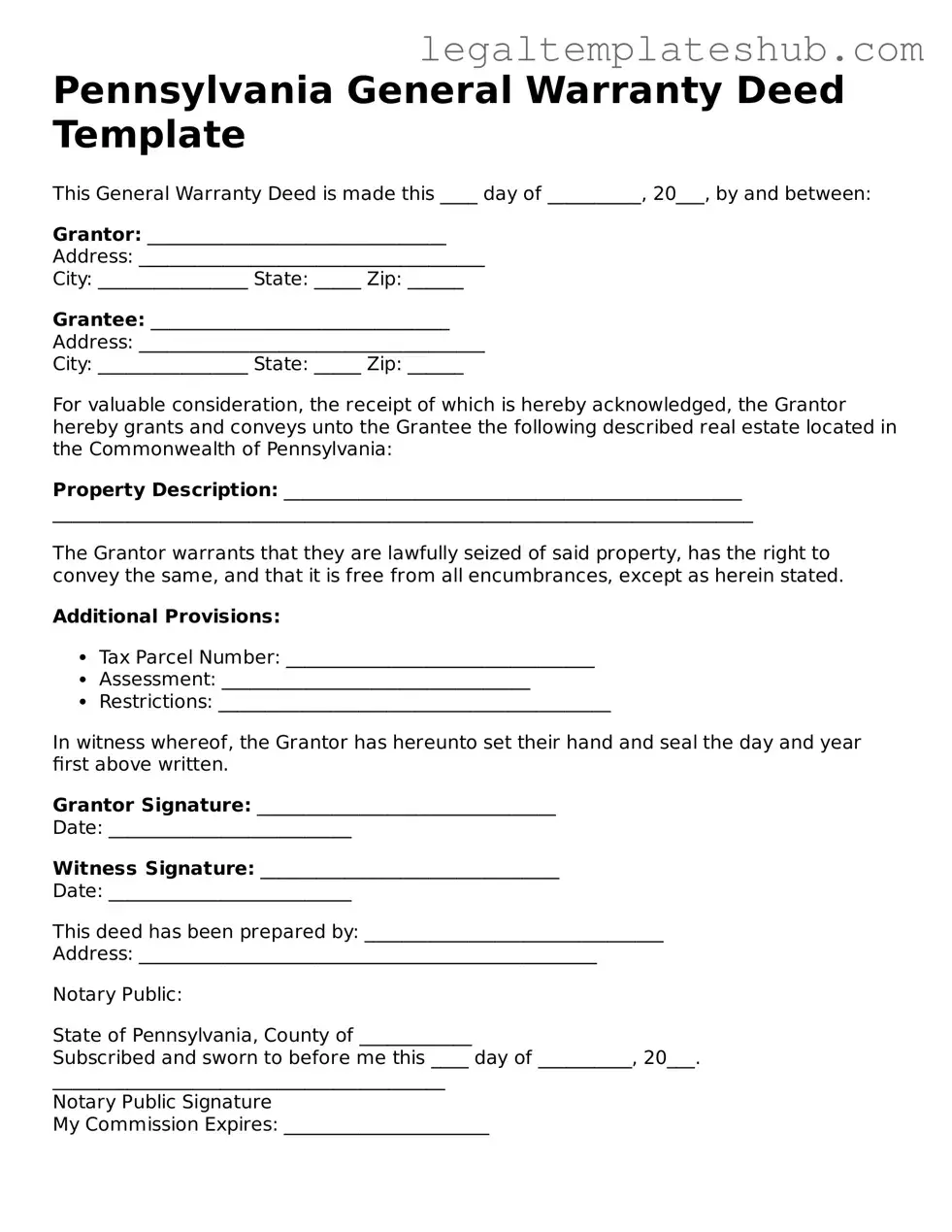

Printable Deed Document for Pennsylvania

PDF Form Data

| Fact Name | Details |

|---|---|

| Governing Law | The Pennsylvania Deed form is governed by Title 21 of the Pennsylvania Consolidated Statutes. |

| Types of Deeds | Common types of deeds in Pennsylvania include warranty deeds, quitclaim deeds, and special warranty deeds. |

| Property Description | A legal description of the property must be included in the deed to identify it clearly. |

| Signatures Required | The grantor must sign the deed, and in some cases, the grantee's signature may also be required. |

| Notarization | Notarization of the grantor's signature is required for the deed to be valid. |

| Recording | The deed must be recorded in the county where the property is located to provide public notice of the transfer. |

| Transfer Tax | Pennsylvania imposes a real estate transfer tax on the sale of property, which is typically paid at the time of recording. |

| Effective Date | The effective date of the deed is usually the date it is signed, unless otherwise specified. |

Key takeaways

Ensure that the Pennsylvania Deed form is filled out completely and accurately. Missing information can lead to delays or complications in the transfer of property.

Identify the type of deed you are using. Different types, such as warranty deeds or quitclaim deeds, serve different purposes and offer varying levels of protection.

Clearly state the names of the parties involved in the transaction. This includes the grantor (seller) and grantee (buyer). Accurate identification is crucial for legal recognition.

Provide a detailed description of the property being transferred. This should include the address and any relevant parcel numbers to avoid confusion.

Consider having the deed notarized. Notarization adds an extra layer of authenticity and can help prevent disputes in the future.

Check for any specific local requirements or additional forms that may be needed in your county. Local regulations can vary significantly.

Record the deed with the appropriate county office. Failing to do so may affect the legal standing of the property transfer.

Keep a copy of the completed deed for your records. This serves as proof of ownership and can be useful for future transactions or legal matters.

Dos and Don'ts

When filling out the Pennsylvania Deed form, attention to detail is crucial. Here are six important dos and don'ts to consider:

- Do ensure that all names are spelled correctly. Mistakes in names can lead to legal complications.

- Do include the complete and accurate property description. This helps avoid disputes about the property boundaries.

- Do sign the deed in the presence of a notary. A notary's acknowledgment is often required for the deed to be valid.

- Do check for any applicable transfer taxes. Understanding these can prevent unexpected costs later.

- Don't leave any required fields blank. Incomplete forms can be rejected, causing delays in the transfer process.

- Don't use white-out or erasers on the form. Any alterations can raise questions about the document's validity.

By following these guidelines, you can help ensure a smoother process when completing your Pennsylvania Deed form.

More Deed State Templates

New York Warranty Deed Form - Can specify terms of the transfer, such as conditions or restrictions.

The New York Operating Agreement is a vital document for Limited Liability Companies (LLCs) in New York, outlining the management structure and operational guidelines of the business. This agreement serves to protect members’ interests while providing clarity on procedures and responsibilities. To ensure your LLC is set up correctly, consider filling out the form by clicking the button below, or you can access helpful resources such as PDF Templates to assist you in the process.

Nc Deed Transfer Form - The process of executing a Deed varies by jurisdiction.

Michigan Property Transfer Affidavit - Deeds serve as proof of property ownership and outline the rights of the owner.

Instructions on Filling in Pennsylvania Deed

After gathering all necessary information, you are ready to complete the Pennsylvania Deed form. This document requires specific details about the property and the parties involved. Ensure that all information is accurate to avoid any delays in processing.

- Begin by entering the date at the top of the form.

- Fill in the names of the grantor(s) (the person(s) transferring the property) in the designated space.

- Provide the names of the grantee(s) (the person(s) receiving the property) in the next section.

- Include the complete address of the property being transferred, including the county and municipality.

- Describe the property in detail, including any relevant identification numbers or parcel numbers.

- Specify the consideration amount, which is the value exchanged for the property.

- Sign the form in the presence of a notary public, ensuring that all signatures are legible.

- Have the notary public complete their section, including their signature and seal.

- Make copies of the completed deed for your records.

- Submit the original deed to the appropriate county office for recording.

Misconceptions

- All deeds are the same. Different types of deeds serve various purposes. For instance, a warranty deed provides guarantees about the property title, while a quitclaim deed transfers interest without any warranties.

- Only lawyers can prepare a deed. While legal assistance can be beneficial, individuals can also prepare deeds themselves, provided they follow the correct procedures and requirements.

- A deed must be notarized to be valid. In Pennsylvania, a deed must be acknowledged before a notary public, but it is not strictly required for validity in all cases.

- Once a deed is recorded, it cannot be changed. Although a recorded deed is a public document, it can be amended or corrected through a new deed if necessary.

- Deeds are only needed for property sales. Deeds are also necessary for gifting property, transferring ownership, or establishing joint ownership.

- All property transfers require a new deed. In some cases, property transfers can occur through other legal documents, such as a will or trust, without needing a new deed.

- The deed must be filed immediately after signing. While it is advisable to record a deed promptly, there is often a grace period during which the deed can still be recorded without penalty.

- Only the buyer needs to sign the deed. Typically, both the grantor (seller) and grantee (buyer) must sign the deed for it to be valid.

- Property taxes are not affected by a deed transfer. A transfer of property ownership may trigger a reassessment of property taxes, depending on local laws.

- Deeds are only relevant for residential properties. Deeds are essential for all types of property, including commercial, industrial, and agricultural land.