory note to be legally binding in North Carolina. As long as both parties agree to the terms and sign the document, it holds legal weight.

- Promissory notes must be complex legal documents. Simplicity is often key. A promissory note can be straightforward, containing essential elements such as the amount, interest rate, and repayment terms.

- All promissory notes are the same. Each note can be tailored to the specific agreement between the lender and borrower. Terms can vary widely based on the needs and circumstances of the parties involved.

- Interest rates on promissory notes are always fixed. This is not true. Interest rates can be fixed or variable, depending on what both parties agree upon in the note.

- Only banks can issue promissory notes. Individuals can also create and sign promissory notes. This form is not limited to financial institutions.

- Once signed, a promissory note cannot be changed. Modifications can be made if both parties agree to the changes. It is advisable to document any amendments in writing.

Being aware of these misconceptions can help you navigate the process more effectively. Always ensure you understand the terms and conditions before signing any financial document.