Printable Last Will and Testament Document for Pennsylvania

PDF Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Last Will and Testament is governed by the Pennsylvania Probate, Estates and Fiduciaries Code. |

| Age Requirement | Testators must be at least 18 years old to create a valid will in Pennsylvania. |

| Witness Requirement | A will must be signed by at least two witnesses who are present at the same time. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document. |

| Self-Proving Wills | Pennsylvania allows for self-proving wills, which simplify the probate process by including a notarized affidavit from the witnesses. |

| Holographic Wills | Holographic wills, or handwritten wills, are recognized in Pennsylvania if they are signed by the testator. |

Key takeaways

When filling out and using the Pennsylvania Last Will and Testament form, consider the following key takeaways:

- Eligibility: You must be at least 18 years old and of sound mind to create a valid will in Pennsylvania.

- Signature Requirement: Your will must be signed by you in the presence of two witnesses. These witnesses should also sign the document.

- Revocation: You can revoke your will at any time by creating a new will or by destroying the existing one.

- Executor Designation: Choose a reliable person to serve as your executor. This individual will manage your estate after your passing.

- Clear Instructions: Clearly outline how you want your assets distributed. This helps prevent confusion and potential disputes among beneficiaries.

Dos and Don'ts

When filling out the Pennsylvania Last Will and Testament form, it’s essential to approach the process with care and attention. Here’s a list of things to keep in mind to ensure that your will is valid and reflects your wishes.

- Do ensure that you are of sound mind when creating your will. This means you should understand the nature of the document and the implications of your decisions.

- Do clearly identify yourself in the document. Include your full name and address to avoid any confusion.

- Do specify how you want your assets distributed. Be as detailed as possible to prevent disputes among your heirs.

- Do appoint an executor. This person will be responsible for carrying out your wishes as stated in the will.

- Don't use vague language. Ambiguities can lead to misunderstandings and potential legal challenges.

- Don't forget to sign your will. In Pennsylvania, your signature is crucial for the document to be legally binding.

- Don't overlook the need for witnesses. Pennsylvania requires at least two witnesses to sign your will, confirming that you signed it voluntarily.

- Don't store your will in a place that is difficult to access. Ensure that your executor knows where to find it when needed.

By following these guidelines, you can create a Last Will and Testament that accurately reflects your wishes and stands up to legal scrutiny.

More Last Will and Testament State Templates

Free Will Forms to Print - Specifies beneficiaries who will receive property and possessions.

Can You Write Your Own Will in Nc - Helps to simplify the process for your loved ones during an emotional time.

The complete Horse Bill of Sale guide serves as an important resource for individuals engaging in the purchase and sale of horses in Colorado, outlining necessary details to protect both parties in the transaction.

Making a Will in Nj - Can specify timelines for the distribution of assets.

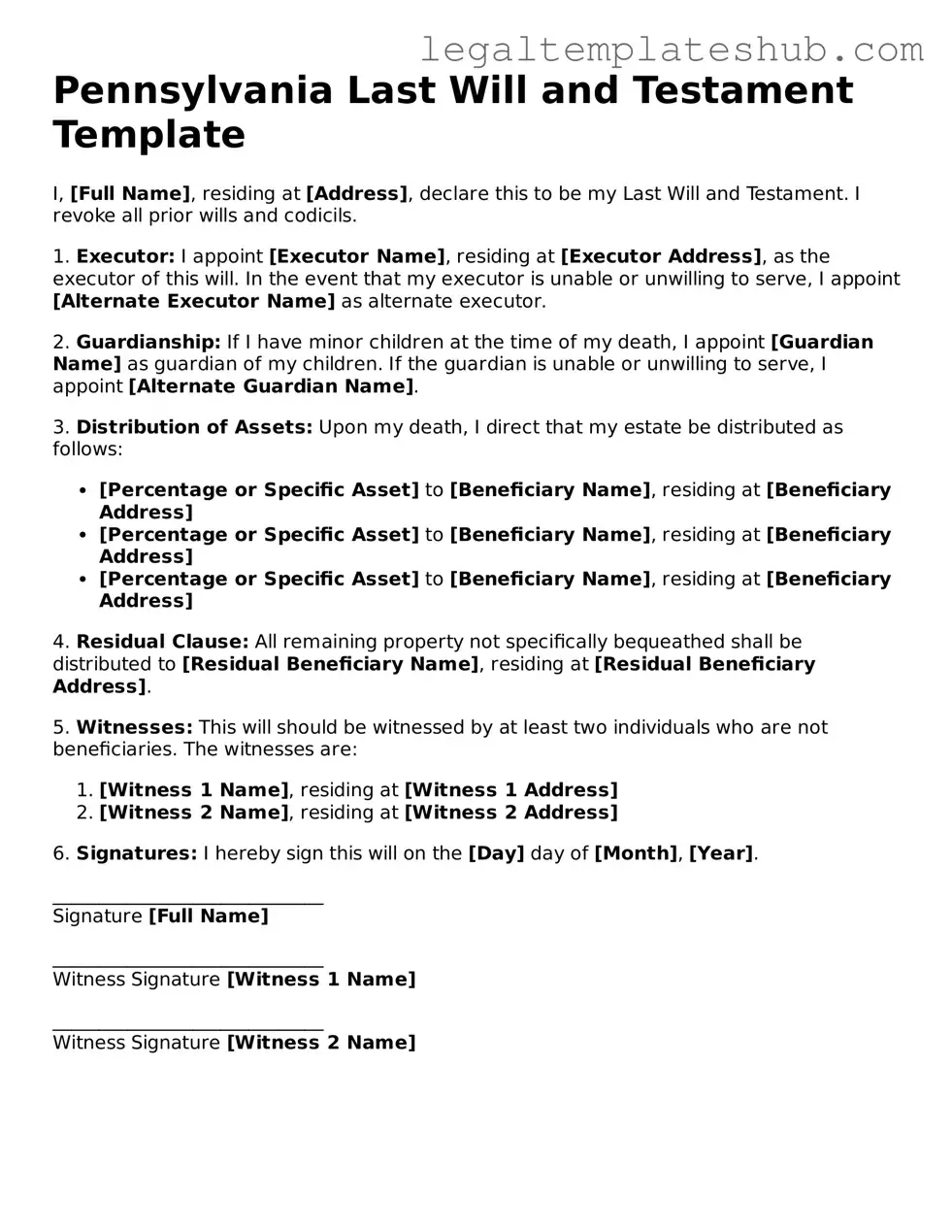

Instructions on Filling in Pennsylvania Last Will and Testament

After obtaining the Pennsylvania Last Will and Testament form, you will need to complete it accurately to ensure your wishes are clearly stated. This process involves providing personal information, designating beneficiaries, and appointing an executor. Once completed, the form must be signed and witnessed according to state requirements.

- Begin by entering your full name at the top of the form.

- Provide your current address, including city, state, and zip code.

- State your date of birth to confirm your identity.

- Designate your beneficiaries by listing their names and relationships to you.

- Specify what each beneficiary will receive, whether it is a specific item, a sum of money, or a percentage of your estate.

- Choose an executor who will be responsible for carrying out the terms of your will. Include their name and contact information.

- If applicable, name an alternate executor in case the primary executor is unable to serve.

- Include any additional instructions or wishes you have regarding your estate.

- Review the completed form for accuracy and completeness.

- Sign the form in the presence of at least two witnesses who are not beneficiaries.

- Have your witnesses sign the form, providing their names and addresses.

Misconceptions

Understanding the Pennsylvania Last Will and Testament is essential for anyone looking to secure their estate. However, several misconceptions can lead to confusion and potential issues. Here are five common misconceptions:

- A handwritten will is not valid in Pennsylvania. This is false. Pennsylvania recognizes holographic wills, which are handwritten and signed by the testator. However, they must meet certain criteria to be considered valid.

- You need a lawyer to create a valid will. While having a lawyer can help ensure that your will meets all legal requirements, it is not strictly necessary. Individuals can create their own wills, provided they adhere to state laws.

- All assets must be listed in the will. It is a misconception that every asset must be detailed in the will. While it is advisable to specify major assets, any property not mentioned may still be distributed according to Pennsylvania's intestacy laws.

- You cannot change your will once it is created. This is incorrect. Wills can be amended or revoked at any time, as long as the testator is of sound mind and follows the proper legal procedures.

- Only wealthy individuals need a will. This belief is misleading. Everyone, regardless of their financial situation, can benefit from having a will. It ensures that personal wishes are honored and can simplify the process for loved ones after death.