Printable Deed in Lieu of Foreclosure Document for Pennsylvania

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | The Pennsylvania Deed in Lieu of Foreclosure is governed by Pennsylvania state law, specifically under Title 68, Real and Personal Property. |

| Eligibility | Homeowners facing financial difficulties may be eligible for a deed in lieu of foreclosure, provided they meet specific criteria set by the lender. |

| Benefits | This process can help borrowers avoid the lengthy and stressful foreclosure process, allowing for a quicker resolution. |

| Impact on Credit | While a deed in lieu of foreclosure is less damaging than a foreclosure, it may still negatively impact the borrower’s credit score. |

| Tax Implications | Borrowers should be aware of potential tax implications, as the IRS may consider forgiven debt as taxable income. |

| Documentation | Proper documentation is crucial; the borrower must provide the lender with all necessary financial information and property details. |

| Legal Assistance | Consulting with a legal professional is recommended to navigate the complexities of a deed in lieu of foreclosure effectively. |

Key takeaways

When considering the Pennsylvania Deed in Lieu of Foreclosure form, keep these key points in mind:

- The form allows homeowners to voluntarily transfer their property to the lender to avoid foreclosure.

- Ensure that you have a clear understanding of your mortgage obligations before proceeding.

- Consult with a real estate attorney or advisor to navigate the process smoothly.

- Complete the form accurately to prevent delays in processing.

- Consider the impact on your credit score; this option may still affect it.

- Be aware of any potential tax implications that could arise from the transfer.

- Once submitted, follow up with your lender to confirm receipt and discuss next steps.

Dos and Don'ts

When filling out the Pennsylvania Deed in Lieu of Foreclosure form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn’t do:

- Do provide accurate property information, including the address and legal description.

- Do include the names of all parties involved in the transaction.

- Do sign the document in front of a notary public.

- Do ensure that all required fields are completed before submission.

- Don’t leave any sections blank; incomplete forms can lead to delays.

- Don’t use unclear or ambiguous language in the form.

- Don’t forget to check for any local requirements or additional documentation needed.

- Don’t submit the form without reviewing it for errors or typos.

More Deed in Lieu of Foreclosure State Templates

Deed in Lieu - Homeowners should document all communication with the lender regarding this option.

Foreclosure Vs Deed in Lieu - In some cases, lenders may offer relocation assistance to homeowners who sign a Deed in Lieu.

Understanding the significance of a New York Residential Lease Agreement is crucial for both landlords and tenants, as it establishes the framework for their rental relationship, covering vital aspects such as rental amount and lease duration. To simplify the process of securing your rental space, you can utilize resources like PDF Templates to ensure accuracy and compliance when filling out this important document.

Deed in Lieu Vs Foreclosure - Enables homeowners to avoid the negative impact of foreclosure on their credit score.

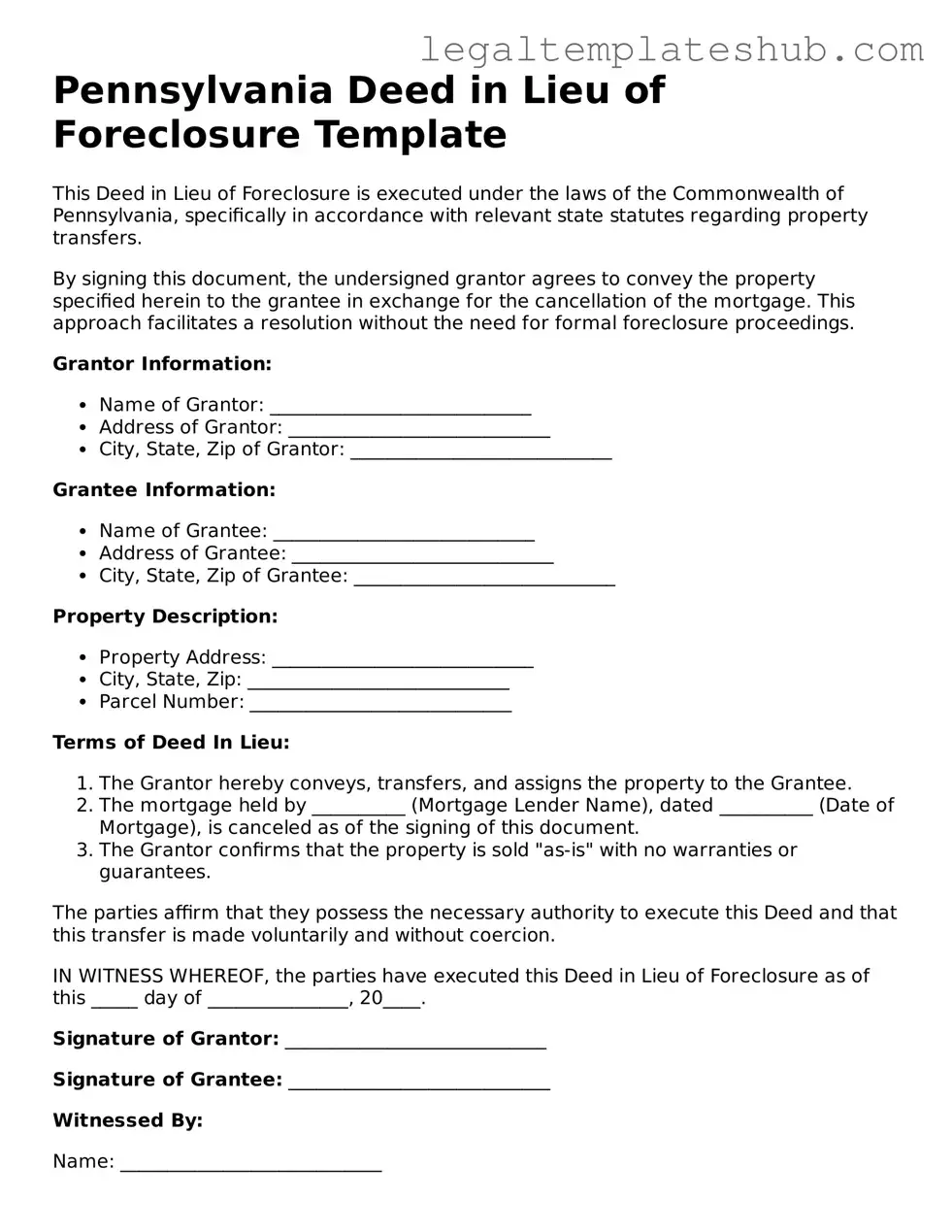

Instructions on Filling in Pennsylvania Deed in Lieu of Foreclosure

After completing the Pennsylvania Deed in Lieu of Foreclosure form, the next step involves submitting the document to the appropriate parties. This typically includes the lender and possibly the county recorder's office. Ensure you keep copies for your records.

- Gather necessary information. You will need details about the property, including the address and legal description.

- Identify the parties involved. This includes the grantor (homeowner) and the grantee (lender).

- Fill out the grantor's information. Include the full name and address of the homeowner.

- Complete the grantee's information. Enter the lender's name and address accurately.

- Provide the legal description of the property. This information can usually be found on the original deed or property tax documents.

- Indicate the consideration. This is often a nominal amount, such as $1.

- Sign the document. The homeowner must sign the deed in front of a notary public.

- Have the deed notarized. This step is crucial for the document to be legally binding.

- Submit the completed deed. Send it to the lender and file it with the county recorder's office if required.

Misconceptions

Understanding the Pennsylvania Deed in Lieu of Foreclosure can be challenging, and several misconceptions often arise. Here are eight common misunderstandings that people may have regarding this legal process:

- It eliminates all debts associated with the property. Many believe that signing a deed in lieu of foreclosure cancels all debts. However, this is not always the case. The lender may still pursue other debts or obligations not tied to the property.

- It is a quick and easy solution. While it may seem straightforward, the process can be lengthy. Lenders often require extensive documentation and may take time to review the situation before accepting a deed in lieu.

- It will not affect credit scores. A deed in lieu of foreclosure can still impact credit scores negatively. Although it may be less damaging than a foreclosure, it is still considered a significant event in one’s credit history.

- All lenders accept deeds in lieu of foreclosure. Not all lenders are willing to accept this option. Some may prefer to proceed with foreclosure, depending on their policies and the specific circumstances of the loan.

- Homeowners can simply walk away from their mortgage. This is a misconception. A deed in lieu of foreclosure requires the homeowner to formally agree to transfer the property to the lender, which involves specific legal steps.

- It absolves the homeowner of all legal responsibilities. After signing a deed in lieu, homeowners may still have certain obligations, such as property taxes or HOA fees, until the transfer is fully completed.

- It can be done without legal assistance. While it is possible to navigate the process independently, having legal guidance can help ensure that all aspects are handled properly and that the homeowner's rights are protected.

- It is the same as a short sale. Although both options involve transferring property to relieve debt, they are distinct processes. A short sale typically involves selling the property for less than the mortgage owed, while a deed in lieu transfers ownership directly to the lender.

Understanding these misconceptions can help homeowners make informed decisions when facing financial difficulties related to their property. It is crucial to seek accurate information and consider all options available.