Printable Quitclaim Deed Document for Ohio

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any guarantees about the title. |

| Governing Law | In Ohio, quitclaim deeds are governed by the Ohio Revised Code, specifically Section 5302.20. |

| Use Cases | Commonly used in situations such as transferring property between family members or clearing up title issues. |

| Title Assurance | This type of deed does not provide any title insurance or warranty, meaning the grantee assumes the risk of any title defects. |

| Recording | To ensure the transfer is legally recognized, the quitclaim deed must be recorded with the county recorder's office where the property is located. |

| Signature Requirements | The deed must be signed by the grantor, and it is advisable to have the signature notarized to enhance its validity. |

| Tax Implications | In Ohio, transferring property via a quitclaim deed may have tax implications, including potential transfer taxes or reassessment of property taxes. |

Key takeaways

When dealing with property transfers in Ohio, understanding the Quitclaim Deed form is essential. Here are some key takeaways to keep in mind.

- Purpose of the Quitclaim Deed: This form is primarily used to transfer ownership of real estate from one party to another without any warranties. It’s a straightforward way to convey interest in a property.

- Parties Involved: The form requires the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Make sure both names are spelled correctly.

- Property Description: A clear and accurate description of the property is vital. This includes the address and legal description to avoid any confusion about what is being transferred.

- Signatures: The grantor must sign the Quitclaim Deed in the presence of a notary public. This signature validates the transfer of ownership.

- Filing Requirements: After completing the form, it must be filed with the county recorder's office where the property is located. There may be a small fee for this service.

- Tax Implications: While a Quitclaim Deed itself does not incur transfer taxes, it’s important to check local regulations. Always consult a tax professional if unsure.

- Use with Caution: Since a Quitclaim Deed offers no guarantees, it’s advisable to use this form when you trust the other party or when transferring property between family members.

By keeping these points in mind, you can navigate the process of using the Ohio Quitclaim Deed form with greater confidence.

Dos and Don'ts

When filling out the Ohio Quitclaim Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are nine things to consider:

- Do ensure that all names are spelled correctly and match the names on the title.

- Do provide a complete and accurate legal description of the property.

- Do include the current address of the grantor and grantee.

- Do sign the form in the presence of a notary public.

- Do check for any applicable county-specific requirements before submission.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't forget to include the date of the transfer.

- Don't use incorrect or informal property descriptions.

- Don't neglect to record the deed with the county recorder after completion.

More Quitclaim Deed State Templates

Virginia Quit Claim Deed Requirements - It is a straightforward way to handle property among family members.

Pennsylvania Quit Claim Deed Pdf - A quitclaim deed is often used among family members or friends.

The Ohio Residential Lease Agreement form is an essential tool for landlords and tenants to establish a clear understanding of their rental arrangement in Ohio. By utilizing this agreement, both parties can avoid misunderstandings and ensure their rights are safeguarded. For an easy way to access the necessary documentation, visit PDF Templates to help you get started with creating your lease.

Quitclaim Deed Utah - Grantees should exercise caution, as they acquire only the rights the grantor has.

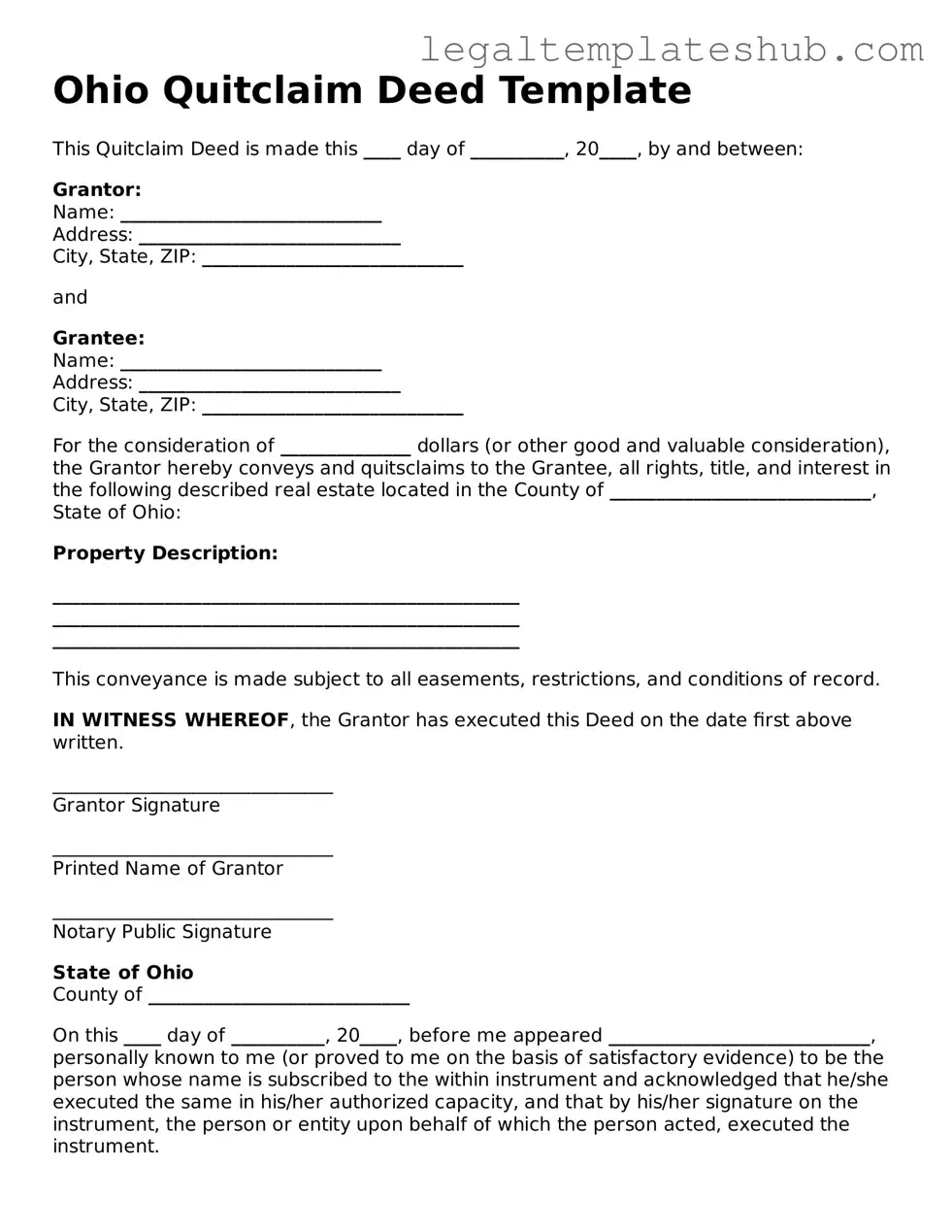

Instructions on Filling in Ohio Quitclaim Deed

Once you have the Ohio Quitclaim Deed form ready, you will need to fill it out accurately to ensure a smooth transfer of property. After completing the form, you will typically need to sign it in front of a notary public and then file it with the county recorder's office. Follow these steps to fill out the form correctly:

- Identify the Grantor: Begin by entering the name of the person or entity transferring the property. This is known as the grantor.

- Provide the Grantee's Information: Next, fill in the name of the person or entity receiving the property, referred to as the grantee.

- Describe the Property: Include a detailed description of the property being transferred. This should match the legal description found in previous deeds or property records.

- Insert the Consideration Amount: Indicate the amount of money or other consideration being exchanged for the property, if applicable. If it's a gift, you can state "for love and affection."

- Include the Date: Write the date when the deed is being executed. This is important for legal purposes.

- Sign the Deed: The grantor must sign the deed in the designated area. If there are multiple grantors, each must sign.

- Notarization: Take the completed form to a notary public for notarization. The notary will verify the identities of the signers and witness the signing.

- File the Deed: Finally, submit the notarized deed to the county recorder's office where the property is located. Be prepared to pay any filing fees.

Misconceptions

Understanding the Ohio Quitclaim Deed form can be challenging. Here are six common misconceptions about it:

- It transfers ownership without any warranties. Many people believe that a quitclaim deed guarantees clear title. In reality, it only transfers whatever interest the grantor has, without any promises about the title's validity.

- It's only for transferring property between family members. While quitclaim deeds are often used in familial transactions, they can be used for any type of property transfer, including sales between strangers.

- It is the same as a warranty deed. A warranty deed provides guarantees about the title, while a quitclaim deed does not. This distinction is crucial for anyone considering their options for property transfer.

- It can be used to remove someone from the title. A quitclaim deed can transfer ownership but cannot remove someone from the title without their consent. All parties must agree to the transaction.

- It requires a formal closing process. Unlike other types of deeds, a quitclaim deed does not always require a formal closing. However, it is still advisable to follow proper procedures to ensure legality.

- It is only valid if notarized. While notarization is recommended for validity and to avoid disputes, the deed can still be valid without it. However, having it notarized makes it easier to prove in court if necessary.

These misconceptions can lead to confusion and potential issues in property transactions. Understanding the true nature of a quitclaim deed is essential for anyone involved in real estate in Ohio.