Printable Motor Vehicle Bill of Sale Document for Texas

PDF Form Data

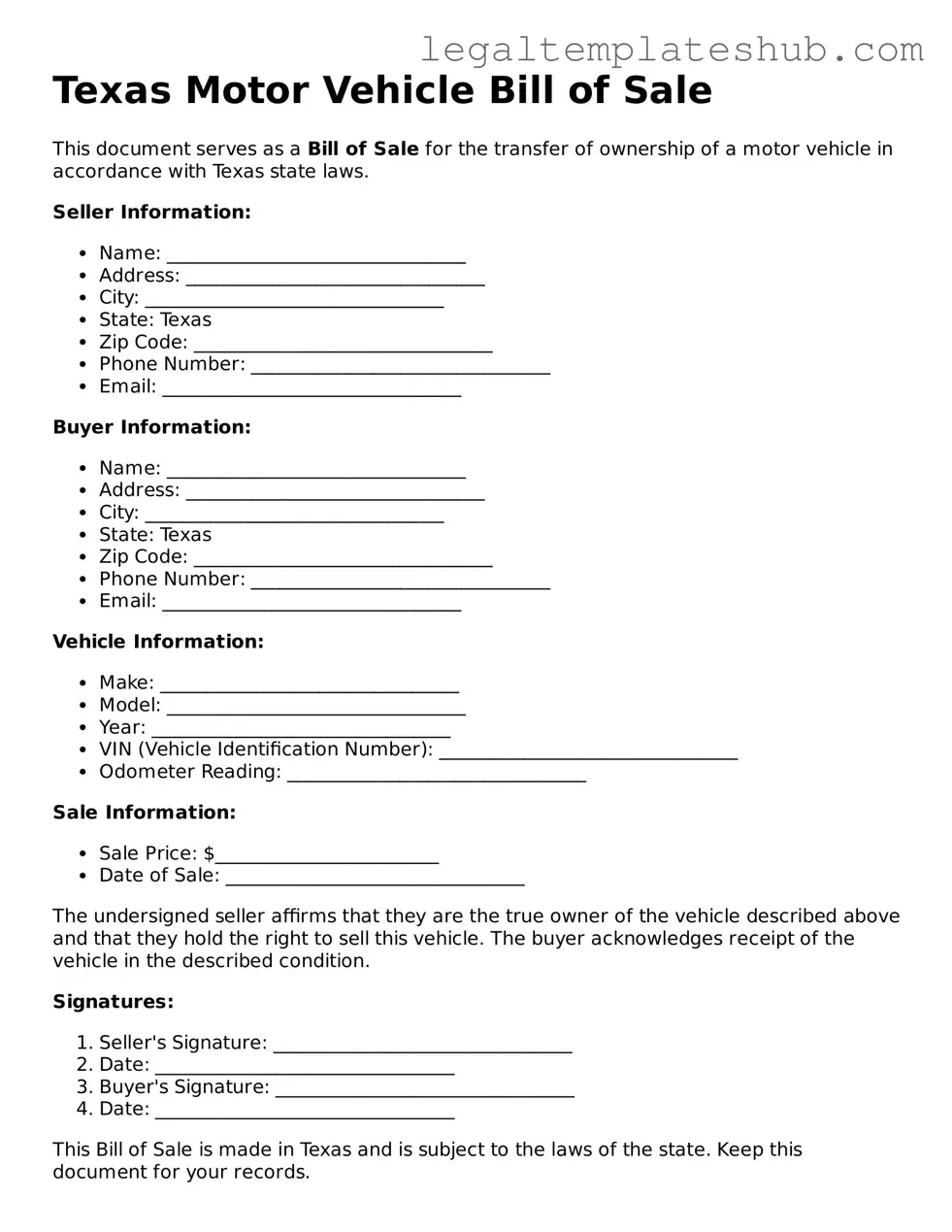

| Fact Name | Description |

|---|---|

| Purpose | The Texas Motor Vehicle Bill of Sale form is used to document the sale of a vehicle between a buyer and a seller. |

| Governing Law | This form is governed by Texas Transportation Code, Section 501.145. |

| Required Information | It must include details such as the vehicle identification number (VIN), make, model, year, and sale price. |

| Signatures | Both the buyer and seller must sign the form to validate the transaction. |

| Notarization | While notarization is not required, it is recommended to enhance the document's credibility. |

| Use for Registration | The completed form can be used to register the vehicle in the buyer's name at the local Department of Motor Vehicles (DMV). |

| Record Keeping | Both parties should keep a copy of the signed Bill of Sale for their records, as it serves as proof of the transaction. |

Key takeaways

When filling out and using the Texas Motor Vehicle Bill of Sale form, there are several important points to keep in mind. Here are six key takeaways:

- Accurate Information: Ensure that all details, including the vehicle identification number (VIN), make, model, year, and odometer reading, are filled out accurately. Mistakes can lead to complications in the transfer of ownership.

- Seller and Buyer Details: Both the seller and buyer must provide their full names and addresses. This information is crucial for legal documentation and future correspondence.

- Signature Requirement: The bill of sale must be signed by both the seller and the buyer. Without these signatures, the document may not be considered valid.

- Consideration Amount: Clearly state the sale price or consideration amount. This figure is essential for tax purposes and should reflect the agreed-upon price.

- Record Keeping: Keep a copy of the completed bill of sale for your records. This document serves as proof of the transaction and can be useful in case of disputes.

- Additional Documentation: Be prepared to provide additional documents, such as the title and any relevant maintenance records. These can help facilitate a smooth transfer of ownership.

Dos and Don'ts

When filling out the Texas Motor Vehicle Bill of Sale form, it's essential to ensure that all information is accurate and complete. Here are five important dos and don'ts to keep in mind:

- Do provide accurate information about the vehicle, including the make, model, year, and VIN (Vehicle Identification Number).

- Do include the names and addresses of both the buyer and the seller to avoid any confusion later on.

- Do sign and date the form to make it legally binding.

- Don't leave any sections blank; incomplete forms can lead to delays in processing.

- Don't forget to keep a copy of the completed Bill of Sale for your records.

More Motor Vehicle Bill of Sale State Templates

Selling a Car in Washington State - It may include the Vehicle Identification Number (VIN) for clarity.

Nc Bill of Sale - It helps in avoiding disputes about vehicle ownership after the sale.

For anyone looking to finalize their transaction, the easy-to-use essential Bill of Sale form template is available through our platform. Feel free to ensure all details are accurately documented by visiting this link.

Ohio Bill of Sale Requirements - Encourages transparency in disclosing any vehicle defects or issues.

Instructions on Filling in Texas Motor Vehicle Bill of Sale

After acquiring the Texas Motor Vehicle Bill of Sale form, the next steps involve accurately completing the necessary fields. This document serves as a record of the transaction between the buyer and seller. Ensuring all information is precise will help avoid future disputes or complications.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller in the designated section.

- Next, fill in the buyer's full name and address.

- Include the vehicle identification number (VIN) of the vehicle being sold.

- Record the make, model, and year of the vehicle.

- Indicate the sale price of the vehicle clearly.

- If applicable, note any trade-in vehicle details.

- Both the seller and buyer should sign and date the form at the bottom.

Misconceptions

Many people have misunderstandings about the Texas Motor Vehicle Bill of Sale form. Clarifying these misconceptions can help ensure a smoother transaction when buying or selling a vehicle. Below are some common myths and the truths behind them.

- It is not necessary to have a Bill of Sale for vehicle transactions. Some believe that a Bill of Sale is optional. In Texas, while it is not legally required, having one provides proof of the transaction and can protect both parties.

- Only the seller needs to sign the Bill of Sale. This is incorrect. Both the buyer and seller should sign the document to validate the transaction and confirm agreement on the sale terms.

- A Bill of Sale serves as the title for the vehicle. This misconception can lead to confusion. The Bill of Sale is not a title; it is a separate document that records the sale. The title must be transferred separately to officially change ownership.

- All information on the Bill of Sale must be handwritten. Some individuals think that the form must be filled out by hand. In reality, it can be typed or printed as long as all required information is included and legible.

- The Bill of Sale is only necessary for used vehicles. This is not true. A Bill of Sale can be beneficial for both new and used vehicle transactions, providing a record of the sale regardless of the vehicle's age.

- There is a specific format that must be used for the Bill of Sale. While the state does not mandate a specific format, it is essential to include certain key details, such as the vehicle identification number (VIN), purchase price, and both parties' information.

- A Bill of Sale protects against all future disputes. While it is a helpful document, it does not guarantee that disputes will not arise. It serves as evidence of the transaction but does not cover every potential issue.

- Once the Bill of Sale is signed, the transaction is complete. This is misleading. After signing, the buyer must still ensure the title is transferred and any necessary registrations are updated with the Texas Department of Motor Vehicles.

- Only licensed dealers can provide a Bill of Sale. This is a common misconception. Individuals can create and use a Bill of Sale for private transactions, as long as it meets the necessary requirements.

Understanding these misconceptions can help individuals navigate the vehicle buying and selling process in Texas more effectively. Always ensure that you have the proper documentation to protect your interests in any transaction.