Blank P 45 It PDF Form

File Breakdown

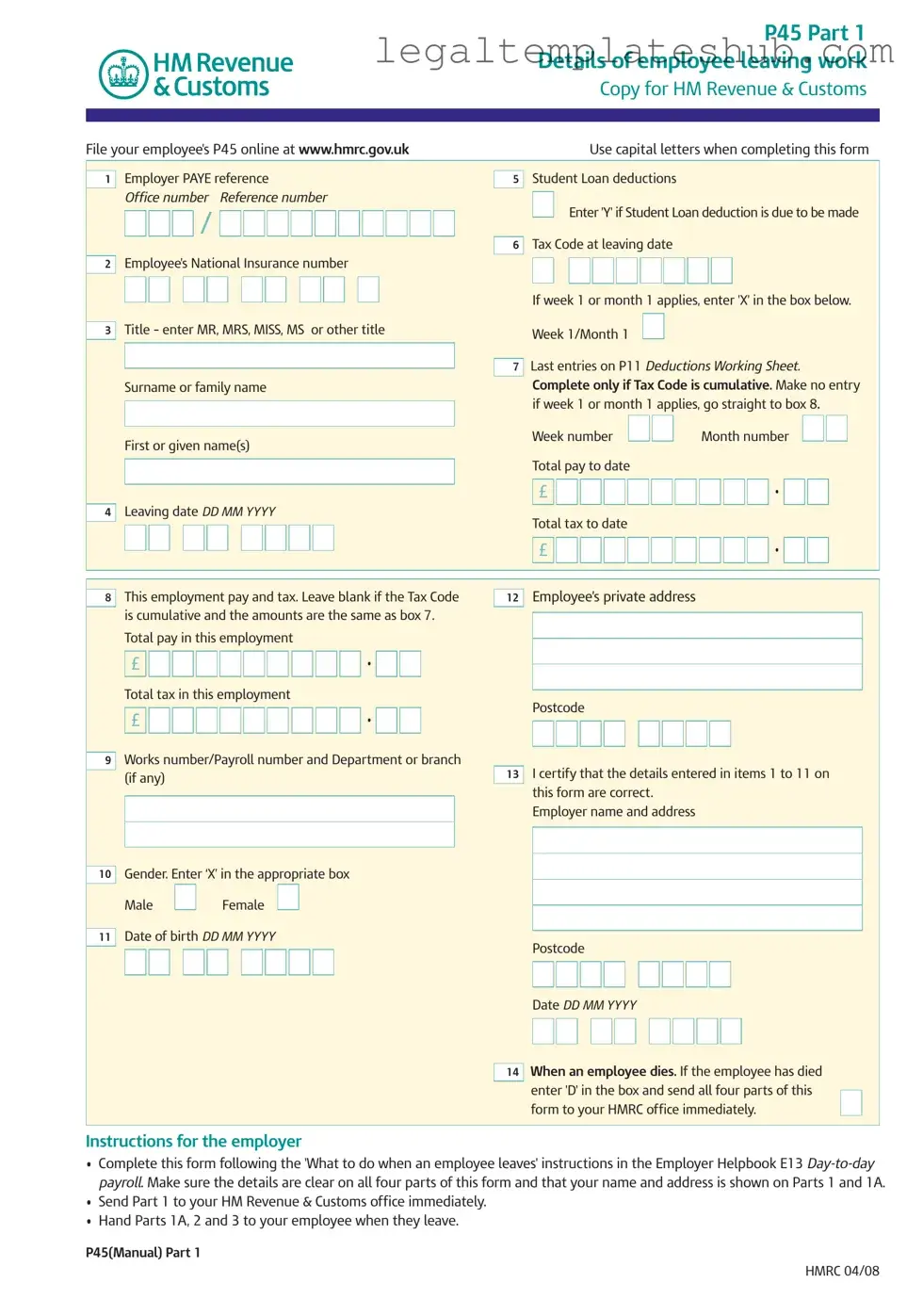

| Fact Name | Description |

|---|---|

| Purpose | The P45 form is used to provide details about an employee's tax and income when they leave a job. |

| Parts of the Form | The P45 consists of three parts: Part 1 for HM Revenue & Customs, Part 1A for the employee, and Parts 2 and 3 for the new employer. |

| Employer's Responsibilities | Employers must complete the form accurately and send Part 1 to HMRC immediately after an employee leaves. |

| Employee's Responsibilities | Employees should keep Part 1A safe for future tax returns and provide Parts 2 and 3 to their new employer. |

| Tax Codes | The form includes information about the employee's tax code at the time of leaving, which affects how much tax is deducted in future employment. |

| Student Loan Deductions | The form indicates whether student loan deductions are applicable, which is crucial for both the employee and the new employer. |

| Leaving Date | Employees must provide their leaving date, which is essential for calculating the final tax liability. |

| Regulatory Compliance | The P45 is governed by UK tax law, specifically under the Income Tax (Earnings and Pensions) Act 2003. |

Key takeaways

- The P45 form is essential when an employee leaves a job, providing necessary details about their employment and tax status.

- It consists of three parts: Part 1 is for HM Revenue & Customs (HMRC), Part 1A is for the employee, and Parts 2 and 3 are for the new employer.

- When completing the form, use capital letters to ensure clarity and accuracy.

- Include the employee's National Insurance number, PAYE reference, and tax code at the leaving date.

- If the employee is subject to Student Loan deductions, mark 'Y' in the appropriate box.

- Employers must send Part 1 to HMRC immediately and provide Parts 1A, 2, and 3 to the employee upon their departure.

- Employees should keep Part 1A safe, as it may be needed for future tax returns or claims.

- New employers must complete Parts 2 and 3 accurately and send them to HMRC without delay to avoid tax issues for the employee.

Dos and Don'ts

- Do use capital letters when filling out the form to ensure clarity.

- Do enter the correct National Insurance number to avoid processing delays.

- Do check the tax code carefully, as it affects tax deductions.

- Do ensure that all sections are completed accurately to prevent future complications.

- Don't leave any fields blank unless specifically instructed; this can lead to errors.

- Don't forget to sign and date the form, as this certifies the information provided.

- Don't use corrections fluid or tape; any changes should be neatly crossed out and initialed.

- Don't ignore the instructions regarding student loan deductions, as these must be noted if applicable.

Common PDF Templates

Electrical Panel Schedule Template - Assists in comparing load readings with capacity ratings.

In order to facilitate a smooth transaction, it is important to use the correct documentation when buying or selling a mobile home. The New York Mobile Home Bill of Sale form can be easily obtained from various sources, including PDF Templates, which provide a convenient way to access and fill out this essential legal document. This ensures all necessary information is recorded accurately, providing both parties with peace of mind during the transfer of ownership.

Where to Submit I 864 Affidavit of Support - It is critical to accurately complete all sections of the I-864.

Trucking Company Lease Agreement - Owner Operators are encouraged to maintain a high level of professional conduct in their trucking operations.

Instructions on Filling in P 45 It

Filling out the P45 It form is a straightforward process, but it requires careful attention to detail. This form is essential for both employers and employees when someone leaves a job. Once completed, it helps ensure that tax matters are handled correctly and that the employee receives the necessary documentation for future employment or tax purposes.

- Start with Part 1: Write the employer's PAYE reference and office number at the top of the form.

- Enter the employee's National Insurance number: This is crucial for tax records.

- Fill in the employee's title: Choose from MR, MRS, MISS, MS, or other titles.

- Provide the employee's surname: Make sure to spell it correctly.

- Include the employee's first or given name(s): Again, accuracy is key.

- Specify the leaving date: Use the format DD MM YYYY.

- Input the total pay to date: This is the amount earned by the employee up to the leaving date.

- Enter the total tax to date: This reflects the tax deducted from the employee’s pay.

- Complete the employee’s private address: Include the postcode for accuracy.

- Indicate the employee's gender: Mark 'X' in the appropriate box for Male or Female.

- Fill in the employee's date of birth: Again, use the format DD MM YYYY.

- Sign and date the form: This certifies that the information is correct.

- Send Part 1 to HM Revenue & Customs: Do this immediately after completion.

- Hand Parts 1A, 2, and 3 to the employee: Ensure they receive these parts when they leave.

After completing the form, it’s important to ensure that all parts are distributed correctly. The employee will need Parts 1A, 2, and 3 for their records and future employment. Keeping everything organized will help avoid any tax issues later on.

Misconceptions

- Misconception 1: The P45 form is only for employees who resign.

- Misconception 2: You do not need to keep your P45 after leaving a job.

- Misconception 3: The P45 form is only relevant for tax purposes.

- Misconception 4: You will automatically receive a P45 when you leave a job.

- Misconception 5: The P45 form is only issued in paper format.

- Misconception 6: You can alter the information on your P45.

- Misconception 7: The P45 is not needed if you start a new job immediately.

- Misconception 8: The P45 form does not affect your tax code.

This is not true. The P45 form is also issued when an employee is laid off or terminated for other reasons, including redundancy or dismissal.

In fact, it is important to keep your P45 safe. You may need it for tax purposes or when starting a new job, as it provides essential information about your previous employment and tax deductions.

While the P45 is indeed important for tax, it is also relevant for benefits claims, such as Jobseeker's Allowance. It helps to ensure that you receive the correct amount of benefits based on your previous earnings.

Employers are required to provide a P45, but it is advisable to remind them if you do not receive it promptly after your departure.

Employers can file the P45 online, and employees may receive digital copies. However, it is still crucial to keep a record of the information provided.

Altering the P45 is not allowed. Any mistakes should be addressed by contacting your employer or HM Revenue & Customs (HMRC) to ensure accurate records.

It is essential to provide your new employer with your P45. Without it, you may be placed on an emergency tax code, which could lead to overpayment of taxes.

The P45 does impact your tax code. It provides information about your earnings and tax paid, which is used to determine your tax code in your new job.