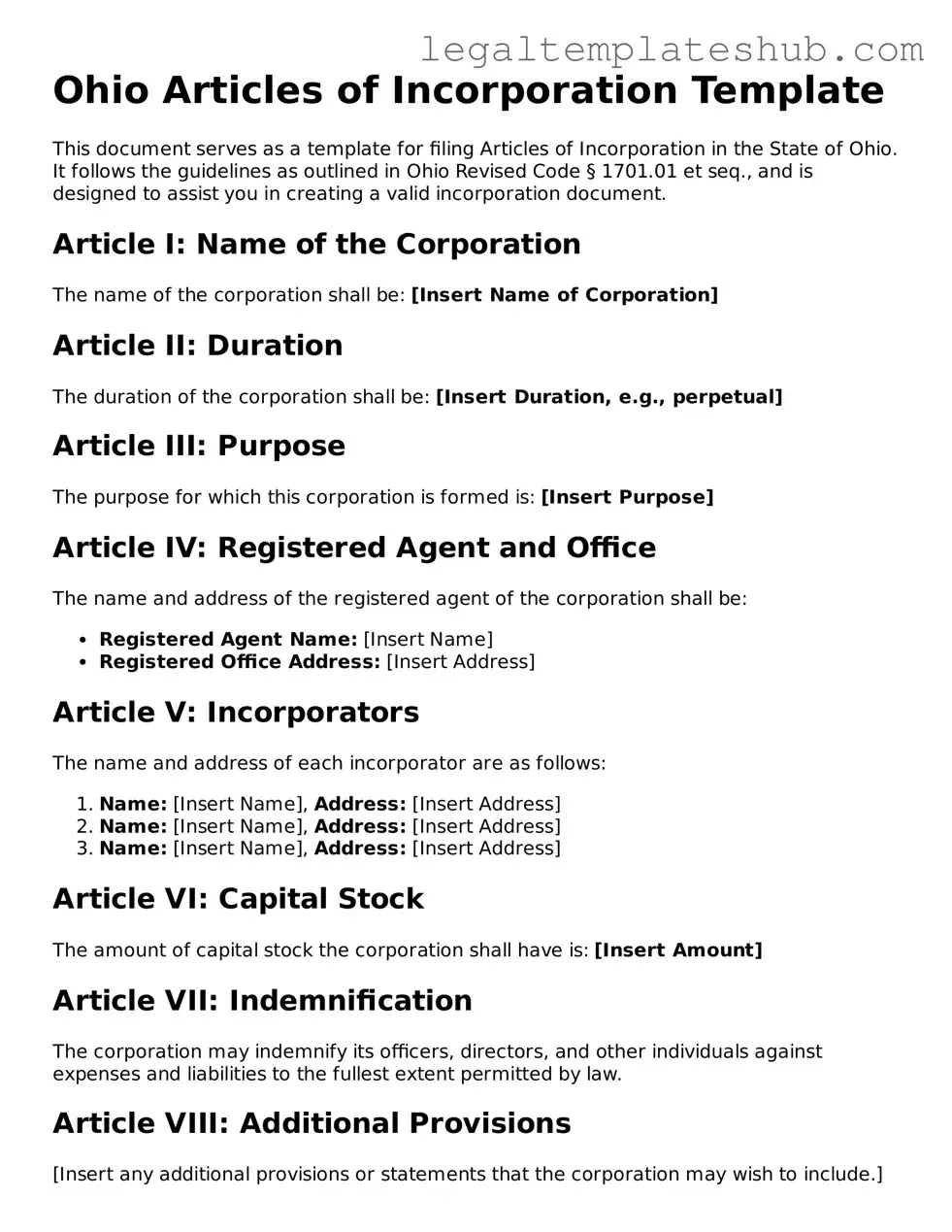

Printable Articles of Incorporation Document for Ohio

PDF Form Data

| Fact Name | Details |

|---|---|

| Governing Law | The Ohio Articles of Incorporation are governed by the Ohio Revised Code, specifically Chapter 1701. |

| Purpose of Form | This form is used to officially create a corporation in the state of Ohio. |

| Filing Fee | The standard filing fee for the Articles of Incorporation is $99, though additional fees may apply for expedited processing. |

| Required Information | Key information includes the corporation's name, purpose, registered agent, and the number of shares authorized. |

| Registered Agent | Every corporation must designate a registered agent who will receive legal documents on behalf of the corporation. |

| Approval Timeline | Typically, the processing time for the Articles of Incorporation is about 7 to 10 business days. |

| Amendments | Once filed, any changes to the Articles of Incorporation require an amendment process, which also involves a fee. |

Key takeaways

When filling out and using the Ohio Articles of Incorporation form, there are several important points to consider. Here are some key takeaways:

- Understand the purpose of the Articles of Incorporation. This document officially establishes your corporation in the state of Ohio.

- Gather necessary information before starting. You will need details such as the corporation's name, address, and the names of the initial directors.

- Choose a unique name for your corporation. The name must not be similar to any existing business registered in Ohio.

- Decide on the type of corporation. Ohio allows for various types, including nonprofit and for-profit corporations.

- Provide a registered agent's information. This person or business will receive legal documents on behalf of the corporation.

- Include the purpose of the corporation. A brief description of the business activities can be helpful for clarity.

- Review the filing fees. There is a fee associated with submitting the Articles of Incorporation, which varies based on the type of corporation.

- File the form with the Ohio Secretary of State. This can be done online or by mail, depending on your preference.

- Keep a copy of the filed Articles of Incorporation. This document is essential for future reference and may be required for other business activities.

By following these guidelines, individuals can effectively navigate the process of incorporating a business in Ohio.

Dos and Don'ts

When filling out the Ohio Articles of Incorporation form, it is essential to approach the process with care and attention to detail. Below are ten important guidelines to follow, including things you should do and things to avoid.

- Do ensure that all information is accurate and up-to-date.

- Do include the name of your corporation exactly as you want it to appear.

- Do provide a valid address for the principal office.

- Do designate a registered agent who has a physical address in Ohio.

- Do clearly state the purpose of your corporation.

- Don't leave any required fields blank; incomplete forms can lead to delays.

- Don't use a name that is too similar to an existing corporation in Ohio.

- Don't forget to include the names and addresses of the initial directors.

- Don't submit the form without reviewing it for errors.

- Don't neglect to pay the required filing fee, as it is necessary for processing.

By following these guidelines, you can help ensure that your Articles of Incorporation are completed correctly and efficiently. Taking the time to double-check your work can save you from potential complications down the road.

More Articles of Incorporation State Templates

North Carolina Corporation - Can include bylaws to guide corporate operations.

To facilitate a smooth transition during the divorce process, it is crucial to utilize the Florida Divorce Settlement Agreement form, which can be accessed at https://floridaformspdf.com/printable-divorce-settlement-agreement-form. This document serves to clarify the division of assets and responsibilities, ultimately minimizing conflict and promoting a fair settlement.

Virginia Llc Fee - A filing fee is typically associated with submitting the Articles.

Instructions on Filling in Ohio Articles of Incorporation

After gathering the necessary information, you can begin filling out the Ohio Articles of Incorporation form. This form is essential for officially establishing your business entity in Ohio. Once completed, you will submit it to the appropriate state office along with the required fee.

- Start by entering the name of your corporation. Ensure that it complies with Ohio naming requirements, including the inclusion of "Corporation," "Incorporated," or an abbreviation like "Inc."

- Provide the principal office address. This must be a physical address in Ohio, not a P.O. Box.

- List the name and address of the statutory agent. This person or business must have a physical address in Ohio and is responsible for receiving legal documents on behalf of the corporation.

- Indicate the purpose of the corporation. A brief description of the business activities will suffice.

- Specify the number of shares the corporation is authorized to issue. If there are different classes of shares, detail those as well.

- Include the names and addresses of the initial directors. You typically need at least one director.

- Provide the name and address of the incorporator. This is the person who is filing the Articles of Incorporation.

- Sign and date the form. The incorporator must sign to validate the document.

- Prepare the filing fee. Check the current fee schedule to ensure you include the correct amount with your submission.

- Submit the completed form and fee to the Ohio Secretary of State's office. This can often be done online, by mail, or in person.

Misconceptions

When it comes to the Ohio Articles of Incorporation form, several misconceptions can lead to confusion. Here are six common misunderstandings:

- Misconception 1: Anyone can file the Articles of Incorporation without any prior knowledge.

- Misconception 2: The Articles of Incorporation are the only requirement for starting a business in Ohio.

- Misconception 3: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 4: The Articles of Incorporation are the same for all types of businesses.

- Misconception 5: Filing the Articles of Incorporation guarantees that your business will succeed.

- Misconception 6: The process of filing the Articles of Incorporation is quick and easy.

While technically possible, it is advisable to understand the requirements and implications of incorporation before filing. Knowledge of the process helps avoid mistakes that could delay approval.

Incorporating is just one step. Businesses must also obtain necessary licenses, permits, and possibly register for taxes, depending on their activities.

In fact, amendments can be made to the Articles of Incorporation. This allows businesses to adapt to changes in ownership, structure, or purpose over time.

Different business structures, such as corporations and limited liability companies (LLCs), have distinct requirements. Each type has its own specific Articles of Incorporation.

Incorporation provides legal protection and structure but does not ensure profitability or success. Business planning and execution are crucial for achieving goals.

While the form itself may be straightforward, the overall process can take time. Gathering necessary information, completing the form accurately, and waiting for approval can require patience.