Printable Transfer-on-Death Deed Document for Texas

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Texas to transfer real estate upon their death without going through probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Chapter 114 of the Texas Estates Code. |

| Eligibility | Any individual who owns real estate in Texas can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time by the property owner through a subsequent deed or a written declaration. |

| Beneficiaries | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Filing Requirement | The Transfer-on-Death Deed must be recorded in the county where the property is located to be effective. |

| Impact on Taxes | The deed does not affect property taxes during the owner's lifetime; taxes remain the owner's responsibility. |

| Limitations | This deed cannot be used for transferring property that is subject to a mortgage or lien without special considerations. |

Key takeaways

When filling out and using the Texas Transfer-on-Death Deed form, there are several important points to keep in mind. These takeaways can help ensure the process is smooth and effective.

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death, without going through probate.

- It is essential to complete the form accurately, including the legal description of the property and the names of the beneficiaries. Any errors may lead to complications later.

- The deed must be signed by the property owner and should be recorded in the county where the property is located to be legally effective.

- Beneficiaries can be changed or revoked at any time before the owner's death, providing flexibility in estate planning.

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it's essential to follow specific guidelines to ensure the document is valid and effective. Here are seven things to consider:

- Do provide accurate property descriptions. Ensure that the legal description of the property is clear and precise.

- Don't forget to include the names of all beneficiaries. Each person receiving the property must be listed.

- Do sign the deed in the presence of a notary. This step is crucial for the deed's legal validity.

- Don't use vague language. Be specific about the terms and conditions of the transfer.

- Do file the deed with the county clerk's office. This action makes the transfer official and public.

- Don't neglect to check state laws. Familiarize yourself with any specific requirements or changes in Texas law regarding transfer-on-death deeds.

- Do keep a copy of the filed deed for your records. This ensures you have proof of the transfer for future reference.

More Transfer-on-Death Deed State Templates

Can a Beneficiary Deed Be Contested - A convenient option for those looking to simplify their estate after passing.

In addition to its importance in formalizing ownership transfers, utilizing the Pennsylvania Bill of Sale form can be enhanced by accessing various resources for templates, such as those found on PDF Templates, which can streamline the process and ensure accuracy in your documentation.

Washington Transfer on Death Deed - Transfer-on-Death Deeds are generally easy to complete and understand, making them accessible for many homeowners.

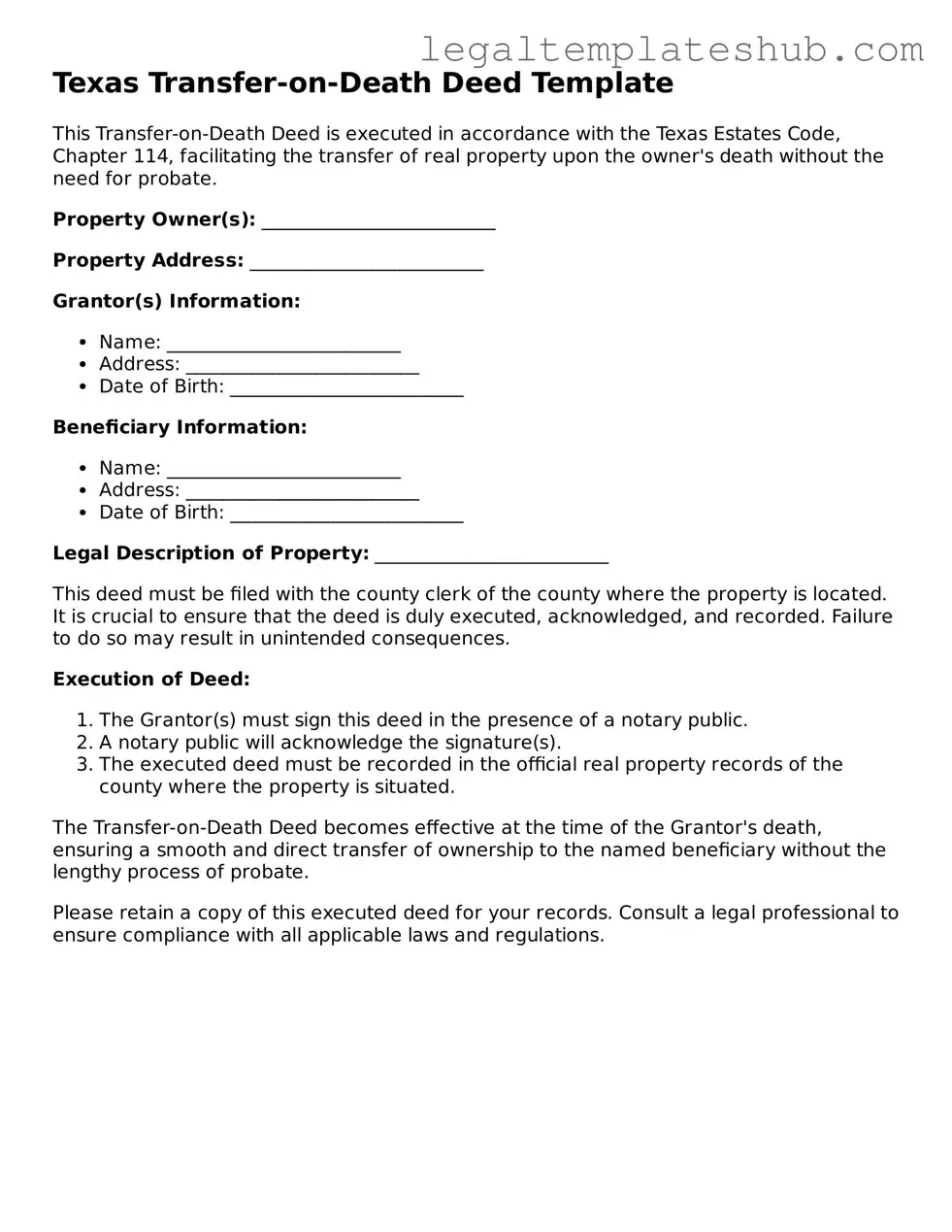

Instructions on Filling in Texas Transfer-on-Death Deed

Filling out the Texas Transfer-on-Death Deed form is a straightforward process that allows you to designate a beneficiary for your property after your passing. Once you have completed the form, it must be filed with the county clerk in the county where the property is located. This step ensures that your wishes are legally recognized and carried out.

- Begin by downloading the Texas Transfer-on-Death Deed form from a reliable source or obtain a physical copy from your local county clerk's office.

- Fill in your name as the owner of the property. Ensure that your name is written exactly as it appears on the property title.

- Provide the legal description of the property. This information can usually be found on your property tax statement or the original deed.

- Identify the beneficiary or beneficiaries. Clearly write their names and ensure you include their relationship to you.

- Include the address of each beneficiary. This ensures there is no confusion about who is intended to receive the property.

- Sign the form in the presence of a notary public. Your signature must be notarized to validate the document.

- Make copies of the completed and notarized form for your records and for your beneficiaries.

- File the original form with the county clerk in the county where the property is located. Be sure to check if there are any filing fees.

After filing, it's wise to inform your beneficiaries about the deed and where they can find it. This proactive communication can help prevent confusion or disputes later on.

Misconceptions

The Texas Transfer-on-Death Deed (TODD) is a useful estate planning tool, but several misconceptions can lead to confusion. Here are five common misunderstandings about this form:

-

Misconception 1: The TODD automatically transfers property upon death.

In reality, the transfer only occurs when the owner passes away. Until that time, the owner retains full control over the property, including the right to sell or modify it.

-

Misconception 2: A TODD avoids probate entirely.

While a TODD can simplify the transfer process and may avoid probate for the property listed, it does not eliminate the need for probate for other assets or debts the deceased may have.

-

Misconception 3: A TODD can only be used for residential property.

This is incorrect. The TODD can be utilized for various types of real estate, including commercial properties and vacant land, as long as they are not subject to a mortgage.

-

Misconception 4: The TODD form is permanent and cannot be revoked.

In fact, the owner can revoke or change the TODD at any time before their death. This flexibility allows for adjustments in estate planning as circumstances change.

-

Misconception 5: A TODD does not require any formalities.

Although the TODD simplifies the process, it must be properly executed and recorded to be valid. Failure to follow these steps can result in the deed being ineffective.

Understanding these misconceptions can help individuals make informed decisions regarding their estate planning strategies in Texas.