Printable Transfer-on-Death Deed Document for Pennsylvania

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Pennsylvania Consolidated Statutes, Title 20, Chapter 77. |

| Execution Requirements | The deed must be signed by the property owner in the presence of a notary public and recorded in the county where the property is located. |

| Revocation | The property owner can revoke the deed at any time before their death by executing a new deed or a written revocation. |

Key takeaways

Understanding the Pennsylvania Transfer-on-Death Deed form is essential for ensuring a smooth transition of property ownership. Here are some key takeaways to consider:

- Purpose: The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon their death, avoiding the probate process.

- Eligibility: Only individuals who hold title to real estate in Pennsylvania can execute this deed. Joint owners can also use it, but it must be clear who the beneficiaries are.

- Filling Out the Form: Accurate completion of the form is crucial. Include the property description and the full names of the beneficiaries. All required signatures must be obtained for the deed to be valid.

- Recording the Deed: After filling out the deed, it must be recorded with the county recorder of deeds in the county where the property is located. This step is necessary to ensure that the transfer is legally recognized.

Dos and Don'ts

When filling out the Pennsylvania Transfer-on-Death Deed form, it's essential to approach the task with care. Here’s a guide on what to do and what to avoid:

- Do ensure you have the correct legal description of the property.

- Do clearly state the names of the beneficiaries.

- Do sign the deed in the presence of a notary public.

- Do file the completed deed with the appropriate county office.

- Do keep a copy of the deed for your records.

- Don't leave any sections of the form blank.

- Don't use vague language when describing the property.

- Don't forget to check for any specific county requirements.

- Don't assume the deed is valid without proper notarization.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is filled out correctly and meets all necessary requirements.

More Transfer-on-Death Deed State Templates

Transfer on Death Deed Texas Form 2023 - Different states have varying rules regarding the execution and recording of Transfer-on-Death Deeds.

Can a Beneficiary Deed Be Contested - This form must be properly filed with your local land records office to be valid.

What Are the Disadvantages of a Transfer on Death Deed? - Ensures a smooth transition of property to heirs.

Having a comprehensive New York Operating Agreement is essential for every LLC, as it details the management framework and operational protocols that govern the business. This document safeguards members’ rights and clarifies their roles and responsibilities. To facilitate the creation of your agreement, you may find it helpful to access the PDF Templates designed for this purpose.

Problems With Transfer on Death Deeds in Indiana - A Transfer-on-Death Deed can only be revoked or amended by the property owner during their lifetime.

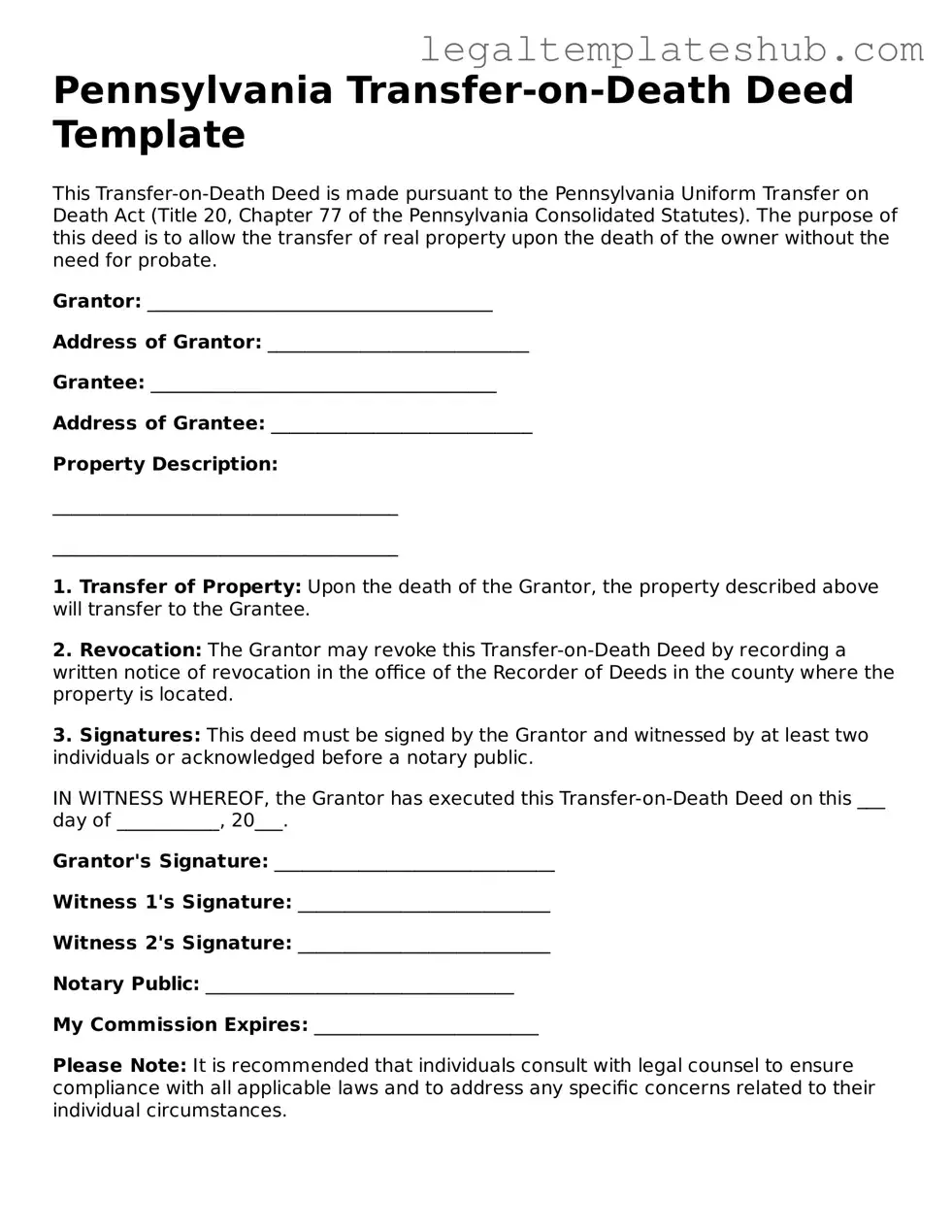

Instructions on Filling in Pennsylvania Transfer-on-Death Deed

After obtaining the Pennsylvania Transfer-on-Death Deed form, you will need to carefully complete it to ensure that your wishes regarding property transfer are accurately documented. Follow the steps below to fill out the form correctly.

- Obtain the form: Download the Pennsylvania Transfer-on-Death Deed form from a reliable source or obtain a physical copy from your local county office.

- Identify the property: Clearly describe the property you wish to transfer. Include the address, parcel number, and any other identifying details.

- Provide your information: Enter your full name and address as the current owner of the property.

- List the beneficiary: Write the full name and address of the person or persons you wish to inherit the property upon your death.

- Include additional beneficiaries: If applicable, list any alternate beneficiaries in case the primary beneficiary is unable to inherit.

- Sign the form: Sign and date the form in the presence of a notary public. Ensure that the notary public also signs and stamps the document.

- File the deed: Submit the completed and notarized form to the appropriate county office for recording. This step is crucial for the deed to be legally effective.

Once you have filled out and filed the form, it will be recorded in the county records. This ensures that your wishes regarding the property transfer are legally recognized and enforceable upon your passing.

Misconceptions

The Pennsylvania Transfer-on-Death Deed (TOD) form allows property owners to transfer their real estate to designated beneficiaries upon their death without the need for probate. However, several misconceptions exist regarding this form. Below are four common misunderstandings.

- The TOD deed avoids all taxes. Many people believe that using a TOD deed means beneficiaries will not face any tax implications. In reality, while the deed allows for a direct transfer of property, beneficiaries may still be responsible for inheritance taxes, depending on the value of the estate and their relationship to the deceased.

- The TOD deed can be used for any type of property. Some individuals assume that the TOD deed applies to all forms of property. However, this form is specifically designed for real estate. It cannot be used for personal property, such as vehicles or bank accounts, which require different legal instruments for transfer.

- The TOD deed is irrevocable once executed. There is a common belief that once a TOD deed is signed, it cannot be changed. In fact, property owners can revoke or modify the deed at any time before their death, provided they follow the correct legal procedures.

- The TOD deed eliminates the need for a will. Some people think that having a TOD deed means they do not need a will. While the TOD deed facilitates the transfer of specific property, it does not cover all aspects of an estate. A will is still essential for addressing other assets and ensuring that all wishes regarding the estate are fulfilled.