Printable Operating Agreement Document for Ohio

PDF Form Data

| Fact Name | Details |

|---|---|

| Purpose | The Ohio Operating Agreement outlines the management structure and operational procedures for a Limited Liability Company (LLC). |

| Governing Law | The agreement is governed by the Ohio Revised Code, specifically Chapter 1705. |

| Members | All members of the LLC should be included in the Operating Agreement to ensure clarity in ownership and responsibilities. |

| Flexibility | Ohio law allows for considerable flexibility in how an Operating Agreement can be structured, accommodating various business needs. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, which helps maintain harmony within the LLC. |

| Amendments | Members can amend the Operating Agreement as needed, provided all members agree to the changes. |

| Record Keeping | Maintaining a copy of the Operating Agreement is essential for legal compliance and for reference during business operations. |

| Tax Treatment | The Operating Agreement can specify how profits and losses are allocated among members, impacting tax treatment. |

| Not Mandatory | While not legally required, having an Operating Agreement is highly recommended to prevent misunderstandings and disputes. |

Key takeaways

When filling out and using the Ohio Operating Agreement form, there are several important points to keep in mind:

- Understand the Purpose: An Operating Agreement outlines the management structure and operating procedures of your LLC. It serves as a foundational document that helps prevent disputes among members.

- Include Essential Information: Make sure to detail key aspects such as ownership percentages, member roles, and decision-making processes. Clarity in these areas can save time and confusion later.

- Review State Requirements: Ohio has specific legal requirements for Operating Agreements. Familiarize yourself with these to ensure compliance and avoid potential issues.

- Keep it Updated: As your business evolves, so should your Operating Agreement. Regularly review and amend the document to reflect any changes in membership or business operations.

Dos and Don'ts

When filling out the Ohio Operating Agreement form, it’s important to keep a few things in mind. Here’s a list of what you should and shouldn’t do.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information about your business.

- Do consult with a professional if you have questions.

- Do keep a copy of the completed form for your records.

- Don’t rush through the form; take your time to ensure accuracy.

- Don’t leave any required fields blank.

- Don’t ignore the importance of signatures and dates.

By following these guidelines, you can complete the Ohio Operating Agreement form with confidence.

More Operating Agreement State Templates

Creating an Operating Agreement - It provides a framework for amending the Operating Agreement as needed.

For those looking to navigate the complexities of equine transactions, a thorough understanding of the Horse Bill of Sale process is vital. This documentation plays a crucial role in ensuring all necessary details are clearly stated, thus safeguarding the interests of both buyers and sellers. For more information, visit our guide on the important aspects of the Horse Bill of Sale.

Llc New York - It may include a schedule for periodic reviews of the agreement itself.

Llc Operating Agreement Michigan - It plays a vital role in outlining governance for different business scenarios.

How Much Does It Cost to Start an Llc in Texas - The Operating Agreement can help establish credibility with banks and investors.

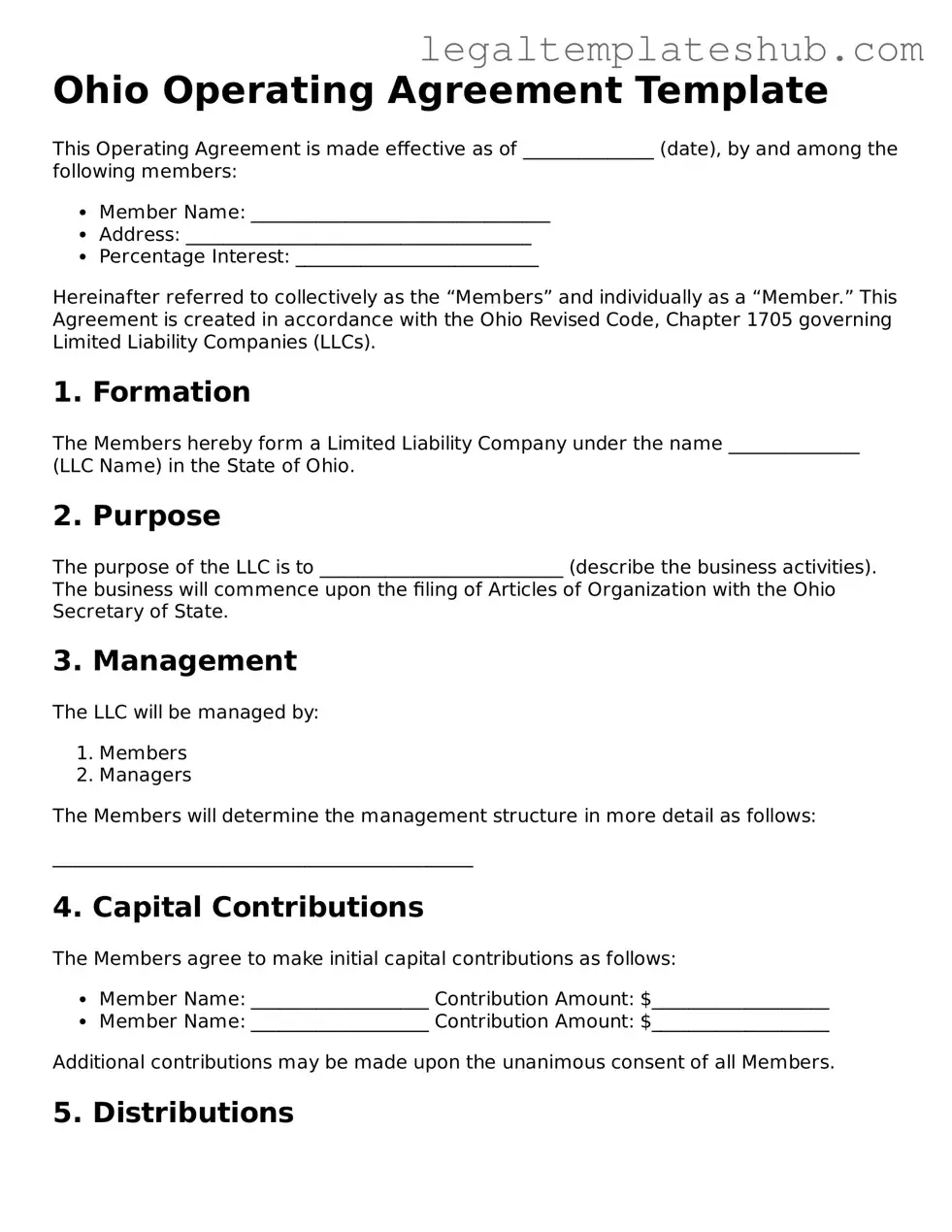

Instructions on Filling in Ohio Operating Agreement

Filling out the Ohio Operating Agreement form is an important step in establishing your business structure. This document outlines the management and operational procedures of your limited liability company (LLC). After completing the form, you will be one step closer to formalizing your LLC and ensuring clarity among members regarding their roles and responsibilities.

- Begin by entering the name of your LLC at the top of the form. Ensure that the name is consistent with the name registered with the state.

- Next, provide the principal office address of your LLC. This should be a physical address where your business operates.

- List the names and addresses of all members involved in the LLC. This includes anyone who has an ownership interest in the business.

- Indicate the purpose of your LLC. Briefly describe what your business does or intends to do.

- Specify the management structure of your LLC. Decide if it will be member-managed or manager-managed, and provide the necessary details.

- Outline the capital contributions of each member. Clearly state how much each member is contributing to the LLC.

- Detail the profit and loss distribution among members. Specify how profits and losses will be allocated.

- Include provisions for the transfer of ownership interests. Explain how members can sell or transfer their shares.

- Sign and date the form. Ensure that all members review and sign the document to validate it.

Misconceptions

Many people have misunderstandings about the Ohio Operating Agreement form. Here are five common misconceptions:

-

It is only necessary for large businesses.

Many believe that only large companies need an operating agreement. In reality, any LLC, regardless of size, benefits from having a formal agreement. It helps clarify roles, responsibilities, and procedures.

-

It's a one-time document.

Some think that once the operating agreement is created, it never needs to be updated. However, as the business evolves, changes in ownership or structure may require revisions to the agreement.

-

It is not legally required in Ohio.

While Ohio does not mandate an operating agreement for LLCs, not having one can lead to misunderstandings and disputes among members. It is strongly advised to have one in place.

-

All members must agree on every detail.

Some believe that unanimous agreement is necessary for all aspects of the operating agreement. In fact, members can agree to allow certain decisions to be made by a majority vote, making it easier to manage the business.

-

It only covers financial aspects.

Many assume that the operating agreement is solely about finances. In truth, it encompasses a wide range of topics, including management structure, member roles, and procedures for adding or removing members.