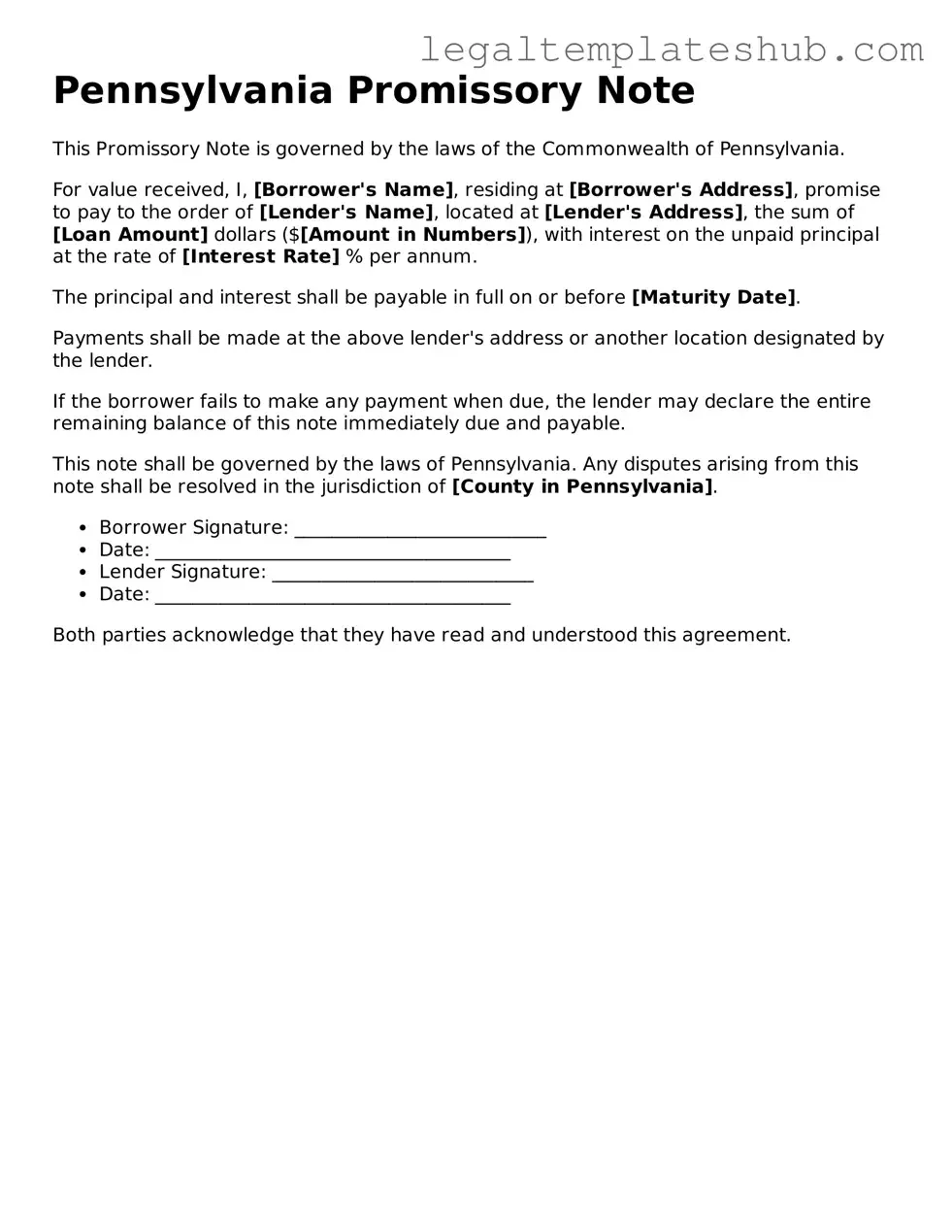

Printable Promissory Note Document for Pennsylvania

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Promissory Note is a written promise to pay a specified amount of money to a designated party at a defined time. |

| Governing Law | The Pennsylvania Uniform Commercial Code (UCC) governs promissory notes in the state. |

| Parties Involved | The note involves a borrower (maker) and a lender (payee). |

| Interest Rate | Interest can be specified in the note; if not stated, the legal rate applies as per Pennsylvania law. |

| Signature Requirement | The note must be signed by the maker to be enforceable. |

| Transferability | Promissory notes in Pennsylvania can be transferred or assigned to another party unless restricted by the terms of the note. |

Key takeaways

When using the Pennsylvania Promissory Note form, keep these key points in mind:

- Complete Information: Ensure all parties' names, addresses, and contact information are accurate. This helps avoid confusion later.

- Clear Terms: Specify the loan amount, interest rate, and repayment schedule. Clarity is crucial for both parties.

- Signatures Required: All parties involved must sign the document. A signed note is enforceable in court.

- Keep Copies: Retain copies of the signed note for your records. This provides proof of the agreement.

Dos and Don'ts

When filling out the Pennsylvania Promissory Note form, it's important to be careful and precise. Here’s a helpful list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do include all necessary personal information, such as names and addresses.

- Do specify the loan amount clearly.

- Do outline the repayment terms, including interest rates and payment schedule.

- Do sign and date the document in the appropriate places.

- Don't leave any blank spaces on the form.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to make copies for both parties involved.

- Don't rush through the process; take your time to ensure accuracy.

- Don't ignore state-specific requirements that may apply.

More Promissory Note State Templates

Create Promissory Note - Being clear about each party’s expectations can lead to a smoother repayment process.

Promissory Note for Personal Loan - The lender may request personal information for credit assessment.

Utah Promissory Note - Using a promissory note helps document the terms of a loan, preventing confusion about repayment obligations.

In addition to understanding the terms of a Florida Commercial Lease Agreement, landlords and tenants may benefit from reviewing templates and examples available online, such as the one found at floridaformspdf.com/printable-commercial-lease-agreement-form/, which can aid in ensuring that all necessary legal stipulations are met for a successful rental arrangement.

Promissory Note Template Ohio - Can be used in conjunction with other financial documents.

Instructions on Filling in Pennsylvania Promissory Note

Completing the Pennsylvania Promissory Note form is an important step in formalizing a loan agreement. Once the form is filled out, both parties will have a clear understanding of the terms and conditions associated with the loan. It is essential to ensure that all information is accurate and complete to avoid any misunderstandings in the future.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Identify the borrower. Write the full legal name of the person or entity borrowing the money.

- Next, provide the lender's information. Enter the full legal name of the person or entity lending the money.

- Specify the principal amount. Clearly state the total amount of money being borrowed.

- Detail the interest rate. Indicate the annual interest rate applicable to the loan, if any.

- Outline the repayment terms. Describe how and when the borrower will repay the loan, including any specific payment dates.

- Include any late fees or penalties. State the conditions under which late fees will be applied.

- Sign the document. Both the borrower and lender must sign and date the form to make it legally binding.

- Consider having the document notarized. Although not always required, notarization can provide an extra layer of security.

Misconceptions

Understanding the Pennsylvania Promissory Note form can be challenging due to various misconceptions. Here are nine common misunderstandings that people often have:

- All promissory notes must be notarized. Many believe that notarization is a requirement for all promissory notes. In Pennsylvania, while notarization can add an extra layer of authenticity, it is not legally required for the note to be valid.

- Promissory notes are only for large loans. Some individuals think that promissory notes are only applicable for substantial amounts of money. In reality, they can be used for any loan amount, no matter how small.

- Written agreements are unnecessary if there is a verbal promise. A common misconception is that a verbal agreement suffices. However, having a written promissory note provides clarity and legal protection, making it easier to enforce the agreement.

- Interest rates must be specified in the note. Many assume that a promissory note must include an interest rate. While it is common to specify this, it is not mandatory. A note can be interest-free if both parties agree.

- Promissory notes are only for personal loans. Some people think these notes are exclusively for personal transactions. In truth, they can be used in business contexts as well, facilitating loans between companies or individuals.

- Once signed, a promissory note cannot be changed. There is a belief that a signed note is set in stone. However, parties can amend the terms of the note if both agree and document the changes appropriately.

- Defaulting on a promissory note is a criminal offense. Many worry that failing to repay a promissory note will result in criminal charges. In fact, defaulting is typically a civil matter, leading to potential legal action to recover the debt.

- All promissory notes are the same. Some people think that all promissory notes follow a standard template. In reality, these notes can vary significantly in terms of structure and language, tailored to fit the specific agreement between the parties.

- Promissory notes do not require signatures. A misconception exists that a promissory note can be valid without signatures. However, signatures from both parties are essential to demonstrate agreement and enforceability.

Recognizing these misconceptions can help individuals navigate the complexities of promissory notes in Pennsylvania more effectively.