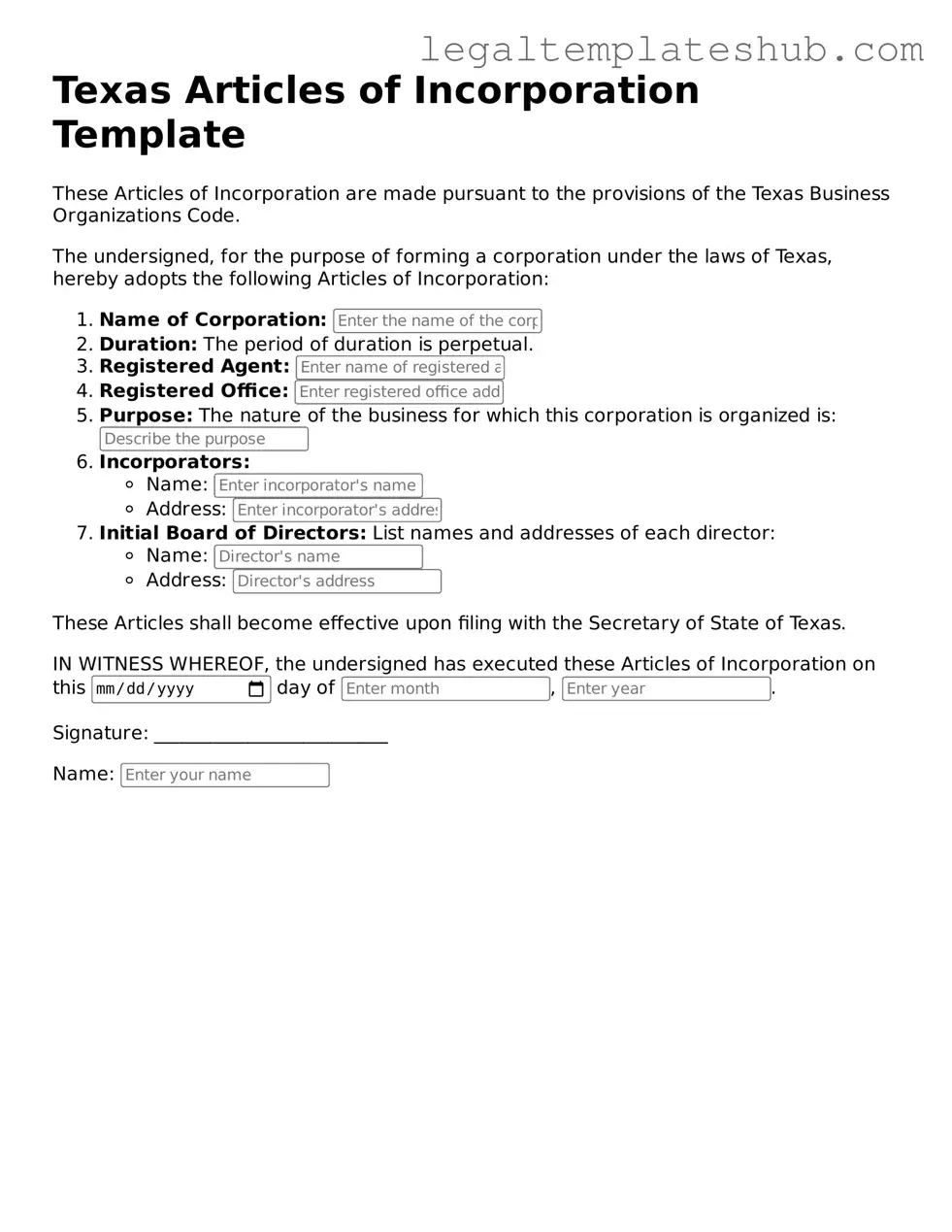

Printable Articles of Incorporation Document for Texas

PDF Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Articles of Incorporation form is governed by the Texas Business Organizations Code. |

| Purpose | This form is used to legally establish a corporation in the state of Texas. |

| Filing Requirement | It must be filed with the Texas Secretary of State to create a corporation. |

| Information Required | The form typically requires details such as the corporation's name, duration, and registered agent. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Effective Date | The corporation can specify an effective date for its formation, which can be immediate or a future date. |

Key takeaways

Ensure that you have a clear purpose for your corporation. The Articles of Incorporation require a statement of the business's purpose, which should be specific yet broad enough to encompass future activities.

Designate a registered agent. This individual or business must have a physical address in Texas and will be responsible for receiving legal documents on behalf of your corporation.

Include the name of your corporation. The name must be unique and not too similar to existing businesses. Check the Texas Secretary of State's database to confirm availability.

Decide on the structure of your corporation. Clearly outline the number of shares your corporation is authorized to issue and the par value of those shares, if applicable.

Provide the names and addresses of the initial directors. These individuals will oversee the corporation until the first annual meeting of shareholders.

Consider including provisions for indemnification. This can protect directors and officers from personal liability for actions taken on behalf of the corporation.

File the Articles with the Texas Secretary of State. Be prepared to pay the required filing fee, and ensure that you follow up to confirm that your application has been processed.

Dos and Don'ts

When filling out the Texas Articles of Incorporation form, it is essential to approach the process with care. The following guidelines can help ensure that the form is completed accurately and effectively.

- Do: Provide accurate and complete information about the corporation, including the name, address, and purpose.

- Do: Review the form for any errors or omissions before submission to avoid delays in processing.

- Do: Include the names and addresses of the initial directors, as this information is required for incorporation.

- Do: Ensure that the corporation name complies with Texas naming requirements, avoiding any prohibited words.

- Don't: Use abbreviations or informal names that do not match the official name of the corporation.

- Don't: Forget to sign and date the form, as an unsigned form will not be processed.

- Don't: Leave sections blank; all applicable fields must be filled out to prevent rejection.

- Don't: Submit the form without the required filing fee, as this is necessary for the processing of your application.

More Articles of Incorporation State Templates

Ohio Llc Fees - Early submission of the Articles can help launch your business promptly.

Llc Articles of Organization Nj - The Articles provide a framework for decision-making and strategy.

For those looking to understand the significance of the Mobile Home Bill of Sale in Colorado, it is important to consider how this document simplifies the transfer process. This essential Mobile Home Bill of Sale form ensures a clear record of ownership change, safeguarding both parties in the transaction. For more information, visit the official page.

Utah Corporation Search - Provisions may be included for the rights of shareholders.

Instructions on Filling in Texas Articles of Incorporation

After you have gathered all necessary information, it's time to fill out the Texas Articles of Incorporation form. This document is essential for officially establishing your corporation in Texas. Follow these steps carefully to ensure everything is completed correctly.

- Begin by downloading the Texas Articles of Incorporation form from the Texas Secretary of State's website.

- Fill in the name of your corporation. Make sure the name complies with Texas naming requirements.

- Provide the duration of your corporation. Most corporations are set up to exist perpetually, unless you specify otherwise.

- Enter the purpose of your corporation. Be clear and concise about what your business will do.

- List the address of your corporation's registered office in Texas. This is where official documents will be sent.

- Include the name and address of your registered agent. This person or entity will receive legal documents on behalf of your corporation.

- Indicate the number of shares your corporation is authorized to issue. Specify the classes of shares if applicable.

- Provide the names and addresses of the initial directors. Include at least one director.

- Sign and date the form. Ensure the signature is from an individual authorized to file the Articles of Incorporation.

- Submit the completed form to the Texas Secretary of State, along with the required filing fee.

Once the form is submitted, you will receive confirmation from the Secretary of State. Keep this confirmation for your records, as it serves as proof of your corporation's existence.

Misconceptions

When it comes to forming a corporation in Texas, many people hold misconceptions about the Articles of Incorporation form. Understanding the truth behind these myths can help streamline the incorporation process. Here are nine common misconceptions:

- 1. You must be a Texas resident to file. Many believe that only Texas residents can file Articles of Incorporation in the state. However, anyone can file, regardless of their residency status.

- 2. The form is overly complicated. While the Articles of Incorporation form may seem daunting, it is designed to be straightforward. Most information required is basic and can be easily provided.

- 3. You need a lawyer to file. Some think that hiring a lawyer is necessary to complete the form. In reality, individuals can file on their own if they feel comfortable doing so.

- 4. You can’t change the Articles once filed. Many assume that once the Articles of Incorporation are filed, they cannot be altered. In fact, amendments can be made later if needed.

- 5. The filing fee is excessively high. People often believe that the cost to file the Articles of Incorporation is prohibitive. However, the fee is relatively modest compared to other business expenses.

- 6. Only certain types of businesses can incorporate. There is a misconception that only specific types of businesses are eligible to incorporate. In truth, various business types can choose to incorporate in Texas.

- 7. You must have a physical office in Texas. Some think that a physical office in Texas is a requirement for incorporation. However, having a registered agent with a Texas address is sufficient.

- 8. Filing automatically grants tax-exempt status. Many believe that filing Articles of Incorporation automatically qualifies a business for tax-exempt status. This is not true; separate applications are needed for tax exemptions.

- 9. The process takes a long time. People often think that the incorporation process is lengthy and cumbersome. In reality, once the Articles are filed, they are typically processed quickly.

Clearing up these misconceptions can make the process of incorporating a business in Texas much smoother. Understanding the facts helps ensure that entrepreneurs can focus on what really matters: building their business.