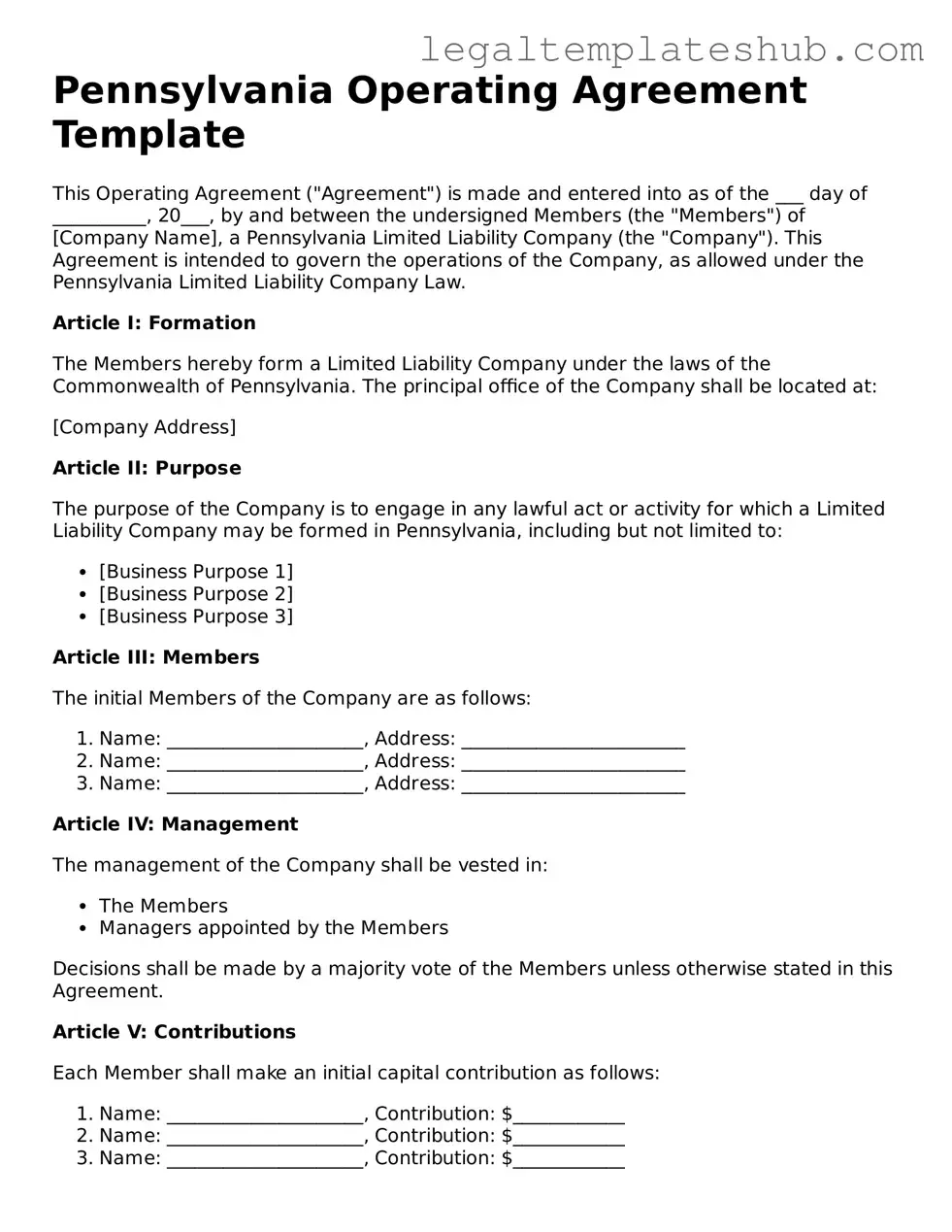

Printable Operating Agreement Document for Pennsylvania

PDF Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Operating Agreement outlines the management structure and operational procedures of a Limited Liability Company (LLC). |

| Governing Law | This agreement is governed by the Pennsylvania Uniform Limited Liability Company Act. |

| Members | All members of the LLC should be included in the agreement to ensure clarity in ownership and responsibilities. |

| Flexibility | The agreement allows for customization, enabling members to define their specific roles and profit-sharing arrangements. |

| Legal Requirement | While not legally required, having an Operating Agreement is highly recommended to avoid disputes among members. |

| Amendments | Members can amend the Operating Agreement as needed, provided that all members agree to the changes. |

| Dispute Resolution | The agreement can include provisions for resolving disputes, which can help prevent litigation in the future. |

Key takeaways

When filling out and using the Pennsylvania Operating Agreement form, it's essential to understand several key aspects. Here are some important takeaways:

- The Operating Agreement is a crucial document for LLCs in Pennsylvania, outlining the management structure and operational guidelines.

- Every member of the LLC should have a clear understanding of their rights and responsibilities as detailed in the agreement.

- It's advisable to include provisions for profit and loss distribution among members to avoid future disputes.

- Members should decide on the duration of the LLC and whether it will be perpetual or have a specific end date.

- Consider including a buy-sell agreement to outline how members can buy out each other's interests.

- Clearly define the roles of each member, including who will handle day-to-day operations.

- Regularly review and update the Operating Agreement to reflect any changes in the business or membership.

- While not required by law, having an Operating Agreement can help protect your LLC's limited liability status.

- Consulting with a legal professional can provide valuable insights and help tailor the agreement to your specific needs.

- Ensure that all members sign the agreement to validate its terms and conditions.

By keeping these points in mind, you can create a comprehensive Operating Agreement that supports your LLC's success and stability.

Dos and Don'ts

When filling out the Pennsylvania Operating Agreement form, it's essential to approach the task with care and attention to detail. Here are nine important dos and don'ts to consider:

- Do read the entire form thoroughly before starting to fill it out.

- Don't rush through the process; take your time to ensure accuracy.

- Do provide clear and concise information about the members and their roles.

- Don't leave any sections blank unless explicitly stated as optional.

- Do double-check all names and addresses for spelling and accuracy.

- Don't use abbreviations or informal language that could lead to confusion.

- Do consult with a legal professional if you have any uncertainties.

- Don't ignore the importance of signatures; ensure all necessary parties sign the document.

- Do keep a copy of the completed form for your records.

By adhering to these guidelines, you can help ensure that your Operating Agreement is completed correctly and effectively serves its intended purpose.

More Operating Agreement State Templates

Operating Agreement Llc Virginia - The Operating Agreement can provide guidelines for resolving disputes between members.

In order to establish a clear understanding between landlords and tenants, it is essential to utilize the Ohio Residential Lease Agreement form, which details the expectations and obligations of both parties. For those looking to streamline this process, various resources, including PDF Templates, are available to assist in creating a comprehensive lease agreement.

Llc Operating Agreement Michigan - It provides a framework for the organization’s structure and operations.

How to Write an Operating Agreement - Comprehensive Operating Agreements can lead to smoother business operations overall.

Operating Agreement Llc Utah - This document is tailored to the specific needs and agreements made by the business's members.

Instructions on Filling in Pennsylvania Operating Agreement

Completing the Pennsylvania Operating Agreement form is essential for establishing the foundational rules and regulations governing your business entity. Properly filling out this form ensures clarity in operations and helps prevent future disputes among members. Follow the steps below to accurately complete the form.

- Begin by obtaining the Pennsylvania Operating Agreement form from a reliable source, such as the Pennsylvania Department of State's website or a legal document provider.

- Read through the entire form to familiarize yourself with the required information and sections.

- Enter the name of your business entity as it appears on your registration documents.

- Provide the principal office address of the business. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the business. Ensure that each member's information is accurate and up-to-date.

- Specify the percentage of ownership for each member. This will define how profits and losses are shared.

- Outline the management structure of the business. Indicate whether it will be member-managed or manager-managed.

- Detail the voting rights of each member. Clarify how decisions will be made within the business.

- Include any additional provisions that may be relevant to your business operations, such as dispute resolution methods or buyout procedures.

- Review the completed form for accuracy and completeness. Make sure all members have agreed to the terms outlined.

- Sign and date the form. Ensure that all members also sign, if required.

- Submit the form according to the instructions provided, whether electronically or via mail, to the appropriate state office.

Misconceptions

Many individuals and businesses often misunderstand the Pennsylvania Operating Agreement form. Here are four common misconceptions:

- It is not necessary for all LLCs. Some people believe that an Operating Agreement is optional for Limited Liability Companies (LLCs) in Pennsylvania. However, while it is not required by law, having one is crucial for outlining the management structure and operational procedures of the LLC.

- Only large businesses need an Operating Agreement. There is a misconception that only larger companies or those with multiple members need an Operating Agreement. In reality, even single-member LLCs benefit from having this document as it helps establish the owner's rights and responsibilities.

- It must be filed with the state. Some individuals think that the Operating Agreement must be submitted to the state of Pennsylvania. In fact, this document is kept internally within the LLC and does not need to be filed with any state agency.

- It cannot be changed once created. Many assume that once an Operating Agreement is drafted and signed, it cannot be modified. This is incorrect; members can amend the agreement as needed, provided that the process for amendments is outlined within the document itself.