Printable Bill of Sale Document for Texas

PDF Form Data

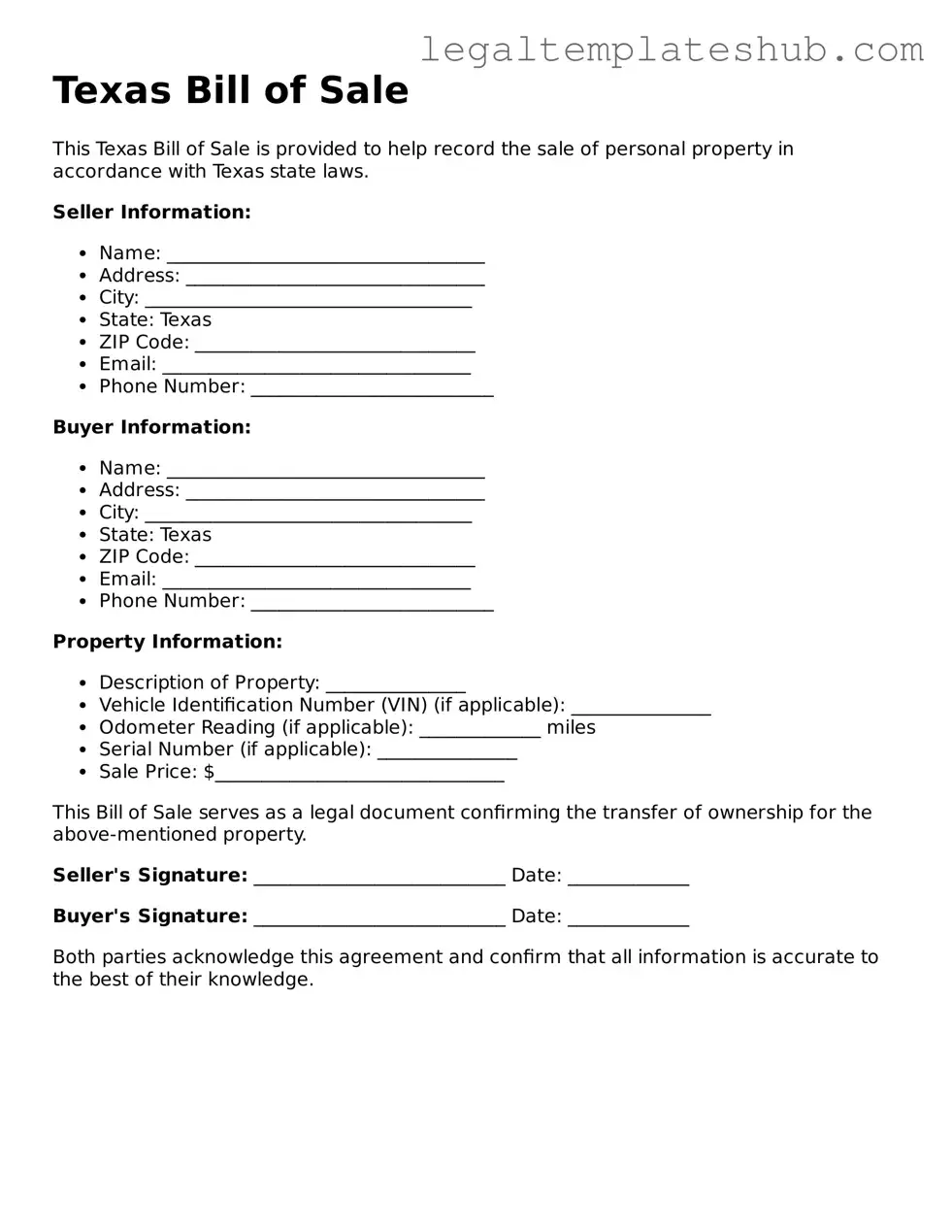

| Fact Name | Details |

|---|---|

| Purpose | The Texas Bill of Sale serves as a legal document that transfers ownership of personal property from one party to another. |

| Governing Law | The Texas Bill of Sale is governed by the Texas Business and Commerce Code, specifically Title 9, Chapter 2. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Requirements | The form must include the names and addresses of both the buyer and seller, a description of the property, and the purchase price. |

| Signatures | Both parties should sign the document to validate the transaction, although notarization is not required. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records, as it may be needed for future reference. |

| Use in Vehicle Transactions | A Bill of Sale is often required when registering a vehicle with the Texas Department of Motor Vehicles. |

Key takeaways

Filling out and using the Texas Bill of Sale form can be straightforward if you keep a few key points in mind. Here are some important takeaways:

- Understand the Purpose: The Bill of Sale serves as a legal document that transfers ownership of an item from one party to another. It provides proof of the transaction.

- Gather Necessary Information: Before filling out the form, collect all relevant details such as the buyer's and seller's names, addresses, and the description of the item being sold.

- Be Accurate: Ensure that all information entered is correct. Mistakes can lead to confusion or disputes later on.

- Include Payment Details: Clearly state the sale price and any payment terms. This helps clarify the financial aspect of the transaction.

- Signatures Matter: Both the buyer and seller should sign the document. This indicates agreement to the terms outlined in the Bill of Sale.

- Keep Copies: After completing the Bill of Sale, both parties should retain a copy for their records. This can be useful for future reference or in case of disputes.

By following these key takeaways, the process of using the Texas Bill of Sale can be more efficient and effective for all parties involved.

Dos and Don'ts

When filling out the Texas Bill of Sale form, it's important to ensure accuracy and clarity. Here’s a list of what you should and shouldn’t do:

- Do include the full names and addresses of both the buyer and seller.

- Do provide a detailed description of the item being sold, including any identification numbers.

- Do specify the sale price clearly to avoid any misunderstandings.

- Do sign and date the form to validate the transaction.

- Don't leave any fields blank; incomplete forms can lead to issues later.

- Don't use abbreviations or shorthand that may confuse the reader.

- Don't forget to keep a copy of the completed Bill of Sale for your records.

- Don't rush through the process; take your time to ensure all information is accurate.

More Bill of Sale State Templates

Nj Car Bill of Sale - Buyers should verify the accuracy of all information before signing.

To further facilitate this process, you may find it helpful to access resources like the PDF Documents Hub, which provides templates and guidelines for completing your California Motor Vehicle Bill of Sale accurately.

Bill of Sales for Cars - A Bill of Sale specifies what is included in the sale, reducing potential disputes.

Instructions on Filling in Texas Bill of Sale

Once you have the Texas Bill of Sale form in hand, you will need to fill it out carefully to ensure all necessary information is included. This document will help in the transfer of ownership for a vehicle or personal property. Follow these steps to complete the form accurately.

- Begin by entering the date of the transaction at the top of the form.

- Provide the full names and addresses of both the seller and the buyer. Make sure to include the city, state, and zip code for each party.

- Clearly describe the item being sold. Include details like the make, model, year, and Vehicle Identification Number (VIN) for vehicles. For other items, provide a detailed description.

- State the sale price of the item. This should be the agreed amount between the seller and buyer.

- Include any additional terms or conditions of the sale if applicable. This can cover warranties, payment methods, or other agreements.

- Both the seller and buyer must sign and date the form at the bottom. Ensure that the signatures are clear and legible.

- Make copies of the completed Bill of Sale for both parties. This ensures that each has a record of the transaction.

Misconceptions

The Texas Bill of Sale form is often misunderstood. Here are eight common misconceptions that people may have about this important document:

-

It is only needed for vehicle sales.

Many believe that a Bill of Sale is only necessary when buying or selling a vehicle. In reality, it can be used for various transactions, including the sale of personal property, boats, and firearms.

-

It must be notarized to be valid.

While notarization can add an extra layer of authenticity, it is not a legal requirement for a Bill of Sale in Texas. The document is valid as long as both parties sign it.

-

It is the same as a receipt.

A Bill of Sale serves a different purpose than a simple receipt. It provides detailed information about the transaction, including the item description, sale price, and buyer and seller information.

-

It is only necessary for high-value items.

Some people think that a Bill of Sale is only needed for expensive items. However, it is wise to use one for any significant transaction to protect both parties, regardless of the item's value.

-

It cannot be used for gifts.

Another misconception is that a Bill of Sale is only for transactions involving money. In fact, it can also be used to document the transfer of ownership for gifts, providing a record of the transaction.

-

Once signed, it cannot be changed.

People often think that a Bill of Sale is final and cannot be altered. In reality, both parties can agree to amend the document, as long as the changes are documented and signed by both parties.

-

It is not legally binding.

Some individuals believe that a Bill of Sale holds no legal weight. However, it is a legally binding contract that can be enforced in a court of law, provided it includes the necessary information and signatures.

-

It is only for private sales.

Many assume that a Bill of Sale is only applicable for private transactions. However, it can also be used in sales conducted by businesses, ensuring proper documentation for both parties involved.

Understanding these misconceptions can help ensure that individuals use the Texas Bill of Sale form effectively and protect their interests during transactions.