Printable Deed in Lieu of Foreclosure Document for Ohio

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | An Ohio Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | This form is governed by Ohio Revised Code § 5301.01 and related statutes regarding property transfer and foreclosure. |

| Benefits | Using this form can help borrowers avoid the lengthy foreclosure process and may protect their credit score better than a foreclosure. |

| Requirements | Both the borrower and lender must agree to the deed in lieu arrangement. It is important to consult with a legal professional to ensure compliance with all requirements. |

Key takeaways

When considering the Ohio Deed in Lieu of Foreclosure form, it's essential to understand its purpose and implications. Here are some key takeaways to keep in mind:

- Voluntary Transfer: A Deed in Lieu of Foreclosure allows the homeowner to voluntarily transfer ownership of the property to the lender, helping to avoid the lengthy foreclosure process.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require proof of financial hardship and that the property is not subject to any other liens.

- Property Condition: The property must be in good condition. Lenders may conduct an inspection before accepting the deed.

- Impact on Credit: While a Deed in Lieu can be less damaging than a foreclosure, it may still negatively impact your credit score.

- Release from Debt: Homeowners may be released from the mortgage debt, but this depends on the agreement with the lender. Always confirm the terms before proceeding.

- Legal Considerations: It's advisable to consult with a legal professional to understand the implications fully and ensure that all paperwork is completed correctly.

Understanding these points can help homeowners navigate the process more effectively and make informed decisions regarding their property.

Dos and Don'ts

When filling out the Ohio Deed in Lieu of Foreclosure form, there are important guidelines to follow. Here are six things you should and shouldn't do:

- Do ensure that all personal information is accurate and complete.

- Do consult with a legal professional if you have questions about the process.

- Do provide a clear description of the property involved in the deed.

- Do sign the document in the presence of a notary public.

- Don't leave any sections of the form blank; this could delay the process.

- Don't submit the form without reviewing it for errors or omissions.

More Deed in Lieu of Foreclosure State Templates

Deed in Lieu of Mortgage - A straightforward option for homeowners to relinquish their home and settle debts amicably.

For those looking to formalize the sale, the necessary documentation can be found at PDF Templates, which provides convenient resources to create a comprehensive New York Motorcycle Bill of Sale.

Deed in Lieu - This form is a voluntary agreement between a borrower and lender to settle a mortgage default.

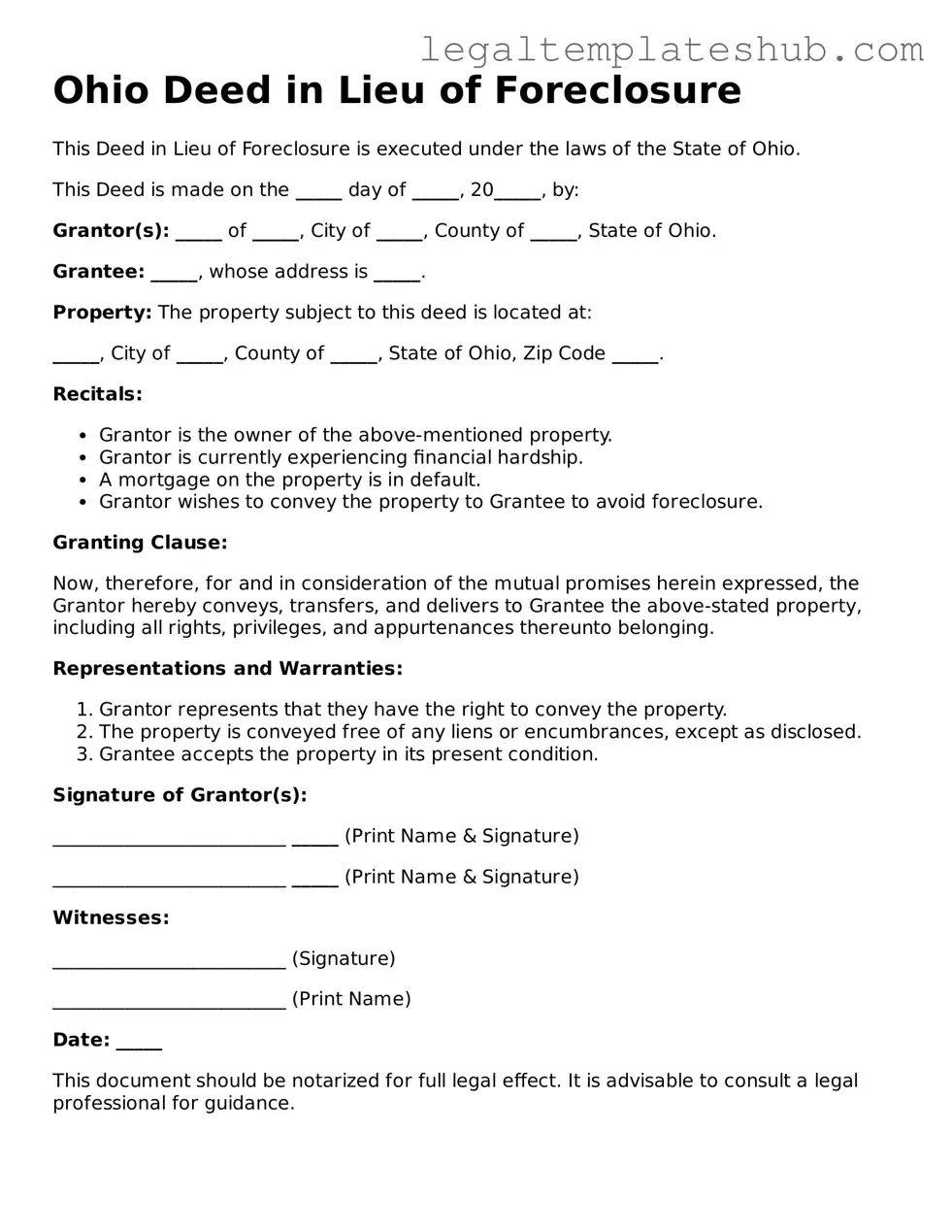

Instructions on Filling in Ohio Deed in Lieu of Foreclosure

After obtaining the Ohio Deed in Lieu of Foreclosure form, it's important to carefully complete it to ensure that all necessary information is accurately provided. Once filled out, the form will need to be signed and submitted according to the requirements set forth by your lender.

- Begin by writing the date at the top of the form.

- Identify the parties involved. Fill in the name of the property owner (grantor) and the lender (grantee).

- Provide the property address, including street number, street name, city, and zip code.

- Include a legal description of the property. This can usually be found on the original deed or through your local property records office.

- State the reason for the deed in lieu of foreclosure. Briefly explain the circumstances leading to this decision.

- Sign the document. The property owner must sign in the designated area.

- Have the signature notarized. A notary public will need to witness the signing and affix their seal.

- Make copies of the completed form for your records.

- Submit the original form to your lender as instructed.

Misconceptions

Understanding the Ohio Deed in Lieu of Foreclosure form is essential for homeowners facing financial difficulties. However, several misconceptions can cloud this understanding. Below is a list of common misconceptions and clarifications regarding this form.

- It eliminates all debts associated with the property. Many believe that signing a Deed in Lieu of Foreclosure automatically cancels all debts. In reality, this may not be the case, especially if there are second mortgages or liens on the property.

- It is a quick and easy solution. While it may seem straightforward, the process can be lengthy and complicated. Lenders often require extensive documentation and may take time to review the request.

- It guarantees a smooth transition to a new living situation. This form does not ensure that a homeowner will find a new place to live easily. Finding suitable housing can still be a challenge.

- It has no impact on credit scores. A Deed in Lieu of Foreclosure can negatively affect credit scores, similar to a foreclosure. This impact can last for several years.

- All lenders accept Deeds in Lieu of Foreclosure. Not all lenders will agree to this option. Some may prefer to proceed with foreclosure instead.

- It absolves the homeowner of all future liability. Homeowners may still be liable for any deficiency judgments if the property sells for less than the owed mortgage balance.

- It is the same as a short sale. A Deed in Lieu of Foreclosure differs from a short sale. In a short sale, the property is sold for less than the mortgage balance with lender approval, while a Deed in Lieu transfers ownership back to the lender.

- Homeowners cannot negotiate terms. Homeowners can negotiate terms with the lender, such as the timeline for vacating the property or potential relocation assistance.

- It is a guaranteed way to avoid foreclosure. While it can prevent foreclosure, it is not guaranteed. The lender must agree to the Deed in Lieu of Foreclosure.

Clarifying these misconceptions can help homeowners make informed decisions during a challenging time.