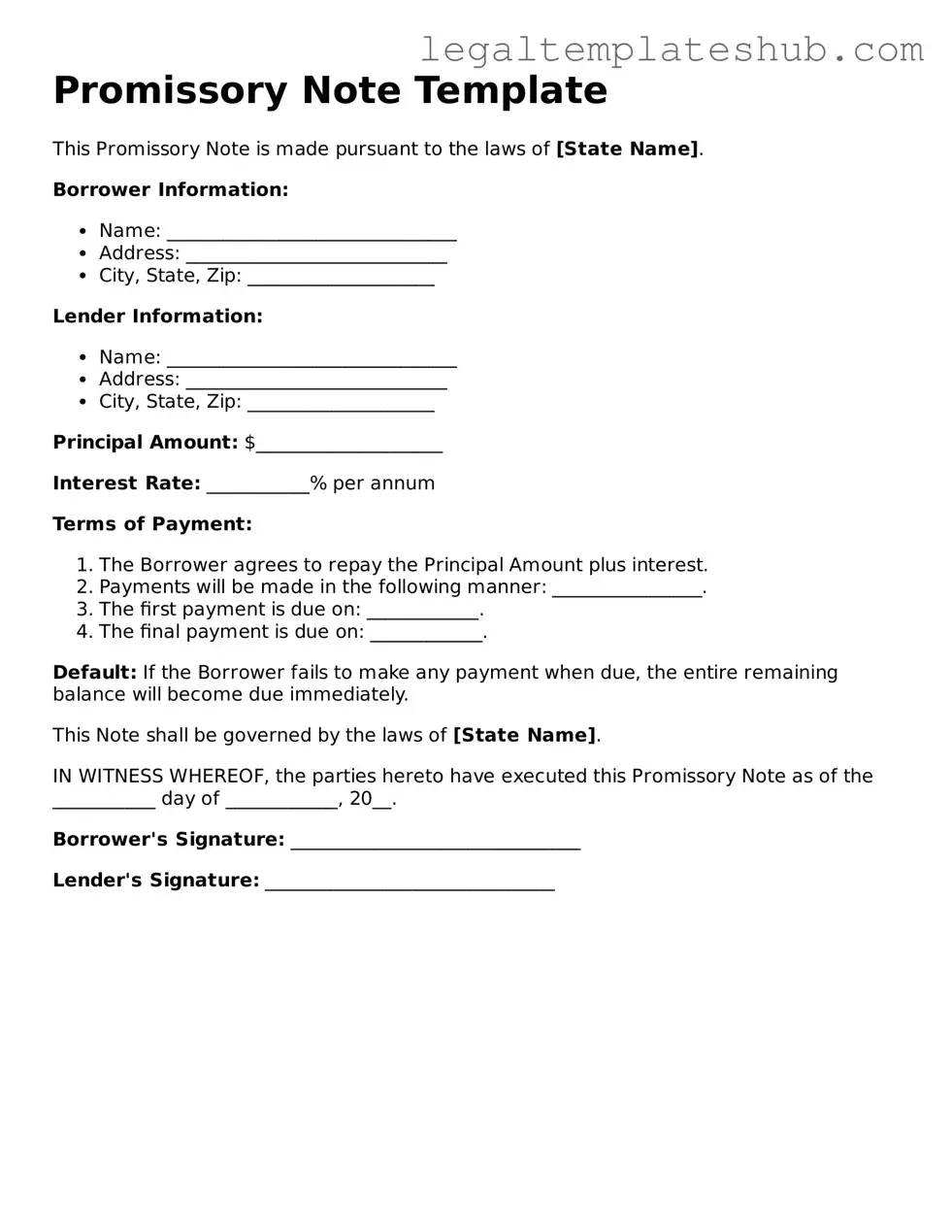

Printable Promissory Note Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a defined time or on demand. |

| Parties Involved | Typically, there are two parties: the borrower (maker) who promises to pay and the lender (payee) who receives the payment. |

| Governing Law | In the United States, the Uniform Commercial Code (UCC) governs promissory notes, but state-specific laws may also apply. |

| Interest Rate | The note may specify an interest rate, which is the cost of borrowing the money, and can be fixed or variable. |

| Payment Terms | Payment terms outline when and how payments will be made, including due dates and installment amounts. |

| Secured vs. Unsecured | A promissory note can be secured by collateral or unsecured, depending on the agreement between the parties. |

| Transferability | Promissory notes can often be transferred to another party, allowing the new holder to collect the debt. |

| Default Consequences | If the borrower fails to make payments, the lender has the right to take legal action to recover the owed amount. |

| Importance of Clarity | Clear terms in a promissory note help prevent misunderstandings and disputes between the parties involved. |

Promissory Note - Adapted for State

Promissory Note Document Categories

Key takeaways

Filling out and using a Promissory Note form is an important step in any lending arrangement. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Promissory Note serves as a written promise to repay a loan. It outlines the terms of the agreement between the borrower and lender.

- Include Essential Information: Make sure to fill in all necessary details, including the names of both parties, the loan amount, interest rate, and repayment schedule.

- Specify the Interest Rate: Clearly state the interest rate, whether it is fixed or variable. This helps avoid confusion later on.

- Detail Repayment Terms: Outline how and when payments will be made. Include information on due dates and acceptable payment methods.

- Consider Late Fees: If applicable, mention any late fees for missed payments. This can encourage timely repayment.

- Include Default Terms: Define what constitutes a default on the loan and the consequences that follow. This protects the lender's interests.

- Signatures Required: Both parties must sign the Promissory Note for it to be legally binding. Ensure that all signatures are dated.

- Keep Copies: After signing, both the borrower and lender should retain copies of the Promissory Note. This provides a reference for future discussions.

- Consult a Professional: If unsure about any aspect of the Promissory Note, seeking legal advice can provide clarity and ensure compliance with relevant laws.

By following these key points, you can create a clear and effective Promissory Note that protects both parties involved in the lending process.

Dos and Don'ts

When filling out a Promissory Note form, attention to detail is crucial. Here are seven important dos and don’ts to keep in mind:

- Do clearly state the amount of money being borrowed.

- Do include the names and addresses of both the borrower and the lender.

- Do specify the interest rate, if applicable, and how it will be calculated.

- Do outline the repayment schedule, including due dates and payment amounts.

- Don't leave any sections blank; incomplete information can lead to misunderstandings.

- Don't use vague language; clarity is essential for enforceability.

- Don't forget to sign and date the document; without signatures, the note may not be valid.

Common Templates:

Imm 1294 Form 2023 Pdf Download - Information about previous marriages or common-law relationships must be disclosed if applicable.

By utilizing the Ohio Residential Lease Agreement, landlords and tenants can prevent misunderstandings, providing a clear framework for their rental relationship. For convenient access to essential documents, consider exploring the available PDF Templates that can help streamline the leasing process.

Garage Rental Lease - Defines potential rent increases during the lease term.

6 Month Lease Contract - Specifies the rental duration, typically less than 30 days.

Instructions on Filling in Promissory Note

Filling out a Promissory Note form is an important step in documenting a loan agreement between parties. Once the form is completed, it should be signed by all parties involved to ensure that everyone understands and agrees to the terms outlined within the document.

- Begin by entering the date at the top of the form. This should be the date when the note is being created.

- Next, clearly write the name of the borrower. This is the individual or entity that is receiving the loan.

- Then, provide the name of the lender. This is the individual or entity that is giving the loan.

- Indicate the principal amount of the loan. This is the total sum of money being borrowed.

- Specify the interest rate. This is the percentage that will be charged on the unpaid balance of the loan.

- Outline the repayment schedule. Include details such as the frequency of payments (monthly, quarterly, etc.) and the due date for each payment.

- Include any additional terms or conditions that apply to the loan, such as penalties for late payments or options for early repayment.

- Sign the form. The borrower and lender should both sign and date the document to make it legally binding.

- Finally, make copies of the signed Promissory Note for both the borrower and lender for their records.

Misconceptions

Understanding the Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions often cloud people's understanding of this important financial document. Here are ten common misconceptions, along with clarifications to help you grasp the true nature of promissory notes.

- Promissory notes are only used for large loans. Many believe that these notes are reserved for significant amounts of money. In reality, they can be used for any loan amount, whether it's a few hundred dollars or thousands.

- They must be notarized to be valid. While notarization can add an extra layer of security, it is not a requirement for a promissory note to be legally binding.

- Promissory notes are the same as contracts. Although both are legally binding, a promissory note specifically outlines a borrower's promise to repay a loan, while contracts can cover a broader range of agreements.

- You cannot change the terms once signed. Some people think that once a promissory note is signed, the terms are set in stone. However, parties can mutually agree to amend the terms at any time.

- Only banks can issue promissory notes. This is a misconception. Individuals and businesses can also create and issue promissory notes, not just financial institutions.

- They are only for personal loans. While commonly used in personal lending, promissory notes are also prevalent in business transactions, including loans between companies.

- A promissory note guarantees repayment. While it is a promise to pay, it does not guarantee repayment. If the borrower defaults, the lender may need to take legal action to recover the funds.

- All promissory notes are the same. There is no one-size-fits-all promissory note. The terms and conditions can vary widely based on the agreement between the parties involved.

- Interest rates on promissory notes are fixed. Many assume that the interest rate is always fixed. However, the rate can be negotiated and may vary based on the agreement.

- They are not enforceable in court. Some believe that promissory notes lack legal standing. In fact, they are enforceable in court, provided they meet certain legal requirements.

By debunking these misconceptions, individuals can approach promissory notes with a clearer understanding, empowering them to make informed financial decisions.