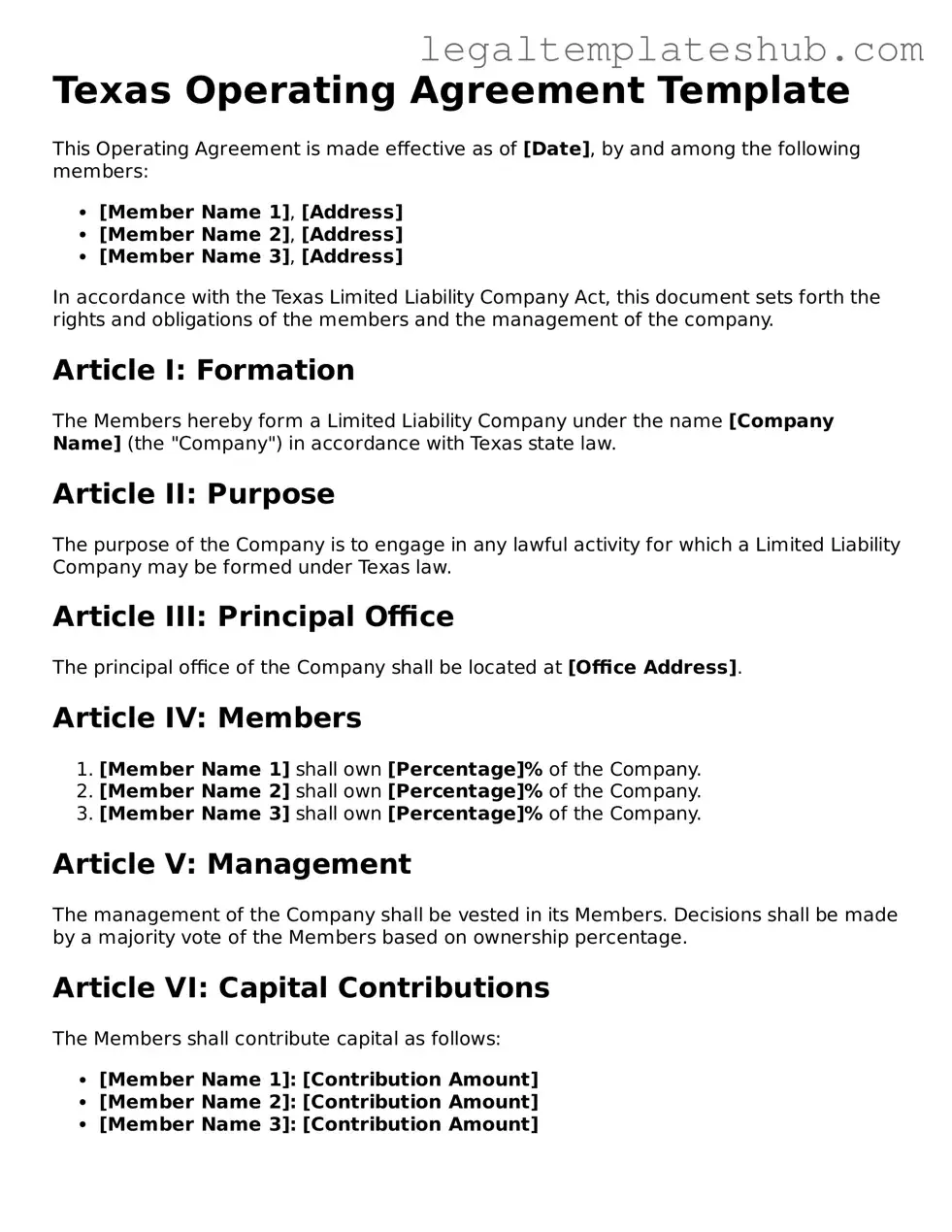

Printable Operating Agreement Document for Texas

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Texas Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC) in Texas. |

| Governing Law | The Texas Operating Agreement is governed by the Texas Business Organizations Code. |

| Purpose | This document serves to protect the members' rights and clarify the responsibilities of each member. |

| Customization | Members can customize the agreement to fit their specific needs and business goals. |

| Legal Requirement | While not legally required, having an Operating Agreement is highly recommended for LLCs in Texas. |

| Contents | The agreement typically includes details on management, voting rights, profit distribution, and procedures for adding or removing members. |

| Dispute Resolution | Many Operating Agreements include provisions for resolving disputes among members to avoid litigation. |

| Amendments | Members can amend the Operating Agreement as needed, following the procedures outlined within the document. |

| Duration | The agreement remains in effect until the LLC is dissolved or the agreement is amended or terminated by the members. |

Key takeaways

Filling out and using the Texas Operating Agreement form is a critical step for business owners in the state. Here are five key takeaways to consider:

- The Operating Agreement outlines the management structure and operational procedures of the business.

- It is essential for defining the roles and responsibilities of members, ensuring clarity in decision-making.

- Having a well-drafted agreement can help prevent disputes among members by establishing clear guidelines.

- While Texas does not legally require an Operating Agreement, it is highly recommended to protect personal assets and limit liability.

- Regularly reviewing and updating the agreement can help adapt to changes in the business or membership.

Dos and Don'ts

When filling out the Texas Operating Agreement form, consider the following guidelines to ensure accuracy and compliance.

- Do provide complete and accurate information about all members of the LLC.

- Do clearly outline the management structure and responsibilities of each member.

- Don't leave any sections blank; incomplete forms can lead to delays or rejections.

- Don't use ambiguous language; clarity is essential for understanding the agreement.

More Operating Agreement State Templates

Llc New York - It outlines the procedures for holding meetings and documenting decisions.

Operating Agreement Llc Utah - The Operating Agreement may include buy-sell provisions to manage ownership transfers smoothly.

To simplify the process of drafting a Power of Attorney, you can utilize various resources, including PDF Templates that provide a clear framework for these essential documents, ensuring that your decisions are well articulated and legally binding.

Creating an Operating Agreement - An Operating Agreement plays a significant role in business longevity and stability.

Instructions on Filling in Texas Operating Agreement

Completing the Texas Operating Agreement form is an important step in establishing the internal structure and operating procedures of your business. This process requires careful attention to detail to ensure that all relevant information is accurately captured. Once the form is filled out, it can help clarify the roles and responsibilities of members, as well as outline the management structure.

- Begin by gathering all necessary information about your business, including the name, address, and type of entity.

- Identify all members of the business. Collect their names, addresses, and ownership percentages.

- Determine the management structure. Decide whether the business will be member-managed or manager-managed.

- Outline the purpose of the business. Clearly state what the business intends to do.

- Include details about capital contributions. Specify what each member is contributing to the business.

- Establish the distribution of profits and losses. Decide how profits and losses will be shared among members.

- Set the rules for meetings. Specify how often meetings will occur and how they will be conducted.

- Include provisions for adding or removing members. Outline the process for membership changes.

- Review the document for accuracy. Ensure all information is correct and complete.

- Once finalized, have all members sign the agreement. This step formalizes the document and makes it binding.

Misconceptions

When it comes to the Texas Operating Agreement form, several misconceptions can lead to confusion among business owners. Understanding these misconceptions is crucial for ensuring compliance and protecting your interests.

- Misconception 1: The Texas Operating Agreement is optional for LLCs.

- Misconception 2: All Operating Agreements must be filed with the state.

- Misconception 3: A single-member LLC does not need an Operating Agreement.

- Misconception 4: The Operating Agreement cannot be changed once it is created.

Many believe that an Operating Agreement is not necessary in Texas. While it's true that Texas does not legally require an LLC to have one, having an Operating Agreement is highly recommended. It helps outline the management structure and operational procedures, reducing potential conflicts among members.

Some think that the Operating Agreement needs to be submitted to the Texas Secretary of State. In reality, this document is kept internally and does not need to be filed. However, it should be maintained in a safe place for reference and in case of disputes.

It’s a common belief that single-member LLCs can skip the Operating Agreement. This is not advisable. Even for a single-member LLC, having an Operating Agreement can provide clarity on ownership and help separate personal and business liabilities.

Some individuals think that once an Operating Agreement is signed, it cannot be modified. In fact, Operating Agreements can be amended as needed. It’s important to review and update the document regularly to reflect any changes in the business or ownership structure.