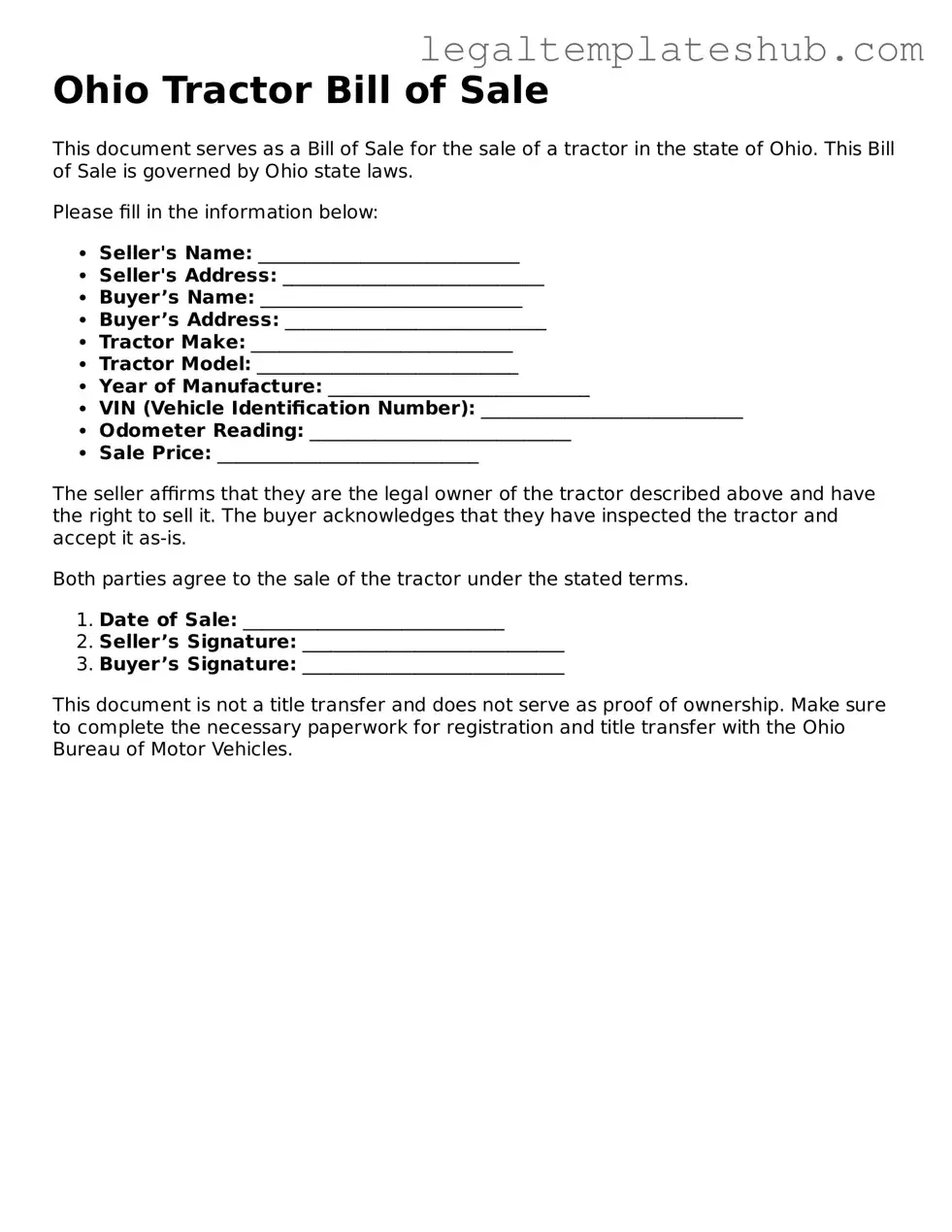

Printable Tractor Bill of Sale Document for Ohio

PDF Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor between parties. |

| Requirements | The form must be filled out completely and signed by both the seller and buyer to be considered valid. |

| Governing Law | This form is governed by Ohio Revised Code Section 4505.06, which outlines the requirements for vehicle title transfers. |

| Additional Information | It's advisable to keep a copy of the completed form for personal records, as it serves as proof of the transaction. |

Key takeaways

When filling out and using the Ohio Tractor Bill of Sale form, consider the following key takeaways:

- Identify the Parties: Clearly state the names and addresses of both the seller and the buyer. This information is crucial for establishing ownership.

- Provide Vehicle Details: Include specific details about the tractor, such as make, model, year, and Vehicle Identification Number (VIN). This helps to uniquely identify the tractor being sold.

- Sales Price: Clearly indicate the agreed-upon sale price. This amount should be written in both numerical and written form to avoid confusion.

- Date of Sale: Record the date when the transaction takes place. This is important for legal and record-keeping purposes.

- Disclosure of Condition: Sellers should provide information about the tractor’s condition. Any known defects or issues should be disclosed to the buyer.

- Signatures Required: Both the seller and buyer must sign the document. This signifies that both parties agree to the terms of the sale.

- Witness or Notary: Although not always required, having a witness or notarization can add an extra layer of security and legitimacy to the transaction.

- Keep Copies: Each party should retain a copy of the completed bill of sale for their records. This serves as proof of the transaction.

- Registration and Title Transfer: After the sale, the buyer must ensure the tractor is properly registered and that the title is transferred to their name.

- Consult Local Regulations: Check local laws and regulations regarding tractor sales. Requirements may vary by county or municipality.

Dos and Don'ts

When filling out the Ohio Tractor Bill of Sale form, it's important to be thorough and accurate. Here are some key dos and don'ts to keep in mind:

- Do provide accurate information about the tractor, including make, model, and year.

- Do include the names and addresses of both the buyer and the seller.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; incomplete forms can cause issues later.

- Don't use outdated information; ensure all details are current.

- Don't forget to check for any specific state requirements that may apply.

- Don't rush through the process; take your time to avoid mistakes.

More Tractor Bill of Sale State Templates

In Consideration of Bill of Sale Example - The Tractor Bill of Sale should be signed by both parties to be considered valid.

Bill of Sale Tractor - Serves as proof of the sale of a tractor between individuals or businesses.

Bill of Sale Tractor - Enhances the professionalism of the sale process.

When renting a property in New York, it's crucial to understand your rights and responsibilities, which are clearly defined in a New York Residential Lease Agreement. This legal document not only outlines the rental amount and lease duration but also ensures both parties are on the same page regarding their obligations. For those looking to secure a rental space, completing this form is an essential step; you can access it through PDF Templates to make the process easier.

Bill of Sale Truck - Essential for proving ownership after a tractor sale.

Instructions on Filling in Ohio Tractor Bill of Sale

Once you have the Ohio Tractor Bill of Sale form, you can begin the process of filling it out. This form is essential for documenting the sale of a tractor in Ohio. Follow these steps to ensure you complete it correctly.

- Start by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Make sure to include the city, state, and ZIP code.

- Next, enter the full name and address of the buyer, including the city, state, and ZIP code.

- Fill in the details of the tractor. This includes the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the tractor. Write this amount clearly in both numbers and words to avoid any confusion.

- If applicable, note any additional terms of the sale. This could include warranties or conditions agreed upon by both parties.

- Both the seller and buyer must sign and date the form. Ensure that signatures are clear and legible.

After completing the form, both parties should keep a copy for their records. This documentation will serve as proof of the transaction and can be helpful for future reference.

Misconceptions

When it comes to the Ohio Tractor Bill of Sale form, several misconceptions can lead to confusion. Understanding the realities behind these myths is essential for anyone involved in buying or selling a tractor in Ohio.

- Myth 1: A Bill of Sale is not necessary for a tractor transaction.

- Myth 2: The Bill of Sale must be notarized.

- Myth 3: Any format can be used for the Bill of Sale.

- Myth 4: The Bill of Sale is only for the buyer's protection.

Many people believe that a Bill of Sale is optional for tractor sales. However, having a written document is crucial. It provides proof of the transaction, protects both parties, and can be required for registration purposes.

Some assume that notarization is mandatory for the Bill of Sale to be valid. In Ohio, notarization is not required for a tractor Bill of Sale. However, having it notarized can add an extra layer of security and authenticity.

While it’s true that there is no official state form for the Bill of Sale, using a clear and comprehensive format is essential. The document should include specific details like the buyer's and seller's information, tractor description, and sale price to ensure it meets legal standards.

Some people think that the Bill of Sale solely benefits the buyer. In reality, it protects both parties. The seller can prove they transferred ownership, while the buyer has a record of the purchase and any agreed-upon terms.