Printable Horse Bill of Sale Document for Ohio

PDF Form Data

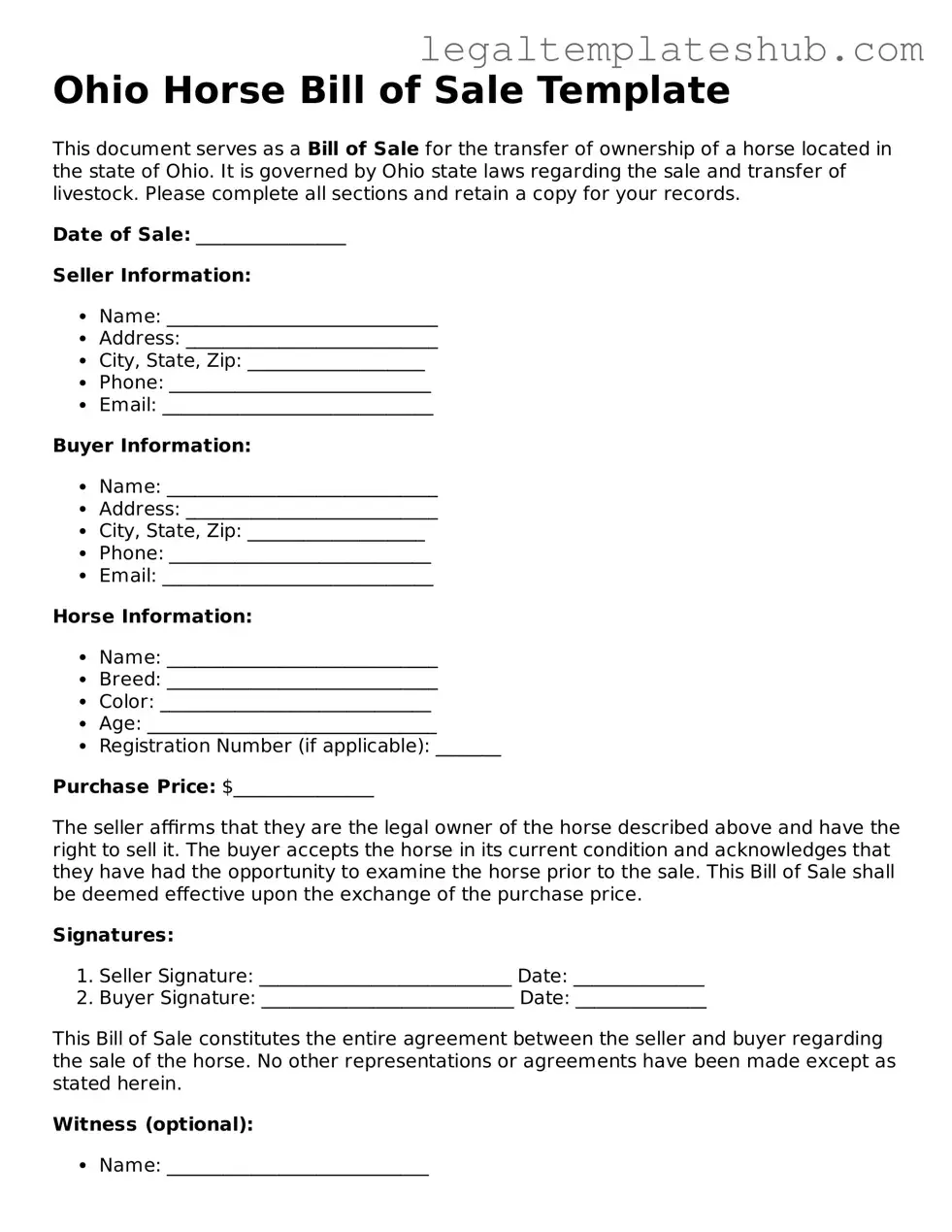

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Horse Bill of Sale form is used to document the sale and transfer of ownership of a horse. |

| Requirements | Both the buyer and seller must sign the form to validate the transaction. |

| Governing Law | The sale of horses in Ohio is governed by Ohio Revised Code Section 1302.01 et seq. |

| Additional Information | It is advisable to include details such as the horse's breed, age, and health status for clarity. |

Key takeaways

When filling out and using the Ohio Horse Bill of Sale form, it is essential to keep several key points in mind. This document serves as a legal record of the transaction between the buyer and seller. Understanding its components will help ensure a smooth process.

- Identify the Parties: Clearly state the names and addresses of both the buyer and seller. This information is crucial for establishing ownership and accountability.

- Provide Detailed Horse Information: Include specific details about the horse, such as its breed, age, color, and any unique identifying marks. This helps avoid confusion later.

- State the Purchase Price: Clearly outline the agreed-upon price for the horse. This should be documented in a straightforward manner to prevent disputes.

- Include Payment Terms: Specify the payment method and any terms related to the transaction. This may include deposits, financing arrangements, or payment deadlines.

- Disclosures and Warranties: Address any known issues or health conditions related to the horse. Transparency is key in building trust between parties.

- Signatures Required: Ensure that both the buyer and seller sign the document. This step is vital for the bill of sale to be legally binding.

By following these guidelines, both parties can facilitate a clear and legally sound transaction. Taking the time to fill out the Ohio Horse Bill of Sale form accurately will protect the interests of everyone involved.

Dos and Don'ts

When filling out the Ohio Horse Bill of Sale form, it's important to ensure that the information is accurate and complete. Here’s a helpful list of things you should and shouldn’t do:

- Do include all relevant details about the horse, such as breed, age, color, and any identifying marks.

- Do provide both the buyer's and seller's full names and contact information.

- Do clearly state the sale price and any terms of payment.

- Do sign and date the document to make it legally binding.

- Don't leave any sections blank; incomplete forms can lead to confusion or disputes.

- Don't use vague language when describing the horse; be as specific as possible.

- Don't forget to provide a bill of sale copy to the buyer for their records.

- Don't rush through the process; take your time to review the form before finalizing it.

By following these guidelines, you can help ensure a smooth transaction and avoid potential issues down the line.

More Horse Bill of Sale State Templates

Equine Bill of Sale - This form can be a requirement for transferring registration documents.

An Operating Agreement is a vital document that outlines the management structure and operating procedures for a limited liability company (LLC). It serves as an internal guide for members, detailing financial arrangements, voting rights, and responsibilities. To ensure compliance and clarity, consider filling out the form by clicking the button below. For convenient access, you can find helpful resources at PDF Templates.

Instructions on Filling in Ohio Horse Bill of Sale

Once you have the Ohio Horse Bill of Sale form ready, you can begin filling it out. This document will require specific information about the horse, the seller, and the buyer. Make sure to have all necessary details at hand for a smooth process.

- Start by entering the date of the sale at the top of the form.

- Fill in the seller's full name and address. Ensure that all contact information is accurate.

- Next, provide the buyer's full name and address. Double-check for any spelling errors.

- In the designated section, describe the horse being sold. Include details such as the horse's name, breed, age, color, and any identification numbers, like a registration number or microchip number.

- Specify the sale price clearly. Indicate the amount in both numbers and words to avoid confusion.

- Include any terms of the sale. This may cover payment methods, any warranties, or conditions related to the horse's health or training.

- Both the seller and buyer should sign and date the form at the bottom. Make sure each party retains a copy for their records.

Misconceptions

When it comes to the Ohio Horse Bill of Sale form, there are several misconceptions that can lead to confusion. Understanding the truth behind these myths can help ensure a smooth transaction. Here are eight common misconceptions:

- The form is only necessary for purebred horses. Many believe that only purebred horses require a Bill of Sale. In reality, any horse being sold or transferred in Ohio should have this document to protect both the buyer and seller.

- A verbal agreement is sufficient. Some people think that a handshake or verbal agreement is enough. However, having a written Bill of Sale provides legal protection and clarity for both parties involved.

- The form is complicated and hard to understand. Many assume that legal forms are difficult to navigate. The Ohio Horse Bill of Sale is straightforward and can be completed with basic information about the horse and the transaction.

- Only licensed dealers need a Bill of Sale. It’s a common belief that only professional sellers require this document. In truth, anyone selling a horse, regardless of their status, should use a Bill of Sale.

- The Bill of Sale doesn’t need to be notarized. Some think that notarization is optional. While it’s not always required, having the document notarized can add an extra layer of security and authenticity.

- Once the Bill of Sale is signed, the seller has no further obligations. There’s a misconception that the seller is free from any responsibilities after the sale. However, sellers may still be liable for certain disclosures or issues that arise post-sale.

- The form can be used for any type of horse-related transaction. Some believe that the Bill of Sale is suitable for all horse transactions. It’s important to note that this form is specifically for the sale or transfer of ownership and may not cover other agreements.

- Buyers don’t need a copy of the Bill of Sale. Many think that only the seller needs to keep the document. In fact, both parties should retain a copy for their records to avoid any future disputes.

By clearing up these misconceptions, both buyers and sellers can approach their transactions with confidence and clarity.