Printable Deed in Lieu of Foreclosure Document for Texas

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | Texas Property Code governs the process and requirements for deeds in lieu of foreclosure. |

| Eligibility | Typically, the borrower must be in default on their mortgage to qualify for this option. |

| Benefits | It helps borrowers avoid a lengthy foreclosure process and potential damage to their credit score. |

| Process | The borrower and lender must agree to the terms, and the deed must be executed and recorded. |

| Potential Drawbacks | Borrowers may still be liable for any deficiency balance if the property sells for less than the mortgage owed. |

| Title Issues | The borrower must ensure there are no liens or title issues that could complicate the transfer. |

| Tax Implications | Consulting a tax advisor is recommended, as there may be tax consequences related to forgiven debt. |

| Alternatives | Other options include loan modification, short sale, or traditional foreclosure. |

Key takeaways

Filling out and using the Texas Deed in Lieu of Foreclosure form can be a critical step for homeowners facing financial difficulties. Here are four key takeaways to consider:

- Understand the Purpose: The deed in lieu of foreclosure allows a homeowner to transfer the ownership of their property back to the lender. This process can help avoid the lengthy and costly foreclosure process.

- Eligibility Requirements: Not all homeowners qualify for this option. Lenders typically require that the homeowner is in default on their mortgage and that the property is not subject to any other liens.

- Impact on Credit: While a deed in lieu of foreclosure is generally less damaging than a foreclosure, it will still negatively impact the homeowner’s credit score. Understanding the long-term implications is essential.

- Legal Advice Recommended: Consulting with a legal professional before completing the deed in lieu of foreclosure form can provide valuable guidance. A lawyer can help ensure that the homeowner's rights are protected throughout the process.

Dos and Don'ts

When filling out the Texas Deed in Lieu of Foreclosure form, there are important steps to follow to ensure the process goes smoothly. Here’s a list of what you should and shouldn’t do:

- Do provide accurate information about the property and all parties involved.

- Do ensure that all signatures are notarized to avoid any issues with validity.

- Do consult with a legal professional if you have questions about the process.

- Do keep copies of the completed form for your records.

- Don't rush through the form; take your time to review each section carefully.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't ignore any outstanding debts related to the property, as these may affect the deed.

- Don't forget to check with your lender about their specific requirements for acceptance.

More Deed in Lieu of Foreclosure State Templates

Foreclosure Vs Deed in Lieu - Maintaining an open dialogue with the lender can foster a more favorable resolution.

A New York Residential Lease Agreement is a vital legal document that clearly defines the relationship between a landlord and tenant in New York State, detailing crucial elements such as rental amount, lease duration, and the obligations of both parties. For those navigating the rental market, accessing a reliable source for this information can be crucial; check out the PDF Templates to help streamline the process of completing this form.

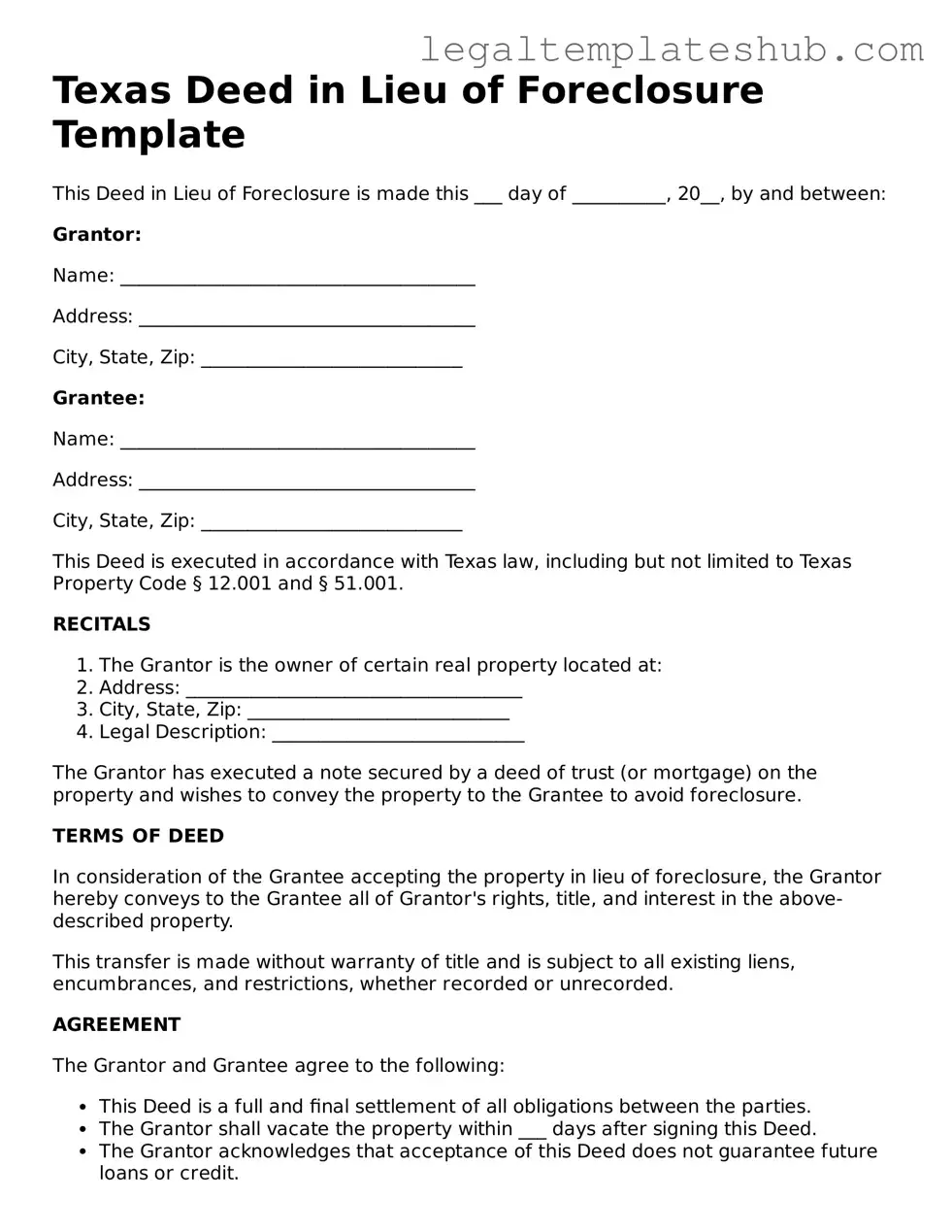

Instructions on Filling in Texas Deed in Lieu of Foreclosure

After completing the Texas Deed in Lieu of Foreclosure form, the next step involves submitting it to the appropriate parties. This typically includes your lender and, in some cases, the county clerk's office. Make sure to keep copies of all documents for your records. Now, let’s go through the steps to fill out the form correctly.

- Begin by entering the date at the top of the form. Ensure that you write the full date, including the month, day, and year.

- Next, provide your name as the grantor. This is the person transferring the property.

- Include your address. This should be the address where you currently reside.

- Identify the grantee. This is typically the lender or financial institution that holds your mortgage.

- Write the name of the grantee’s representative if applicable. This may be a specific person or department within the lending institution.

- Fill in the property description. This should include the address and any legal description of the property being transferred.

- Sign the form. Make sure to sign your name exactly as it appears in the grantor section.

- Have the form notarized. A notary public must witness your signature and provide their stamp on the document.

- Make copies of the completed form for your records before submitting it.

Following these steps will help ensure that the form is filled out correctly and is ready for submission. Be sure to check for any specific requirements your lender may have regarding the process.

Misconceptions

Understanding the Texas Deed in Lieu of Foreclosure form is essential for homeowners facing financial difficulties. However, several misconceptions can cloud judgment. Here are four common misconceptions:

- It eliminates all debts associated with the property. Many believe that signing a Deed in Lieu automatically wipes out all debts. In reality, it only addresses the mortgage debt. Other liens or debts may still remain.

- It is a quick and easy process. Some homeowners think that a Deed in Lieu is a simple solution to avoid foreclosure. However, the process can be lengthy and requires approval from the lender, which may involve negotiations and paperwork.

- It will not affect your credit score. There is a belief that a Deed in Lieu has no impact on credit ratings. This is misleading. While it may be less damaging than a foreclosure, it can still negatively affect credit scores.

- It is the same as a short sale. Many confuse a Deed in Lieu with a short sale. In a short sale, the property is sold for less than what is owed on the mortgage, with lender approval. A Deed in Lieu involves transferring ownership back to the lender without a sale.

Being informed about these misconceptions can help homeowners make better decisions during challenging times.