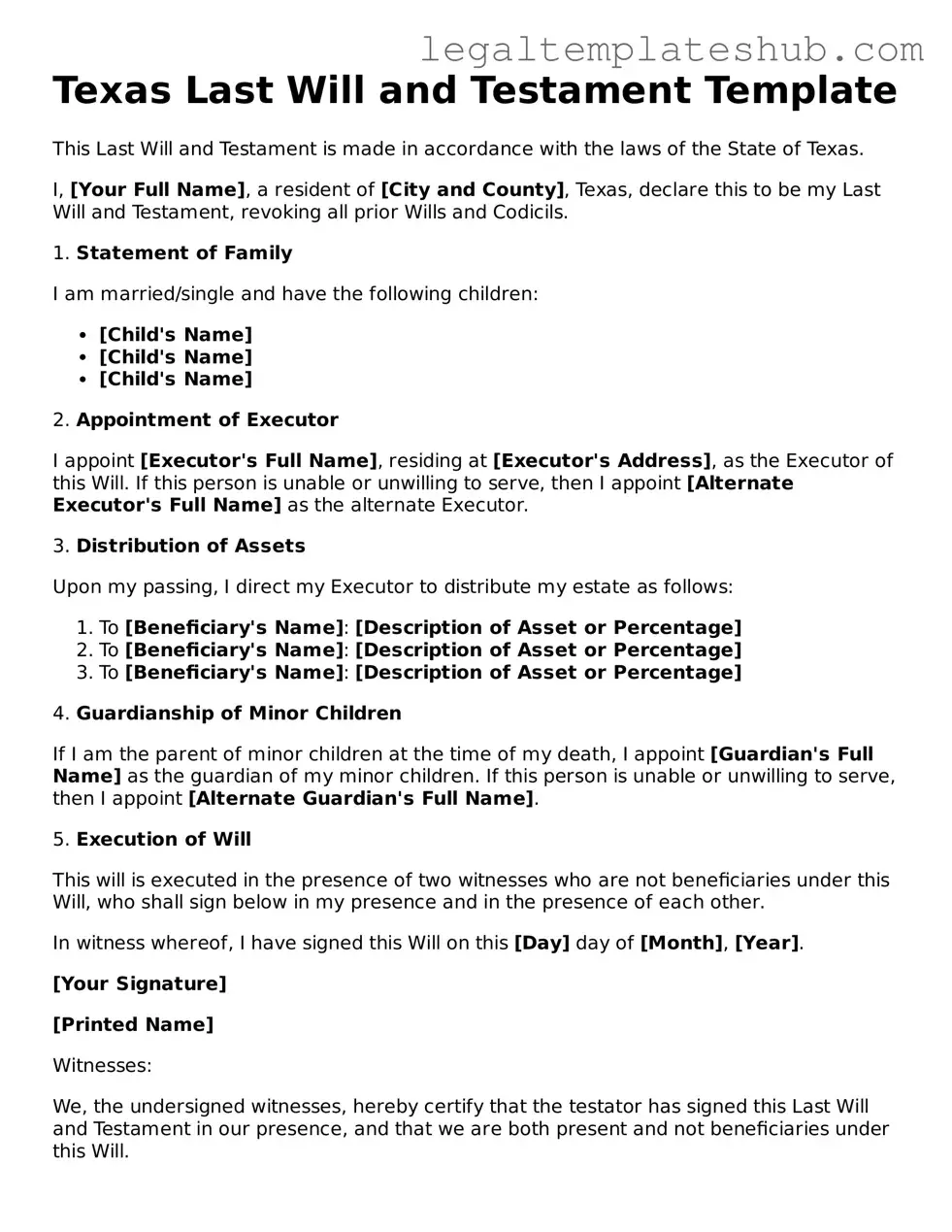

Printable Last Will and Testament Document for Texas

PDF Form Data

| Fact Name | Details |

|---|---|

| Legal Requirement | A Last Will and Testament must be in writing to be valid in Texas. |

| Signature Requirement | The testator must sign the will, or it must be signed in their presence by someone else. |

| Witnesses | At least two witnesses are required to validate the will, and they must be at least 14 years old. |

| Holographic Wills | Texas recognizes holographic wills, which do not require witnesses if written entirely in the testator's handwriting. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document. |

| Governing Law | The Texas Estates Code governs the creation and execution of wills in Texas. |

Key takeaways

Creating a Last Will and Testament in Texas is a crucial step in ensuring that your wishes are honored after your passing. Here are some key takeaways to consider when filling out and using the Texas Last Will and Testament form:

- Understand the Purpose: A will allows you to specify how your assets will be distributed and who will manage your estate after your death.

- Eligibility: You must be at least 18 years old and of sound mind to create a valid will in Texas.

- Choose an Executor: This person will be responsible for carrying out your wishes as outlined in the will. Select someone you trust.

- Be Specific: Clearly describe your assets and how you want them divided. Ambiguities can lead to disputes among heirs.

- Witness Requirements: Texas law requires at least two witnesses to sign your will. They should not be beneficiaries to avoid conflicts of interest.

- Consider a Self-Proving Affidavit: Including this affidavit can simplify the probate process by verifying the will's authenticity.

- Revocation: If you create a new will, it automatically revokes any previous ones. Ensure that your latest will is clearly marked as such.

- Storing Your Will: Keep your will in a safe place, and inform your executor and loved ones where it can be found.

- Review Regularly: Life changes such as marriage, divorce, or the birth of children may necessitate updates to your will.

- Legal Assistance: While you can create a will on your own, consulting with a legal professional can help ensure that it meets all legal requirements and adequately reflects your wishes.

By following these guidelines, you can create a Last Will and Testament that provides peace of mind for you and your loved ones.

Dos and Don'ts

When filling out the Texas Last Will and Testament form, it is important to approach the process with care. Here are some key do's and don'ts to keep in mind.

- Do ensure that you are of sound mind when creating your will.

- Do clearly identify yourself and your beneficiaries.

- Do specify how you want your assets distributed.

- Do sign the document in front of two witnesses.

- Don't use vague language that could lead to confusion.

- Don't forget to update your will after major life changes.

Taking these steps can help ensure that your wishes are honored and that your loved ones are cared for after your passing. Always consider seeking guidance if you have questions or concerns.

More Last Will and Testament State Templates

Making a Will in Nj - Can protect family members from potential financial disputes.

For anyone interested in the legal aspects of mobile home transactions, an essential document to consider is the Mobile Home Bill of Sale. This form is pivotal in ensuring that ownership of the mobile home is properly transferred, safeguarding the interests of both buyers and sellers in the process.

Can You Write Your Own Will in Nc - Enables you to name an executor who will manage your estate according to your wishes.

Virginia Will Template - A means of ensuring that your assets are handled according to your beliefs.

Instructions on Filling in Texas Last Will and Testament

Once you have the Texas Last Will and Testament form in front of you, it's time to fill it out carefully. Completing this form involves providing essential information about yourself, your assets, and your beneficiaries. After filling out the form, you will need to follow certain steps to ensure that your will is valid and legally binding.

- Begin by writing your full name at the top of the form.

- Next, include your address. This helps to identify your residence.

- State your marital status. Indicate whether you are single, married, or divorced.

- Designate an executor. This person will be responsible for carrying out the instructions in your will.

- List your beneficiaries. Include their full names and relationships to you. Be clear about who gets what.

- Detail any specific gifts. If you want to leave particular items or amounts of money to someone, note these clearly.

- Include a residuary clause. This addresses any remaining assets not specifically mentioned.

- Sign the form at the designated space. Your signature is essential for the will to be valid.

- Have at least two witnesses sign the document. They should be present when you sign the will.

- Make copies of the signed will for your records and for your executor.

After completing the form, ensure that it is stored safely. You may want to keep it in a secure location, such as a safe or with your attorney. Inform your executor and close family members where the will is located, as this will help facilitate the process when the time comes.

Misconceptions

Understanding the Texas Last Will and Testament can be challenging, especially with the many misconceptions that surround it. Here are eight common myths and the truths behind them:

-

Myth 1: A will is only necessary for the wealthy.

Many people believe that only those with substantial assets need a will. In reality, a will is important for anyone who wants to ensure their wishes are followed after they pass away, regardless of their financial status.

-

Myth 2: A handwritten will is not valid in Texas.

While it’s true that Texas recognizes handwritten wills, known as holographic wills, they must meet certain criteria. As long as the document is signed and the material provisions are in the individual's handwriting, it can be valid.

-

Myth 3: You can change your will anytime without formalities.

While you can change your will, it’s important to do so properly. Simply crossing out or adding to a will may not be legally binding. A new will or a formal amendment, known as a codicil, is often necessary.

-

Myth 4: If you die without a will, the state takes everything.

This is a common misconception. While it’s true that dying without a will (intestate) means your assets will be distributed according to state law, it doesn’t mean the state takes everything. Your assets will go to your closest relatives instead.

-

Myth 5: You need an attorney to create a valid will in Texas.

Although having an attorney can help ensure that your will is properly drafted and executed, it is not a requirement. Individuals can create their own wills, but they must follow Texas laws to ensure validity.

-

Myth 6: All debts must be paid before beneficiaries receive anything.

While debts must be settled before assets are distributed, beneficiaries may receive their inheritance while the estate is still settling debts. However, the estate must ultimately cover all debts before final distributions are made.

-

Myth 7: You can name anyone as an executor of your will.

In Texas, you can choose anyone to be your executor, but they must be at least 18 years old and of sound mind. It’s wise to choose someone responsible and trustworthy, as they will manage your estate after your passing.

-

Myth 8: A will can cover all types of assets.

Wills do not govern certain types of assets, such as life insurance policies or retirement accounts, which have designated beneficiaries. It's important to review all your assets and ensure they are properly accounted for in your estate planning.

Clearing up these misconceptions can help individuals make informed decisions about their estate planning. A well-prepared will can provide peace of mind and ensure that your wishes are honored.