Printable Transfer-on-Death Deed Document for North Carolina

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners in North Carolina to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The TOD deed is governed by North Carolina General Statutes, specifically Chapter 32A. |

| Eligibility | Any individual who owns real estate in North Carolina can create a TOD deed, as long as they are of sound mind and at least 18 years old. |

| Beneficiaries | Property owners can designate one or more beneficiaries to receive the property upon their death. Beneficiaries can be individuals or entities. |

| Revocation | A TOD deed can be revoked at any time by the property owner, as long as they follow the proper legal procedures for revocation. |

| Filing Requirements | The completed TOD deed must be recorded with the county register of deeds in the county where the property is located to be effective. |

Key takeaways

When considering the use of a Transfer-on-Death Deed in North Carolina, it is essential to understand its implications and requirements. Below are key takeaways to guide you through the process.

- Purpose of the Deed: A Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death, avoiding the probate process.

- Filling Out the Form: Ensure that the form is filled out completely and accurately. Include the names and addresses of both the property owner and the beneficiaries to avoid any confusion later.

- Recording the Deed: After completing the form, it must be recorded with the local register of deeds in the county where the property is located. This step is crucial for the deed to be legally effective.

- Revocation: The Transfer-on-Death Deed can be revoked at any time before the owner's death. This can be done by filing a revocation form or creating a new deed that supersedes the previous one.

Understanding these key points will help ensure that the Transfer-on-Death Deed serves its intended purpose and provides peace of mind for both property owners and their beneficiaries.

Dos and Don'ts

When filling out the North Carolina Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure the document is completed correctly. Below is a list of dos and don'ts to consider.

- Do provide accurate information about the property being transferred.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the deed in the presence of a notary public.

- Do ensure the deed is recorded in the county where the property is located.

- Do keep a copy of the completed deed for your records.

- Don't leave any sections of the form blank.

- Don't use outdated forms or templates.

- Don't forget to check for any local requirements that may apply.

- Don't alter the form after it has been signed and notarized.

- Don't assume that the deed will take effect without proper recording.

More Transfer-on-Death Deed State Templates

Washington Transfer on Death Deed - Creating a Transfer-on-Death Deed can help reduce stress for loved ones during a difficult time.

A Florida Commercial Lease Agreement form is a legally binding document between a landlord and a business tenant. It outlines the terms and conditions under which the tenant can rent commercial property in Florida. This form is essential for businesses seeking space for their operations, ensuring both parties understand their rights and responsibilities. For more information, you can visit https://floridaformspdf.com/printable-commercial-lease-agreement-form/.

Affidavit for Transfer Without Probate Ohio - Your designated beneficiary will be able to claim the property without pressure or stress.

Transfer on Death Deed Utah - Using a Transfer-on-Death Deed can help ensure that your property remains within the family for future generations.

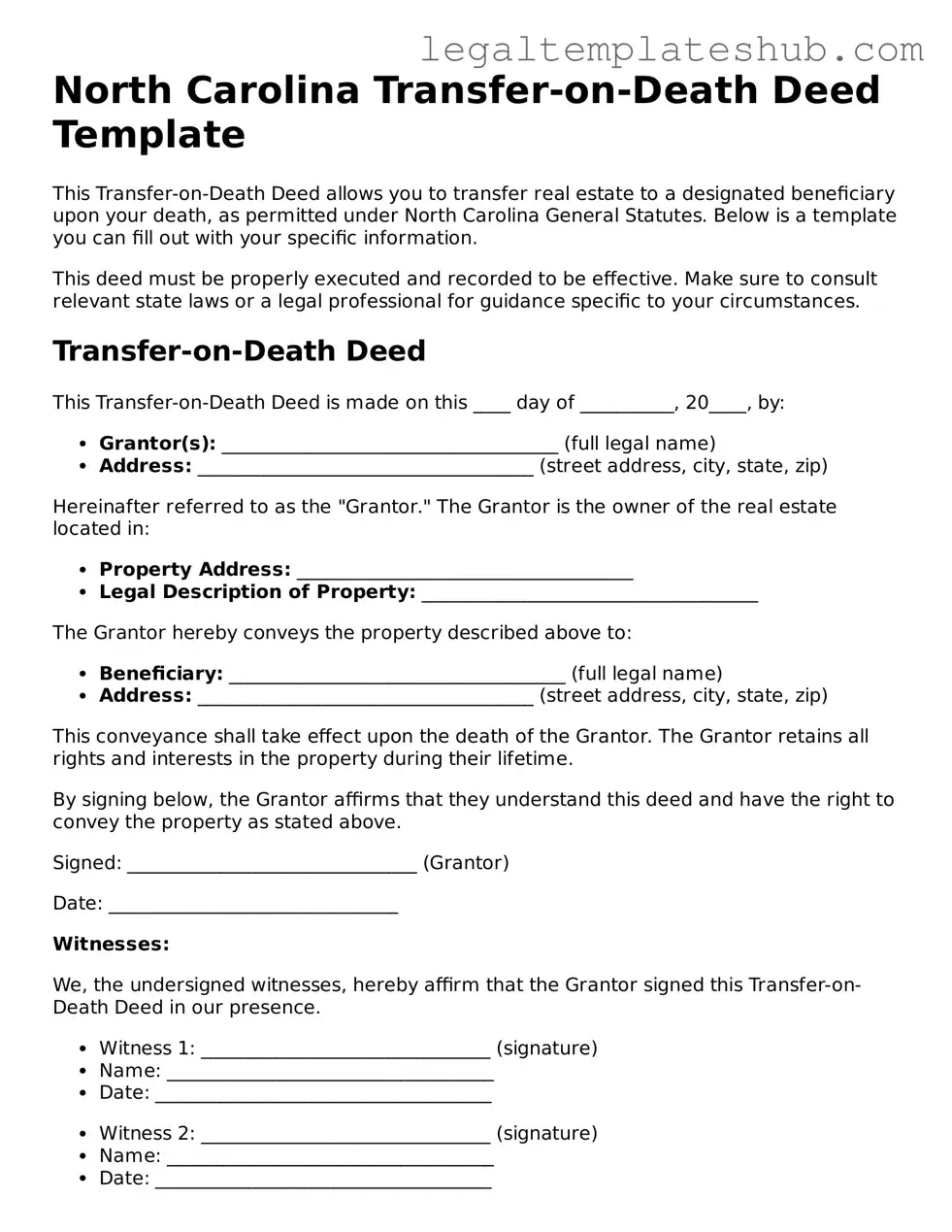

Instructions on Filling in North Carolina Transfer-on-Death Deed

After obtaining the North Carolina Transfer-on-Death Deed form, the next step involves carefully filling it out to ensure that your intentions regarding property transfer are clearly documented. This process requires attention to detail, as accuracy is crucial for the deed to be valid and effective.

- Begin by entering the date at the top of the form. This should reflect the date on which you are completing the deed.

- Next, provide your name as the grantor. This is the individual transferring the property.

- Include your address, ensuring it is complete and accurate. This helps in identifying you as the property owner.

- Identify the property being transferred. This includes a description that matches the legal description found in the property deed.

- List the name(s) of the beneficiary(ies) who will receive the property upon your passing. Be specific and include full legal names.

- Provide the address(es) of the beneficiary(ies) to ensure proper identification.

- Sign the deed in the designated space. This signature must be yours as the grantor.

- Have the deed notarized. A notary public will verify your identity and witness your signature.

- Finally, record the completed deed with the appropriate county register of deeds. This step is essential for the deed to take effect.

Misconceptions

- Misconception 1: The Transfer-on-Death Deed automatically transfers property upon the owner's death.

- Misconception 2: A Transfer-on-Death Deed can only be used for residential properties.

- Misconception 3: The Transfer-on-Death Deed avoids all probate processes.

- Misconception 4: Beneficiaries have immediate rights to the property once the owner signs the deed.

- Misconception 5: A Transfer-on-Death Deed cannot be revoked once it is executed.

This is not accurate. The Transfer-on-Death Deed allows the property owner to designate beneficiaries who will receive the property after the owner's death. However, the transfer does not occur until the owner passes away and the deed is properly recorded.

This misconception overlooks the versatility of the deed. It can be utilized for various types of real estate, including commercial properties and vacant land, as long as the property is eligible under state law.

While the Transfer-on-Death Deed does allow property to pass outside of probate, it does not eliminate the need for probate for other assets. Furthermore, any debts or claims against the estate may still require probate proceedings.

This is misleading. Beneficiaries do not gain any rights to the property until the owner dies. Until that point, the owner retains full control over the property and can sell or modify it as they see fit.

This is incorrect. The property owner retains the right to revoke or change the Transfer-on-Death Deed at any time before death. This flexibility allows owners to adjust their estate plans as circumstances change.