Printable Durable Power of Attorney Document for Ohio

PDF Form Data

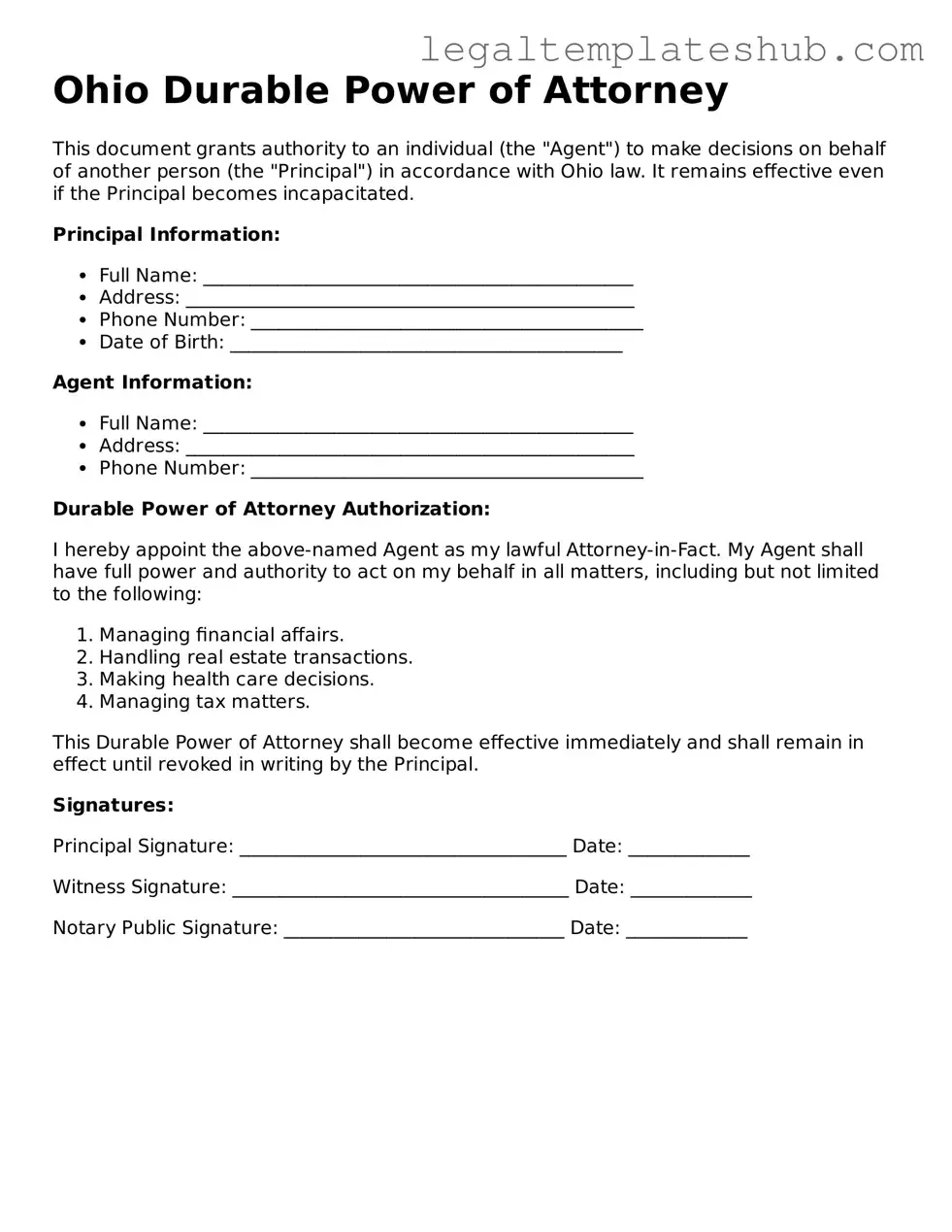

| Fact Name | Description |

|---|---|

| Definition | The Ohio Durable Power of Attorney form allows an individual (the principal) to appoint someone (the agent) to make financial and legal decisions on their behalf. |

| Durability | This form remains effective even if the principal becomes incapacitated, ensuring that decisions can still be made when needed. |

| Governing Law | The Ohio Durable Power of Attorney is governed by Ohio Revised Code Section 1337.22 to 1337.64. |

| Agent Authority | The agent can handle a wide range of financial matters, including banking, real estate transactions, and tax matters. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Execution Requirements | The form must be signed by the principal and acknowledged before a notary public or signed in the presence of two witnesses. |

| Springing vs. Immediate | This form can be set up to take effect immediately or to "spring" into effect upon the principal's incapacity. |

| Agent Selection | Choosing a trustworthy agent is crucial, as they will have significant control over the principal's financial matters. |

| Limitations | Some powers, such as making medical decisions, require a separate healthcare power of attorney. |

| Legal Advice | It is advisable to seek legal counsel when drafting or executing a Durable Power of Attorney to ensure it meets all legal requirements. |

Key takeaways

Filling out and using the Ohio Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are handled according to your wishes. Here are some key takeaways to consider:

- Understand the Purpose: The Durable Power of Attorney allows you to designate someone to manage your financial affairs if you become incapacitated.

- Choose Your Agent Wisely: Select a trusted individual who understands your values and will act in your best interest.

- Specify Powers Clearly: Be explicit about the powers you are granting. This may include managing bank accounts, real estate transactions, and other financial decisions.

- Consider Multiple Agents: You can appoint more than one agent, but ensure they can work together effectively.

- Review State Requirements: Familiarize yourself with Ohio's specific requirements for a Durable Power of Attorney to ensure the document is valid.

- Sign in Front of Witnesses: In Ohio, the form must be signed in the presence of a notary public or two witnesses to be legally binding.

- Keep Copies Accessible: After completing the form, provide copies to your agent, your attorney, and any financial institutions that may need it.

- Review Regularly: Life circumstances change. Periodically review and update your Durable Power of Attorney to reflect your current wishes.

- Understand Revocation: You can revoke the Durable Power of Attorney at any time, as long as you are competent to do so.

- Seek Legal Advice if Needed: If you have questions or concerns, consulting with a legal professional can provide clarity and ensure your document meets your needs.

Dos and Don'ts

When filling out the Ohio Durable Power of Attorney form, it’s essential to approach the process with care. Here are nine important do's and don'ts to keep in mind:

- Do ensure you understand the powers you are granting to your agent.

- Do choose a trustworthy person as your agent.

- Do sign the document in the presence of a notary public.

- Do keep a copy of the signed document for your records.

- Do review the form periodically to ensure it still meets your needs.

- Don't leave any sections of the form blank; complete all necessary fields.

- Don't choose an agent who may have conflicting interests.

- Don't forget to inform your agent about their responsibilities.

- Don't use outdated forms; always use the most current version.

More Durable Power of Attorney State Templates

How to Fill Out a Power of Attorney - It provides peace of mind knowing someone you trust is in charge if needed.

Virginia Power of Attorney - Individuals can appoint a trusted person to make decisions on their behalf through a Durable Power of Attorney.

When planning your estate, a thorough Last Will and Testament guide is crucial to ensure your wishes are executed as intended. This legal document provides clear directives on asset distribution, allowing peace of mind for you and your loved ones.

How to Get Power of Attorney in Nc - With a Durable Power of Attorney, you can designate a trusted person to handle your affairs, providing peace of mind for you and your family.

Instructions on Filling in Ohio Durable Power of Attorney

Filling out the Ohio Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes, especially if you become unable to make decisions for yourself. After completing the form, it is crucial to ensure that it is signed and witnessed properly to be legally valid.

- Begin by downloading the Ohio Durable Power of Attorney form from a reliable source or obtain a physical copy from a legal office.

- Read through the entire form carefully to understand the sections and requirements.

- In the first section, provide your full name and address. This identifies you as the principal.

- Next, designate an agent by filling in their name and address. This person will have the authority to act on your behalf.

- Consider whether you want to name an alternate agent. If so, provide their name and address as well.

- In the section outlining the powers granted, specify the types of decisions your agent can make. This may include financial matters, real estate transactions, and more.

- Indicate the duration of the power of attorney. You can choose for it to be effective immediately or only if you become incapacitated.

- Review the form to ensure all information is accurate and complete.

- Sign and date the form in the presence of a notary public or witnesses, as required by Ohio law.

- Provide copies of the signed form to your agent and any relevant institutions, such as banks or healthcare providers.

Once you have completed these steps, your Durable Power of Attorney will be ready to use when needed. It is advisable to keep the original document in a safe place while ensuring that your agent knows how to access it.

Misconceptions

Understanding the Ohio Durable Power of Attorney form is essential for effective estate planning. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

-

It only applies to financial matters.

Many people believe that a Durable Power of Attorney (DPOA) only covers financial decisions. In reality, it can also grant authority over healthcare decisions if specified.

-

It becomes invalid if the principal becomes incapacitated.

This is incorrect. A Durable Power of Attorney remains effective even if the principal becomes incapacitated, which is a key feature that distinguishes it from a regular Power of Attorney.

-

All powers are automatically granted.

Not all powers are automatically included. The principal must specify the powers they wish to grant to their agent in the document.

-

It can only be revoked by a court.

A Durable Power of Attorney can be revoked by the principal at any time, as long as they are mentally competent to do so. This does not require court involvement.

-

Agents must act in the best interest of the principal.

While agents are expected to act in good faith, the DPOA does not legally enforce this expectation. It is crucial to choose a trustworthy agent.

-

It is the same as a living will.

A Durable Power of Attorney is not the same as a living will. A living will specifically addresses healthcare decisions at the end of life, while a DPOA can cover a broader range of decisions.

-

Once signed, it cannot be changed.

This is a misconception. The principal can modify or create a new DPOA at any time, as long as they are competent to do so.

-

It is only necessary for older individuals.

Many believe that a Durable Power of Attorney is only important for seniors. However, anyone can benefit from having a DPOA in place, regardless of age.

Addressing these misconceptions can help individuals make informed decisions about their estate planning needs.