Printable Gift Deed Document for Texas

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer ownership of property as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by the Texas Property Code, specifically Chapter 5. |

| Requirements | The deed must be in writing, signed by the grantor, and must identify the property being gifted. |

| Consideration | No monetary consideration is required, as the transfer is a gift. |

| Recording | To ensure the gift is legally recognized, the deed should be recorded with the county clerk's office where the property is located. |

| Tax Implications | Gift tax may apply, and it is advisable to consult with a tax professional to understand potential liabilities. |

| Revocation | Once executed and delivered, a gift deed generally cannot be revoked unless certain conditions are met. |

Key takeaways

When filling out and using the Texas Gift Deed form, consider the following key takeaways:

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any exchange of money. It’s essential to ensure that the intent to gift is clear.

- Complete Information: Fill in all required details accurately, including the names of both the donor and the recipient, as well as the property description.

- Signatures Matter: Both the donor and the recipient must sign the deed. In some cases, a notary public may also need to witness the signatures.

- Consider Tax Implications: Gifting property may have tax consequences. Consult with a tax professional to understand potential gift tax liabilities.

- File the Deed: After completion, the Gift Deed should be filed with the county clerk’s office where the property is located to ensure public record.

- Review Local Laws: Be aware of any specific state or local laws that may affect the validity of the Gift Deed in Texas.

Dos and Don'ts

When filling out the Texas Gift Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are some essential do's and don'ts:

- Do provide accurate information about the property being gifted.

- Do include the full names and addresses of both the donor and the recipient.

- Do sign the deed in front of a notary public to validate the document.

- Do check for any local regulations that may affect the gift transfer.

- Don't leave any sections of the form blank; all areas must be completed.

- Don't forget to keep a copy of the completed deed for your records.

By following these guidelines, you can help ensure that the gift deed is properly executed and legally binding.

More Gift Deed State Templates

Virginia Deed of Gift Requirements - The form should be filled out with care to ensure all legal requirements are met.

Understanding the terms of your lease is crucial to a successful rental experience, and by utilizing resources such as PDF Templates, you can ensure that all necessary details are included in your New York Residential Lease Agreement, protecting both landlord and tenant rights.

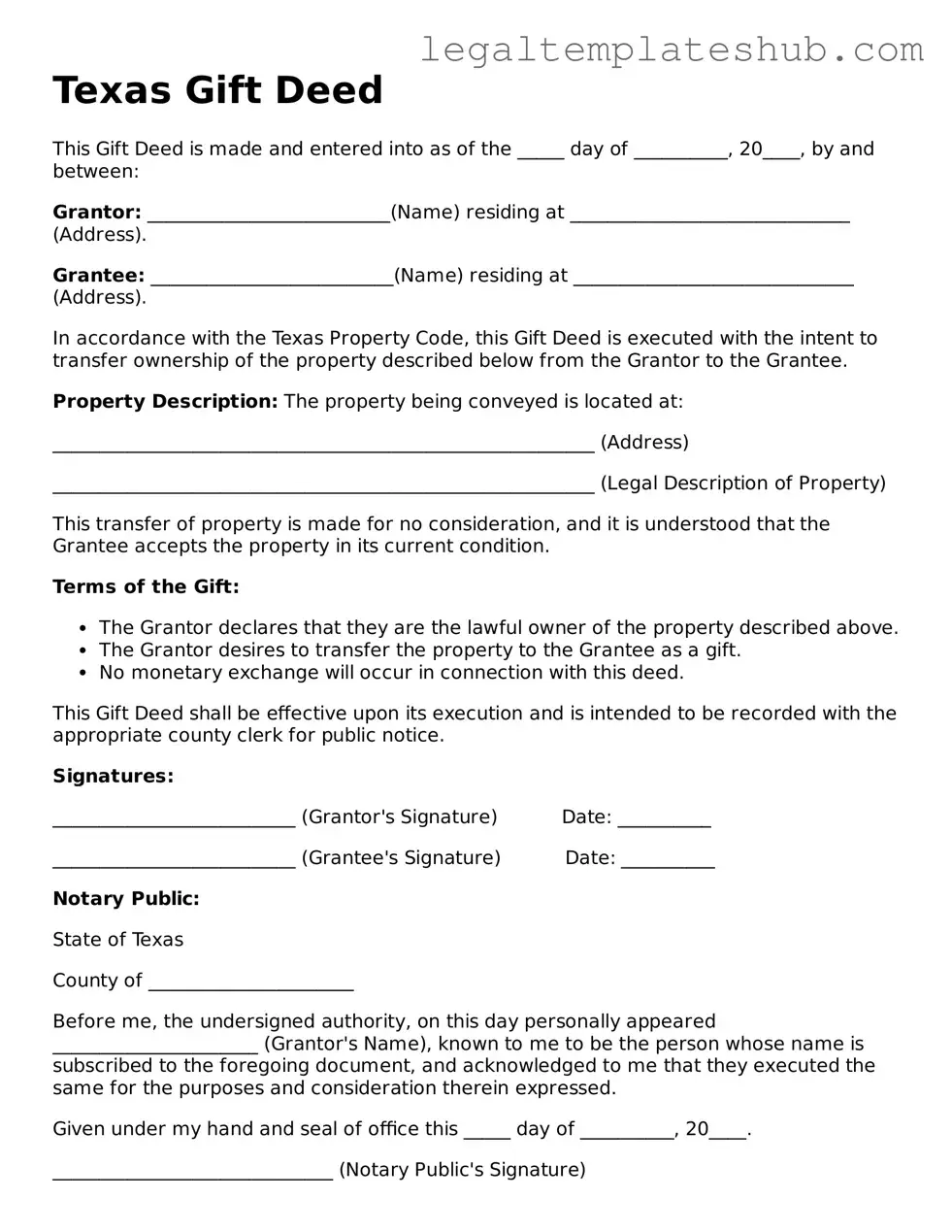

Instructions on Filling in Texas Gift Deed

After you have gathered all necessary information and documents, you can begin filling out the Texas Gift Deed form. This process requires careful attention to detail to ensure that all information is accurate and complete. Once you have filled out the form, you will need to have it notarized and recorded with the appropriate county office.

- Begin by downloading the Texas Gift Deed form from a reliable source or obtain a physical copy from a local legal office.

- At the top of the form, enter the name and address of the grantor, who is the person giving the gift.

- Next, provide the name and address of the grantee, the individual receiving the gift.

- Clearly describe the property being gifted. Include details such as the address, legal description, and any relevant identifiers like parcel numbers.

- Specify the date of the gift. This is the date when the transfer of ownership is intended to take place.

- If applicable, include any conditions or terms associated with the gift. This might involve stipulations about the use of the property.

- Both the grantor and grantee should sign the form. Ensure that the signatures are dated.

- Find a notary public to witness the signatures. The notary will need to verify the identities of both parties and will then notarize the document.

- Finally, take the completed and notarized form to the county clerk’s office where the property is located. Submit the form for recording, and pay any associated fees.

Misconceptions

When it comes to the Texas Gift Deed form, there are several misconceptions that can lead to confusion. Understanding these can help clarify the process and requirements involved. Here’s a list of ten common misconceptions:

- A Gift Deed is the same as a Will. Many people believe that a Gift Deed functions like a will, but it is not. A Gift Deed transfers property during the giver's lifetime, while a will only takes effect after death.

- You can use a Gift Deed for any type of property. Some assume that all types of property can be transferred using a Gift Deed. However, certain properties, like those with liens or mortgages, may have restrictions.

- A Gift Deed does not require witnesses. Contrary to popular belief, a Gift Deed must be signed by at least two witnesses to be valid in Texas.

- Gift Deeds can be revoked easily. Some think that once a Gift Deed is signed, it can be easily undone. In reality, revoking a Gift Deed can be complex and may require legal action.

- There are no tax implications for a Gift Deed. Many believe that gifting property has no tax consequences. However, the IRS may impose gift taxes if the value exceeds a certain threshold.

- You don’t need to record a Gift Deed. Some people think that recording the deed is optional. In Texas, it is essential to record the Gift Deed to protect the new owner’s rights.

- A Gift Deed can be used to avoid creditors. Some believe that transferring property via a Gift Deed can shield it from creditors. However, this can be challenged in court if done with the intent to defraud.

- Only family members can receive gifts through a Gift Deed. While many use Gift Deeds for family transfers, anyone can be a recipient, including friends or charitable organizations.

- You must be wealthy to use a Gift Deed. Some think that only those with significant assets can utilize a Gift Deed. In reality, anyone can give a gift of property, regardless of their financial status.

- A Gift Deed is a complicated legal document. Many fear that creating a Gift Deed is overly complex. However, with the right guidance, it can be a straightforward process.

Understanding these misconceptions can help individuals navigate the process of transferring property in Texas more effectively. Always consider seeking legal advice to ensure that all aspects are handled properly.