Blank Payroll Check PDF Form

File Breakdown

| Fact Name | Details |

|---|---|

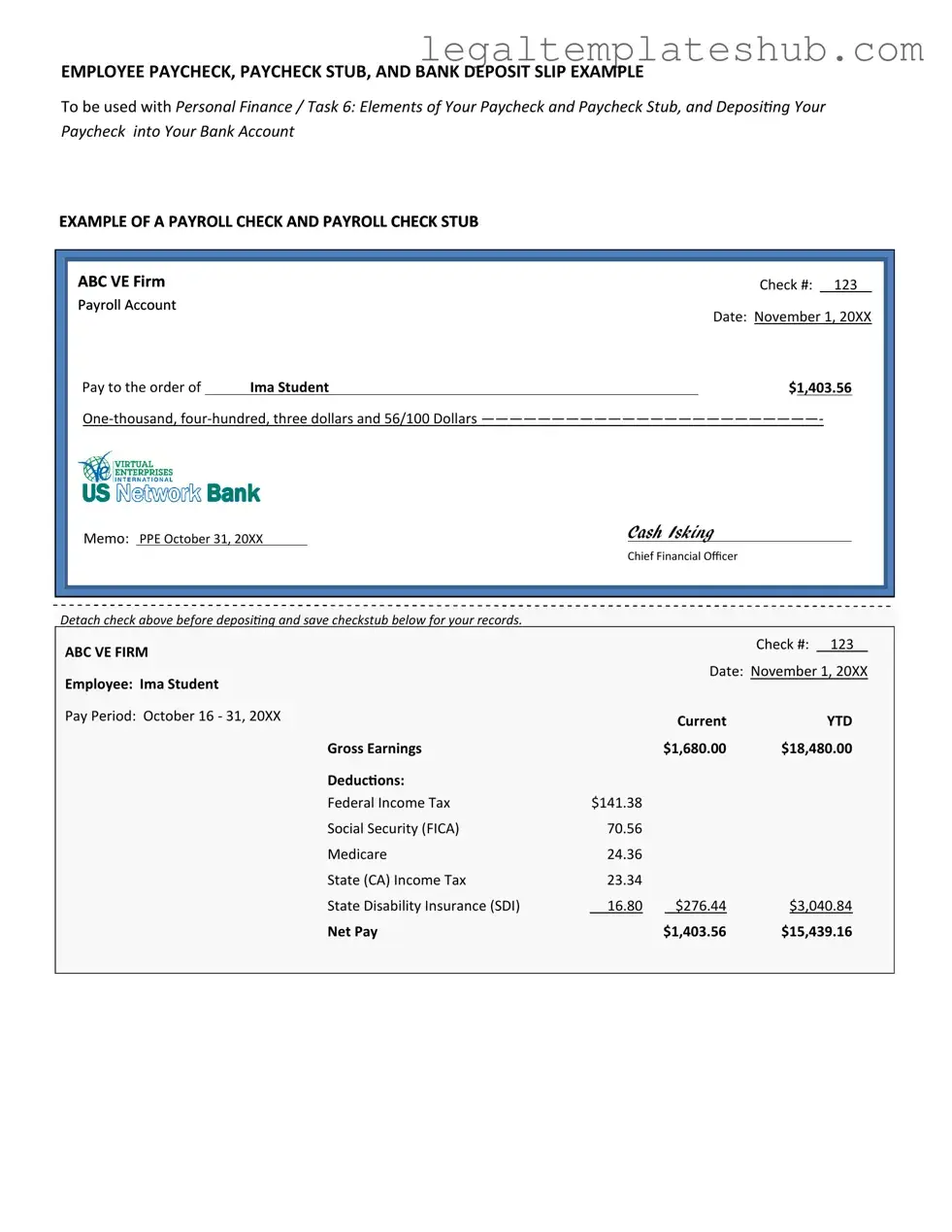

| Definition | A Payroll Check form is a document used by employers to pay employees for their work. |

| Components | The form typically includes employee name, pay period, gross pay, deductions, and net pay. |

| Frequency | Employers may issue payroll checks weekly, bi-weekly, or monthly, depending on company policy. |

| State-Specific Forms | Some states require specific payroll check formats. For example, California mandates compliance with state labor laws. |

| Tax Deductions | Payroll checks must reflect federal and state tax deductions, including Social Security and Medicare contributions. |

| Record Keeping | Employers are required to keep payroll records for a minimum of three years, as per federal law. |

| Direct Deposit Option | Many employers offer direct deposit as an alternative to physical payroll checks, enhancing convenience for employees. |

| Employee Rights | Employees have the right to receive their payroll checks on time and to be informed about deductions made. |

Key takeaways

Filling out and using a Payroll Check form is an essential task for employers and employees alike. Understanding the key aspects of this process can ensure that payments are made accurately and on time. Here are some important takeaways:

- Accurate Information: Always double-check that the employee's name, address, and Social Security number are correctly entered. Mistakes can lead to delays or tax issues.

- Payment Amount: Clearly specify the gross pay before deductions. This is the total amount earned by the employee for the pay period.

- Deductions: List all applicable deductions, such as taxes, insurance, and retirement contributions. This helps the employee understand their take-home pay.

- Net Pay: Calculate the net pay, which is the amount the employee will actually receive after all deductions. This figure should be prominently displayed.

- Pay Period: Indicate the start and end dates of the pay period. This information is crucial for transparency and record-keeping.

- Signature: The Payroll Check form should be signed by an authorized individual, confirming that the payment is approved and valid.

- Check Number: Assign a unique check number for each payment. This helps in tracking and referencing payments in the future.

- Record Keeping: Maintain copies of all Payroll Check forms for your records. This can be useful for audits and tax filings.

- Timely Distribution: Ensure that checks are distributed on time. Delayed payments can affect employee morale and trust.

- Compliance: Familiarize yourself with federal and state payroll laws. Adhering to these regulations is essential to avoid penalties.

By keeping these points in mind, employers can streamline their payroll processes and foster a positive work environment.

Dos and Don'ts

When filling out the Payroll Check form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check all personal information for accuracy.

- Do ensure the correct payment amount is entered.

- Do sign the form in the designated area.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use correction fluid on the form.

Common PDF Templates

When to File 1099-nec - Copy A of the 1099-NEC is provided for informational purposes and appears in red.

For those looking to expedite the transaction, utilizing resources like PDF Templates can provide ready-to-use forms and ensure that all necessary information is accurately captured during the sale process.

Bf Application - Seeking someone who prioritizes quality time without the distractions of technology.

USCIS Form I-864 - The form outlines the sponsor's financial responsibilities toward the immigrant.

Instructions on Filling in Payroll Check

Completing the Payroll Check form is an important step in ensuring that employees receive their compensation accurately and on time. Following the steps outlined below will help ensure that the form is filled out correctly.

- Begin by entering the employee's name in the designated field.

- Next, input the employee's identification number or Social Security number.

- Fill in the pay period dates to indicate the start and end of the payment cycle.

- Specify the total hours worked during the pay period.

- Enter the hourly wage or salary of the employee.

- Calculate the gross pay by multiplying the total hours worked by the hourly wage.

- Deduct any taxes and other withholdings to determine the net pay.

- Write the net pay amount in the appropriate field.

- Finally, sign and date the form to confirm its accuracy.

Misconceptions

Understanding payroll checks can be challenging, especially with the various misconceptions that surround them. Here are seven common misunderstandings that many people have regarding payroll check forms:

-

Payroll checks are only for employees.

While payroll checks are primarily issued to employees, they can also be used for independent contractors or freelancers who provide services. The key is that payment is made for work performed.

-

All payroll checks are the same.

Payroll checks can vary significantly based on the employer's policies, the state laws, and the specific agreements made with employees. Different deductions, bonuses, and payment frequencies can lead to variations in the checks.

-

Direct deposit eliminates the need for payroll checks.

While direct deposit is a popular method of payment, some employers still provide physical payroll checks as an option. Employees may choose checks for various reasons, including preference or lack of access to banking services.

-

Payroll checks always reflect gross pay.

Many people assume that the amount on the check represents the total earnings. However, payroll checks typically display net pay, which is the amount after taxes and other deductions have been taken out.

-

Payroll checks can be issued at any time.

Employers must adhere to specific payroll schedules, which can be weekly, bi-weekly, or monthly. Issuing checks outside of this schedule can lead to legal and financial complications.

-

All deductions on payroll checks are mandatory.

While some deductions, like taxes, are required by law, others, such as retirement contributions or health insurance premiums, may be optional. Employees should review their payroll check to understand what is being deducted and why.

-

Payroll checks are the only way to receive payment.

In today’s digital age, there are numerous ways to receive payment, including electronic transfers and payroll cards. Payroll checks remain a traditional method, but they are not the sole option available.

By dispelling these misconceptions, individuals can gain a clearer understanding of payroll checks and the important role they play in the employment relationship.