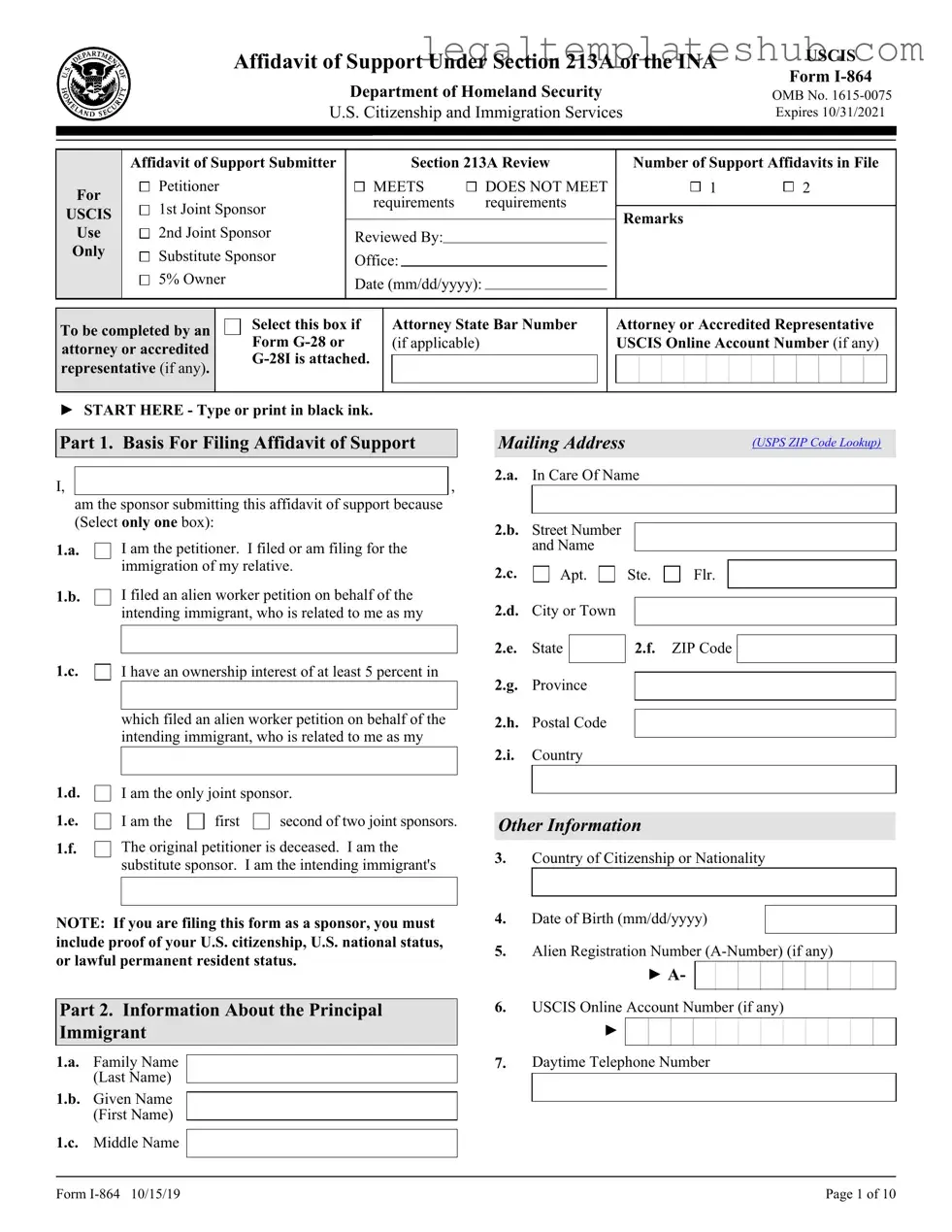

Blank USCIS I-864 PDF Form

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The I-864 form is used to demonstrate that a sponsor can financially support an immigrant. This ensures the immigrant will not rely on government assistance. |

| Eligibility | U.S. citizens and lawful permanent residents can act as sponsors. They must meet specific income requirements. |

| Income Requirement | The sponsor's income must be at least 125% of the Federal Poverty Guidelines for their household size. |

| Joint Sponsors | If the primary sponsor does not meet the income requirement, a joint sponsor can help. They must also fill out their own I-864 form. |

| Binding Contract | Signing the I-864 creates a legally binding contract. The sponsor is responsible for supporting the immigrant financially. |

| Duration of Obligation | The sponsor's obligation lasts until the immigrant becomes a U.S. citizen, can be credited with 40 quarters of work, or dies. |

| State-Specific Laws | While the I-864 is a federal form, state laws may affect enforcement. Consult local regulations for any additional requirements. |

Key takeaways

- Understand the Purpose: The I-864 form is used to demonstrate that an immigrant has adequate financial support and will not become a public charge.

- Eligibility Requirements: The sponsor must be a U.S. citizen or lawful permanent resident and must meet certain income requirements.

- Income Calculation: The sponsor's income must be at least 125% of the Federal Poverty Guidelines for the household size.

- Household Size: When calculating household size, include the sponsor, the immigrant, and any dependents.

- Assets Consideration: If the sponsor's income is insufficient, assets can be used to meet the financial requirements. The value of assets must be three times the difference between the income and the required amount.

- Signatures Required: The form must be signed by the sponsor and, in some cases, by the joint sponsor if applicable.

- Supporting Documents: Include necessary documents like tax returns, W-2s, and proof of income to support the information provided on the form.

- Submit with Other Forms: The I-864 should be submitted along with the immigrant visa application or adjustment of status application.

- Updates and Changes: If there are changes in income or household size, the sponsor must notify USCIS and may need to submit an updated I-864.

Dos and Don'ts

When filling out the USCIS I-864 form, it’s important to follow certain guidelines to ensure your application is processed smoothly. Here are some things you should and shouldn’t do:

- Do read the instructions carefully before starting the form.

- Do provide accurate and truthful information to avoid delays.

- Do sign and date the form where required.

- Do double-check your calculations for income and household size.

- Don’t leave any sections blank; fill in all applicable fields.

- Don’t use white-out or erase any mistakes; simply cross them out and write the correct information.

Following these tips can help ensure that your I-864 form is completed correctly and efficiently.

Common PDF Templates

D1 Form - Supporting documents to prove identity include passports and birth certificates.

To ensure a smooth transaction, consider utilizing a reliable Alabama bill of sale template for your documentation needs. This will help you create an accurate record of the transaction, providing clarity for both the buyer and the seller. For more resources, visit this essential Alabama bill of sale form guide.

Medicare Abn Form Pdf - Filling out this form correctly helps providers avoid misunderstandings related to payment responsibilities.

Instructions on Filling in USCIS I-864

After gathering all necessary information and documents, you are ready to fill out the USCIS I-864 form. This form is crucial for demonstrating financial support for a family member seeking a visa or green card. Completing it accurately is essential for a smooth application process.

- Download the Form: Visit the USCIS website to download the latest version of the I-864 form.

- Read the Instructions: Carefully review the instructions provided with the form to understand the requirements.

- Provide Your Information: Fill in your full name, address, and contact information in the designated sections.

- Indicate Your Status: Specify your immigration status, whether you are a U.S. citizen or a lawful permanent resident.

- List Household Members: Include information about all household members, even if they are not applying for a visa.

- Financial Information: Fill out your income details, including your annual income, assets, and any other sources of financial support.

- Sign and Date: Don’t forget to sign and date the form at the end. An unsigned form will not be accepted.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid delays.

- Submit the Form: Follow the submission instructions to send the completed form to the appropriate USCIS office.

Misconceptions

The USCIS I-864 form, also known as the Affidavit of Support, is crucial for many immigration processes. However, several misconceptions surround this form that can lead to confusion. Here are ten common misunderstandings:

- It is only for family members. Many believe that the I-864 is exclusively for sponsoring family members. While it is primarily used for family-based immigration, it can also apply in certain employment-based scenarios.

- Only the sponsor's income counts. Some people think that only the sponsor's income is considered. In reality, other household members' income and assets can be included to meet the financial requirements.

- It guarantees a green card. There is a misconception that submitting the I-864 guarantees approval of a green card application. While it is a necessary part of the process, approval depends on various factors, including eligibility and background checks.

- All income sources are acceptable. Not all income sources are considered valid. For example, income from temporary jobs or sporadic freelance work may not meet the requirements.

- Once submitted, it cannot be changed. Some believe that once the form is submitted, it cannot be altered. In fact, if circumstances change, such as income fluctuations, it is possible to update the information.

- It only needs to be submitted once. Many think the I-864 is a one-time requirement. However, it may need to be submitted again if the applicant applies for a different immigration benefit in the future.

- It has no impact on tax obligations. Some assume that completing the I-864 does not affect their tax responsibilities. In truth, sponsors must demonstrate that they meet the income threshold, which involves tax returns and financial documentation.

- It is only a formality. Some view the I-864 as a mere formality. In reality, it is a legally binding contract that holds sponsors accountable for supporting their immigrants financially.

- It is only for U.S. citizens. There is a belief that only U.S. citizens can act as sponsors. Lawful permanent residents can also file the I-864 for certain family members.

- Submitting it means you are financially responsible for life. Many think that signing the I-864 means they are financially responsible for the immigrant indefinitely. The obligation lasts until the immigrant becomes a U.S. citizen, can be credited with 40 quarters of work, or leaves the U.S. permanently.

Understanding these misconceptions can help clarify the role of the I-864 in the immigration process. It is essential to approach this form with accurate information to ensure compliance and a smoother application experience.