Printable Bill of Sale Document for Ohio

PDF Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Bill of Sale form is used to document the transfer of ownership of personal property. |

| Governing Law | This form is governed by Ohio Revised Code Section 1302.01. |

| Types of Property | The form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | Notarization is not required for the Bill of Sale in Ohio, but it can provide additional legal protection. |

| Buyer's Information | The form requires the buyer's name, address, and contact information for proper identification. |

| Seller's Information | Seller's details, including name and address, must also be included to establish ownership. |

| Date of Sale | The date of the transaction should be clearly stated to document when the sale occurred. |

| Purchase Price | The agreed-upon purchase price must be recorded to reflect the value of the transaction. |

| Condition of Property | It's advisable to include a statement about the condition of the property to avoid future disputes. |

| Record Keeping | Both the buyer and seller should keep a copy of the Bill of Sale for their records. |

Key takeaways

When filling out and using the Ohio Bill of Sale form, it’s important to understand its purpose and the key elements involved. Here are some essential takeaways to consider:

- Purpose of the Bill of Sale: This document serves as proof of the transfer of ownership from one party to another. It can be crucial for legal and tax purposes.

- Required Information: Ensure you include the names and addresses of both the buyer and seller, a description of the item being sold, and the purchase price. This information solidifies the agreement.

- Signatures: Both parties must sign the Bill of Sale. This signature serves as an acknowledgment that the transaction has occurred and that both parties agree to the terms.

- Notarization: While notarization is not always required in Ohio, having the document notarized can add an extra layer of authenticity and may be beneficial in case of future disputes.

- Record Keeping: After the transaction, both the buyer and seller should keep a copy of the Bill of Sale. This record can be helpful for future reference, especially for tax purposes or if any issues arise.

Understanding these key points can help ensure a smooth transaction and protect the interests of both parties involved.

Dos and Don'ts

When filling out the Ohio Bill of Sale form, it is important to follow certain guidelines to ensure the document is valid and effective. Here are six things to keep in mind:

- Do: Provide accurate information about the buyer and seller, including full names and addresses.

- Do: Clearly describe the item being sold, including its make, model, year, and Vehicle Identification Number (VIN) if applicable.

- Do: Include the sale price of the item to establish the transaction's value.

- Do: Sign and date the form to validate the agreement between both parties.

- Don't: Leave any sections of the form blank; incomplete forms may lead to issues later.

- Don't: Use vague language when describing the item; specificity is key to avoid misunderstandings.

More Bill of Sale State Templates

Bill of Sales for Cars - A Bill of Sale can be customized to fit the specific needs of the seller and buyer.

For anyone looking to understand the nuances of transactions, the essential guide on a General Bill of Sale for personal property is invaluable. This document not only facilitates a smooth exchange of ownership but also ensures that both parties are protected by clearly outlining the terms of the sale.

Nj Car Bill of Sale - The seller should disclose any known issues with the item being sold.

Instructions on Filling in Ohio Bill of Sale

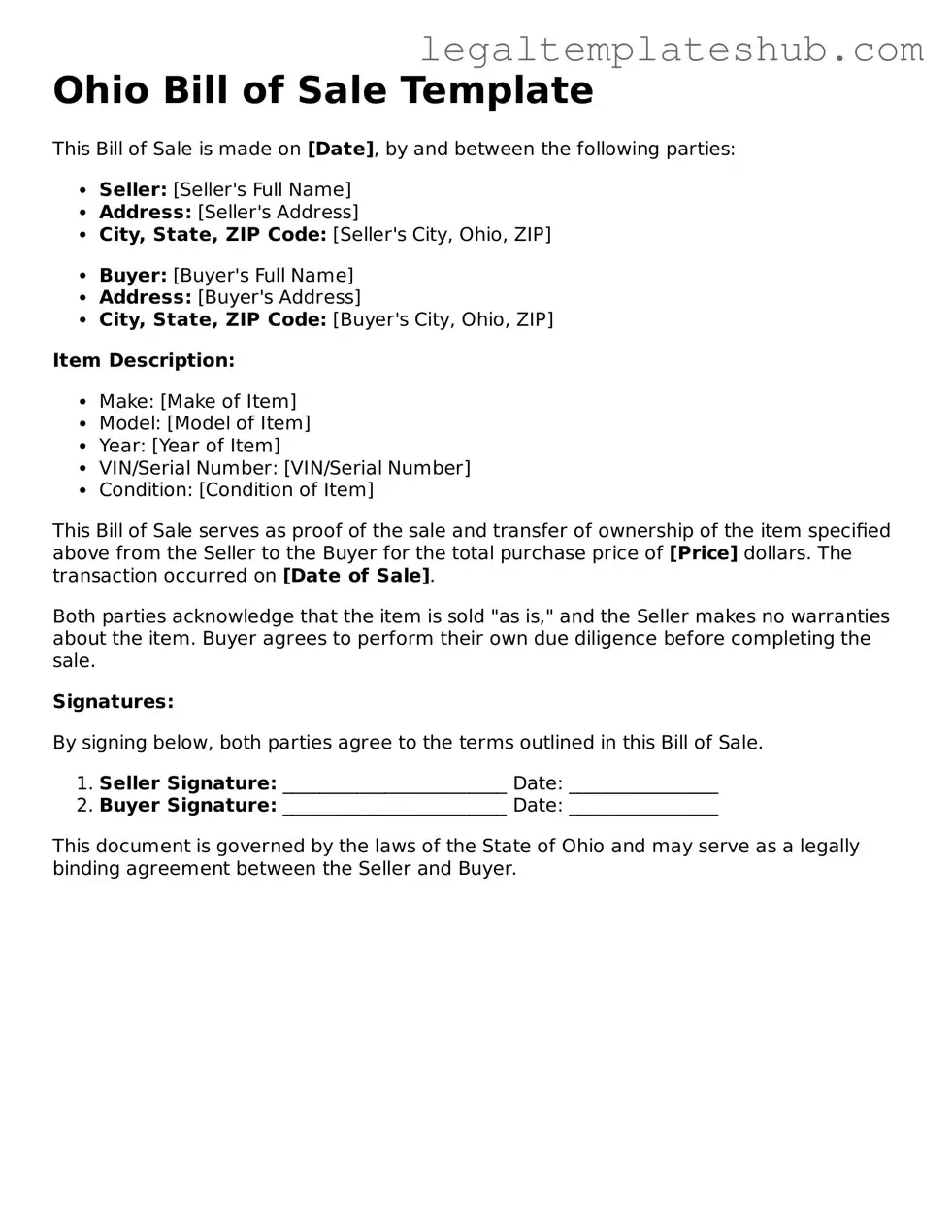

Once you have your Ohio Bill of Sale form ready, it’s time to fill it out accurately. This document is essential for recording the transfer of ownership for various items, such as vehicles or personal property. Follow these steps carefully to ensure that all necessary information is included and correctly stated.

- Obtain the Form: Download or print the Ohio Bill of Sale form from a reliable source.

- Identify the Seller: Write the full name and address of the seller. Ensure that this information is accurate.

- Identify the Buyer: Next, enter the full name and address of the buyer. Double-check for any spelling errors.

- Describe the Item: Provide a detailed description of the item being sold. Include make, model, year, and any identifying numbers, such as a Vehicle Identification Number (VIN) for vehicles.

- State the Sale Price: Clearly indicate the sale price of the item. Be specific about the amount in both numbers and words to avoid any confusion.

- Include Date of Sale: Write the date on which the sale is taking place. This is important for record-keeping.

- Signatures: Both the seller and buyer must sign the form. Include printed names below the signatures for clarity.

- Notarization (if required): In some cases, you may need to have the document notarized. Check local requirements to see if this step is necessary.

After completing the form, ensure that both parties retain a copy for their records. This will serve as proof of the transaction and can be important for future reference.

Misconceptions

Understanding the Ohio Bill of Sale form is crucial for anyone involved in buying or selling personal property. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- It is only for vehicles. Many people believe that a Bill of Sale is only necessary for vehicle transactions. In reality, it can be used for various personal property sales, including boats, trailers, and even furniture.

- It does not need to be notarized. Some assume that a Bill of Sale does not require notarization. While notarization is not mandatory for all transactions, having it notarized can provide an additional layer of security and validation.

- It is not legally binding. There is a misconception that a Bill of Sale is not a legally binding document. In fact, when properly completed, it serves as a legal record of the transaction and can be enforced in court.

- Only the seller needs to sign. Some individuals think that only the seller's signature is necessary. However, both the buyer and seller should sign the document to confirm the agreement.

- It is only necessary for large transactions. Many believe a Bill of Sale is only required for high-value items. In truth, it is advisable to use one for any sale, regardless of the item's value, to ensure clarity and protection for both parties.

- It is the same as a receipt. Some confuse a Bill of Sale with a simple receipt. A Bill of Sale contains more detailed information about the transaction and serves as a formal record of ownership transfer.

- It does not need to include specific details. There is a belief that a Bill of Sale can be vague. In reality, it should include specific details such as the item description, sale price, and the names of both parties to be effective.

- It is not necessary for private sales. Many think that a Bill of Sale is only required for transactions through dealers or businesses. However, it is equally important for private sales to protect both the buyer and the seller.

Being aware of these misconceptions can help ensure that the process of buying or selling personal property in Ohio is smooth and legally sound.