Printable Bill of Sale Document for Utah

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A Bill of Sale is a legal document that transfers ownership of personal property from one party to another. |

| Use Cases | Commonly used for vehicles, boats, equipment, and other tangible personal property. |

| Governing Law | Utah Code Title 70A, which addresses the Uniform Commercial Code. |

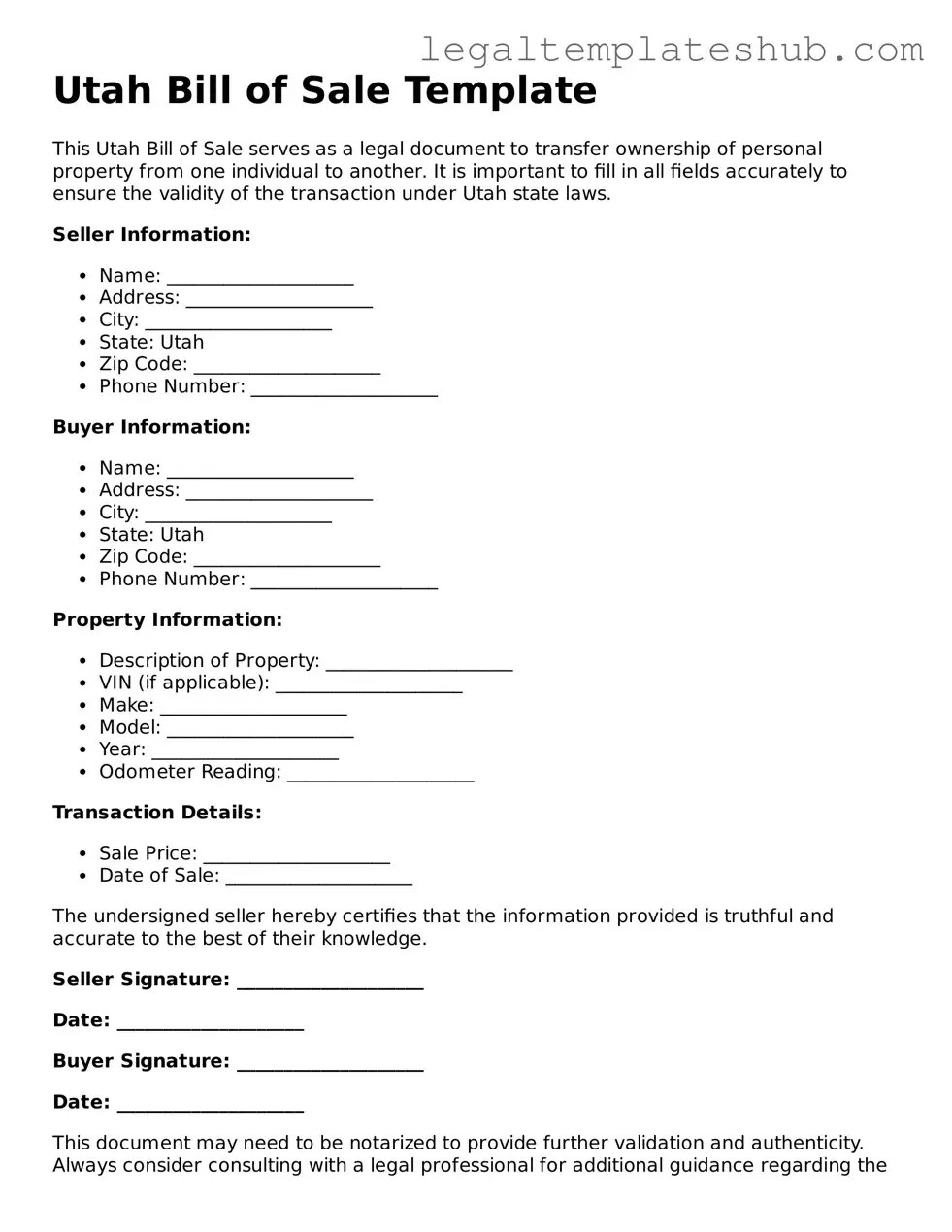

| Required Information | The form typically includes the names of the buyer and seller, a description of the item, and the sale price. |

| Notarization | While notarization is not mandatory in Utah, it is recommended for added legal protection. |

| Tax Implications | Sales tax may apply, and the buyer is responsible for reporting the sale to the Utah State Tax Commission. |

| Retention of Copies | Both parties should retain a copy of the Bill of Sale for their records. |

| Format | The Bill of Sale can be created in a written format and does not require a specific template, though it must meet legal requirements. |

Key takeaways

When dealing with the Utah Bill of Sale form, understanding its key aspects can simplify the process of transferring ownership of personal property. Here are some essential takeaways:

- Purpose: The Bill of Sale serves as a legal document that records the transfer of ownership from one party to another.

- Details Required: Ensure that the form includes critical information such as the names and addresses of both the buyer and seller, a description of the item, and the sale price.

- Signature Requirement: Both parties should sign the document to validate the transaction. This step is crucial for legal protection.

- Notarization: While not always required, having the Bill of Sale notarized can add an extra layer of authenticity and help in future disputes.

- Record Keeping: Keep a copy of the completed Bill of Sale for your records. This can be useful for tax purposes or if any issues arise later.

- Applicable Transactions: The form can be used for various types of property, including vehicles, boats, and personal items. Each type may have specific requirements.

- State-Specific Rules: Familiarize yourself with any additional regulations or requirements specific to Utah, as these can affect the validity of the Bill of Sale.

By following these guidelines, you can ensure a smooth and legally sound transaction when using the Utah Bill of Sale form.

Dos and Don'ts

When filling out the Utah Bill of Sale form, it's important to follow specific guidelines to ensure accuracy and legality. Here’s a list of what you should and shouldn't do:

- Do include the full names and addresses of both the buyer and seller.

- Do provide a clear description of the item being sold, including make, model, and VIN if applicable.

- Do specify the purchase price in both numerical and written form.

- Do sign and date the form to make it legally binding.

- Don't leave any blank spaces that could be filled in later.

- Don't forget to check for any local regulations that may apply to your sale.

- Don't use vague terms; be as specific as possible in your descriptions.

By following these guidelines, you can ensure that your Bill of Sale is complete and legally valid in Utah.

More Bill of Sale State Templates

Wa Bill of Sale - Having a Bill of Sale can enhance the resale value of an item by providing provenance.

By utilizing the General Bill of Sale, you can confirm the transfer of ownership and avoid any potential disputes. It's important to keep accurate records of such transactions, and for that, you can find various resources available, including PDF Templates that can simplify the process of creating your bill of sale.

Bill of Sale Pennsylvania - This form details the transaction, including the buyer, seller, and description of the item being sold.

Michigan Bill of Sale - This document should be kept in a safe place for future reference.

Bill of Sale for Car Virginia - The form should be signed by both the seller and the buyer to validate the transaction.

Instructions on Filling in Utah Bill of Sale

Once you have the Utah Bill of Sale form ready, you'll need to provide specific information to complete it accurately. Follow these steps to ensure all necessary details are included.

- Begin by entering the date of the transaction at the top of the form.

- Next, fill in the name and address of the seller. This identifies the person transferring ownership.

- Provide the name and address of the buyer. This is the individual receiving ownership.

- Clearly describe the item being sold. Include details such as make, model, year, and any identification numbers, like a VIN for vehicles.

- Specify the purchase price of the item. This amount should reflect what the buyer is paying.

- If applicable, indicate any warranties or guarantees associated with the sale. This could affect the buyer's rights.

- Both the seller and buyer should sign and date the form at the bottom. This confirms their agreement to the terms outlined.

After completing the form, ensure that both parties retain a copy for their records. This will serve as proof of the transaction and can be useful for future reference.

Misconceptions

Understanding the Utah Bill of Sale form is essential for anyone engaging in the buying or selling of personal property. However, several misconceptions can lead to confusion. Here are ten common misunderstandings:

- A Bill of Sale is only necessary for vehicles. Many people think this document is only needed for car transactions. In reality, it applies to various personal property sales, including boats, trailers, and even equipment.

- A verbal agreement is enough. Some believe that a verbal agreement suffices for a sale. However, having a written Bill of Sale provides clear proof of the transaction and can protect both parties in case of disputes.

- The Bill of Sale must be notarized. While notarization can add an extra layer of authenticity, it is not a requirement for a Bill of Sale in Utah. The document is valid as long as both parties sign it.

- Only the seller needs to sign the document. Many assume that only the seller's signature is necessary. In fact, both the buyer and seller should sign to ensure mutual agreement on the terms of the sale.

- It’s only for used items. Some people think Bills of Sale are only applicable for second-hand goods. New items can also require a Bill of Sale, especially when transferring ownership.

- A Bill of Sale is the same as a title transfer. While a Bill of Sale documents the sale, it does not transfer ownership in the same way a title does. For vehicles, a title transfer is also necessary.

- All Bills of Sale are the same. Not all Bills of Sale are created equal. Different types of transactions may require different information or formats, so it's important to tailor the document to the specific sale.

- Once signed, the Bill of Sale cannot be changed. Some believe that any changes after signing render the document void. However, amendments can be made if both parties agree and initial the changes.

- You don’t need a Bill of Sale for gifts. Even when property is given as a gift, a Bill of Sale can be useful for record-keeping and tax purposes, especially for high-value items.

- A Bill of Sale is only for individuals. Businesses also use Bills of Sale. Companies buying or selling assets should always use this document to maintain clear records and protect their interests.

Being aware of these misconceptions can help ensure a smoother transaction process in Utah. Always take the time to understand the requirements and implications of a Bill of Sale.