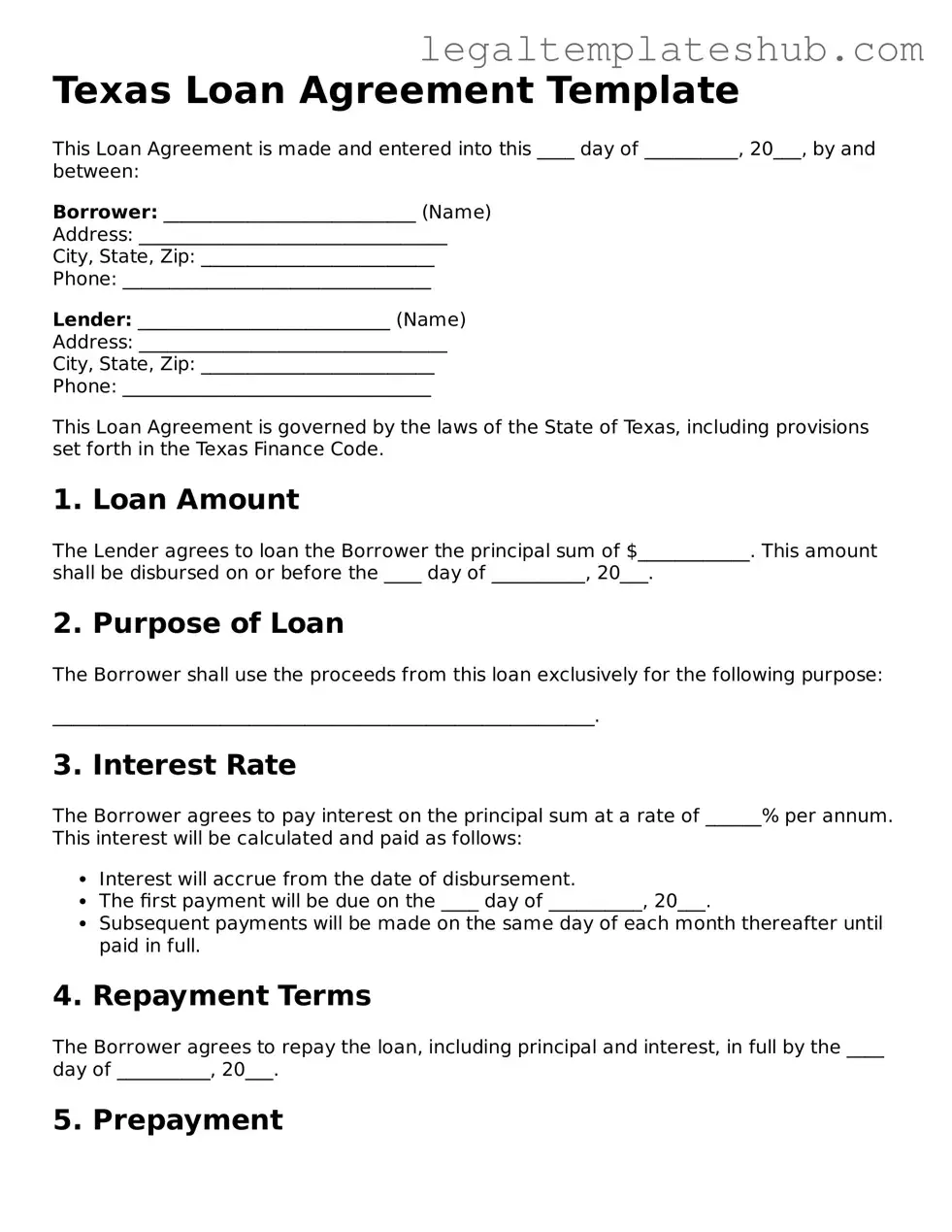

Printable Loan Agreement Document for Texas

PDF Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Loan Agreement form is governed by the Texas Business and Commerce Code. |

| Purpose | This form is used to outline the terms of a loan between a lender and a borrower in Texas. |

| Required Information | Key details such as loan amount, interest rate, repayment schedule, and parties involved must be included. |

| Legal Enforceability | When properly executed, the agreement is legally binding and enforceable in a Texas court. |

Key takeaways

When it comes to filling out and using the Texas Loan Agreement form, there are several important points to keep in mind. Understanding these key takeaways can help ensure that the process goes smoothly and that all parties are protected.

- Understand the Purpose: The Texas Loan Agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower.

- Include Essential Details: Make sure to include all necessary information, such as the loan amount, interest rate, repayment schedule, and any fees associated with the loan.

- Specify the Parties Involved: Clearly identify the lender and borrower, including their full names and contact information, to avoid any confusion later on.

- Review State Laws: Familiarize yourself with Texas laws regarding loans, as they may impact the terms of your agreement.

- Consider Collateral: If applicable, specify any collateral that secures the loan. This can provide additional protection for the lender.

- Signatures Matter: Ensure that both parties sign and date the agreement. This step is crucial for the document to be legally binding.

- Keep Copies: After signing, both parties should retain a copy of the agreement for their records. This can be important for future reference.

- Consult a Professional: If unsure about any part of the agreement, consider seeking advice from a legal professional to avoid potential pitfalls.

By following these takeaways, individuals can navigate the Texas Loan Agreement process with greater confidence and clarity.

Dos and Don'ts

When filling out the Texas Loan Agreement form, it is crucial to approach the task with care. Here are ten important do's and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check all numbers and dates for accuracy.

- Do ensure that all required signatures are included.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed to do so.

- Don't use white-out or erasers on the form.

- Don't rush through the process; take your time.

- Don't ignore any instructions provided with the form.

- Don't submit the form without reviewing it one last time.

More Loan Agreement State Templates

Promissory Note New York - The Loan Agreement may include a default clause to outline consequences.

To ensure a smooth transaction when transferring ownership of a trailer, it is essential to have the correct paperwork in place, such as the New York Trailer Bill of Sale form. This document not only provides proof of ownership but also protects both the buyer and seller. For convenient access to various templates, including this important form, you can visit PDF Templates, which offers resources to assist you in completing the necessary documentation accurately.

Instructions on Filling in Texas Loan Agreement

Completing the Texas Loan Agreement form is an important step in securing your loan. Ensure you have all necessary information ready before you begin. This will help streamline the process and avoid any delays.

- Begin by entering the date at the top of the form. Make sure it is accurate and current.

- Fill in your full name and address in the designated fields. Double-check for any spelling errors.

- Provide the borrower’s information, if different from yours. Include their full name and address.

- Specify the loan amount. Be clear and precise about the total amount you are requesting.

- Indicate the interest rate. This should be a percentage and should match what you discussed with the lender.

- Detail the repayment terms. Include the duration of the loan and the schedule for payments (monthly, quarterly, etc.).

- Include any collateral information if applicable. Describe the assets that will secure the loan.

- Review the terms and conditions of the agreement. Ensure you understand each section before signing.

- Sign and date the form at the bottom. Make sure to print your name below your signature.

- Submit the completed form to the lender. Keep a copy for your records.

Misconceptions

Understanding the Texas Loan Agreement form is essential for borrowers and lenders alike. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- All loan agreements are the same. Many believe that all loan agreements follow a standard format. In reality, each agreement can vary significantly based on the terms, conditions, and specific requirements of the parties involved.

- Signing a loan agreement is just a formality. Some view the signing process as merely a formality. However, it is a legally binding commitment that requires careful consideration of all terms and conditions.

- The Texas Loan Agreement is only for large loans. Many assume this form is only applicable for substantial amounts. In fact, it can be used for various loan sizes, accommodating both small and large transactions.

- Once signed, the terms cannot be changed. There is a belief that once the agreement is signed, no changes can be made. Amendments can be made, but both parties must agree to the new terms and document them properly.

- Interest rates are fixed in all agreements. Some think that all loan agreements come with fixed interest rates. This is not true; interest rates can be variable, depending on the agreement and market conditions.

- Only banks can issue loan agreements. Many believe that only traditional banks can create these agreements. In reality, private lenders, credit unions, and individuals can also draft and sign loan agreements.

- Loan agreements are not enforceable in court. There is a misconception that loan agreements lack legal standing. In Texas, properly executed loan agreements are enforceable in court, provided they meet legal requirements.

- The loan agreement protects only the lender. Some think that the agreement only serves the lender's interests. In fact, a well-structured loan agreement protects both parties by clearly outlining rights and responsibilities.

Addressing these misconceptions can help ensure a smoother borrowing experience and foster better understanding between parties involved in a loan agreement.