Printable Mobile Home Bill of Sale Document for Ohio

PDF Form Data

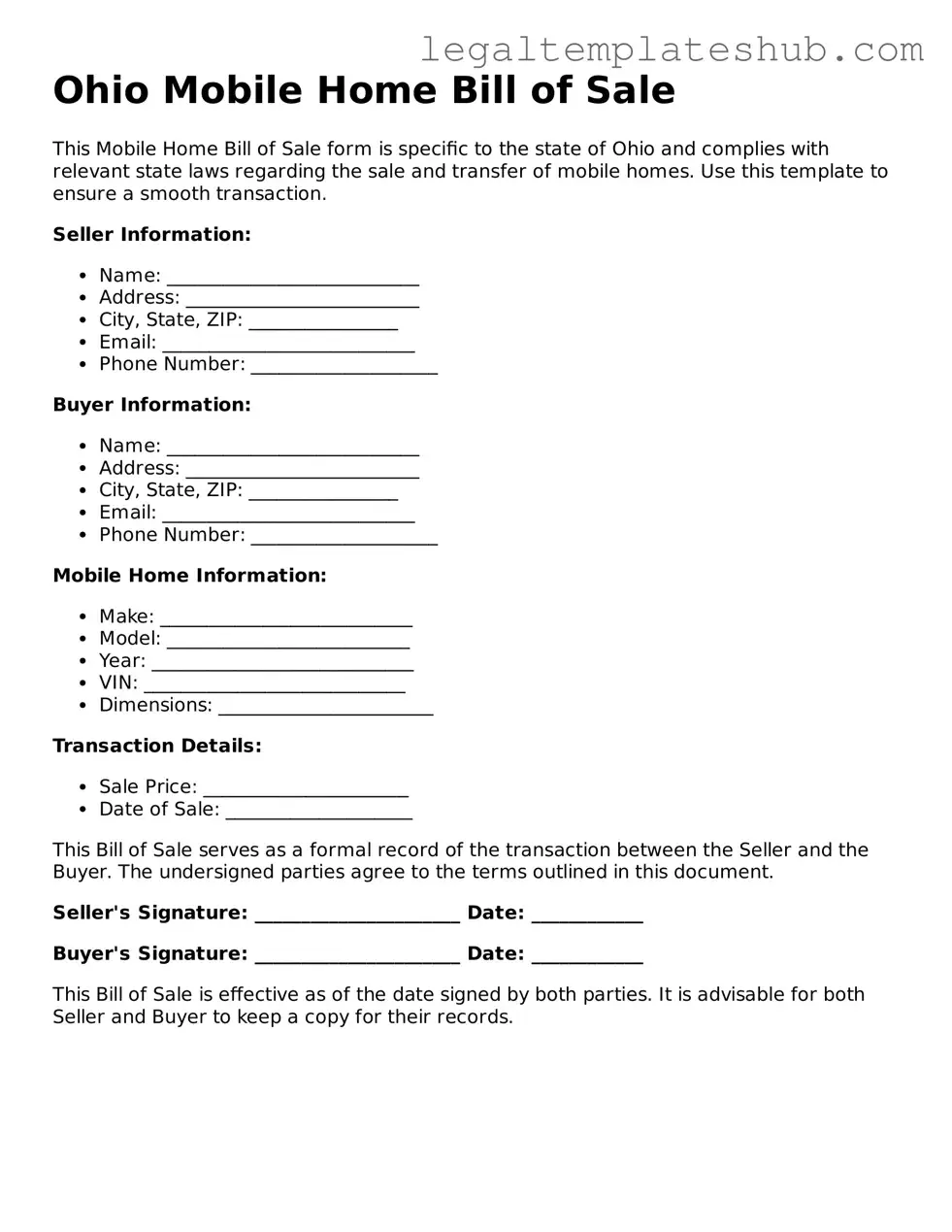

| Fact Name | Detail |

|---|---|

| Purpose | The Ohio Mobile Home Bill of Sale form is used to document the sale of a mobile home. |

| Governing Law | This form is governed by Ohio Revised Code Section 4505.06. |

| Parties Involved | The form includes information about the seller and the buyer of the mobile home. |

| Mobile Home Description | A detailed description of the mobile home must be included, such as make, model, and year. |

| Purchase Price | The agreed-upon purchase price for the mobile home must be clearly stated. |

| Signatures Required | Both the seller and the buyer must sign the form to make it valid. |

| Date of Sale | The date of the sale should be recorded on the form. |

| Notarization | Notarization is not required but can add an extra layer of security. |

| Transfer of Ownership | This form facilitates the transfer of ownership from the seller to the buyer. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed form for their records. |

Key takeaways

When filling out and using the Ohio Mobile Home Bill of Sale form, keep the following key takeaways in mind:

- Understand the Purpose: This form serves as a legal document that transfers ownership of a mobile home from one party to another.

- Gather Necessary Information: Collect all required details, including the seller's and buyer's names, addresses, and contact information.

- Include Mobile Home Details: Clearly state the mobile home's make, model, year, and Vehicle Identification Number (VIN) to avoid confusion.

- Specify the Sale Price: Indicate the agreed-upon sale price for the mobile home, ensuring both parties are in agreement.

- Signatures Required: Both the seller and buyer must sign the form to validate the transaction. Ensure all signatures are present before finalizing.

- Consider Notarization: While not always required, having the document notarized can add an extra layer of authenticity and protection.

- Keep Copies: After completing the form, both parties should retain copies for their records. This helps in future reference and potential disputes.

- Check Local Regulations: Verify any local laws or regulations that may affect the sale or transfer of mobile homes in your area.

- Use Clear Language: Write clearly and concisely to ensure all terms are easily understood by both parties.

- Consult Professionals if Needed: If unsure about any part of the process, consider seeking advice from a legal professional or real estate expert.

By keeping these takeaways in mind, you can navigate the process of completing and using the Ohio Mobile Home Bill of Sale form more effectively.

Dos and Don'ts

When filling out the Ohio Mobile Home Bill of Sale form, it is important to follow certain guidelines to ensure the process goes smoothly. Below is a list of things to do and avoid.

- Do provide accurate information about the mobile home, including the make, model, and year.

- Do include the Vehicle Identification Number (VIN) on the form.

- Do ensure that both the buyer and seller sign the document.

- Do date the form to indicate when the transaction took place.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; fill out all required fields.

- Don't use incorrect or outdated information regarding ownership.

- Don't forget to verify the identities of both parties involved.

- Don't rush the process; take time to review the form before submission.

More Mobile Home Bill of Sale State Templates

Bill of Sale for Mobile Home - Protects the interests of both parties throughout the transfer process.

For those looking to easily create and download the necessary paperwork, you can find a reliable resource in the provided PDF Templates which will guide you through the process of filling out the Pennsylvania Motor Vehicle Bill of Sale form seamlessly.

How to Fill Out a Bill of Sale Utah - A Mobile Home Bill of Sale should be signed by both the seller and the buyer.

Mobile Home Bill of Sale Template - Helps establish the date of the sale for legal purposes.

Bill of Sale Verbiage - The document may include terms regarding payment methods and timelines.

Instructions on Filling in Ohio Mobile Home Bill of Sale

Filling out the Ohio Mobile Home Bill of Sale form is a straightforward process. After completing the form, you will need to provide it to the appropriate parties involved in the transaction. This document serves as a record of the sale and may be required for registration or transfer of ownership.

- Obtain the Ohio Mobile Home Bill of Sale form. This can typically be found online or at a local government office.

- Fill in the date of the sale at the top of the form.

- Provide the name and address of the seller. Make sure to include a contact number.

- Enter the name and address of the buyer, along with their contact information.

- Describe the mobile home being sold. Include details such as the make, model, year, and Vehicle Identification Number (VIN).

- State the purchase price clearly. This should be the total amount agreed upon for the sale.

- Include any terms of the sale, if applicable. This might cover payment methods or conditions of the sale.

- Both the seller and buyer should sign and date the form at the bottom. Ensure that signatures are clear and legible.

- Make copies of the completed form for both parties to keep for their records.

Misconceptions

The Ohio Mobile Home Bill of Sale form is often misunderstood. Here are seven common misconceptions surrounding this important document:

- It is only for new mobile homes. Many believe the Bill of Sale is only necessary for newly purchased mobile homes. In reality, it is required for both new and used mobile homes to document the transfer of ownership.

- It does not need to be notarized. Some people think that a notarization is not necessary for the Bill of Sale. However, having the document notarized adds a layer of authenticity and can be required for registration purposes.

- It is the same as a traditional real estate sale. While both involve the transfer of ownership, the Bill of Sale for mobile homes is specifically tailored to mobile home transactions, which have different regulations and requirements than standard real estate sales.

- It does not require a description of the mobile home. A common misconception is that the Bill of Sale can be vague about the mobile home’s details. In fact, it must include specific information such as the make, model, year, and Vehicle Identification Number (VIN).

- Once signed, it cannot be changed. Some individuals believe that once the Bill of Sale is signed, it is set in stone. Modifications can be made, but both parties must agree and sign the revised document.

- It is only necessary for private sales. People often think that the Bill of Sale is only needed for transactions between individuals. However, it is also necessary for sales through dealers or brokers to ensure proper documentation.

- It is not important for tax purposes. Many assume that the Bill of Sale has no impact on taxes. In truth, it serves as proof of purchase and can be crucial for tax assessments and future transactions.

Understanding these misconceptions can help ensure a smoother transaction process when buying or selling a mobile home in Ohio.