Printable Bill of Sale Document for Pennsylvania

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A Pennsylvania Bill of Sale is a legal document that transfers ownership of personal property from one party to another. |

| Governing Law | The bill of sale is governed by Pennsylvania’s Uniform Commercial Code (UCC). |

| Types of Property | This form can be used for various types of personal property, including vehicles, equipment, and goods. |

| Notarization | While notarization is not required, it is recommended for added legal protection. |

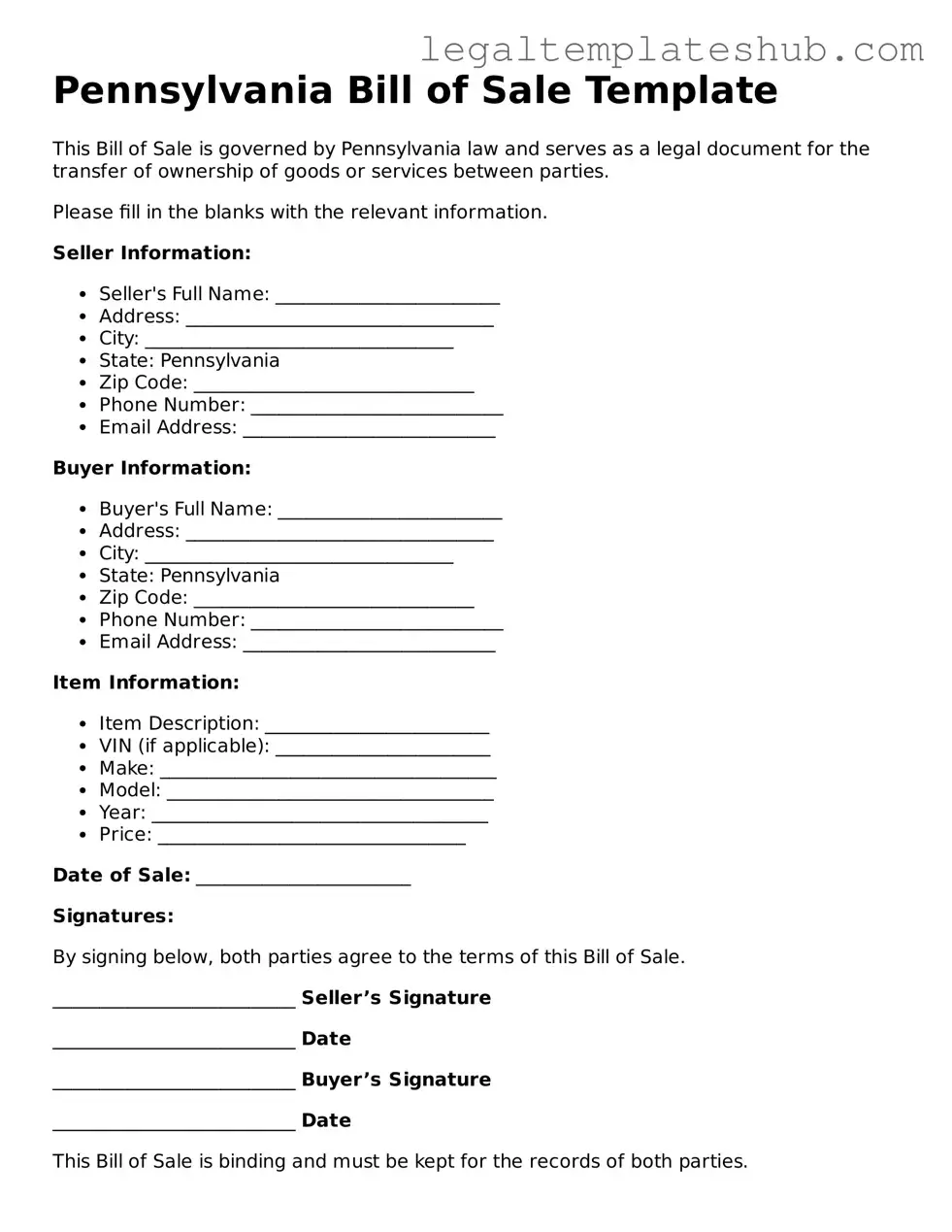

| Information Required | It typically requires the names and addresses of the buyer and seller, a description of the property, and the sale price. |

| As-Is Clause | Many bills of sale include an "as-is" clause, indicating the buyer accepts the property in its current condition. |

| Use in Vehicle Sales | For vehicle sales, the bill of sale can serve as proof of ownership transfer for the Department of Motor Vehicles. |

| Tax Implications | Sales tax may apply to the transaction, and it is the buyer's responsibility to ensure it is paid. |

| Record Keeping | Both parties should keep a copy of the signed bill of sale for their records. |

| Dispute Resolution | In case of disputes, the bill of sale can serve as a key piece of evidence in legal proceedings. |

Key takeaways

When filling out and using the Pennsylvania Bill of Sale form, keep the following key takeaways in mind:

- Understand the Purpose: A Bill of Sale serves as a legal document that records the transfer of ownership of an item, such as a vehicle or personal property.

- Include Complete Information: Ensure that the form contains all necessary details, including the names and addresses of both the buyer and the seller, as well as a description of the item being sold.

- Accurate Item Description: Provide a detailed description of the item, including make, model, year, and any identifying numbers, such as a Vehicle Identification Number (VIN) for cars.

- Sales Price: Clearly state the agreed-upon sale price. This amount should reflect the actual transaction and can be important for tax purposes.

- Signatures Required: Both the buyer and seller must sign the Bill of Sale. This signature indicates that both parties agree to the terms of the sale.

- Consider Notarization: While notarization is not always required, having the document notarized can add an extra layer of legitimacy and may be beneficial in case of disputes.

- Keep Copies: After completing the Bill of Sale, both parties should retain a copy for their records. This documentation can be useful in the future.

- Check Local Regulations: Be aware of any specific local regulations or requirements that may apply to the sale of certain items, especially vehicles.

- Use Clear Language: Avoid using complex language or abbreviations. Clear and straightforward wording helps prevent misunderstandings.

Dos and Don'ts

When filling out the Pennsylvania Bill of Sale form, there are important considerations to keep in mind. Proper completion of this document can ensure a smooth transaction and protect both the buyer and seller. Below is a list of things you should and shouldn't do.

- Do provide accurate and complete information about the vehicle or item being sold.

- Do include the date of the sale to establish a clear timeline.

- Do sign and date the form to validate the agreement.

- Do keep a copy of the Bill of Sale for your records after it is completed.

- Don't leave any sections blank; incomplete forms can lead to confusion or disputes.

- Don't use vague descriptions; be specific about the make, model, year, and condition of the item.

By following these guidelines, you can ensure that the Bill of Sale is filled out correctly and serves its purpose effectively.

More Bill of Sale State Templates

Bill of Sale for Car Virginia - People often use Bill of Sale templates to ensure all necessary information is included without missing any details.

To ensure a smooth transfer of ownership while adhering to legal requirements, it's advisable to utilize resources like PDF Documents Hub, which offers easy access to the California Motorcycle Bill of Sale form.

Nj Car Bill of Sale - It's important to keep the Bill of Sale in a safe place after the transaction.

Instructions on Filling in Pennsylvania Bill of Sale

After gathering the necessary information, you can begin filling out the Pennsylvania Bill of Sale form. This document serves as a record of the transaction between the buyer and seller, outlining the details of the sale.

- Obtain the Pennsylvania Bill of Sale form from a reliable source, such as the state’s official website or a legal document provider.

- Fill in the date of the sale at the top of the form. This indicates when the transaction took place.

- Enter the full name and address of the seller. Ensure that the information is accurate to avoid any future disputes.

- Provide the full name and address of the buyer. This identifies the new owner of the item being sold.

- Describe the item being sold in detail. Include the make, model, year, and any other identifying features, such as serial numbers.

- State the purchase price of the item. This is the amount the buyer has agreed to pay the seller.

- Include any additional terms of the sale, if applicable. This could involve warranties or conditions that both parties must adhere to.

- Both the seller and the buyer should sign and date the form at the bottom. This indicates that both parties agree to the terms outlined in the document.

- Make copies of the completed Bill of Sale for both the buyer and seller. This ensures that both parties have a record of the transaction.

Misconceptions

Understanding the Pennsylvania Bill of Sale form is essential for anyone engaging in the sale or transfer of personal property. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- A Bill of Sale is not legally required. Many believe that a Bill of Sale is optional for private sales. In Pennsylvania, while it may not be legally required for all transactions, having one provides a clear record and can protect both parties.

- Only a notary can validate a Bill of Sale. Some think that a notary's signature is necessary for a Bill of Sale to be valid. In Pennsylvania, notarization is not mandatory, although it can add an extra layer of credibility.

- A Bill of Sale is only for vehicles. Many associate the form exclusively with vehicle transactions. In reality, a Bill of Sale can be used for various personal property, including furniture, electronics, and other goods.

- The seller must provide a warranty. There is a belief that a Bill of Sale automatically includes warranties or guarantees. In Pennsylvania, unless explicitly stated, the sale is typically "as-is," meaning no warranties are implied.

- All Bills of Sale must be filed with the state. Some individuals think they need to submit their Bill of Sale to a government office. In Pennsylvania, this is not the case. The document is primarily for the buyer and seller's records.

- Once signed, a Bill of Sale cannot be changed. It is a common misconception that a Bill of Sale is final and unchangeable. In fact, parties can modify the document if both agree, as long as the changes are documented and signed.

Clarifying these misconceptions can help ensure smoother transactions and protect the interests of both buyers and sellers.