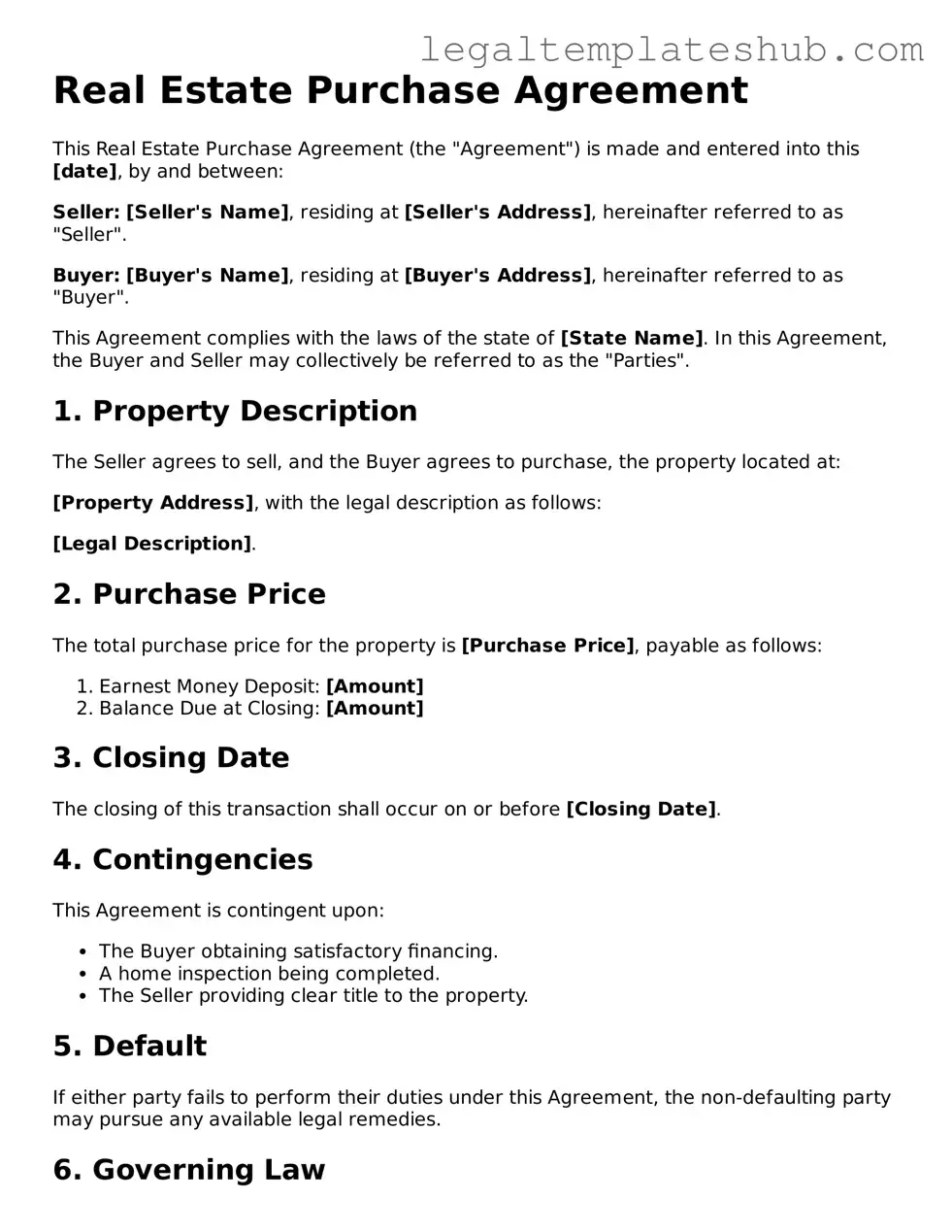

Printable Real Estate Purchase Agreement Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Purpose | A Real Estate Purchase Agreement outlines the terms of a property sale between a buyer and a seller. |

| Governing Law | The agreement is subject to state laws. For example, in California, it follows the California Civil Code. |

| Key Components | It typically includes details like the purchase price, property description, and closing date. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Real Estate Purchase Agreement - Adapted for State

Real Estate Purchase Agreement Document Categories

Key takeaways

When filling out and using a Real Estate Purchase Agreement form, it is essential to keep several important points in mind. This document serves as a binding contract between the buyer and seller, outlining the terms of the sale. Here are some key takeaways to consider:

- Understand the Terms: Familiarize yourself with all the terms included in the agreement. This includes purchase price, financing details, and any contingencies that may apply.

- Be Accurate: Ensure that all information is filled out accurately. Mistakes or omissions can lead to misunderstandings or legal issues down the line.

- Review Contingencies: Pay close attention to contingencies, such as home inspections or financing approvals. These clauses protect your interests and can allow you to back out of the deal under certain conditions.

- Seek Professional Help: Consider consulting with a real estate agent or attorney. Their expertise can provide valuable insights and ensure that your rights are protected.

- Keep Copies: After signing the agreement, keep copies for your records. Having documentation is crucial for any future reference or disputes.

By being informed and diligent when completing the Real Estate Purchase Agreement, you can navigate the home buying process with greater confidence.

Dos and Don'ts

When filling out a Real Estate Purchase Agreement form, it's important to approach the task with care. Here are some guidelines to follow:

- Do read the entire agreement carefully before filling it out.

- Don't leave any blank spaces unless instructed to do so.

- Do ensure all parties involved in the transaction are clearly identified.

- Don't use abbreviations or shorthand that could lead to confusion.

- Do specify the purchase price and any earnest money deposit clearly.

- Don't overlook important terms such as contingencies and closing dates.

- Do double-check all figures and dates for accuracy.

- Don't forget to sign and date the agreement where required.

- Do consult with a real estate professional or attorney if you have questions.

Following these guidelines can help ensure a smoother transaction and prevent misunderstandings down the line.

Common Templates:

Wage and Tax Statement - Electronic formats of W-2 can be accepted by many tax preparation software programs.

In addition to understanding the importance of a Release of Liability form, it's beneficial to explore resources that can guide you in creating or obtaining the necessary documentation, such as PDF Templates which can provide you with useful templates tailored to your needs.

Business New Customer Credit Application Form - Secure funding for your business by completing this credit application.

Instructions on Filling in Real Estate Purchase Agreement

Once you have the Real Estate Purchase Agreement form in hand, the next step is to carefully fill it out with accurate information. This document is crucial for outlining the terms of the sale and ensuring that both the buyer and seller are on the same page. Here’s how to complete the form step by step.

- Begin with the date: Write the date when the agreement is being filled out at the top of the form.

- Identify the parties: Fill in the names and addresses of both the buyer and the seller. Ensure that all names are spelled correctly.

- Property description: Provide a detailed description of the property being sold. This should include the address and any relevant legal descriptions.

- Purchase price: Clearly state the total purchase price for the property. Be specific and accurate.

- Deposit amount: Indicate the amount of earnest money or deposit the buyer will provide. This shows the buyer's commitment to the purchase.

- Financing details: If applicable, specify the type of financing the buyer will use, such as a mortgage or cash purchase.

- Closing date: Enter the anticipated closing date when the sale will be finalized.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as home inspections or financing approvals.

- Signatures: Finally, both parties must sign and date the agreement. This indicates that they agree to the terms outlined in the document.

After completing the form, it’s important to review all the information for accuracy. Both parties should keep a signed copy for their records. This agreement will guide the transaction and help ensure a smooth process moving forward.

Misconceptions

The Real Estate Purchase Agreement (RPA) is a crucial document in the home buying process. However, many people have misconceptions about its purpose and contents. Here are nine common misconceptions about the RPA:

- It's just a formality. Many believe that the RPA is simply a formality that doesn't hold much importance. In reality, it is a legally binding contract that outlines the terms of the sale and protects both the buyer and seller.

- All RPAs are the same. Some think that all RPAs are identical. However, each agreement can vary significantly based on state laws and the specific terms negotiated by the parties involved.

- Signing it means you must buy the property. A common belief is that signing the RPA obligates the buyer to purchase the property. In truth, there are contingencies that can allow a buyer to back out under certain conditions.

- Only real estate agents need to understand it. Many assume that only real estate agents need to be familiar with the RPA. Buyers and sellers should also understand the terms to make informed decisions.

- It covers everything about the property. Some think the RPA includes every detail about the property. While it covers essential terms, other documents may be needed for a complete picture, such as disclosures and inspection reports.

- Once signed, it can't be changed. A misconception exists that the RPA cannot be modified once signed. In fact, both parties can agree to amendments as long as they are documented and signed.

- It's only for residential properties. Many believe the RPA is exclusively for residential transactions. However, it can also be used for commercial real estate deals, depending on the situation.

- Legal advice is unnecessary. Some buyers and sellers think they can navigate the RPA without legal help. Consulting with a lawyer can provide valuable insights and protect their interests.

- It guarantees a successful sale. Lastly, some believe that signing the RPA guarantees the sale will go through. Unfortunately, various factors, such as financing issues or inspection problems, can still derail the transaction.

Understanding these misconceptions can help buyers and sellers navigate the real estate process more effectively and ensure they are well-informed about their rights and responsibilities.