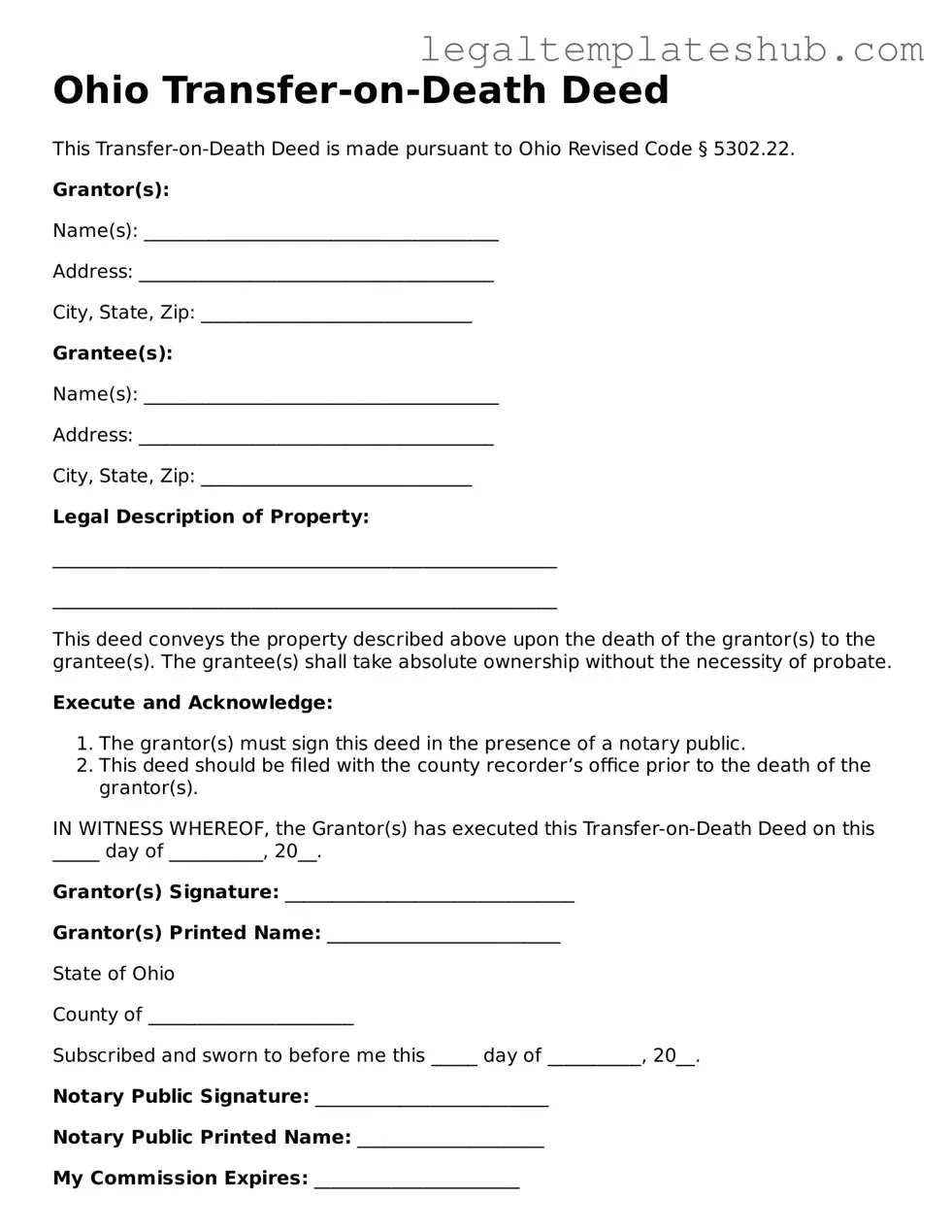

Printable Transfer-on-Death Deed Document for Ohio

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | An Ohio Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Ohio Transfer-on-Death Deed is governed by Ohio Revised Code Section 5302.22. |

| Eligibility | Any individual who owns real estate in Ohio can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property. |

| Revocation | The deed can be revoked at any time before the owner's death, provided the revocation is executed in writing. |

| Recording Requirement | To be effective, the Transfer-on-Death Deed must be recorded with the county recorder's office where the property is located. |

| Effect on Creditors | The property transferred via a Transfer-on-Death Deed is still subject to the owner's debts and can be claimed by creditors. |

| Tax Implications | The transfer of property through a Transfer-on-Death Deed does not trigger gift tax; however, it may affect estate tax. |

| Limitations | This deed cannot be used for property held in joint tenancy or for properties with existing liens that are not satisfied. |

Key takeaways

Understanding the Ohio Transfer-on-Death Deed form is crucial for effective estate planning. Here are some key takeaways to consider:

- The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries without going through probate.

- To be valid, the deed must be signed by the property owner and notarized.

- It is important to list the beneficiaries clearly to avoid confusion later on.

- Once filed, the deed takes effect upon the death of the property owner.

- Beneficiaries can refuse the property if they choose, allowing for flexibility in estate management.

- The deed must be recorded with the county recorder’s office where the property is located.

- It is advisable to keep a copy of the recorded deed in a safe place.

- Property owners can revoke or change the deed at any time before their death.

- Consulting with a legal expert can help ensure that the deed meets all necessary requirements.

- Using this deed can simplify the transfer process and potentially save time and money for heirs.

Dos and Don'ts

When filling out the Ohio Transfer-on-Death Deed form, it’s important to follow certain guidelines to ensure everything goes smoothly. Here’s a list of things you should and shouldn’t do:

- Do make sure to include accurate property descriptions.

- Do ensure that all owners sign the deed.

- Do have the deed notarized to validate it.

- Do file the deed with the county recorder’s office.

- Do keep a copy of the filed deed for your records.

- Don't leave out any required information.

- Don't forget to check for any local filing fees.

- Don't use vague language in property descriptions.

- Don't assume that verbal agreements are sufficient.

- Don't delay filing the deed, as it may affect its validity.

More Transfer-on-Death Deed State Templates

Transfer on Death Deed Utah - Heirs will inherit the property without the need for court involvement, which can save time and money.

Virginia Tod Deed - This deed does not affect your current ownership rights, allowing you to live in or sell the property as you see fit.

To ensure a smooth renting process, it's crucial for tenants and landlords alike to understand the specifics outlined in a New York Residential Lease Agreement. This essential document delineates the responsibilities and expectations of both parties, including rental price and lease duration. For your convenience, you can access the necessary documentation through PDF Templates, which provides a straightforward way to complete this important step in securing a rental property.

Problems With Transfer on Death Deeds in Indiana - When filling out the deed, precise property description is vital for clarity and legality.

Instructions on Filling in Ohio Transfer-on-Death Deed

Once you have the Ohio Transfer-on-Death Deed form ready, it's essential to fill it out accurately. This deed allows you to transfer your property to a designated beneficiary upon your passing, without going through probate. Follow these steps to ensure the form is completed correctly.

- Gather Necessary Information: Collect the full names and addresses of both the property owner(s) and the beneficiary(ies).

- Identify the Property: Clearly describe the property being transferred. Include the address and any relevant details such as parcel numbers.

- Complete the Form: Fill in the names of the property owner(s) in the designated section. Next, write the names of the beneficiary(ies) in the appropriate area.

- Sign the Deed: The property owner(s) must sign the deed in front of a notary public. Ensure that the notary acknowledges the signatures.

- File the Deed: Submit the completed and notarized deed to the county recorder's office where the property is located. This step is crucial for the deed to be legally effective.

- Keep a Copy: After filing, make sure to keep a copy of the recorded deed for your records.

By following these steps, you can ensure that your Transfer-on-Death Deed is filled out and filed correctly, paving the way for a smooth transfer of property to your chosen beneficiary.

Misconceptions

Understanding the Ohio Transfer-on-Death Deed can help you plan for the future. However, several misconceptions often arise. Here are six common misunderstandings:

-

It automatically transfers property upon death.

This is not true. The Transfer-on-Death Deed only transfers property after the owner passes away. Until that time, the owner retains full control and ownership of the property.

-

All properties can be transferred using this deed.

Not all properties qualify. For example, properties with existing liens or those held in a trust may not be eligible for a Transfer-on-Death Deed.

-

It requires probate.

One of the main benefits of a Transfer-on-Death Deed is that it avoids probate. The property transfers directly to the beneficiary without going through the probate process.

-

Beneficiaries cannot be changed.

This is a misconception. The owner can change or revoke the beneficiaries at any time before their death, as long as they follow the proper legal procedures.

-

It is only for married couples.

Anyone can use a Transfer-on-Death Deed, regardless of marital status. Individuals, couples, or even multiple parties can designate beneficiaries.

-

It is a complicated process.

Filling out a Transfer-on-Death Deed is straightforward. With the right information, most people can complete the form without needing a lawyer.

By clearing up these misconceptions, you can make informed decisions about your property and estate planning in Ohio.