Printable Owner Financing Contract Template

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | An Owner Financing Contract allows the seller of a property to provide financing directly to the buyer, bypassing traditional mortgage lenders. |

| Benefits | This type of financing can make it easier for buyers who may have difficulty securing a loan from a bank. It can also provide sellers with a steady income stream. |

| Governing Laws | Owner Financing Contracts are subject to state-specific laws. For example, in California, the relevant laws include the California Civil Code sections related to real property transactions. |

| Key Components | Essential elements of the contract typically include the purchase price, interest rate, payment schedule, and any contingencies or conditions. |

| Risks | Both parties should be aware of potential risks. For sellers, there is a chance the buyer may default on payments. Buyers may face higher interest rates compared to traditional loans. |

Key takeaways

When considering owner financing as a method of purchasing a property, it is crucial to understand how to effectively fill out and utilize the Owner Financing Contract form. Here are some key takeaways to keep in mind:

- Clarity is Essential: Ensure that all terms are clearly defined. This includes the purchase price, interest rate, payment schedule, and any penalties for late payments. Ambiguity can lead to misunderstandings later on.

- Legal Compliance: Familiarize yourself with local and state laws regarding owner financing. Each jurisdiction may have specific requirements that must be met to ensure the contract is enforceable.

- Document Everything: Keep a detailed record of all communications and agreements related to the financing. This documentation can be invaluable in case of disputes or misunderstandings.

- Seek Professional Advice: Before finalizing the contract, consider consulting with a legal professional. They can provide insights that may protect your interests and ensure that the contract meets all necessary legal standards.

Taking these steps can help you navigate the complexities of owner financing more effectively. Being proactive now can save you significant time and trouble in the future.

Dos and Don'ts

When filling out an Owner Financing Contract form, there are several important considerations to keep in mind. Here is a list of things you should and shouldn't do:

- Do: Read the entire form carefully before filling it out.

- Do: Provide accurate information about both the buyer and the seller.

- Do: Clearly outline the terms of the financing agreement, including interest rates and payment schedules.

- Do: Include any contingencies that may affect the sale.

- Do: Have all parties sign the document in the presence of a notary public.

- Don't: Rush through the form; take your time to ensure all details are correct.

- Don't: Leave any sections blank; fill in all required fields.

- Don't: Use vague language; be specific in your terms and conditions.

- Don't: Ignore state-specific laws that may apply to owner financing agreements.

Common Types of Owner Financing Contract Forms:

Purchase Agreement Addendum - Ensures changes are legally binding and recognized by both parties.

In addition to the details outlined in the Minnesota Real Estate Purchase Agreement, utilizing resources such as Minnesota PDF Forms can provide further assistance in understanding the necessary documentation associated with real estate transactions. Familiarizing yourself with these forms will help ensure a successful process for both buyers and sellers.

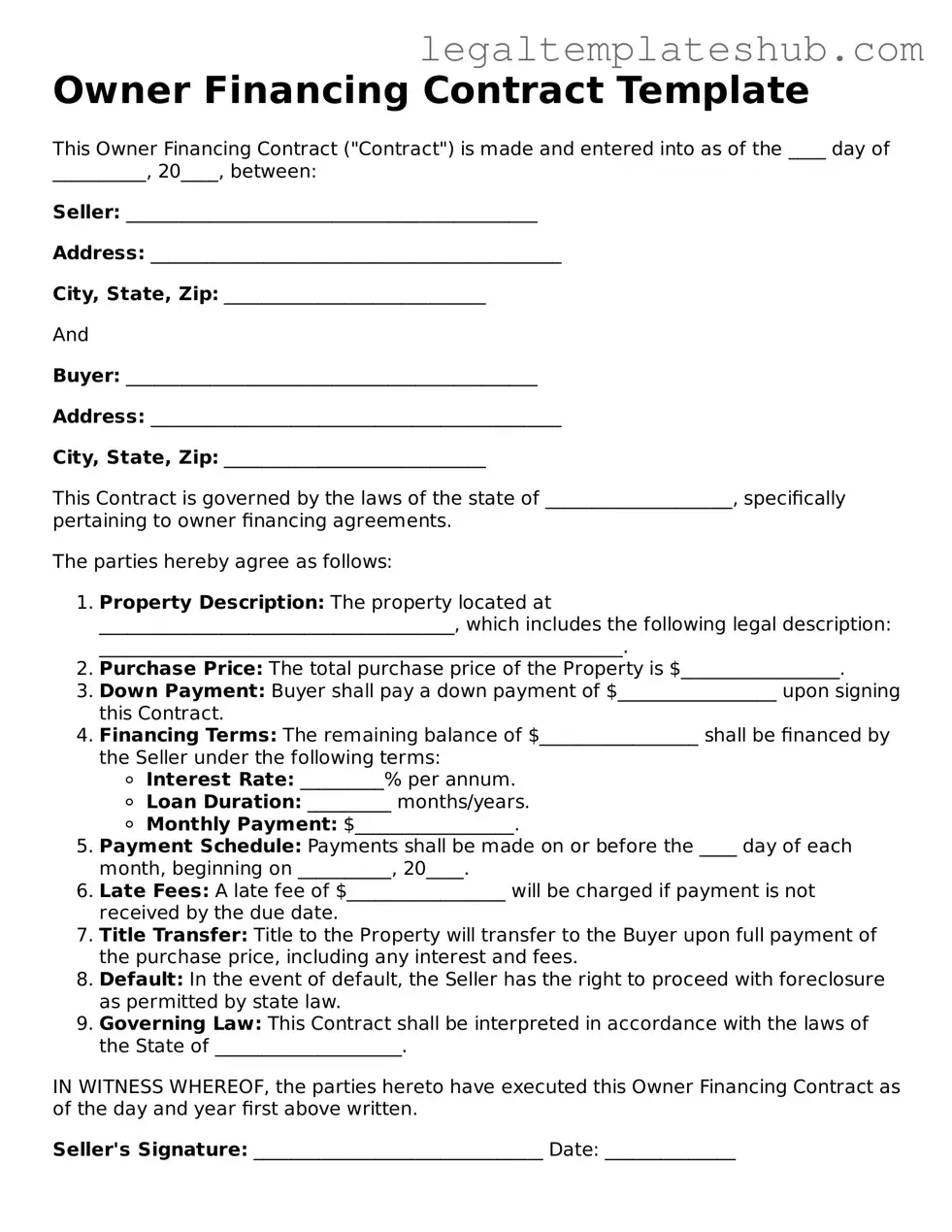

Instructions on Filling in Owner Financing Contract

Completing the Owner Financing Contract form requires careful attention to detail to ensure all necessary information is accurately captured. After filling out this form, it will be used to formalize the agreement between the buyer and seller regarding financing terms.

- Begin by entering the date at the top of the form.

- Provide the full names and addresses of both the seller and the buyer in the designated sections.

- Clearly state the property address being financed. Include any relevant details such as unit number or lot number.

- Fill in the total purchase price of the property. Make sure this amount is correct and reflects any negotiations made.

- Indicate the amount of the down payment, if applicable. This is typically a percentage of the purchase price.

- Specify the interest rate that will apply to the financing. Ensure it aligns with any prior agreements.

- Outline the repayment terms, including the number of months or years for the loan period.

- Detail any additional terms or conditions that both parties have agreed upon. This may include late fees or prepayment options.

- Both the seller and buyer must sign and date the form at the bottom to validate the agreement.

Misconceptions

Owner financing can be an attractive option for buyers and sellers alike, yet several misconceptions often cloud its understanding. Here are eight common misconceptions about the Owner Financing Contract form, along with clarifications to help demystify this important tool in real estate transactions.

- Owner financing is only for buyers with poor credit. Many believe that owner financing is solely a last resort for those unable to secure traditional financing. In reality, it can also appeal to buyers with good credit who prefer the flexibility and terms that owner financing can offer.

- Owner financing is illegal or not recognized. Some people think that owner financing is not a legitimate form of financing. However, it is a legal and recognized method of purchasing property in many jurisdictions, provided that the terms comply with local laws.

- All owner financing agreements are the same. There is a misconception that all owner financing contracts follow a standard template. In truth, these agreements can vary significantly based on the specific needs of the buyer and seller, including interest rates, payment schedules, and contingencies.

- Owner financing eliminates the need for a real estate agent. While some sellers choose to handle owner financing independently, many still benefit from the expertise of a real estate agent. Agents can provide valuable insights and help navigate the complexities of the transaction.

- Owner financing means no down payment is required. It is often assumed that owner financing automatically means zero down payment. However, sellers may require a down payment to mitigate their risk and ensure the buyer's commitment to the purchase.

- Owner financing is a quick and easy process. Some believe that owner financing is a straightforward transaction that can be completed in no time. In reality, it requires careful negotiation and documentation to protect both parties' interests.

- Buyers are not protected under owner financing. There is a belief that buyers have fewer protections in owner financing agreements compared to traditional mortgages. However, buyers can negotiate terms and include clauses that safeguard their rights, just as they would in any contract.

- Owner financing is only suitable for residential properties. Many think that owner financing is limited to residential real estate. In fact, it can be utilized for various types of properties, including commercial real estate, as long as both parties agree to the terms.

Understanding these misconceptions can empower both buyers and sellers to make informed decisions about owner financing. By addressing these myths, individuals can approach the process with greater confidence and clarity.