Printable Deed Document for Ohio

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | An Ohio deed is a legal document that transfers ownership of real property from one party to another. |

| Types of Deeds | Ohio recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Governing Law | The transfer of property through deeds in Ohio is governed by the Ohio Revised Code, specifically Chapter 5301. |

| Signature Requirements | For a deed to be valid, it must be signed by the grantor (the person transferring the property). |

| Notarization | Ohio requires that the signatures on a deed be notarized to ensure authenticity. |

| Recording | To protect the interests of the new owner, the deed should be recorded with the county recorder's office where the property is located. |

| Consideration | While a deed can be executed without monetary consideration, it is common to include the purchase price or a nominal amount. |

| Title Insurance | Obtaining title insurance is advisable to protect against potential disputes over property ownership. |

| Common Uses | Ohio deeds are commonly used in real estate transactions, inheritance situations, and property transfers between family members. |

Key takeaways

Filling out and using the Ohio Deed form is an important step in the process of transferring property ownership. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Ohio Deed form is used to legally transfer ownership of real estate from one party to another.

- Gather Necessary Information: Before filling out the form, collect essential details such as the names of the grantor (seller) and grantee (buyer), property description, and the sale price.

- Choose the Correct Type of Deed: Ohio recognizes various types of deeds, including warranty deeds and quitclaim deeds. Select the one that best fits your needs.

- Provide Accurate Property Description: Clearly describe the property being transferred. This includes the address and legal description, which can often be found in previous deeds or tax records.

- Signatures Are Essential: Ensure that the grantor's signature is present on the deed. If there are multiple grantors, all must sign.

- Notarization Required: The deed must be notarized to be considered valid. A notary public will verify the identities of the signers.

- File with the County Recorder: After completing and notarizing the deed, it must be filed with the county recorder's office where the property is located.

- Pay Attention to Fees: Be prepared to pay filing fees when submitting the deed. These fees can vary by county.

- Keep Copies for Records: After filing, retain copies of the deed for your personal records. This is important for future reference.

- Consult a Professional if Needed: If you have questions or feel uncertain about the process, consider consulting a real estate attorney for guidance.

By following these takeaways, you can navigate the process of filling out and using the Ohio Deed form with confidence.

Dos and Don'ts

When filling out the Ohio Deed form, it's essential to approach the task with care. Here are some important guidelines to follow:

- Do double-check all names and addresses. Accuracy is crucial; any mistakes can lead to complications later.

- Don't leave any required fields blank. Ensure that all necessary information is provided to avoid delays in processing.

- Do use clear and legible handwriting. If you're filling it out by hand, make sure your writing is easy to read.

- Don't forget to sign and date the form. An unsigned deed is not valid, so ensure your signature is included.

- Do consult with a legal professional if you have questions. Seeking guidance can help clarify any uncertainties you may have.

By following these simple dos and don'ts, you can help ensure that your Ohio Deed form is filled out correctly and efficiently.

More Deed State Templates

Clark County Register of Deeds - A deed may also specify any conditions or restrictions attached to the property's use by the buyer.

Utah Deed Requirements - A special purpose deed may be used in transactions involving government entities.

Michigan Property Transfer Affidavit - Real estate agents can provide guidance on deed requirements for specific transactions.

Ensuring a clear understanding between landlords and tenants is crucial, and utilizing a properly formatted New York Residential Lease Agreement can help eliminate any potential misunderstandings. Not only does this document cover key aspects like rental terms and party responsibilities, but it also provides a structured way to formalize the rental relationship. For convenience, you can find the necessary paperwork by checking out PDF Templates to assist you in this important process.

Pennsylvania Deed Transfer Form - Can outline any conditions or restrictions.

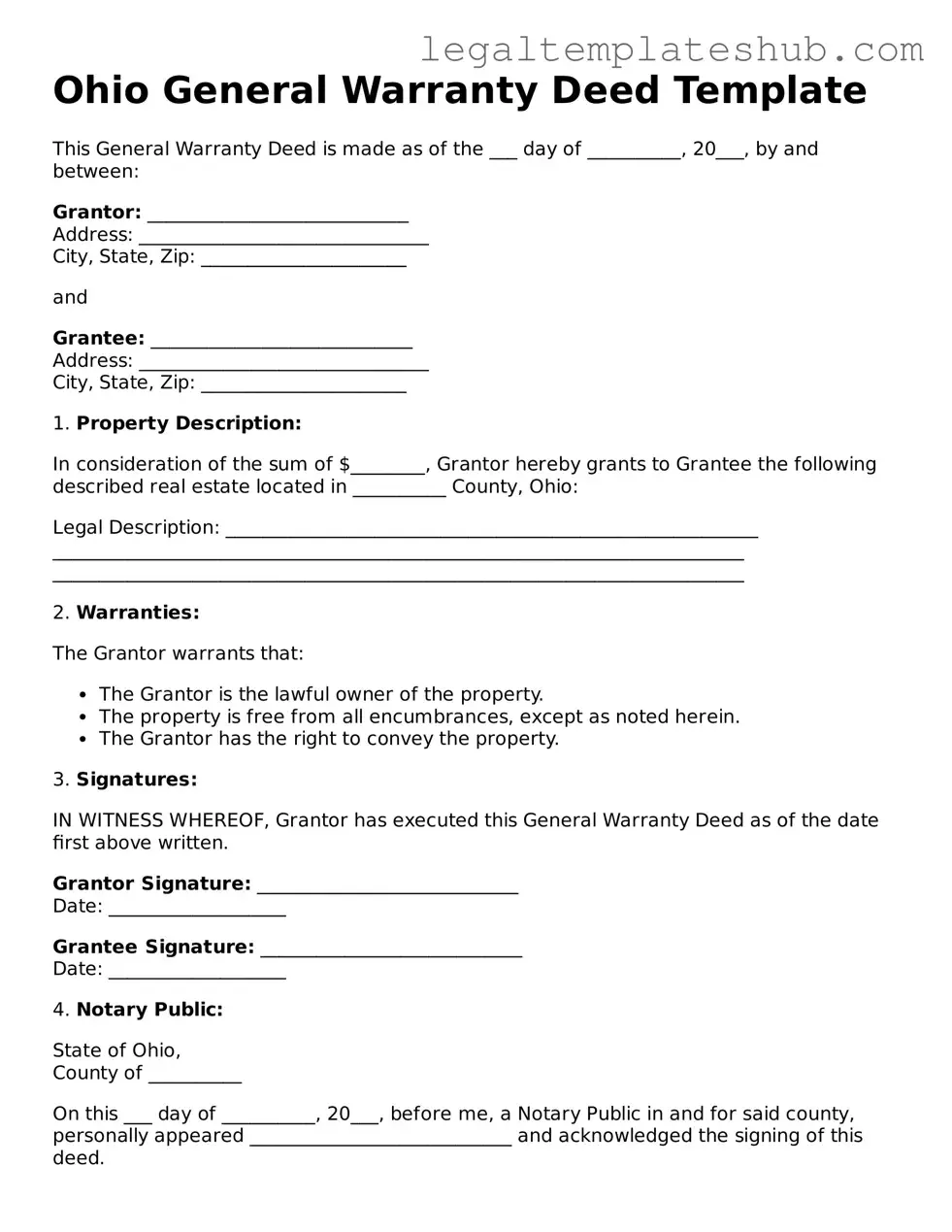

Instructions on Filling in Ohio Deed

Once you have the Ohio Deed form in hand, it’s important to fill it out accurately to ensure a smooth transfer of property ownership. After completing the form, you will need to have it signed, notarized, and then filed with the appropriate county office.

- Begin by entering the date at the top of the form.

- Identify the grantor (the person transferring the property). Provide their full name and address.

- Next, identify the grantee (the person receiving the property). Again, include their full name and address.

- Clearly describe the property being transferred. Include the street address and legal description, if available.

- Indicate the consideration (the amount paid for the property) in the designated section.

- Sign the form in the presence of a notary public. The grantor must sign here.

- Have the notary public complete their section, including their signature and seal.

- Check for any additional requirements specific to your county regarding filing the deed.

- Make copies of the completed deed for your records.

- Finally, file the original deed with the county recorder’s office where the property is located.

Misconceptions

Understanding the Ohio Deed form is essential for anyone involved in property transactions in the state. However, there are several misconceptions that can lead to confusion. Here’s a list of ten common misunderstandings:

- All deeds are the same. Many believe that all deed forms are identical. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving a unique purpose.

- You don’t need a lawyer to create a deed. While it’s possible to draft a deed without legal assistance, having a lawyer can help ensure that the deed meets all legal requirements and protects your interests.

- A deed is the same as a title. Some people think that a deed and a title are interchangeable. The deed transfers ownership, while the title proves ownership.

- Once signed, a deed is automatically valid. A deed must be properly recorded with the county to be legally effective. Simply signing it does not complete the process.

- Only the seller needs to sign the deed. Both the seller and the buyer typically need to sign the deed for it to be valid.

- Deeds don’t need to be notarized. In Ohio, most deeds require notarization to be valid. This adds a layer of authenticity to the document.

- You can use a handwritten deed. While handwritten deeds are allowed, they must still meet specific legal requirements to be enforceable.

- All property transfers require a new deed. In some cases, property transfers can occur without a new deed, such as through inheritance or court orders.

- Deeds can be changed after they are recorded. Once a deed is recorded, it cannot be altered. If changes are needed, a new deed must be created.

- Filing a deed is optional. In Ohio, filing a deed is mandatory to ensure that the transfer of property is recognized legally. Failing to file can lead to disputes over ownership.

By clearing up these misconceptions, individuals can navigate property transactions in Ohio more confidently and effectively.