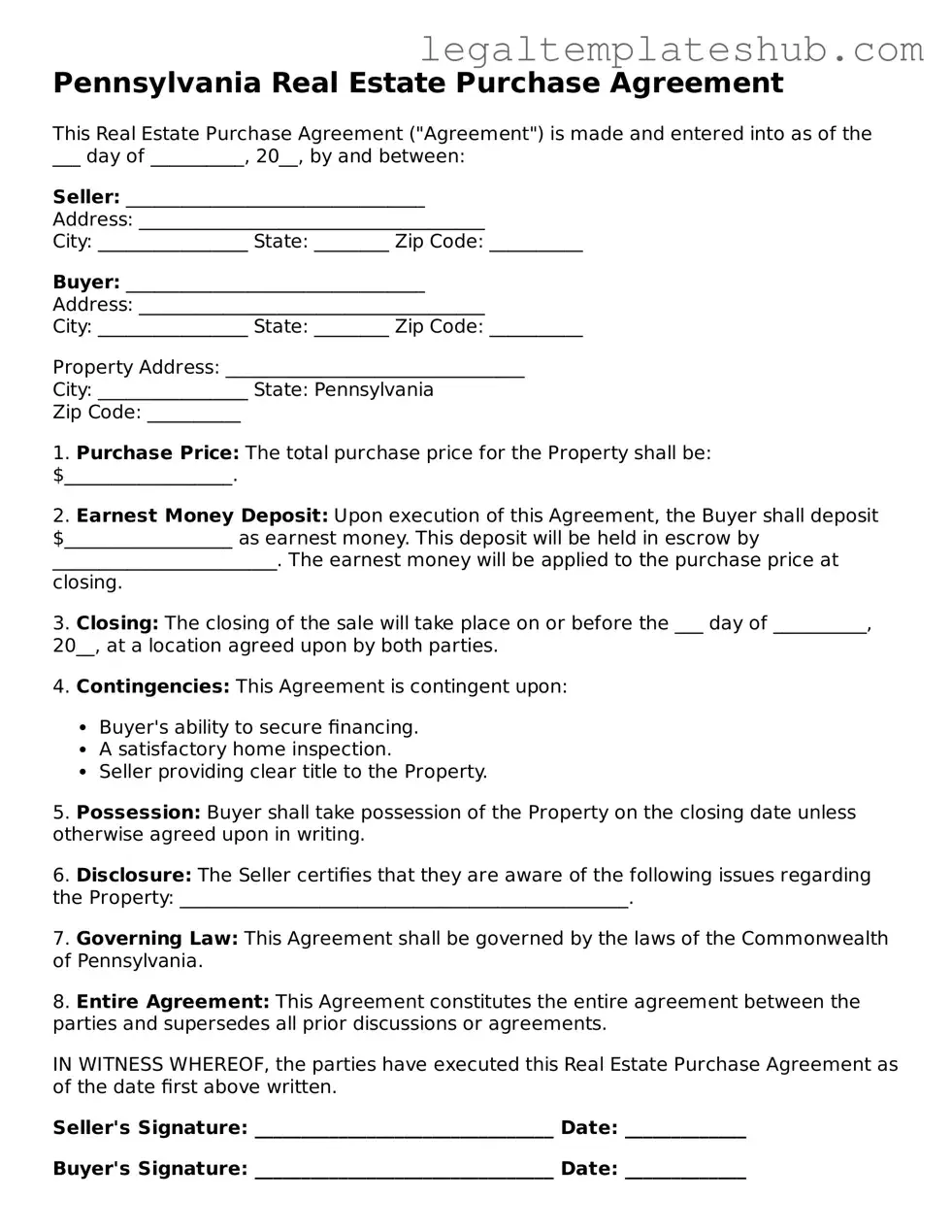

Printable Real Estate Purchase Agreement Document for Pennsylvania

PDF Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Real Estate Purchase Agreement is governed by Pennsylvania state law. |

| Form Purpose | This form is used to outline the terms and conditions of a real estate transaction in Pennsylvania. |

| Buyer and Seller Information | The agreement requires the full names and contact information of both the buyer and the seller. |

| Property Description | A detailed description of the property being sold is necessary, including the address and any relevant legal descriptions. |

| Purchase Price | The total purchase price must be clearly stated in the agreement. |

| Earnest Money | The agreement specifies the amount of earnest money to be deposited by the buyer. |

| Contingencies | Common contingencies, such as financing and inspection, must be included to protect both parties. |

| Closing Date | The agreement should specify a closing date, which is the date when the property transfer occurs. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

Key takeaways

When engaging in a real estate transaction in Pennsylvania, understanding the Real Estate Purchase Agreement form is essential. Here are some key takeaways to consider:

- Clarity is Crucial: Ensure that all terms and conditions are clearly stated. Ambiguities can lead to misunderstandings and potential disputes.

- Include Essential Information: The agreement should contain vital details such as the purchase price, property description, and closing date. Omitting any critical information may complicate the transaction.

- Contingencies Matter: Be aware of contingencies that may affect the sale, such as financing, inspections, or the sale of another property. Clearly outline these conditions in the agreement.

- Review and Revise: Before finalizing the agreement, both parties should review the document thoroughly. Revisions may be necessary to ensure mutual understanding and agreement.

- Seek Professional Guidance: Consulting with a real estate attorney or a qualified agent can provide valuable insights and help navigate any complexities within the agreement.

Dos and Don'ts

When filling out the Pennsylvania Real Estate Purchase Agreement form, it is crucial to follow certain guidelines to ensure a smooth transaction. Here are five things you should do and five things you should avoid:

- Do read the entire form carefully before filling it out.

- Do provide accurate information regarding the property and parties involved.

- Do consult with a real estate attorney if you have any questions.

- Do ensure all necessary signatures are obtained.

- Do keep a copy of the completed agreement for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any blank spaces; fill in all required fields.

- Don't make assumptions about terms; clarify any uncertainties.

- Don't forget to include any contingencies or special conditions.

- Don't ignore deadlines for submitting the agreement.

More Real Estate Purchase Agreement State Templates

How to Write a Purchase and Sale Agreement - By signing, both parties acknowledge their intention to follow through with the sale as specified in the agreement.

Washington Purchase and Sale Agreement - A well-structured agreement can facilitate a smoother closing process.

For those seeking to understand financial management tools, the Durable Power of Attorney is a crucial document that enables you to assign authority over your assets to a trusted individual. To learn more about this powerful legal instrument, visit the essential guide to Durable Power of Attorney forms.

North Carolina Purchase and Sale Agreement - A Real Estate Purchase Agreement facilitates a clear transfer of ownership.

Instructions on Filling in Pennsylvania Real Estate Purchase Agreement

Filling out the Pennsylvania Real Estate Purchase Agreement form requires attention to detail and accuracy. This document serves as a crucial step in the home buying process, ensuring that both the buyer and seller are on the same page regarding the terms of the sale. Once completed, the form will guide the next steps in the transaction, including negotiations and closing.

- Obtain the Form: Start by downloading the Pennsylvania Real Estate Purchase Agreement form from a reliable source or obtaining a hard copy from a real estate agent.

- Fill in Buyer Information: Enter the full names and contact information of all buyers involved in the transaction. Ensure that all names are spelled correctly.

- Fill in Seller Information: Provide the full names and contact information of all sellers. Again, accuracy is key.

- Property Description: Clearly describe the property being sold. Include the address, parcel number, and any other identifying details to avoid confusion.

- Purchase Price: Specify the agreed-upon purchase price for the property. This figure should reflect what both parties have negotiated.

- Deposit Amount: Indicate the amount of earnest money deposit that the buyer will provide. This shows the buyer's commitment to the purchase.

- Financing Contingency: If applicable, outline any financing contingencies. This section details whether the purchase depends on the buyer securing a mortgage or other financing.

- Closing Date: Specify the proposed closing date. This date is when the transaction will be finalized and ownership will transfer.

- Inspection Period: Include any details regarding the inspection period. This allows the buyer to have the property inspected before finalizing the purchase.

- Signatures: Ensure that all parties sign and date the agreement. This step is crucial, as it indicates that everyone agrees to the terms outlined in the document.

After completing the form, it is advisable to review it carefully for any errors or omissions. Once confirmed, both parties should retain copies for their records, and the next steps in the real estate transaction can proceed smoothly.

Misconceptions

The Pennsylvania Real Estate Purchase Agreement (REPA) is a crucial document in real estate transactions. However, several misconceptions surround this form. Understanding these misconceptions can help buyers and sellers navigate the process more effectively.

- Misconception 1: The REPA is a one-size-fits-all document.

- Misconception 2: The REPA only benefits the seller.

- Misconception 3: Once signed, the REPA cannot be changed.

- Misconception 4: A verbal agreement is sufficient if the REPA is signed.

- Misconception 5: The REPA guarantees the sale will go through.

- Misconception 6: Buyers do not need to read the REPA thoroughly.

- Misconception 7: The REPA is only necessary for residential properties.

This is not true. While the REPA provides a standard framework, it can be customized to fit the specific needs of the transaction and the parties involved.

In reality, the REPA protects the interests of both the buyer and the seller. It outlines the rights and responsibilities of each party, ensuring a fair transaction.

This is a common misunderstanding. Parties can negotiate changes to the agreement before closing, as long as all involved agree to the modifications.

While the signed REPA is a binding contract, any verbal agreements made outside of it may not hold legal weight. It’s essential to document all terms in writing.

The REPA outlines the terms of the sale, but it does not guarantee that the transaction will be completed. Contingencies can affect the outcome.

It is crucial for buyers to read the REPA in detail. Understanding each section helps avoid surprises and ensures that all terms are clear.

This is incorrect. The REPA can be used for various types of real estate transactions, including commercial properties, as long as it is appropriately tailored.