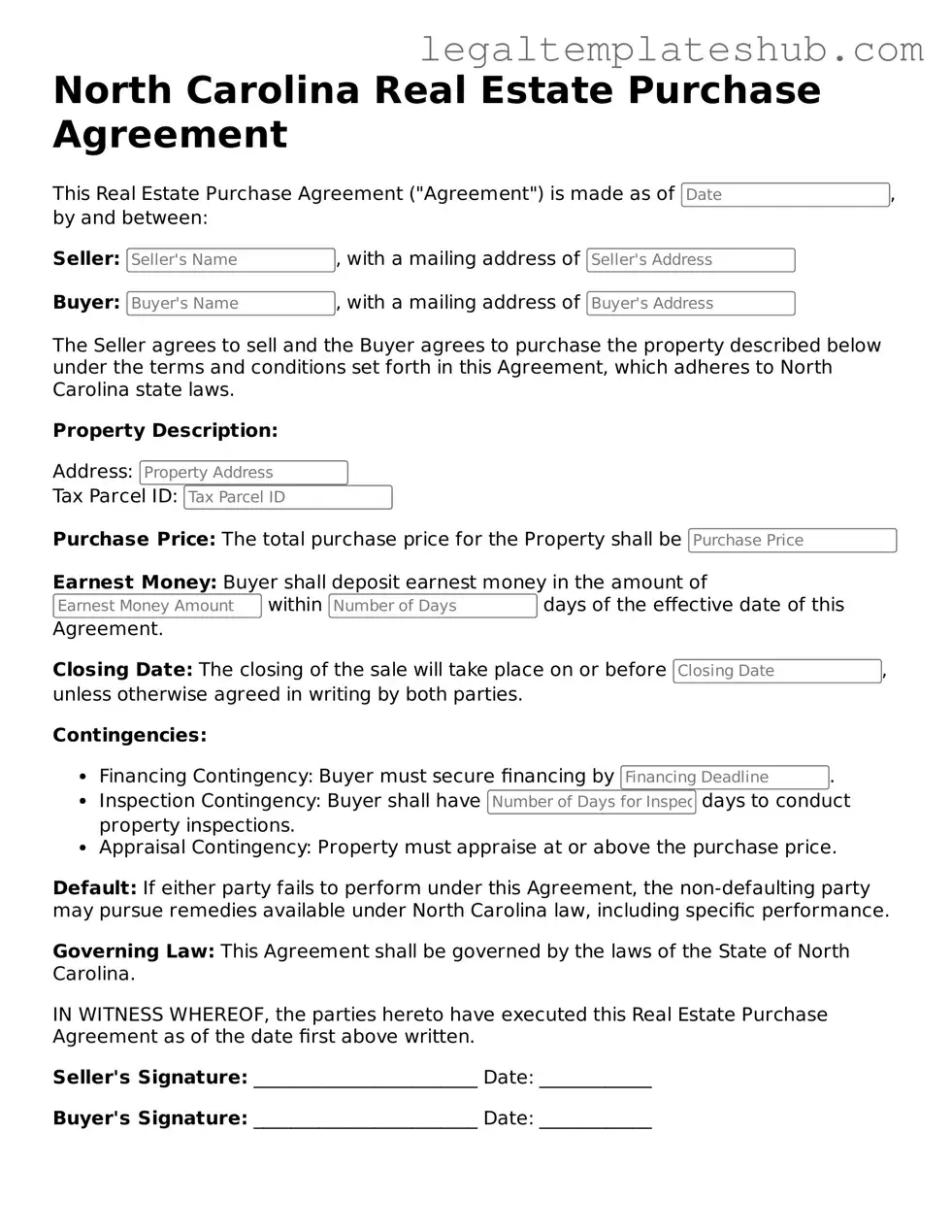

Printable Real Estate Purchase Agreement Document for North Carolina

PDF Form Data

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Real Estate Purchase Agreement is used to outline the terms of a property sale between a buyer and seller. |

| Governing Laws | This agreement is governed by the laws of the State of North Carolina, specifically under the North Carolina General Statutes. |

| Key Components | It includes essential details such as the purchase price, property description, and closing date. |

| Contingencies | The agreement may include contingencies, allowing buyers to withdraw if certain conditions are not met. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Key takeaways

When filling out and using the North Carolina Real Estate Purchase Agreement form, there are several important points to keep in mind. Understanding these key takeaways can help ensure a smoother transaction process.

- Understand the Parties Involved: Clearly identify the buyer and seller in the agreement. Full legal names and contact information should be provided.

- Property Description: Accurately describe the property being sold. Include the address and any relevant details that distinguish the property.

- Purchase Price: Clearly state the total purchase price. This should be agreed upon by both parties before finalizing the agreement.

- Earnest Money: Specify the amount of earnest money to be deposited. This shows the buyer's commitment to the purchase.

- Closing Date: Indicate the proposed closing date. This is when the property ownership will officially transfer.

- Contingencies: Include any contingencies that must be met for the sale to proceed. Common contingencies involve financing, inspections, or the sale of another property.

- Disclosure Obligations: Both parties must be aware of their disclosure obligations. Sellers are required to disclose known issues with the property.

- Signatures: Ensure that both parties sign the agreement. Signatures are necessary for the document to be legally binding.

- Legal Review: Consider having the agreement reviewed by a legal professional. This can help clarify any concerns and ensure compliance with state laws.

By keeping these takeaways in mind, individuals can navigate the process of filling out and using the North Carolina Real Estate Purchase Agreement form more effectively.

Dos and Don'ts

When filling out the North Carolina Real Estate Purchase Agreement form, it’s important to approach the task with care and attention. Here’s a helpful list of things you should and shouldn’t do:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information about the property, including its address and legal description.

- Do clearly state the purchase price and any earnest money deposit.

- Do specify any contingencies, such as financing or inspections, that must be met.

- Do ensure all parties involved sign the agreement.

- Don’t leave any blank spaces; fill in all required fields to avoid confusion.

- Don’t use vague language; be specific about terms and conditions.

- Don’t ignore deadlines for contingencies or closing dates.

- Don’t forget to consult with a real estate attorney if you have questions.

By following these guidelines, you can help ensure a smoother process when completing your Real Estate Purchase Agreement in North Carolina.

More Real Estate Purchase Agreement State Templates

Utah Real Estate Contract - The agreement often requires earnest money, a deposit showing the buyer's commitment to the purchase.

To formalize the rental process in Ohio, utilizing the Ohio Residential Lease Agreement form is essential, and you can conveniently access ready-made templates through PDF Templates to ensure all necessary terms and conditions are covered effectively.

Trec Real Estate - It represents a crucial step in ensuring a successful real estate transaction.

Washington Purchase and Sale Agreement - The agreement can include timelines for necessary inspections and repairs.

Sale Contract for House - It informs the buyer of any homeowner's association (HOA) rules that may affect the property.

Instructions on Filling in North Carolina Real Estate Purchase Agreement

Completing the North Carolina Real Estate Purchase Agreement form is an essential step in the home-buying process. Once you have gathered the necessary information, you can proceed to fill out the form. This document outlines the terms and conditions of the sale, ensuring that both parties are on the same page regarding the transaction.

- Begin by entering the date at the top of the form. This date marks when the agreement is being made.

- Identify the parties involved. Fill in the names of the buyer(s) and seller(s) in the designated sections. Ensure that the names are spelled correctly and match the legal documents.

- Provide the property address. Include the full address of the property being sold, including city, state, and zip code.

- Specify the purchase price. Write the agreed-upon price for the property clearly in the appropriate section.

- Outline the earnest money deposit. Indicate the amount of earnest money the buyer will provide and the method of payment.

- Detail the closing date. Enter the date by which the transaction is expected to be completed.

- Include any contingencies. If there are conditions that must be met before the sale can proceed (such as financing or inspections), list them in the designated area.

- Indicate any personal property included in the sale. If appliances or fixtures are part of the agreement, list them clearly.

- Sign and date the agreement. Both the buyer and seller must sign and date the document to make it legally binding.

Once you have completed these steps, review the form for accuracy. It is advisable to consult with a real estate professional or legal consultant to ensure that all necessary details are correctly filled out before submitting the agreement.

Misconceptions

Understanding the North Carolina Real Estate Purchase Agreement can be challenging, especially with the various misconceptions that surround it. Here’s a breakdown of some common misunderstandings.

- It is a legally binding contract from the moment it is signed. Many people believe that simply signing the agreement makes it legally binding. However, the contract typically requires additional steps, such as acceptance by all parties and possible contingencies, before it becomes enforceable.

- All real estate transactions require a real estate agent. While many buyers and sellers choose to work with agents for their expertise, it is not a legal requirement. Individuals can complete transactions independently, but they should be well-informed about the process.

- The purchase agreement is the only document needed for a transaction. This is a common myth. In reality, multiple documents, including disclosures and closing statements, are necessary to finalize a real estate transaction.

- Once an offer is made, it cannot be changed. Offers can be modified before they are accepted. Buyers and sellers can negotiate terms until both parties agree on the final contract.

- The North Carolina Real Estate Purchase Agreement is the same as in other states. Each state has its own specific laws and forms. The North Carolina agreement includes unique elements that reflect state regulations and practices.

- Buyers can back out of the agreement without consequences. While there are contingencies that allow buyers to withdraw, doing so without a valid reason can lead to financial penalties or loss of earnest money.

- All contingencies are automatically included in the agreement. Buyers must specifically request contingencies, such as financing or inspection clauses. These are not standard unless included by the buyer.

- Signing the agreement means the property is sold. Signing does not equate to the transfer of ownership. The closing process must be completed for the sale to be finalized.

- The purchase agreement is only for residential properties. This form can be used for various types of real estate transactions, including commercial properties, as long as it is appropriately tailored.

By addressing these misconceptions, individuals can approach the North Carolina Real Estate Purchase Agreement with greater confidence and clarity.