Printable Release of Promissory Note Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note. |

| Purpose | This form is used to confirm that the borrower has fulfilled their obligation and the lender releases any claim to the debt. |

| Parties Involved | The form typically involves two parties: the lender (the one who provided the loan) and the borrower (the one who received the loan). |

| State-Specific Forms | Some states may have specific requirements or forms for the release, so it's important to check local laws. |

| Governing Law | In most states, the release is governed by contract law, but specific statutes may vary by state. |

| Signatures Required | Both the lender and borrower must sign the form for it to be legally binding. |

| Record Keeping | It is advisable to keep a copy of the signed release for personal records and future reference. |

| Effectiveness | The release becomes effective immediately upon signing, unless otherwise specified in the document. |

| Notarization | Some states may require the form to be notarized to ensure its validity. |

| Importance | Filing a Release of Promissory Note is crucial to protect both parties from future claims regarding the debt. |

Key takeaways

When dealing with a Release of Promissory Note form, it's important to understand its purpose and how to fill it out correctly. Here are some key takeaways:

- Understand the Purpose: This form officially releases the borrower from their obligation to repay the loan, confirming that the debt has been satisfied.

- Accurate Information: Ensure that all details, such as names, addresses, and loan amounts, are filled out correctly to avoid any future disputes.

- Signatures Matter: Both the lender and borrower must sign the document. Without these signatures, the release is not valid.

- Keep Copies: After the form is completed and signed, make copies for both parties. This serves as proof that the loan has been released.

- Legal Considerations: While this form is straightforward, it’s wise to consult a legal expert if there are any uncertainties regarding the terms or implications.

Dos and Don'ts

When filling out the Release of Promissory Note form, consider the following guidelines:

- Do read the entire form carefully before starting.

- Do provide accurate information about all parties involved.

- Do sign and date the form where indicated.

- Don't leave any required fields blank.

- Don't use correction fluid or tape on the form.

- Don't submit the form without reviewing it for errors.

Common Types of Release of Promissory Note Forms:

How to Write a Promissory Note Example - Understanding the conditions of a Promissory Note can empower borrowers.

When dealing with financial transactions in New Jersey, having the appropriate documentation is crucial; hence, many individuals rely on the New Jersey Promissory Note form to formalize their lending agreements. This document not only outlines the terms of the loan, such as repayment and interest rates, but also protects the interests of both the borrower and the lender. For those looking to easily access and customize these essential documents, NJ PDF Forms offers a user-friendly solution that can streamline the process.

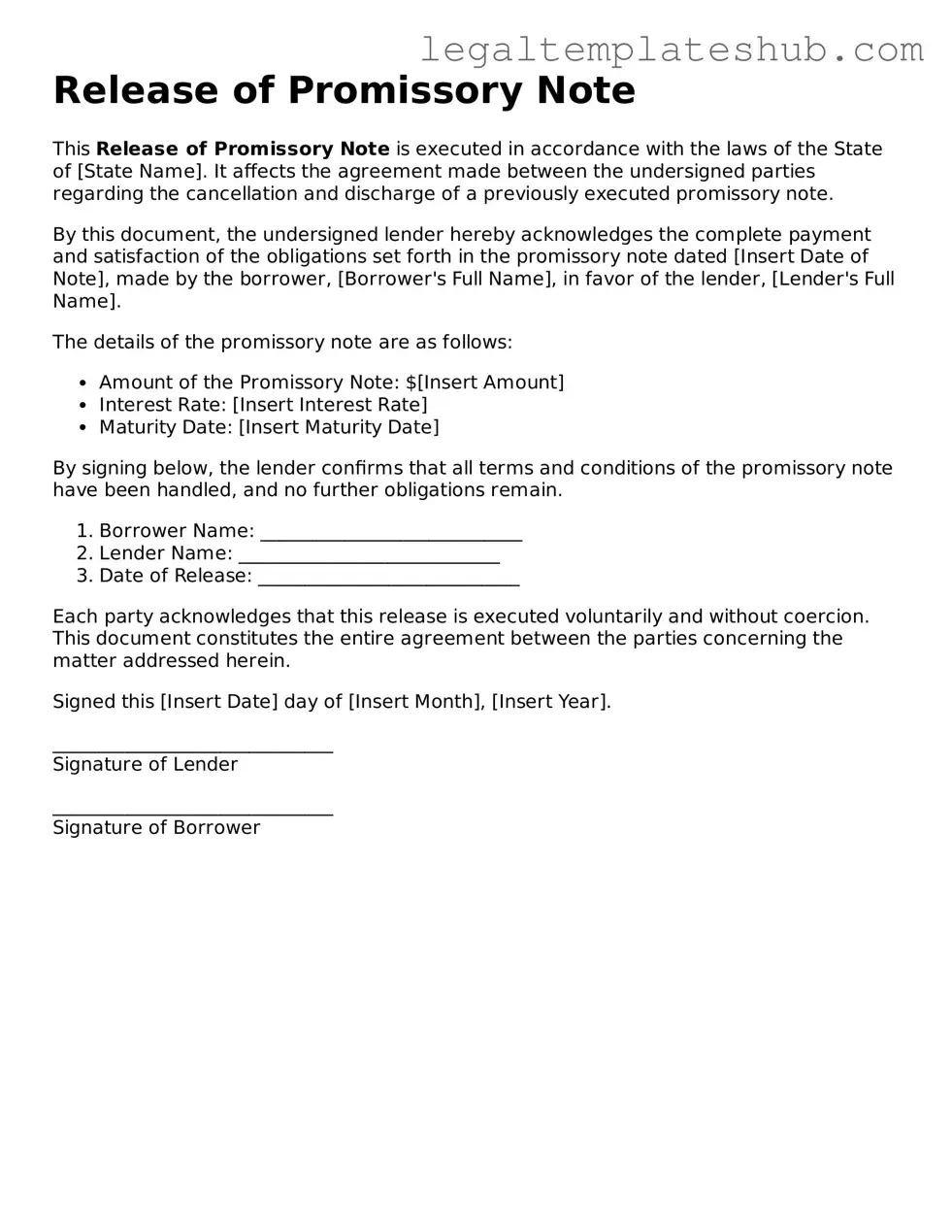

Instructions on Filling in Release of Promissory Note

Once you have gathered all necessary information and documents, you can begin filling out the Release of Promissory Note form. This form is an important step in finalizing the agreement between parties involved in a promissory note. Follow the steps below to ensure that the form is completed accurately.

- Begin by entering the date at the top of the form. Make sure to use the correct format, typically MM/DD/YYYY.

- In the first section, provide the names of the parties involved. Clearly print or type the full legal names of both the borrower and the lender.

- Next, include the address of each party. This should be their current residential or business addresses, ensuring accuracy for future correspondence.

- Identify the promissory note being released. Write down the date of the original note and any reference numbers associated with it.

- In the designated section, clearly state that the promissory note is being released. Use straightforward language to indicate that the lender is relinquishing their claim.

- Include the date of the release. This should be the date you are completing the form.

- Both parties should sign the form. The lender must sign to confirm the release, while the borrower may also sign to acknowledge the release.

- Finally, print the names of the signers below their signatures. This helps to clarify who has signed the document.

After completing the form, make sure to keep copies for your records. It is also advisable to send a copy to all parties involved to ensure everyone is informed of the release. If necessary, consult with a legal professional for any additional steps specific to your situation.

Misconceptions

The Release of Promissory Note form is often misunderstood. Below are six common misconceptions about this form, along with clarifications for each.

- It is only used for loan agreements. Many believe that the Release of Promissory Note form is exclusively for loans. In reality, it can also be relevant in various situations where a debt is settled or forgiven.

- It automatically cancels the debt. Some think that simply filling out this form cancels the debt. However, the form serves as a formal acknowledgment that the debt has been satisfied, but it does not negate any prior agreements unless specifically stated.

- It is not legally binding. There is a misconception that this form lacks legal weight. In fact, once signed by the appropriate parties, it can be enforceable in a court of law.

- Only the lender needs to sign. Many assume that only the lender’s signature is necessary. However, both the borrower and the lender typically need to sign the form to validate the release.

- It is only needed for large loans. Some individuals think this form is only relevant for significant financial transactions. In truth, it can apply to any promissory note, regardless of the amount.

- Once the form is signed, it cannot be revoked. There is a belief that signing the form permanently ends any claims to the debt. While it does release the borrower from the obligation, there may be circumstances under which the lender can contest the release if fraud or misrepresentation occurred.