Printable Quitclaim Deed Document for Pennsylvania

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed transfers ownership of property without guaranteeing that the title is clear. |

| Governing Law | The Pennsylvania Quitclaim Deed is governed by Title 21, Chapter 2 of the Pennsylvania Consolidated Statutes. |

| Use | Commonly used among family members or in divorce settlements to transfer property rights. |

| Consideration | Consideration is not always required, but it is often included to validate the deed. |

| Execution | The grantor must sign the deed in front of a notary public for it to be valid. |

| Recording | It is advisable to record the quitclaim deed with the county recorder of deeds to provide public notice. |

| Title Issues | A quitclaim deed does not protect the grantee from any title defects or liens on the property. |

| Revocation | Once executed and delivered, a quitclaim deed cannot be revoked unless the grantor retains the right to do so in the deed. |

| Tax Implications | Transfer taxes may apply depending on the county in Pennsylvania where the property is located. |

| Form Availability | The Pennsylvania Quitclaim Deed form can be obtained online or through local legal offices. |

Key takeaways

When filling out and using the Pennsylvania Quitclaim Deed form, consider the following key takeaways:

- Understand the Purpose: A Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. This means the seller is not responsible for any claims against the property.

- Complete Information: Ensure that all required fields are filled out accurately. This includes the names of the grantor and grantee, the property description, and the date of the transfer.

- Notarization Requirement: The deed must be signed in the presence of a notary public. This step is crucial for the document to be legally binding and recognized by the state.

- Record the Deed: After execution, the Quitclaim Deed should be filed with the county recorder of deeds. This step officially updates the public record and protects the new owner’s rights.

Dos and Don'ts

When filling out the Pennsylvania Quitclaim Deed form, it is essential to approach the task with care. The following guidelines will help ensure that the process goes smoothly and that all necessary information is accurately provided.

- Do ensure that all names are spelled correctly. A small error can lead to significant complications.

- Do clearly identify the property being transferred. Include the full address and any relevant parcel numbers.

- Do sign the form in the presence of a notary public. This step is crucial for the deed's validity.

- Do check for any local requirements that may apply. Different counties may have specific regulations.

- Do keep a copy of the completed deed for your records. This can be important for future reference.

- Don't leave any fields blank. Incomplete forms can lead to delays or rejections.

- Don't use vague language when describing the property. Be as specific as possible to avoid misunderstandings.

- Don't forget to include the date of the transfer. This information is critical for record-keeping.

- Don't overlook the need for witnesses if required by local law. Some areas may have additional requirements.

- Don't submit the form without reviewing it thoroughly. Mistakes can be costly and time-consuming to correct.

More Quitclaim Deed State Templates

Quitclaim Deed Utah - A Quitclaim Deed can help simplify inheritance issues by transferring property to heirs.

For those looking to secure rental agreements in the state, a detailed Colorado Lease Agreement template is an invaluable resource. This document not only lays out the essential terms between landlords and tenants but also ensures that both parties are aware of their rights and responsibilities during the lease period. For further guidance, refer to the Colorado Lease Agreement.

New York Quitclaim Deed - It is ideal for quick and informal property transfers, emphasizing the mutual trust of the parties involved.

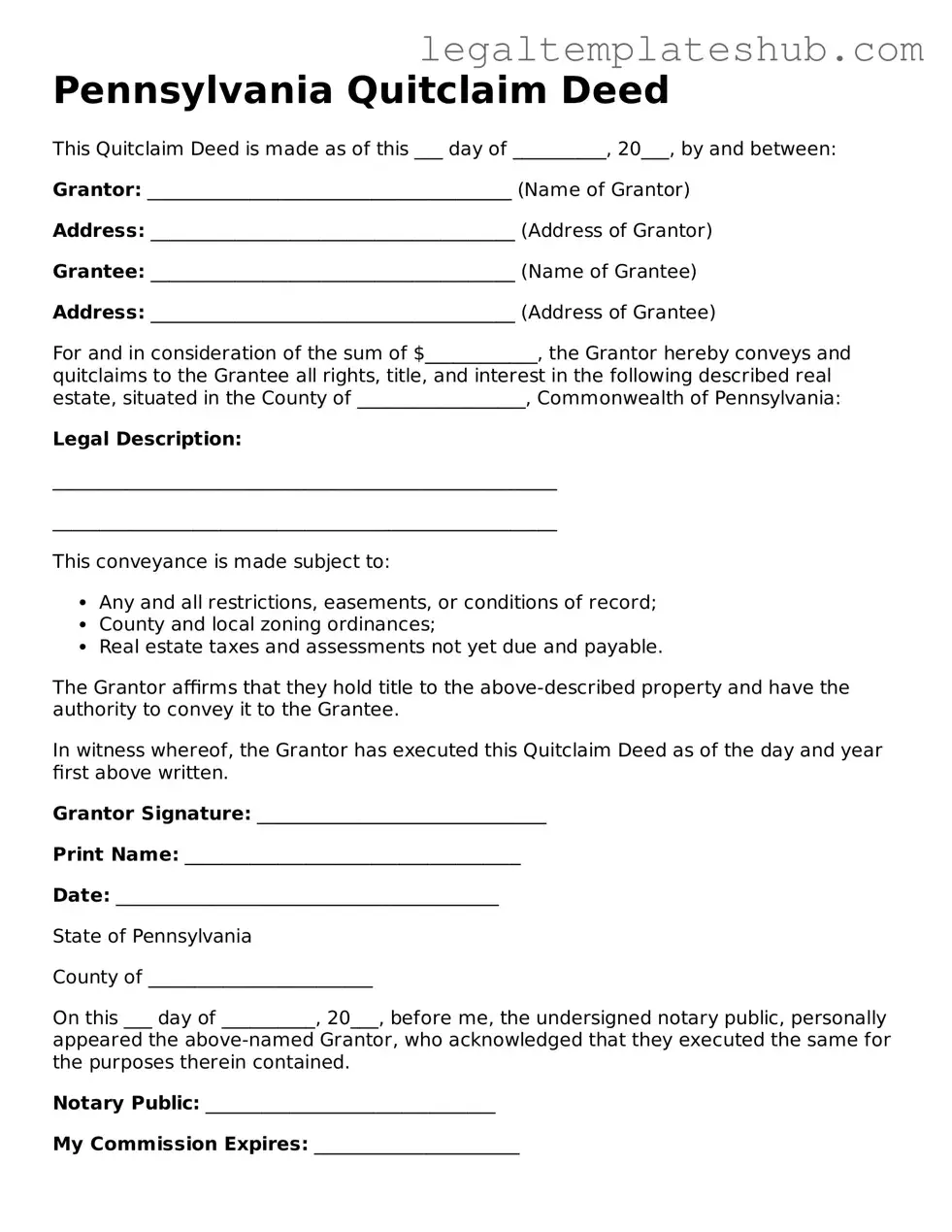

Instructions on Filling in Pennsylvania Quitclaim Deed

After you have gathered the necessary information and documents, you can proceed to fill out the Pennsylvania Quitclaim Deed form. This form is essential for transferring property ownership. Make sure to complete it accurately to avoid any issues later on.

- Obtain the Form: Download or acquire a physical copy of the Pennsylvania Quitclaim Deed form.

- Identify the Grantor: Fill in the name and address of the person transferring the property (the grantor).

- Identify the Grantee: Enter the name and address of the person receiving the property (the grantee).

- Describe the Property: Provide a detailed description of the property being transferred, including the address and any relevant parcel number.

- Include Consideration: State the amount of consideration (payment) for the transfer, if applicable. If the transfer is a gift, you can indicate "for love and affection."

- Sign the Form: The grantor must sign the form in the presence of a notary public. Ensure the signature matches the name provided.

- Notarization: Have the notary public complete their section, confirming the identity of the grantor and witnessing the signature.

- Record the Deed: Take the completed and notarized form to the county recorder's office where the property is located. Pay any required recording fees.

Misconceptions

When dealing with property transfers in Pennsylvania, the Quitclaim Deed form often comes with misunderstandings. Here are four common misconceptions that people have about this important legal document.

- Quitclaim Deeds Transfer Ownership Completely: Many believe that a quitclaim deed guarantees a full transfer of ownership. In reality, this form transfers whatever interest the grantor has in the property, which may not be complete or even valid. It’s crucial to verify the grantor's ownership status before proceeding.

- Quitclaim Deeds Are Only for Divorces: While it's true that quitclaim deeds are often used to transfer property between former spouses, they are not limited to this scenario. These deeds can be used in various situations, including gifting property to family members or transferring interests among business partners.

- Quitclaim Deeds Eliminate Liability: Some individuals mistakenly think that using a quitclaim deed absolves them of any liability related to the property. This is not the case. The grantor may still be liable for any debts or obligations tied to the property, even after the transfer.

- Quitclaim Deeds Don’t Require Legal Assistance: There’s a common belief that anyone can fill out a quitclaim deed without legal help. While it is possible to complete the form independently, consulting with a legal expert is highly recommended to ensure compliance with state laws and to avoid potential issues in the future.

Understanding these misconceptions can help individuals make informed decisions regarding property transfers. Always consider seeking professional advice to navigate the complexities of real estate transactions effectively.