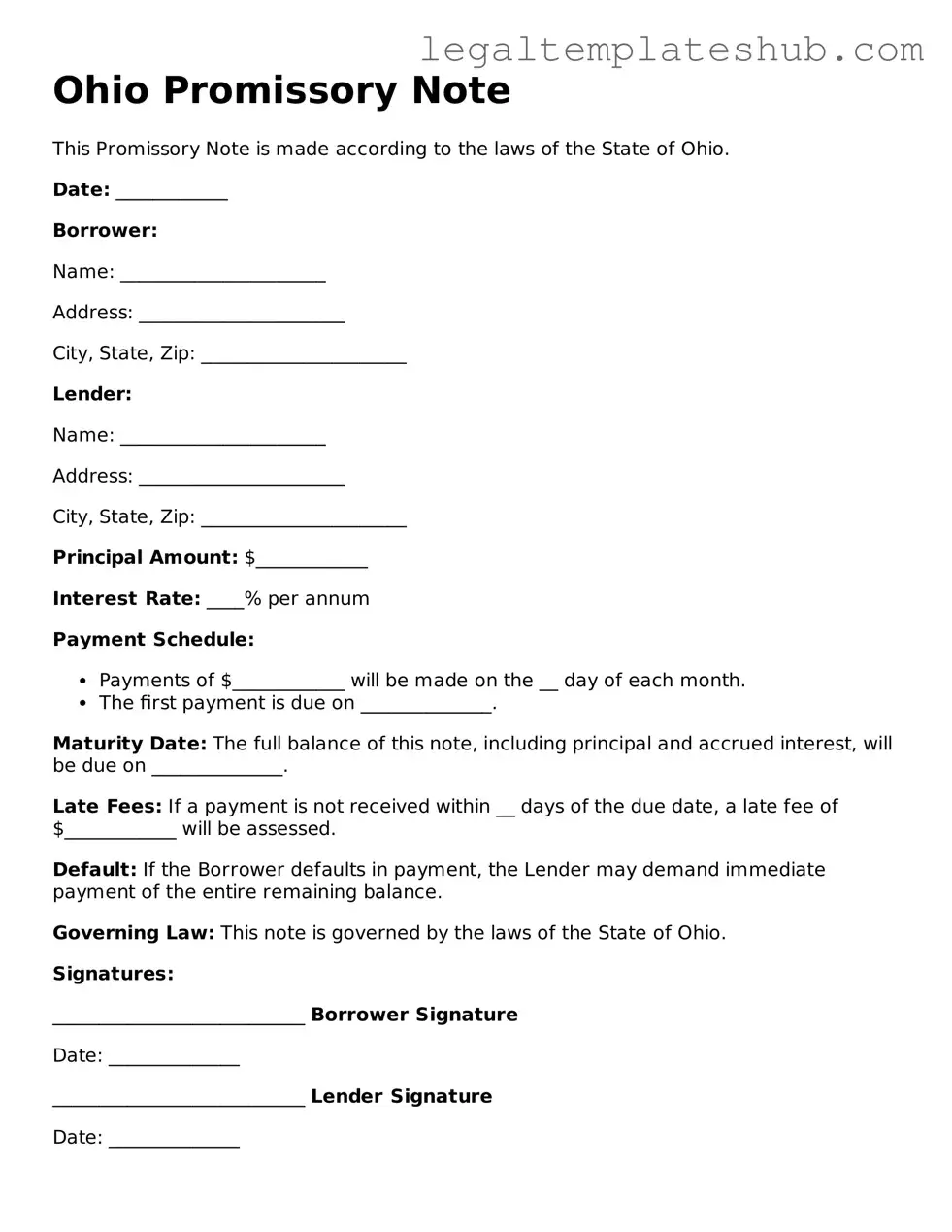

Printable Promissory Note Document for Ohio

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | An Ohio Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a set time. |

| Governing Law | The Ohio Revised Code, specifically Section 1303.01, governs promissory notes in Ohio. |

| Parties Involved | Typically, there are two parties: the borrower (maker) and the lender (payee). |

| Interest Rates | Interest rates can be fixed or variable, and they must be clearly stated in the note. |

| Payment Terms | The payment schedule, including due dates and amounts, should be outlined in the document. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker and include essential terms. |

Key takeaways

When filling out and using the Ohio Promissory Note form, there are several important considerations to keep in mind. Here are five key takeaways that can help you navigate this process effectively:

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan. It serves as a written record of the agreement between the lender and the borrower.

- Complete All Required Fields: Ensure that you fill out all necessary information accurately. This includes the names of both parties, the amount borrowed, interest rate, repayment terms, and any other relevant details.

- Consider Interest Rates: If you are charging interest, be clear about the rate and how it will be applied. Ohio law has specific regulations regarding interest rates, so it’s wise to stay informed.

- Signatures Matter: Both the borrower and lender must sign the document for it to be legally binding. Without signatures, the note may not hold up in court if disputes arise.

- Keep Copies: After completing the promissory note, each party should retain a signed copy. This ensures that both parties have a reference point in case of misunderstandings or legal issues.

Dos and Don'ts

When filling out the Ohio Promissory Note form, it is important to follow certain guidelines to ensure that the document is valid and enforceable. Here are five things to do and five things to avoid:

Things You Should Do:

- Read the entire form carefully before starting.

- Provide accurate information, including names and addresses of both parties.

- Clearly state the loan amount and interest rate.

- Specify the repayment schedule, including due dates.

- Sign and date the document in the appropriate places.

Things You Shouldn't Do:

- Do not leave any sections blank; fill in all required fields.

- Avoid using vague language that could lead to misunderstandings.

- Do not forget to have the document witnessed or notarized if required.

- Refrain from altering the form without proper understanding of the implications.

- Do not ignore state-specific laws that may affect the note.

More Promissory Note State Templates

How to Write a Promissory Note - This document is often governed by state laws, which can vary significantly.

In addition to providing clarity, the California Vehicle Purchase Agreement form can be easily accessed and edited for convenience through this link: https://californiapdf.com/editable-vehicle-purchase-agreement, ensuring all necessary details are accurately captured for a smooth transaction.

Create Promissory Note - This note may contain terms specifying interest rates and payment schedules.

Instructions on Filling in Ohio Promissory Note

Completing the Ohio Promissory Note form is a straightforward process. After filling it out, ensure all details are accurate before submitting it to the appropriate parties. This note serves as a written promise to repay a loan under specified terms.

- Begin by entering the date at the top of the form.

- Fill in the name and address of the borrower. This is the individual or entity receiving the loan.

- Next, provide the lender's name and address. This is the individual or entity providing the loan.

- Clearly state the principal amount of the loan. This is the total amount borrowed.

- Specify the interest rate. This is the percentage charged on the principal amount.

- Indicate the repayment terms. Include the payment schedule and due dates.

- Detail any late fees or penalties for missed payments.

- Include any prepayment options, if applicable. This allows the borrower to pay off the loan early without penalties.

- Both the borrower and lender should sign and date the form at the bottom.

- Make copies of the signed document for both parties' records.

Misconceptions

Misconceptions about the Ohio Promissory Note form can lead to confusion. Here are seven common misunderstandings:

- All promissory notes must be notarized. Many people believe that notarization is a requirement for all promissory notes in Ohio. In reality, notarization is not necessary for a promissory note to be legally enforceable.

- Promissory notes must be in writing. Some assume that verbal agreements cannot be valid. While written notes are easier to enforce, verbal promissory notes can also be legally binding under certain circumstances.

- Interest rates must be specified. It is a common belief that every promissory note must include an interest rate. However, a note can be valid without specifying an interest rate, but it will typically be interpreted as having a zero percent interest rate.

- Only banks can issue promissory notes. Many think that only financial institutions can create these documents. In fact, any individual or business can issue a promissory note.

- Promissory notes are only for large loans. Some people believe that these notes are only applicable for significant amounts of money. Promissory notes can be used for any amount, regardless of size.

- All promissory notes are the same. There is a misconception that all promissory notes follow a standard format. In reality, the terms and conditions can vary widely based on the agreement between the parties involved.

- Failure to pay automatically results in legal action. Some assume that missing a payment on a promissory note will immediately lead to a lawsuit. Typically, lenders will first attempt to resolve the issue through communication before considering legal action.