Printable Prenuptial Agreement Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a legal contract made before marriage that outlines the distribution of assets and responsibilities in the event of divorce or separation. |

| Purpose | The primary purpose is to protect individual assets and clarify financial responsibilities during the marriage and in case of a divorce. |

| Governing Law | Each state has its own laws regarding prenuptial agreements. In the U.S., common governing laws include the Uniform Premarital Agreement Act (UPAA) adopted by many states. |

| Enforceability | For a prenuptial agreement to be enforceable, it must be in writing, signed by both parties, and entered into voluntarily without coercion. |

| Disclosure Requirements | Both parties must fully disclose their assets and liabilities to ensure fairness and transparency in the agreement. |

| Modification | A prenuptial agreement can be modified after marriage, but any changes must be made in writing and signed by both parties. |

Prenuptial Agreement - Adapted for State

Key takeaways

When considering a prenuptial agreement, understanding its purpose and how to complete the necessary form is essential. Here are some key takeaways to keep in mind:

- Understand the Purpose: A prenuptial agreement outlines how assets and debts will be handled in the event of a divorce. It can protect both parties and clarify financial expectations.

- Be Transparent: Full disclosure of assets and liabilities from both partners is crucial. Hiding information can lead to the agreement being challenged later.

- Consider Timing: It’s best to discuss and complete the agreement well in advance of the wedding. Rushing through it can lead to misunderstandings or feelings of pressure.

- Consult Legal Counsel: Each partner should seek independent legal advice. This ensures that both parties fully understand their rights and the implications of the agreement.

- Review State Laws: Prenuptial agreements are subject to state laws, which can vary significantly. Familiarizing yourself with local regulations is important.

- Be Clear and Specific: Clearly outline the terms in the agreement. Vague language can lead to disputes in the future.

- Address Changes: Consider including provisions for how the agreement may be modified in the future. Life circumstances can change, and flexibility may be beneficial.

- Keep Copies: After signing the agreement, ensure that both parties have copies. This prevents confusion and helps maintain clarity.

- Communicate Openly: Engage in honest discussions about finances and expectations. Open communication fosters trust and understanding between partners.

Taking these points into account can help create a fair and effective prenuptial agreement that serves both partners' interests.

Dos and Don'ts

When filling out a Prenuptial Agreement form, there are important considerations to keep in mind. Here’s a list of things you should and shouldn’t do:

- Do communicate openly with your partner about your financial situation.

- Don't hide assets or debts from your partner.

- Do seek legal advice to understand the implications of the agreement.

- Don't rush through the process; take your time to ensure clarity.

- Do be honest about your expectations for the future.

- Don't use the agreement as a tool for manipulation or control.

- Do review the agreement together before signing.

Following these guidelines can help ensure that the Prenuptial Agreement serves its intended purpose and protects both parties fairly.

Common Templates:

Legal Lease Agreement - Both parties are encouraged to review the lease thoroughly before signing.

Stock Transfer Forms - Dates of share transfers are documented to maintain a timeline.

In navigating the complexities of leasing commercial property, it is crucial for both landlords and business tenants to utilize a Florida Commercial Lease Agreement, which can be accessed at floridaformspdf.com/printable-commercial-lease-agreement-form. This legally binding document not only clarifies the terms of the lease but also protects the interests of both parties involved.

Dmv Transfer of Liability - Facilitates clearer communication regarding the use and handling of the vehicle.

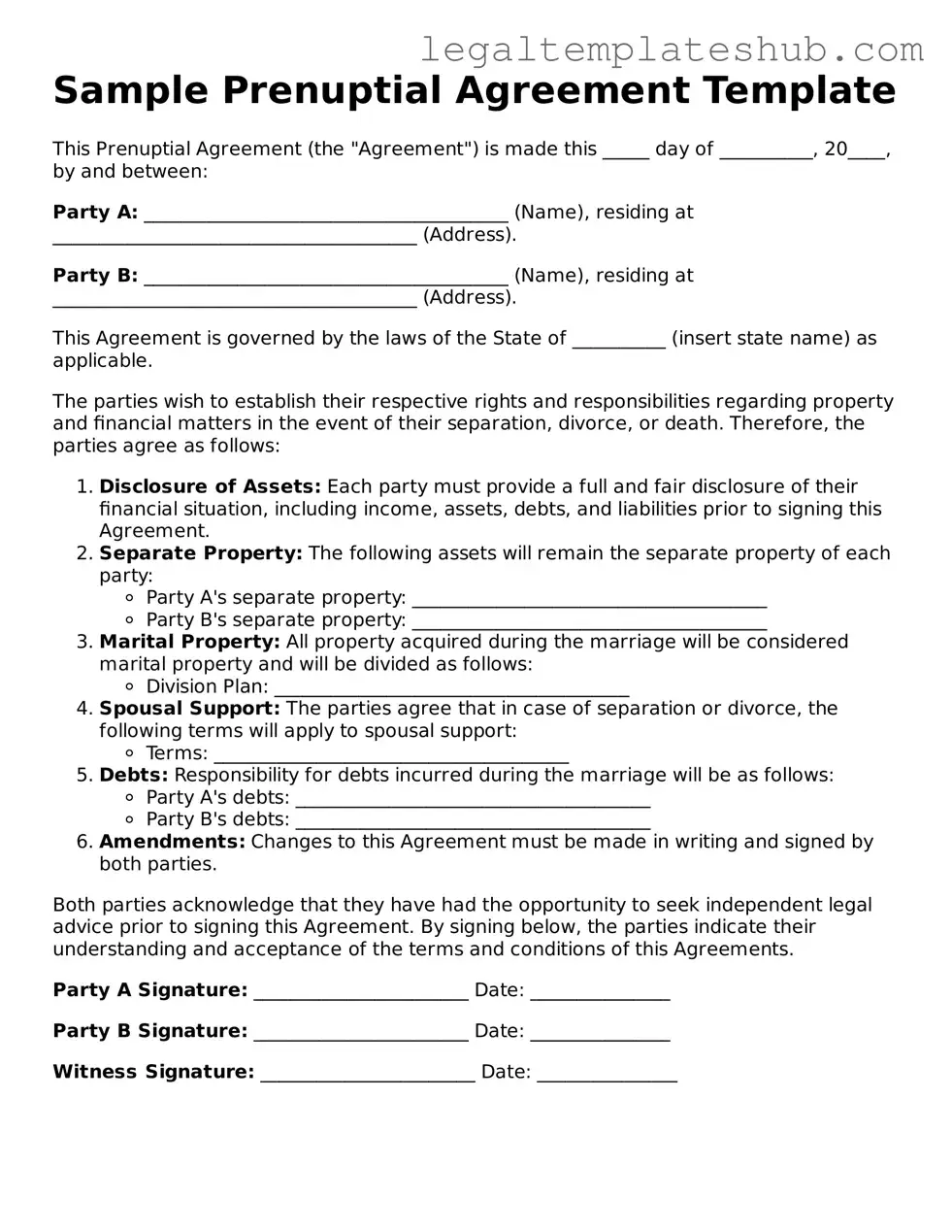

Instructions on Filling in Prenuptial Agreement

Filling out a Prenuptial Agreement form is an important step for couples who want to clarify their financial arrangements before marriage. This process involves careful consideration and clear communication between both parties. Below are the steps to complete the form effectively.

- Gather Financial Information: Collect all relevant financial documents, including bank statements, property deeds, and debt information.

- Discuss Terms: Have an open conversation with your partner about what you both want to include in the agreement.

- Complete the Form: Fill in your names, addresses, and the date of the agreement at the top of the form.

- List Assets: Clearly outline all assets owned by each party, including real estate, savings, investments, and personal property.

- Detail Debts: Include any debts each party has, such as student loans, credit card debt, or mortgages.

- Specify Terms: Write down any specific terms regarding property division, spousal support, and other financial arrangements in case of divorce.

- Review Together: Go through the completed form with your partner to ensure both parties agree on the terms.

- Sign the Document: Both parties should sign the agreement in the presence of a notary public to validate it.

- Store Safely: Keep the signed document in a secure place, and consider providing copies to each party.

Misconceptions

Many people have misunderstandings about prenuptial agreements. Here are six common misconceptions that can lead to confusion:

- Prenuptial agreements are only for the wealthy. Many believe that only rich couples need a prenup. In reality, anyone can benefit from one, regardless of their financial status. It can protect personal assets and clarify financial responsibilities.

- Prenups are unromantic. Some think that discussing a prenup signals a lack of trust or love. However, a prenup can actually strengthen a relationship by encouraging open communication about finances.

- Prenuptial agreements are not enforceable. There is a belief that prenups hold no legal weight. This is false. When drafted properly and with full disclosure, they are legally binding in most states.

- Only one partner benefits from a prenup. Many assume that prenups only protect one party. In truth, they can be structured to benefit both partners, ensuring fairness and clarity.

- Prenups can cover any issue. Some people think that prenups can include any topic, such as child custody. However, prenups typically focus on financial matters and cannot dictate child custody or support arrangements.

- Prenuptial agreements are only for divorce situations. There is a misconception that prenups are only useful if the marriage ends. In fact, they can also provide guidance during the marriage, helping couples navigate financial decisions together.