Printable Motor Vehicle Bill of Sale Document for Pennsylvania

PDF Form Data

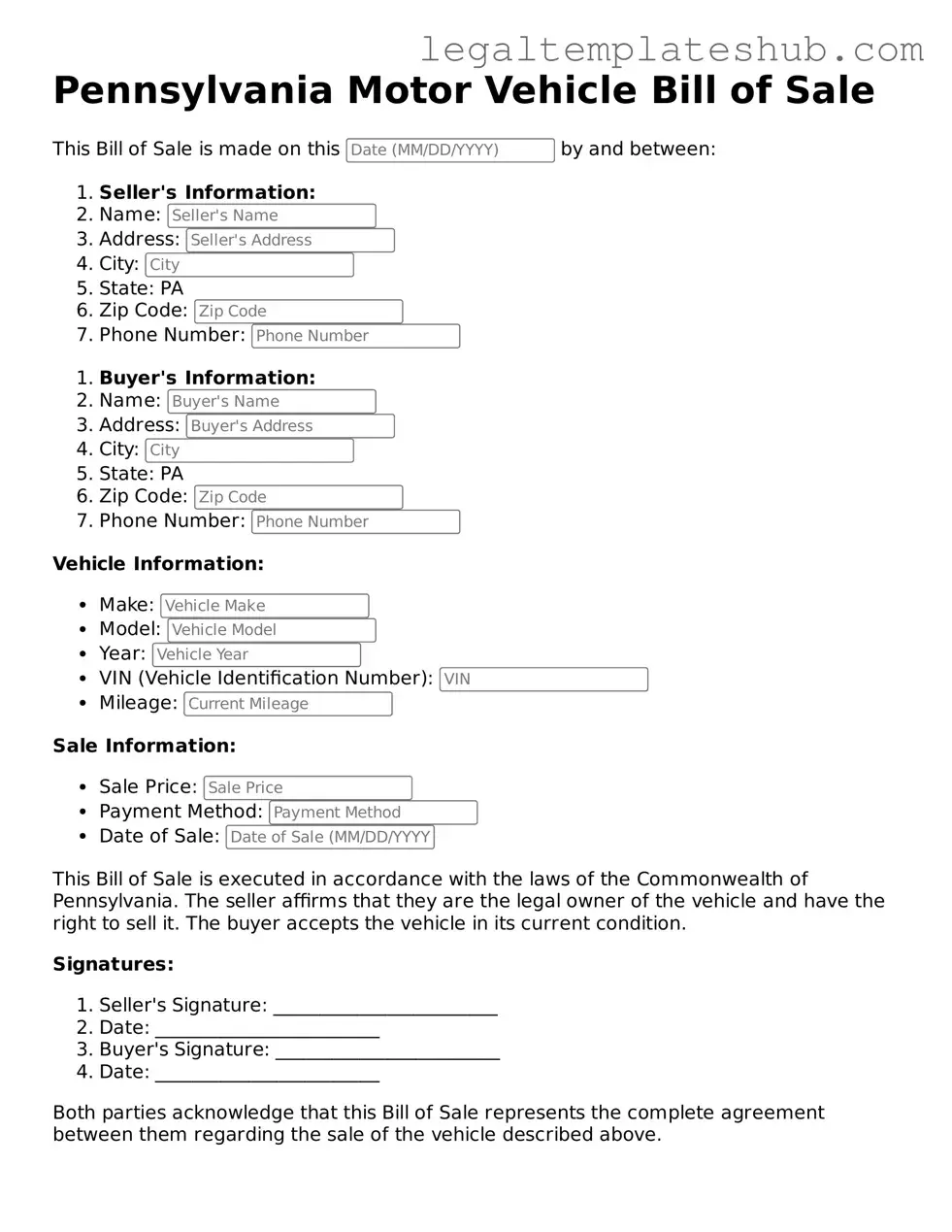

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Motor Vehicle Bill of Sale form is used to document the sale of a motor vehicle between a buyer and a seller. |

| Governing Law | This form is governed by the Pennsylvania Vehicle Code, specifically Title 75 of the Pennsylvania Consolidated Statutes. |

| Required Information | It must include details such as the vehicle identification number (VIN), make, model, year, and the sale price. |

| Signatures | Both the buyer and seller must sign the form to validate the transaction, confirming their agreement to the sale. |

| Notarization | While notarization is not required, having the form notarized can provide additional legal protection for both parties. |

| Record Keeping | It is advisable for both the buyer and seller to keep a copy of the completed Bill of Sale for their records. |

Key takeaways

Ensure that all required fields are filled out completely. Missing information can lead to complications during the registration process.

Both the seller and buyer should sign the form. This step is crucial for validating the transaction.

Include the vehicle's details accurately. This includes the make, model, year, and Vehicle Identification Number (VIN).

Keep a copy of the completed Bill of Sale for your records. This document serves as proof of the transaction.

Check for any specific requirements in your county. Local regulations may vary and could affect the sale process.

Consider having the Bill of Sale notarized. While not always necessary, notarization can add an extra layer of security.

Dos and Don'ts

When filling out the Pennsylvania Motor Vehicle Bill of Sale form, it's important to ensure accuracy and compliance with state regulations. Here’s a helpful list of things you should and shouldn't do:

- Do provide accurate vehicle information, including the make, model, year, and VIN.

- Do include the names and addresses of both the buyer and seller.

- Do specify the sale price clearly to avoid any confusion later.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any blank spaces on the form; this can lead to misunderstandings.

- Don't use abbreviations or shorthand that may confuse the reader.

- Don't forge signatures; all parties must sign willingly.

- Don't forget to check for any additional local requirements that may apply.

By following these guidelines, you can ensure a smoother transaction and protect both parties involved. Remember, a well-completed Bill of Sale is crucial for a successful vehicle transfer.

More Motor Vehicle Bill of Sale State Templates

How to Fill Out a Bill of Sale Utah - Documents the date of the transaction clearly.

Ohio Bill of Sale Requirements - Can be completed quickly, aiding efficient transactions.

How to Transfer a Car Title to a Family Member Nj - Allows for easier processing of vehicle-related paperwork.

When you need to finalize a transaction, utilizing a straightforward Alabama bill of sale template can simplify the process. This document provides all necessary details for a smooth transfer of ownership. For more information, you can visit the guide on our complete bill of sale essentials.

Bill of Sale Template Virginia - Identifies the buyer and seller by full names and addresses.

Instructions on Filling in Pennsylvania Motor Vehicle Bill of Sale

After you gather all necessary information, you can start filling out the Pennsylvania Motor Vehicle Bill of Sale form. This document will help ensure a smooth transfer of ownership for your vehicle. Follow these steps to complete the form accurately.

- Begin by entering the date of the sale at the top of the form.

- Fill in the seller's name and address. Make sure to provide complete and accurate information.

- Next, enter the buyer's name and address. Again, ensure that all details are correct.

- In the vehicle description section, provide the make, model, year, and Vehicle Identification Number (VIN) of the vehicle.

- Indicate the odometer reading at the time of sale. This should reflect the current mileage.

- Specify the sale price of the vehicle. This is the amount the buyer will pay to the seller.

- Both the seller and buyer should sign and date the form at the bottom to confirm the transaction.

Once you have completed the form, ensure both parties keep a copy for their records. This will serve as proof of the sale and can be helpful for future reference.

Misconceptions

When dealing with the Pennsylvania Motor Vehicle Bill of Sale form, several misconceptions often arise. Understanding these misunderstandings can help ensure a smoother transaction process. Below are seven common misconceptions explained.

- It is not necessary to have a Bill of Sale for vehicle transactions. Many people believe that a Bill of Sale is optional. In Pennsylvania, while it is not legally required, having one is highly recommended as it serves as proof of the transaction.

- The Bill of Sale must be notarized. Some individuals think that notarization is mandatory for the Bill of Sale to be valid. However, Pennsylvania does not require notarization for this document, although it can add an extra layer of security.

- Only the seller needs to sign the Bill of Sale. A common belief is that only the seller's signature is required. In reality, both the buyer and seller should sign the document to confirm the agreement and protect both parties.

- The Bill of Sale is the same as the title transfer. Many assume that the Bill of Sale serves the same purpose as transferring the title. While it can aid in the process, it is a separate document and does not replace the need for a title transfer.

- The Bill of Sale is only for used vehicles. Some people think this form is only applicable for used cars. In fact, it can be used for both new and used vehicle sales, providing a record of the transaction.

- All information on the Bill of Sale is optional. There is a misconception that all fields on the Bill of Sale are optional. In truth, certain information, such as the vehicle identification number (VIN) and purchase price, is crucial for the document to be effective.

- A Bill of Sale is not necessary if the vehicle is a gift. Some believe that gifting a vehicle does not require a Bill of Sale. However, it is still advisable to document the transaction, even if no money changes hands, to avoid future disputes.

Clarifying these misconceptions can help individuals navigate the vehicle buying and selling process in Pennsylvania with greater confidence.