Printable Promissory Note Document for Texas

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, specifically Chapter 3, which covers negotiable instruments. |

| Parties Involved | The note typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | Texas law allows the lender to charge interest on the amount owed, but the rate must comply with state usury laws. |

| Payment Terms | The note should clearly state the payment schedule, including due dates and any grace periods. |

| Default Conditions | It is important to outline what constitutes a default, such as missed payments or bankruptcy. |

| Collateral | Some promissory notes may be secured by collateral, which provides the lender with additional protection. |

| Signatures | Both parties must sign the note for it to be legally binding, indicating their agreement to the terms. |

| Amendments | Any changes to the terms of the note must be documented in writing and signed by both parties. |

| Transferability | A Texas Promissory Note can often be transferred to another party, allowing the new holder to enforce the terms. |

Key takeaways

When dealing with a Texas Promissory Note, it's essential to understand its structure and implications. Here are some key takeaways to keep in mind:

- Clear Identification: Always begin by clearly identifying the parties involved. This includes the borrower and the lender, along with their contact information.

- Loan Amount: Specify the exact amount being borrowed. This should be written numerically and in words to avoid any confusion.

- Interest Rate: Clearly state the interest rate. If applicable, indicate whether it is fixed or variable, and detail how it will be calculated.

- Repayment Terms: Outline the repayment schedule. Specify the frequency of payments (monthly, quarterly, etc.) and the due dates.

- Default Clauses: Include provisions that define what constitutes a default. This could involve late payments or failure to meet other terms.

- Governing Law: Indicate that the note is governed by Texas law. This is important for any legal interpretations or disputes that may arise.

By paying attention to these key elements, you can ensure that the Texas Promissory Note serves its intended purpose effectively.

Dos and Don'ts

When filling out the Texas Promissory Note form, it is essential to approach the task with care. Here are some key points to consider:

- Do ensure that all parties involved in the loan are clearly identified. Include full names and addresses.

- Don't leave any sections blank. Each part of the form should be filled out completely to avoid confusion later.

- Do specify the loan amount clearly. This helps prevent any misunderstandings about how much is being borrowed.

- Don't use vague terms. Be precise about the repayment terms, including interest rates and payment schedules.

- Do sign and date the document. Both the borrower and lender should provide their signatures to make the agreement valid.

- Don't forget to keep a copy of the signed document for your records. This is crucial for future reference.

- Do consult with a legal professional if you have any questions. It's better to seek guidance than to make an error.

- Don't rush through the process. Take your time to review the form thoroughly before submitting it.

More Promissory Note State Templates

Pennsylvania Promissory Note - Serves as an acknowledgment of a debt owed by the borrower to the lender.

How to Do a Promissory Note - Micro-lending initiatives also utilize promissory notes to create structured repayment plans for small borrowers.

When engaging in a rental arrangement, utilizing the Ohio Residential Lease Agreement form is essential for defining the responsibilities and expectations of both landlords and tenants. This legal document not only safeguards the interests of both parties but also provides a clear framework for the lease terms. For those looking to streamline this process, resources such as PDF Templates can be incredibly helpful in creating a comprehensive lease agreement.

Nc Promissory Note - Interest rates in a promissory note can be fixed or variable, depending on the agreement.

Promissory Note Washington State - The terms of repayment might include installment payments or a lump sum at maturity.

Instructions on Filling in Texas Promissory Note

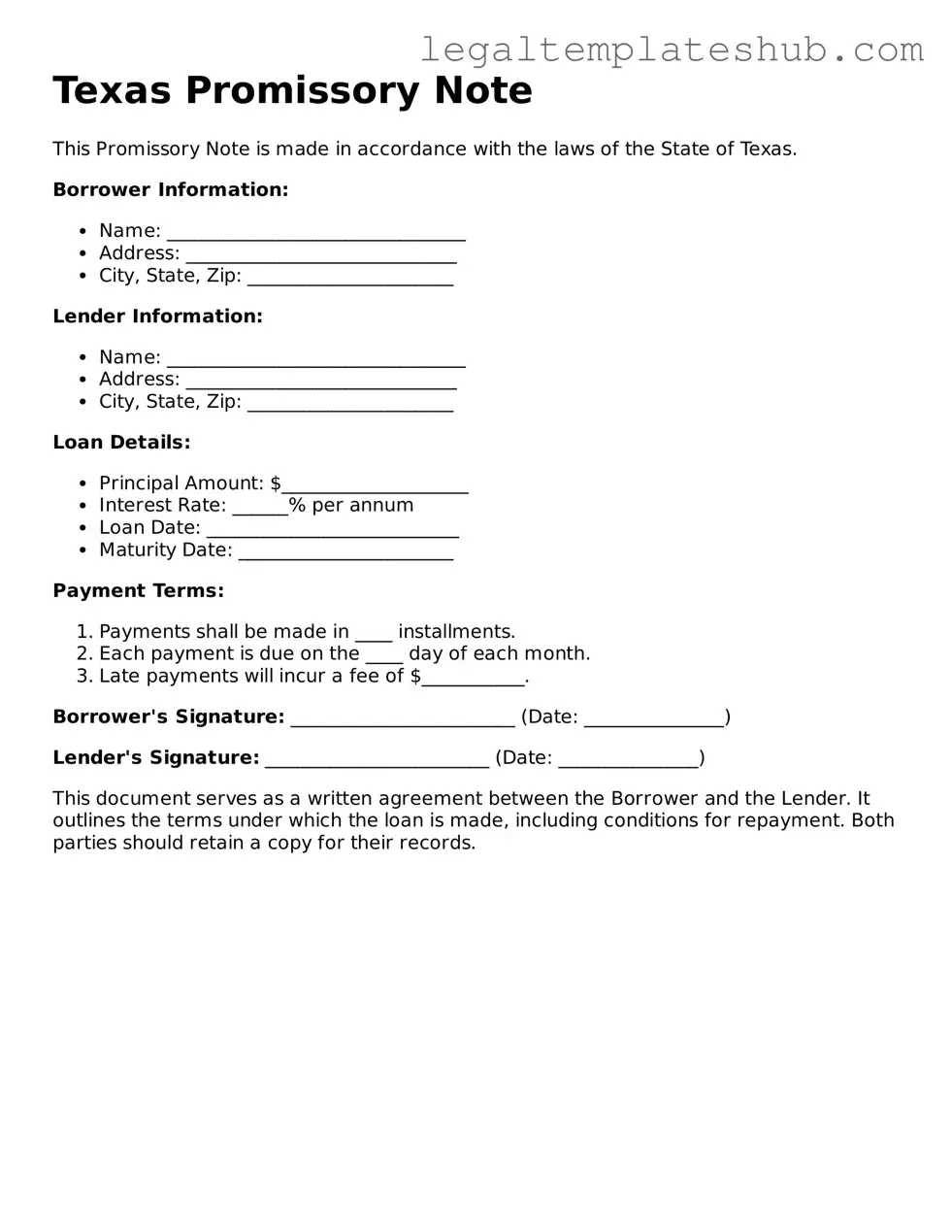

After obtaining the Texas Promissory Note form, you will need to provide specific information to complete it accurately. This form serves as a written promise to repay borrowed money under agreed terms. Follow the steps below to ensure you fill it out correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, fill in the name and address of the borrower. This is the individual or entity that is borrowing the money.

- Provide the name and address of the lender. This is the individual or entity that is lending the money.

- Specify the principal amount being borrowed. This is the total amount of money that the borrower agrees to pay back.

- Indicate the interest rate. This is the percentage of the principal that will be charged as interest.

- State the repayment terms. Include the due date or schedule for payments, such as monthly or quarterly.

- Include any late fees or penalties for missed payments, if applicable.

- Sign and date the form at the bottom. The borrower must provide their signature to confirm their agreement.

- If required, have a witness or notary public sign the form to validate it.

Once the form is filled out and signed, keep a copy for your records. The original should be given to the lender. Make sure to review the completed document for accuracy before finalizing it.

Misconceptions

Understanding the Texas Promissory Note form can be challenging, and several misconceptions often arise. Here are four common misunderstandings:

- Misconception 1: The Texas Promissory Note is a legally binding document only if notarized.

- Misconception 2: A promissory note must be in a specific format to be valid.

- Misconception 3: Once signed, the terms of the promissory note cannot be changed.

- Misconception 4: A promissory note guarantees repayment.

This is not entirely accurate. While notarization can provide additional assurance of authenticity, a promissory note can still be legally binding without it. The essential elements are the agreement between the parties and the terms outlined in the note.

Many believe that there is a rigid format that must be followed. In reality, while certain elements must be included—such as the amount borrowed, interest rate, and repayment terms—the note can be written in various formats as long as it conveys the necessary information clearly.

This is misleading. Parties can agree to modify the terms of a promissory note after it has been signed. It is important to document any changes in writing to avoid misunderstandings in the future.

While a promissory note is a promise to repay, it does not guarantee that the borrower will fulfill that promise. If the borrower defaults, the lender may have legal recourse, but the note itself does not ensure repayment.