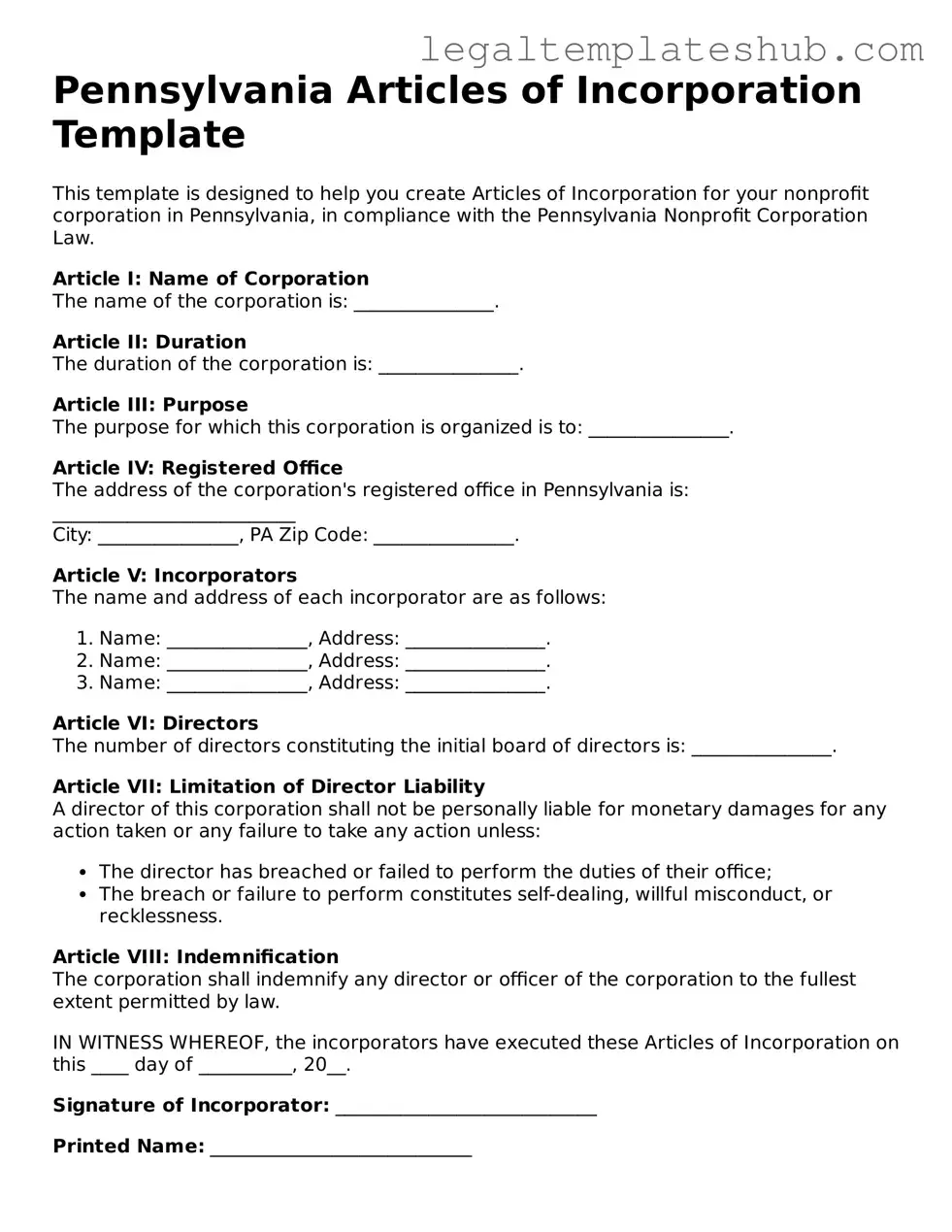

Printable Articles of Incorporation Document for Pennsylvania

PDF Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Articles of Incorporation are governed by the Pennsylvania Business Corporation Law of 1988. |

| Purpose | This form is used to legally create a corporation in Pennsylvania. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for establishing a corporation. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Registered Agent | The form requires the designation of a registered agent for service of process. |

| Corporate Name | The name of the corporation must be unique and include a corporate designator, such as "Inc." or "Corporation." |

| Incorporators | At least one incorporator is required to sign the Articles of Incorporation. |

| Business Purpose | The Articles must state the specific business purpose or general purpose of the corporation. |

| Duration | The Articles can specify a duration for the corporation, which can be perpetual unless stated otherwise. |

| Additional Provisions | Additional provisions can be included in the Articles to govern the corporation's internal affairs. |

Key takeaways

When considering the formation of a corporation in Pennsylvania, understanding the Articles of Incorporation form is crucial. Here are some key takeaways to keep in mind:

- Purpose of the Form: The Articles of Incorporation serve as the foundational document for your corporation. It officially establishes your business as a legal entity in Pennsylvania.

- Required Information: You must provide essential details such as the corporation's name, registered office address, and the purpose of the corporation. Ensure that the name is unique and complies with state regulations.

- Filing Fees: Be prepared to pay a filing fee when submitting the Articles of Incorporation. This fee varies depending on the type of corporation you are forming, so check the current rates.

- Additional Provisions: While basic information is required, you may include additional provisions in the Articles. These can outline the powers of the corporation or any specific rules governing its operations.

- Compliance and Maintenance: After filing, keep in mind that your corporation must comply with ongoing state requirements, such as annual reports and tax filings, to maintain its good standing.

By understanding these key aspects, you can navigate the incorporation process more effectively and set a solid foundation for your business in Pennsylvania.

Dos and Don'ts

Filling out the Pennsylvania Articles of Incorporation form is a crucial step in establishing a corporation. Here are some essential dos and don'ts to keep in mind:

- Do ensure that your corporation name is unique and not already in use by another entity in Pennsylvania.

- Do provide a clear and concise description of your corporation's purpose.

- Do include the names and addresses of the initial directors.

- Do specify the registered office address in Pennsylvania.

- Do check for any specific requirements that might apply to your industry or type of corporation.

- Don't forget to sign the form; an unsigned form will be rejected.

- Don't leave any required fields blank; incomplete forms can delay the process.

- Don't use abbreviations or acronyms without proper explanation in the form.

- Don't underestimate the importance of reviewing your form for accuracy before submission.

Following these guidelines can help ensure a smoother incorporation process in Pennsylvania. Take your time, and pay attention to detail!

More Articles of Incorporation State Templates

Utah Corporation Search - Public access to the Articles ensures transparency in business dealings.

For those looking to understand the process better, this guide to submitting a complete Homeschool Letter of Intent will clarify the necessary steps and requirements involved in initiating a homeschooling journey in Colorado.

Nys Articles of Incorporation - May specify the election process for directors.

Ohio Llc Fees - Information in the Articles is public and can be accessed by anyone.

Instructions on Filling in Pennsylvania Articles of Incorporation

After obtaining the Pennsylvania Articles of Incorporation form, you will need to complete it accurately to establish your corporation. Follow these steps carefully to ensure that all necessary information is included.

- Begin with the name of your corporation. Ensure that it is unique and includes the word "Corporation," "Incorporated," or an abbreviation such as "Inc."

- Provide the principal office address. This should be a physical address in Pennsylvania, not a P.O. Box.

- List the purpose of your corporation. Be clear and concise about the business activities you plan to engage in.

- Identify the name and address of the registered agent. This individual or business will receive legal documents on behalf of your corporation.

- Include the number of shares your corporation is authorized to issue. Specify the classes of shares if applicable.

- Provide the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Sign and date the form. Ensure that all incorporators have signed where required.

- Prepare the filing fee. Check the current fee schedule to ensure you include the correct amount.

- Submit the completed form and payment to the Pennsylvania Department of State. You can do this by mail or online, depending on your preference.

Misconceptions

Understanding the Pennsylvania Articles of Incorporation form can be tricky. Here are ten common misconceptions that people often have about it:

- It’s only for large businesses. Many believe that only large corporations need to file Articles of Incorporation. In reality, any business entity, regardless of size, can benefit from incorporating.

- Incorporation guarantees legal protection. While incorporating does provide some level of protection for personal assets, it doesn’t shield owners from all legal liabilities. Certain actions, like personal guarantees, can still expose personal assets.

- Filing is a one-time process. Some think that once the Articles of Incorporation are filed, no further action is needed. However, ongoing compliance and annual reports are typically required to maintain the corporation's status.

- All states have the same requirements. Each state has its own rules and regulations regarding incorporation. Pennsylvania has specific requirements that may differ from those in other states.

- It’s easy to do without help. Many assume that they can fill out the form without assistance. While it’s possible, seeking guidance can help avoid mistakes that could delay the process.

- Only for-profit businesses can incorporate. Non-profit organizations can also file Articles of Incorporation in Pennsylvania. This allows them to gain legal recognition and benefits.

- Incorporation is expensive. Some people think that incorporating is prohibitively costly. In Pennsylvania, the fees are relatively low compared to the potential benefits of incorporation.

- Once filed, you can’t change anything. It’s a common belief that the Articles of Incorporation are set in stone. However, amendments can be made if necessary, following the proper procedures.

- Incorporation is only for new businesses. Existing businesses can also choose to incorporate at any time, which can provide various advantages, including liability protection and tax benefits.

- You need a lawyer to file. While legal assistance can be beneficial, it’s not mandatory. Many individuals successfully file their Articles of Incorporation on their own.

By clearing up these misconceptions, you can better understand the process and benefits of filing Articles of Incorporation in Pennsylvania.