Blank Stock Transfer Ledger PDF Form

File Breakdown

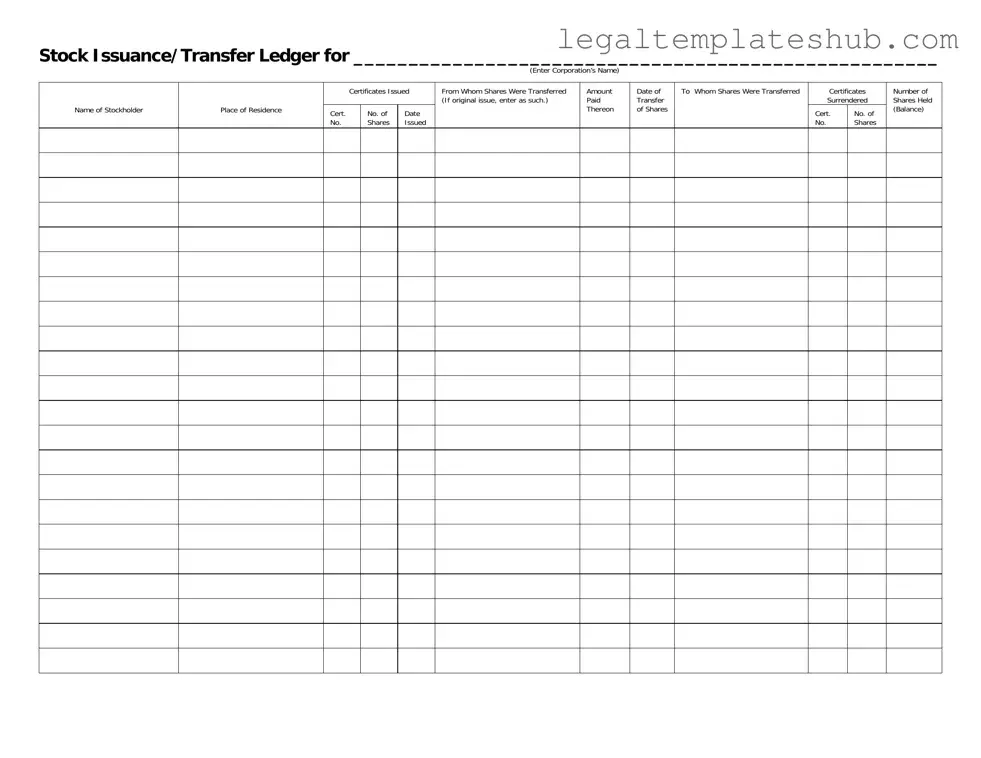

| Fact Name | Details |

|---|---|

| Purpose | The Stock Transfer Ledger form records the issuance and transfer of stock shares within a corporation. |

| Information Required | It requires details such as the corporation’s name, stockholder information, and share transaction specifics. |

| Certificates Issued | The form tracks the certificates issued, including certificate numbers and the number of shares associated with each certificate. |

| Transfer Details | It includes information on the transfer of shares, such as the date of transfer and the parties involved. |

| Governing Law | The governing laws for stock transfers vary by state, often found in state corporation codes. |

| Original Issue Entry | If shares are issued for the first time, the form allows for an entry indicating this status. |

| Balance Tracking | The ledger helps in tracking the number of shares held by stockholders after transfers. |

| Certificates Surrendered | It also notes any certificates that have been surrendered during the transfer process. |

Key takeaways

Filling out and using the Stock Transfer Ledger form is a crucial process for corporations. Here are four key takeaways to consider:

- Accurate Information is Essential: Each section of the form must be completed with precise details, including the corporation’s name and the stockholder's information. Inaccuracies can lead to legal complications.

- Document Transfers Clearly: It is important to clearly indicate the date of transfer and the parties involved. This ensures transparency and helps maintain accurate records of ownership.

- Maintain a Balance Record: The ledger should reflect the number of shares held after each transaction. This allows for easy tracking of ownership changes over time.

- Retain Certificates: Ensure that any certificates surrendered during the transfer process are properly recorded. This helps in verifying ownership and can be crucial for future transactions.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts to consider:

- Do enter the corporation's name clearly at the top of the form.

- Do provide accurate details for each stockholder, including their name and place of residence.

- Do record the certificate numbers and the number of shares issued without omissions.

- Do indicate the date of transfer for each transaction to maintain a clear timeline.

- Do ensure that the amounts paid for shares are accurately reflected in the form.

- Don't leave any sections blank; incomplete information can lead to issues later.

- Don't use abbreviations or shorthand that may confuse the reader.

- Don't forget to surrender the certificates when shares are transferred.

- Don't mix up the entries; maintain a consistent order to avoid confusion.

By adhering to these guidelines, you can help ensure that the Stock Transfer Ledger form is filled out correctly and effectively.

Common PDF Templates

Da - The quantity section allows for the total number of items to be recorded.

How to Pause Melaleuca Membership - Review your filled-out form before sending it to avoid delays.

For a smooth transaction when selling or purchasing a trailer, make sure to utilize the New York Trailer Bill of Sale form, which can be found among a variety of resources, including PDF Templates that simplify the process and ensure all necessary details are included.

Printable Job Application - Consider tailoring your application to the specific position.

Instructions on Filling in Stock Transfer Ledger

After you have gathered all necessary information, it's time to fill out the Stock Transfer Ledger form. This form is crucial for documenting stock transfers within your corporation. Ensure that you have accurate details ready to avoid any discrepancies.

- Begin by entering the name of the corporation at the top of the form where it says Enter Corporation’s Name.

- In the section labeled Name of Stockholder, write the full name of the stockholder involved in the transfer.

- Next, fill in the Place of Residence of the stockholder. Include the city, state, and zip code.

- For Certificates Issued, indicate the number of stock certificates that have been issued to the stockholder.

- In the Cert. No. of Shares Issued field, write the certificate number associated with the issued shares.

- Document the Date when the shares were issued.

- In the From Whom Shares Were Transferred section, state the name of the person or entity from whom the shares were transferred. If this is an original issue, simply write original issue.

- Next, indicate the Amount Paid Thereon for the shares being transferred.

- Fill in the Date of Transfer of Shares to record when the transfer took place.

- In the To Whom Shares Were Transferred section, write the name of the individual or entity receiving the shares.

- For Certificates Surrendered, list the certificate number of the shares being surrendered.

- Indicate the Cert. No. of Shares that were surrendered.

- Finally, write the Number of Shares Held (Balance) to show how many shares the stockholder retains after the transfer.

Misconceptions

Misconceptions about the Stock Transfer Ledger form can lead to confusion. Here are nine common misunderstandings:

-

It is only for large corporations.

Many believe that only big companies need a Stock Transfer Ledger. In reality, any corporation, regardless of size, should maintain this record to track stock ownership.

-

It is optional.

Some think that keeping a Stock Transfer Ledger is not necessary. However, it is a legal requirement for corporations to document stock transfers accurately.

-

Only the original stockholder needs to be listed.

People often assume that only the initial owner should be recorded. In fact, every transfer of shares must be documented, including all previous and current owners.

-

It is the same as a stock certificate.

Many confuse the Stock Transfer Ledger with stock certificates. The ledger is a record of transactions, while certificates serve as proof of ownership.

-

It can be completed at any time.

Some believe they can fill out the ledger whenever they want. It is important to update the ledger promptly after each transfer to ensure accurate records.

-

Only financial details are necessary.

People may think that only monetary information matters. However, the ledger must also include details like names, addresses, and dates of transfers.

-

It is not needed if there are no transfers.

Some assume that if there are no stock transfers, the ledger is unnecessary. However, it should still be maintained to reflect the current state of stock ownership.

-

It can be kept in any format.

While some think any format is acceptable, the ledger must follow specific guidelines to meet legal requirements. It is essential to adhere to the prescribed structure.

-

It is only for internal use.

Many believe the ledger is solely for the corporation's internal purposes. However, it may also be requested by shareholders or regulatory authorities for verification.