Printable Transfer-on-Death Deed Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real estate to a designated beneficiary upon their death without going through probate. |

| Governing Law | The use of Transfer-on-Death Deeds is governed by state law, and specific regulations can vary. For example, in California, it is governed by California Probate Code Section 5600. |

| Revocability | The deed can be revoked or changed at any time before the death of the property owner, providing flexibility for the owner. |

| Beneficiary Designation | It is crucial to clearly identify the beneficiary in the deed to ensure the intended recipient receives the property without complications. |

Transfer-on-Death Deed - Adapted for State

Key takeaways

When considering a Transfer-on-Death Deed (TODD), it’s essential to understand how it works and its implications. Here are some key takeaways to keep in mind:

- Purpose of the TODD: A Transfer-on-Death Deed allows you to transfer real estate to a beneficiary upon your death without going through probate.

- Eligibility: Most states allow this type of deed, but it’s crucial to check your state’s specific laws and requirements.

- Filling Out the Form: Ensure that you accurately fill out the form with the correct legal description of the property and the full name of the beneficiary.

- Signatures: The deed must be signed by you, the property owner, and in some states, it may need to be notarized or witnessed.

- Recording the Deed: After completing the form, you must file it with the appropriate county recorder’s office to make it legally effective.

- Revocation: You can revoke the TODD at any time before your death, typically by filing a revocation form or creating a new deed.

- Tax Implications: Be aware that transferring property via a TODD may have tax implications for your beneficiaries, so consult a tax advisor if needed.

- Beneficiary Considerations: Choose your beneficiary carefully, as they will receive the property directly, and consider how this affects other heirs.

Understanding these points can help you make informed decisions about using a Transfer-on-Death Deed to manage your estate effectively.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it's crucial to follow specific guidelines to ensure that your intentions are clear and legally binding. Below are nine essential dos and don'ts to keep in mind.

- Do ensure that the form is completed in full. Missing information can lead to complications.

- Do include the legal description of the property. This helps to clearly identify the asset.

- Do have the form signed in front of a notary. This step is vital for legal validation.

- Do provide the names and addresses of the beneficiaries. Clear identification of who will inherit is necessary.

- Do keep a copy of the completed form for your records. This can be useful in case of disputes.

- Don't use vague language when describing the property. Clarity is key to avoid confusion.

- Don't forget to check state-specific requirements. Different states may have varying laws regarding Transfer-on-Death Deeds.

- Don't neglect to record the deed with the appropriate government office. Failure to do so can render the deed ineffective.

- Don't assume that verbal agreements are sufficient. Written documentation is crucial for legal purposes.

By adhering to these guidelines, you can help ensure that your Transfer-on-Death Deed is executed smoothly and effectively. Taking these steps seriously will protect your wishes and provide clarity for your beneficiaries.

Common Types of Transfer-on-Death Deed Forms:

What Is a Gift Deed in Real Estate - State laws vary, so it’s important to follow local requirements when creating a Gift Deed.

Correction Deed Form California - This tool provides peace of mind for property owners looking to ensure accurate records.

The California Vehicle Purchase Agreement form is a crucial document used when buying or selling a vehicle in the state of California. It outlines the terms and conditions of the sale, making sure both parties are clear on what's being agreed to. This form serves as a binding contract, ensuring the transaction is conducted smoothly and legally. For more information, you can visit the following link: https://californiapdf.com/editable-vehicle-purchase-agreement.

Ladybird Deed Michigan Form - A Lady Bird Deed allows you to transfer property to a beneficiary while retaining control during your lifetime.

Instructions on Filling in Transfer-on-Death Deed

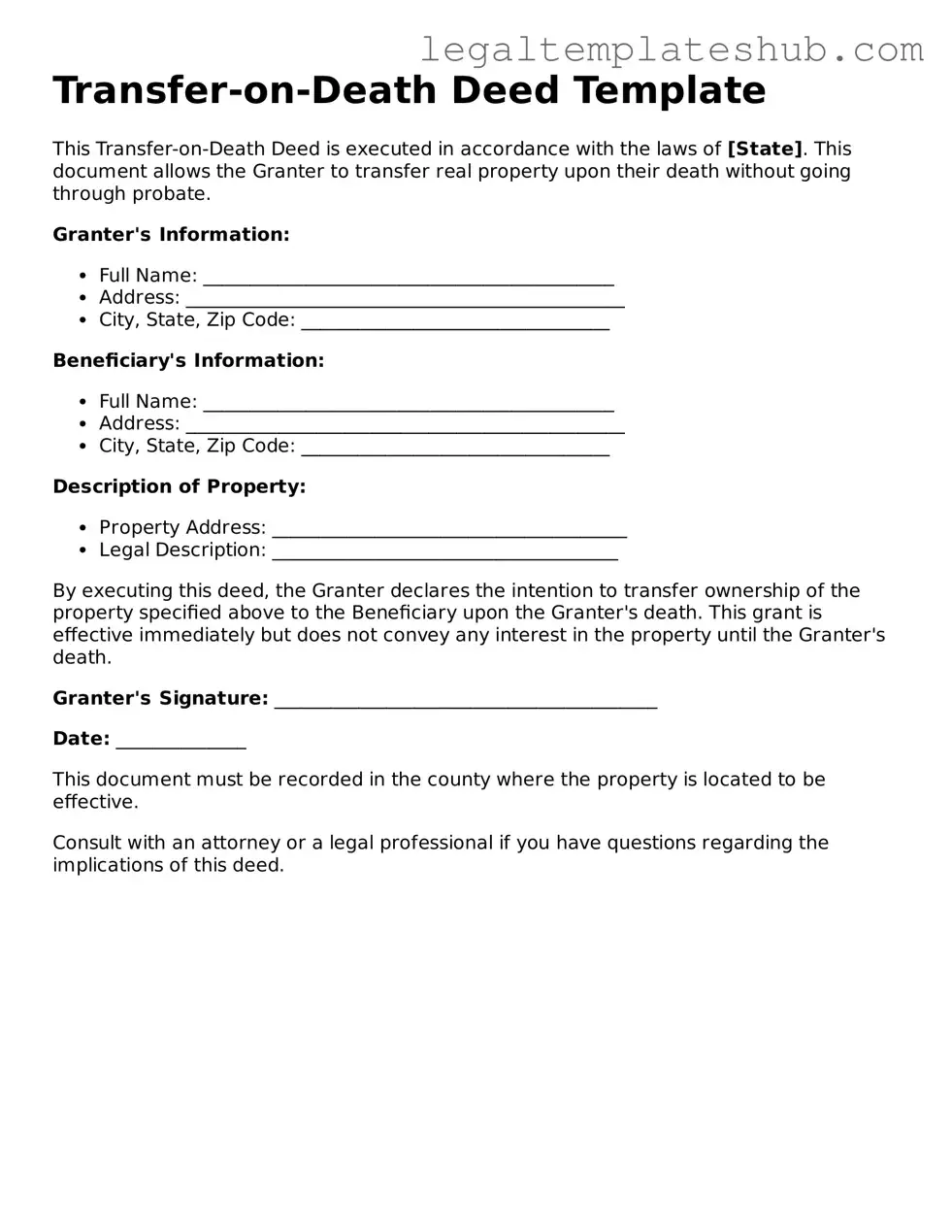

Completing a Transfer-on-Death Deed form is a straightforward process that allows individuals to designate beneficiaries for their property. Once the form is filled out correctly, it must be filed with the appropriate county office to ensure it is legally recognized. Follow these steps to complete the form accurately.

- Begin by obtaining the Transfer-on-Death Deed form from your state’s official website or local county office.

- In the designated section, enter your full name and address as the property owner.

- Clearly describe the property you wish to transfer, including the address and any legal description that may apply.

- Identify the beneficiary or beneficiaries by entering their full names and addresses. If there are multiple beneficiaries, make sure to specify how the property will be divided among them.

- Include a statement indicating that the transfer will occur upon your death. This is often a standard clause in the form.

- Sign the form in the presence of a notary public. This step is crucial to ensure the document is legally binding.

- Have the notary public sign and seal the document to validate your signature.

- File the completed and notarized form with the appropriate county office where the property is located. Be aware of any filing fees that may apply.

After filing the deed, it is advisable to keep a copy for your records. Ensure that your beneficiaries are aware of the deed and its implications. This proactive step can help avoid confusion in the future.

Misconceptions

Transfer-on-Death Deeds (TOD Deeds) can be a useful estate planning tool, but several misconceptions surround them. Here are eight common misunderstandings:

- TOD Deeds are only for wealthy individuals. Many people think that only those with substantial assets can benefit from a TOD Deed. In reality, anyone with property can use this form to simplify the transfer of their assets upon death.

- A TOD Deed avoids probate entirely. While a TOD Deed can help bypass probate for the property it covers, it does not eliminate probate for other assets. It's important to understand that it only applies to the specific property listed in the deed.

- You cannot change or revoke a TOD Deed once it is filed. This is false. A TOD Deed can be revoked or changed at any time before the property owner passes away. This flexibility allows for adjustments as circumstances change.

- All states recognize TOD Deeds. Not every state has adopted the TOD Deed. Some states do not allow them at all, while others have specific rules regarding their use. Always check local laws before proceeding.

- Using a TOD Deed means you lose control of your property. A TOD Deed does not transfer ownership until the property owner dies. Until then, the owner retains full control and can sell or modify the property as desired.

- A TOD Deed automatically covers all types of property. This is misleading. TOD Deeds typically apply only to real estate. Other types of assets, such as bank accounts or personal property, may require different estate planning tools.

- There are no tax implications with a TOD Deed. While a TOD Deed itself does not trigger taxes, beneficiaries may face tax obligations when they inherit the property. Understanding potential tax consequences is essential.

- Beneficiaries must accept the property as is. Beneficiaries can choose to decline the property if they do not want it. They are not obligated to accept the inheritance, allowing them to make decisions based on their individual circumstances.

By clarifying these misconceptions, individuals can make more informed decisions about their estate planning options.