Printable Promissory Note for a Car Template

PDF Form Data

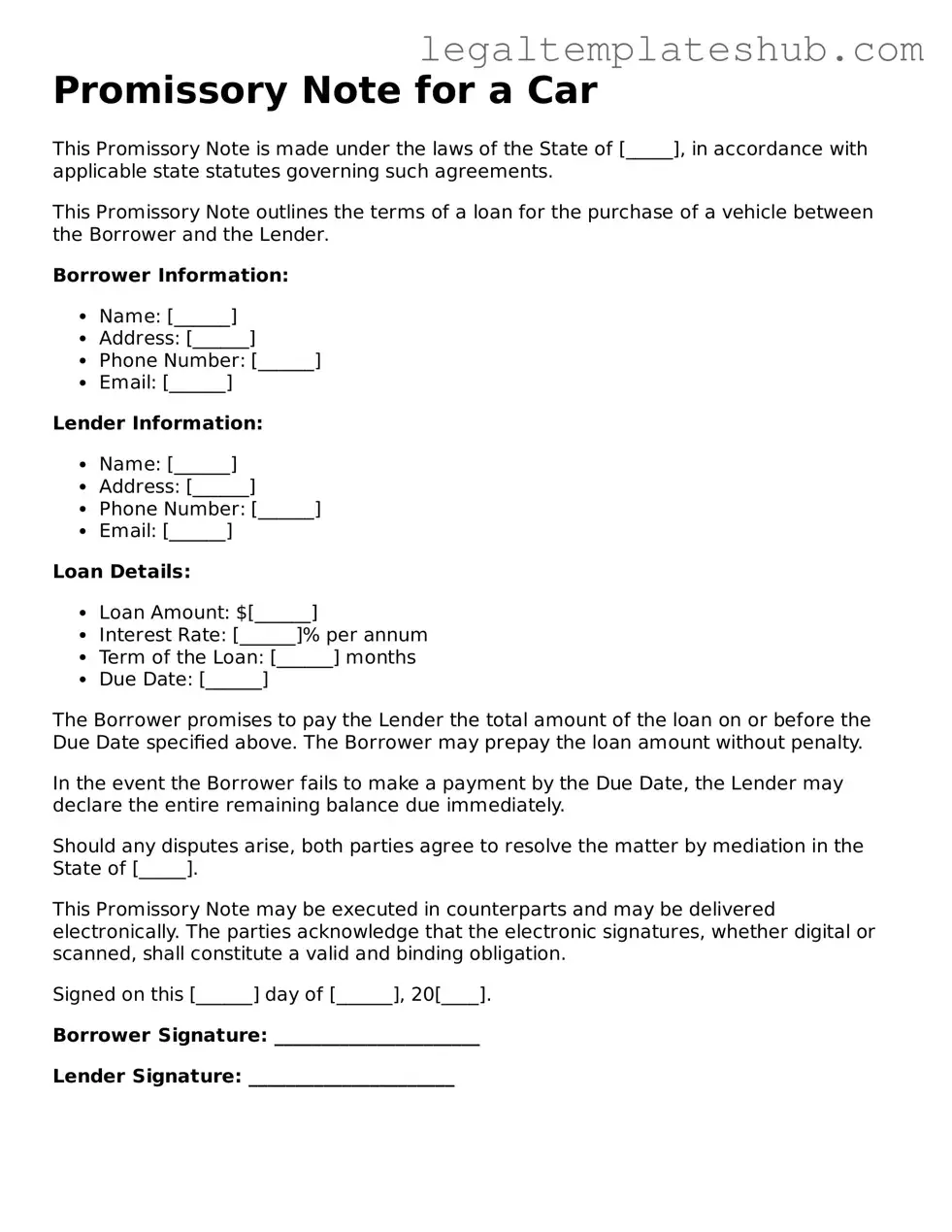

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specific amount of money for the purchase of a vehicle. |

| Parties Involved | The document typically involves two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Payment Terms | It outlines the payment terms, including the total amount due, interest rate, and payment schedule. |

| Governing Law | The laws governing promissory notes vary by state; for example, in California, the California Civil Code applies. |

| Default Consequences | If the borrower fails to make payments, the lender has the right to take legal action or repossess the vehicle. |

| Signatures Required | Both parties must sign the promissory note to make it legally binding and enforceable. |

Key takeaways

When dealing with a Promissory Note for a car, it’s essential to understand its significance and how to fill it out properly. Here are some key takeaways to keep in mind:

- Understand the Purpose: A promissory note is a legal document that outlines the borrower's promise to repay a loan for the vehicle.

- Include All Necessary Information: Ensure that the note contains details such as the names of both parties, the loan amount, and the interest rate.

- Specify Payment Terms: Clearly state the repayment schedule, including due dates and the amount of each payment.

- Document Collateral: If the car serves as collateral, include a description of the vehicle to protect the lender's interest.

- Signatures Matter: Both the borrower and lender must sign the note for it to be legally binding.

- Keep Copies: Each party should retain a copy of the signed promissory note for their records.

- Consider Legal Advice: If unsure about any terms, consulting with a legal expert can provide clarity and ensure the document is enforceable.

- Understand Default Consequences: Familiarize yourself with what happens if payments are missed, including potential repossession of the vehicle.

Dos and Don'ts

When filling out the Promissory Note for a Car form, it's essential to approach the task carefully. Here are some important dos and don'ts to keep in mind:

- Do read the entire form thoroughly before starting to fill it out.

- Do provide accurate information about the borrower and the vehicle.

- Do clearly state the loan amount and interest rate.

- Do include the repayment schedule with specific dates.

- Don't leave any fields blank; fill in all required sections.

- Don't use unclear or ambiguous language in the note.

- Don't forget to sign and date the document at the end.

By following these guidelines, you can help ensure that your Promissory Note is complete and clear, reducing the chances of misunderstandings in the future.

Common Types of Promissory Note for a Car Forms:

Satisfaction of Promissory Note - Important for ensuring both parties have the same understanding.

When preparing a loan agreement, it's important to utilize a New Jersey Promissory Note form, as it provides a clear framework for the obligations of both the borrower and lender. This document not only specifies the loan amount and interest rate but also includes a repayment schedule tailored to the agreement's specifics. For those looking for official documentation, the NJ PDF Forms can be invaluable in ensuring that all terms are properly recorded and legally binding.

Instructions on Filling in Promissory Note for a Car

Filling out a Promissory Note for a car is an important step in securing a loan for your vehicle. Once you have completed the form, it will serve as a legal document outlining the terms of the loan agreement between you and the lender. Make sure to review the completed note carefully before signing.

- Title the Document: At the top of the form, write "Promissory Note" to clearly indicate the purpose of the document.

- Identify the Parties: Fill in your name and address as the borrower. Then, include the lender’s name and address.

- Specify the Loan Amount: Clearly state the total amount of money being borrowed for the car.

- Detail the Interest Rate: Indicate the annual interest rate that will apply to the loan.

- Set the Repayment Schedule: Outline how often payments will be made (e.g., monthly) and the due date for each payment.

- Include the Loan Term: Specify the length of time over which the loan will be repaid (e.g., 36 months).

- Describe the Collateral: Clearly identify the car being financed, including the make, model, year, and Vehicle Identification Number (VIN).

- Sign and Date: Both you and the lender should sign and date the document to make it official.

Misconceptions

When it comes to financing a vehicle, many people encounter the Promissory Note for a Car. Unfortunately, several misconceptions surround this important document. Here are six common misunderstandings:

- A Promissory Note is the same as a car loan agreement. While both documents relate to financing a vehicle, a Promissory Note specifically outlines the borrower's promise to repay the loan. The car loan agreement, on the other hand, includes additional terms like interest rates and repayment schedules.

- Only banks can issue Promissory Notes. This is not true. Any lender, including private individuals or credit unions, can create a Promissory Note. As long as it meets the legal requirements, it is valid.

- Signing a Promissory Note means you automatically own the car. Ownership of the vehicle is determined by the title, not the Promissory Note. The note simply indicates a debt obligation, while the title shows who legally owns the car.

- You cannot negotiate the terms of a Promissory Note. In reality, many terms can be negotiated. Borrowers may discuss interest rates, repayment schedules, and other conditions with the lender before signing.

- A Promissory Note is only valid if it is notarized. While notarization can add an extra layer of authenticity, it is not a requirement for a Promissory Note to be legally binding. As long as it meets certain criteria, it is enforceable.

- If you default on a Promissory Note, you can lose your car immediately. Defaulting does have serious consequences, but the process of repossession usually involves legal steps and notification. Lenders must follow specific procedures before taking possession of the vehicle.

Understanding these misconceptions can help borrowers make informed decisions when financing a vehicle.