Printable Tractor Bill of Sale Document for Texas

PDF Form Data

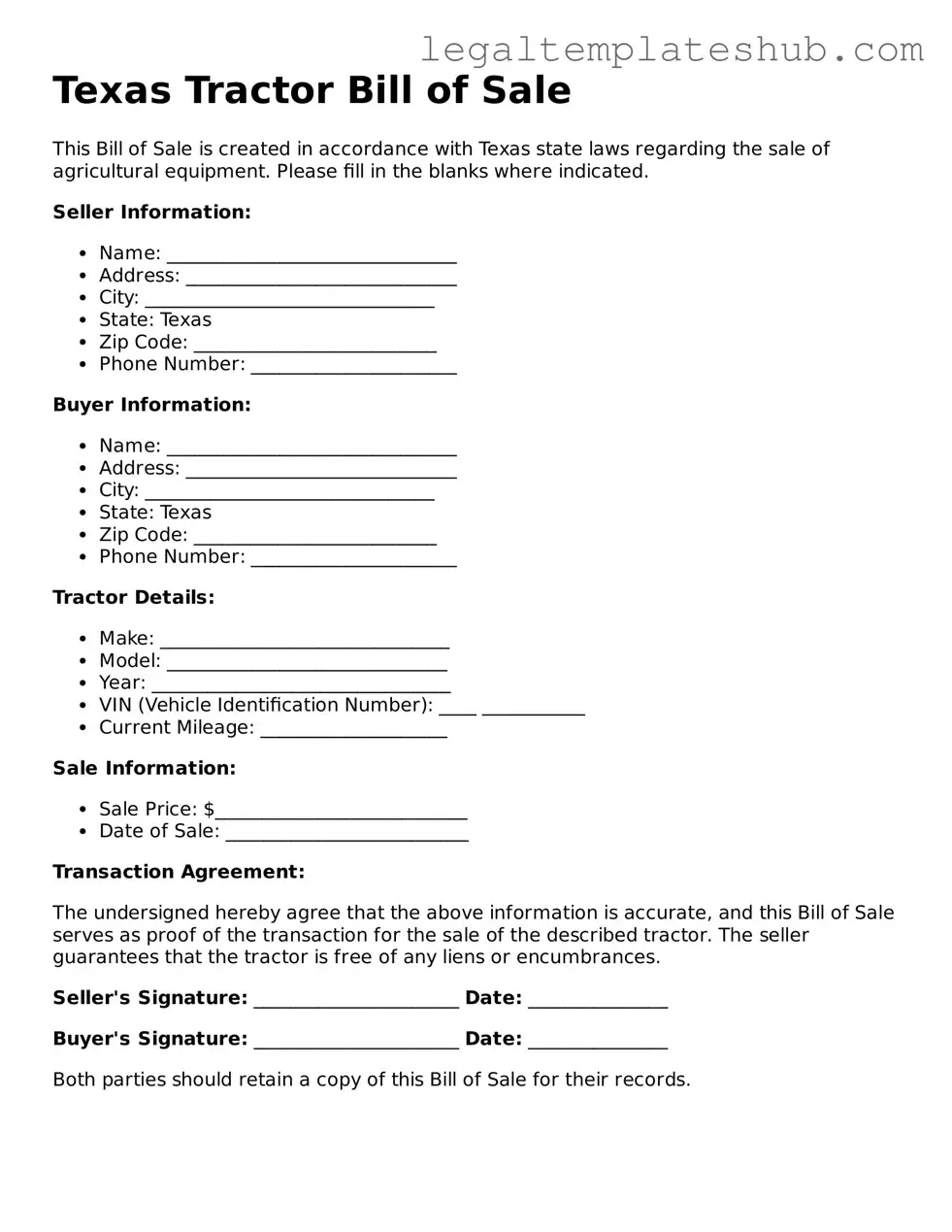

| Fact Name | Details |

|---|---|

| Purpose | The Texas Tractor Bill of Sale form is used to document the sale of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by Texas state law, specifically under the Texas Business and Commerce Code. |

| Identification | It includes sections for identifying the tractor, such as make, model, year, and Vehicle Identification Number (VIN). |

| Seller Information | The form requires the seller's name, address, and signature to validate the sale. |

| Buyer Information | Buyers must provide their name, address, and signature, ensuring both parties are legally recognized. |

| Payment Details | The sale price should be clearly stated, making it clear what the buyer is paying for the tractor. |

| Record Keeping | Both parties should keep a copy of the completed form for their records and future reference. |

Key takeaways

When filling out and using the Texas Tractor Bill of Sale form, consider the following key takeaways:

- Ensure all required information is provided, including the names and addresses of both the seller and buyer.

- Include a detailed description of the tractor, such as the make, model, year, and Vehicle Identification Number (VIN).

- Clearly state the sale price to avoid any misunderstandings later.

- Both parties should sign and date the form to validate the transaction.

- Keep a copy of the completed bill of sale for your records.

- Use the form as proof of ownership transfer for registration purposes.

- Consult local regulations to ensure compliance with any additional requirements.

- Consider having the document notarized to enhance its legal standing.

Dos and Don'ts

When filling out the Texas Tractor Bill of Sale form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are some things you should and shouldn't do:

- Do: Provide accurate information about the tractor, including make, model, year, and VIN.

- Do: Include the sale price clearly to avoid any misunderstandings.

- Do: Sign and date the form to validate the transaction.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any fields blank; fill in all required information.

- Don't: Use white-out or erase any mistakes; simply cross out errors and initial them.

More Tractor Bill of Sale State Templates

Farm Equipment Bill of Sale - Essential for legal ownership confirmation of a tractor.

In Consideration of Bill of Sale Example - A Tractor Bill of Sale helps formalize the sale process, making it clear and transparent.

Bill of Sale Tractor - Can include additional terms like delivery or shipping arrangements.

Obtaining a flexible Durable Power of Attorney solution can greatly simplify financial management, ensuring that your chosen representative can act on your behalf even during times of incapacity, thereby safeguarding your financial interests.

Bill of Sale Truck - Can be notarized for added validity if desired.

Instructions on Filling in Texas Tractor Bill of Sale

After acquiring the Texas Tractor Bill of Sale form, you'll need to provide specific information to ensure that the transaction is properly documented. Completing this form accurately is essential for both the buyer and seller to protect their interests and maintain clear records of the sale.

- Obtain the Form: Start by downloading or printing the Texas Tractor Bill of Sale form from a reliable source.

- Seller Information: Fill in the seller's full name, address, and contact information at the top of the form.

- Buyer Information: Next, provide the buyer's full name, address, and contact information.

- Tractor Details: Enter the details of the tractor being sold. This includes the make, model, year, Vehicle Identification Number (VIN), and any other relevant specifications.

- Sale Price: Clearly state the agreed-upon sale price for the tractor.

- Date of Sale: Write the date when the transaction is taking place.

- Signatures: Both the seller and buyer must sign and date the form to validate the sale.

- Witness Information (if applicable): If a witness is present, include their name and signature as well.

Once the form is completed, ensure that both parties retain a copy for their records. This will help in future reference and can be useful for any potential disputes or for registration purposes.

Misconceptions

When dealing with the Texas Tractor Bill of Sale form, several misconceptions can lead to confusion. Understanding the facts can help ensure a smooth transaction. Here are six common misconceptions:

-

It is not necessary to have a Bill of Sale for a tractor in Texas.

Many people believe that a Bill of Sale is optional. However, having a written record is crucial for proving ownership and can help avoid disputes in the future.

-

Only a notary can validate a Bill of Sale.

Some think that a notary's signature is required for a Bill of Sale to be valid. In Texas, while notarization can add credibility, it is not mandatory for the document to be legally binding.

-

All information on the form is optional.

It's a common belief that buyers and sellers can leave out details. In reality, including complete information, such as the tractor's make, model, and VIN, is important for clarity and legal purposes.

-

The Bill of Sale is only for private sales.

Some assume this document is only needed for private transactions. However, it can also be beneficial for sales through dealerships or auctions, providing a clear record of the sale.

-

Once signed, the Bill of Sale is final and cannot be changed.

Many believe that the document is set in stone after signing. In truth, both parties can agree to amend the Bill of Sale if necessary, as long as both sign the changes.

-

The Bill of Sale is the only document needed for registration.

Some think that the Bill of Sale alone suffices for registering a tractor. While it is a key document, additional paperwork, such as proof of identification and possibly a title, may also be required.